The economic analysis of taxation has plenty of jargon, statistical analysis, and complicated graphs, which can make it seem very mysterious to ordinary people.

But the core principles are actually very easy to understand.

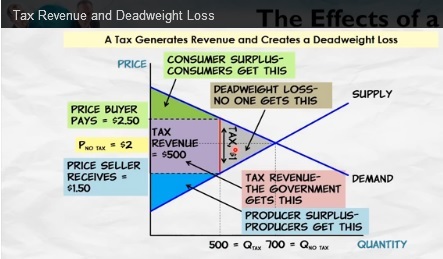

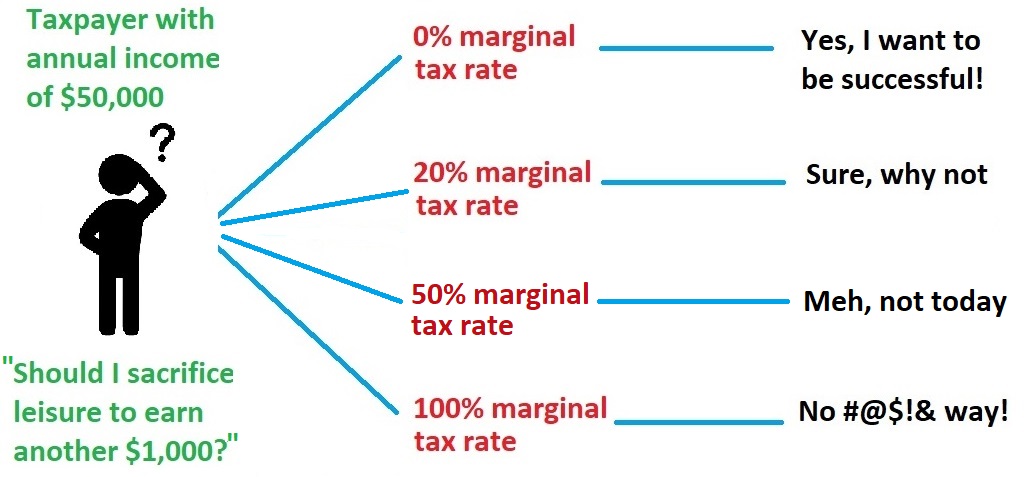

Simply stated, the more you tax of something, the less you get of it.

For instance, politicians often argue that there should be higher taxes on tobacco and alcohol in order to discourage smoking and drinking.

Given my libertarian proclivities, I obviously don’t like them trying to control our private lives, but they are right about higher taxes reducing cigarette and booze consumption.

To be sure, politicians don’t care about our health. They simply want more money in order to buy more votes. And they also don’t seem to care that punitive tax rates increase smuggling.

But I’m digressing. Let’s get back to the economics of tax policy.

View original post 567 more words

Recent Comments