Michael D. Bordo: An Historical Perspective on the Quest for Financial Stability

13 May 2020 Leave a comment

in budget deficits, business cycles, econometerics, economic growth, economic history, financial economics, fiscal policy, global financial crisis (GFC), great depression, great recession, inflation targeting, international economics, job search and matching, macroeconomics, monetarism, monetary economics Tags: new classical macroeconomics

Free Banking and the Federal Reserve

13 May 2020 Leave a comment

in Austrian economics, business cycles, economic history, financial economics, macroeconomics, monetary economics Tags: free banking, monetary policy

Stephen Williamson puzzles over quantitative easing

09 May 2020 Leave a comment

in business cycles, financial economics, global financial crisis (GFC), great recession, macroeconomics, monetary economics

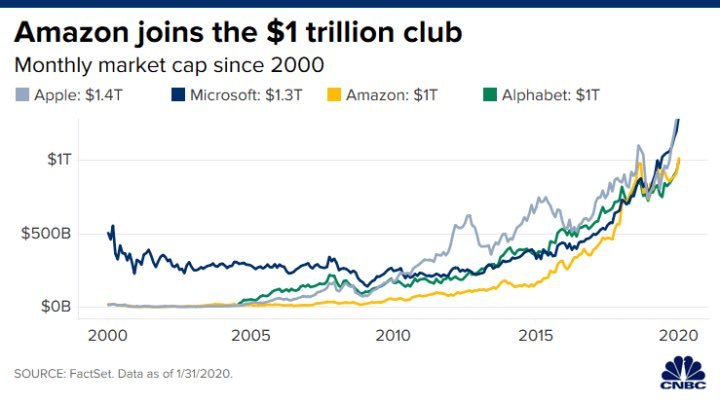

Amazon 1st made a profit in 2006

08 May 2020 Leave a comment

in economic history, entrepreneurship, financial economics, industrial organisation, survivor principle Tags: creative destruction

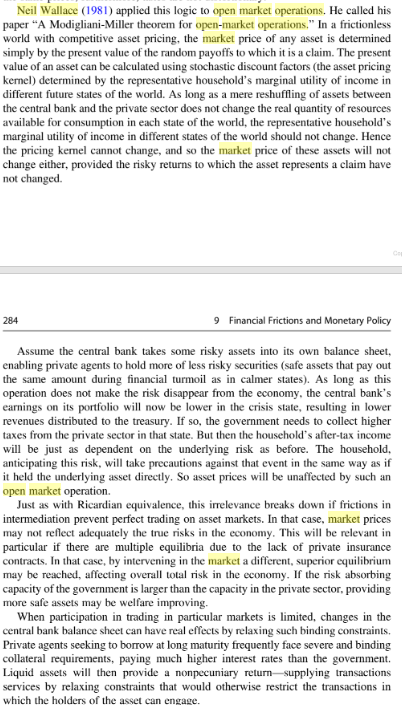

An explanation of Wallace neutrality for quantitative easing

01 May 2020 Leave a comment

in financial economics, macroeconomics, monetary economics

From https://books.google.co.nz/books?id=6kbCDwAAQBAJ&pg=PA283&lpg=PA283&dq=neil+wallace+open+market+operations&source=bl&ots=chwhTeUEA6&sig=ACfU3U1IPVipUeeC0tEa-phUVH7izIhT5A&hl=en&sa=X&ved=2ahUKEwihtKGGsZLpAhUdzDgGHSG4D5A4ChDoATACegQIChAB#v=onepage&q=neil%20wallace%20open%20market%20operations&f=false and https://www.jstor.org/stable/1802777?seq=1#metadata_info_tab_contents

Modigliani-Miller theorems for open market operations describe conditions under which central bank portfolio rearrangements will have no consequences for allocations, relative prices, or the time path of the price level.

Thomas Sargent 2013 MACROECONOMIC THEORY AND THE CRISIS

01 May 2020 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great depression, great recession, macroeconomics, Milton Friedman, monetarism, monetary economics, Robert E. Lucas Tags: sovereign debt crises, sovereign defaults

John Cochrane on quantitative easing not mattering much

01 May 2020 Leave a comment

in business cycles, financial economics, macroeconomics, monetary economics, politics - USA

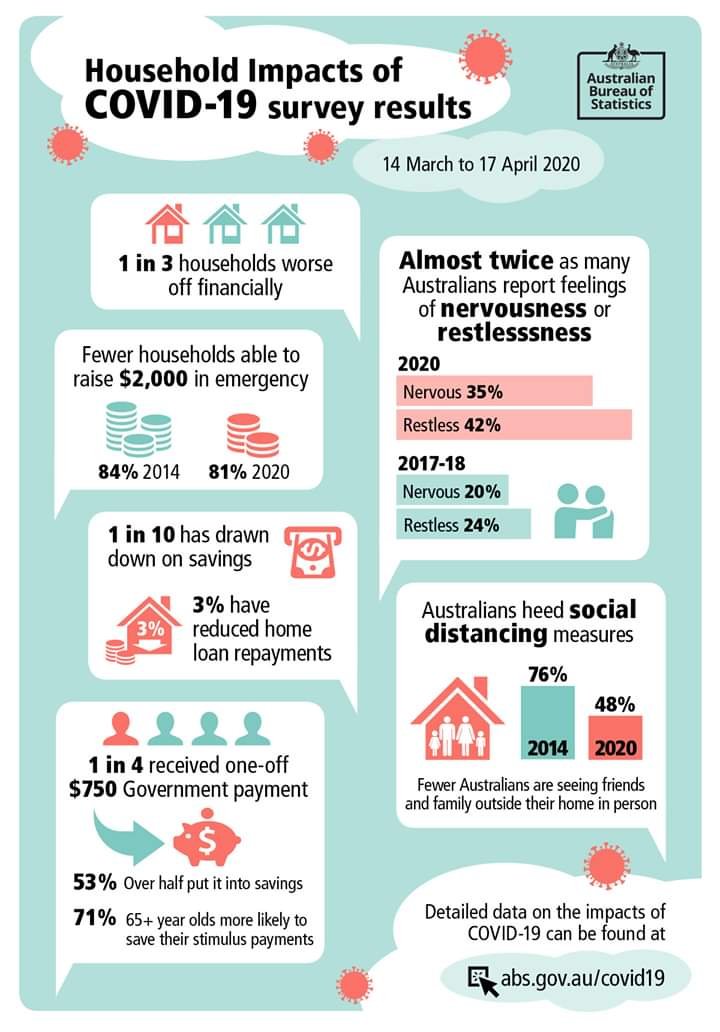

Majority saved $750 #COVID19 stimulus payment! Friedman’s permanent income hypothesis rules

01 May 2020 Leave a comment

in budget deficits, business cycles, financial economics, fiscal policy, macroeconomics, Milton Friedman, monetary economics, unemployment Tags: offsetting behaviour, permanent income hypothesis, The fatal conceit, unintended consequences

John Cochrane explains helicopter drops

01 May 2020 Leave a comment

in financial economics, fiscal policy, macroeconomics, Milton Friedman, monetarism, monetary economics, politics - New Zealand, public economics

Stephen Williamson on quantitative easing

29 Apr 2020 Leave a comment

in financial economics, monetary economics

Do economists ignore the impact of debt on the business cycle?

29 Apr 2020 Leave a comment

in business cycles, economic history, financial economics, global financial crisis (GFC), great depression, great recession, history of economic thought, macroeconomics, monetarism, monetary economics Tags: Keynesian macroeconomics, New Keynesian macroeconomics

Edward Prescott on the unimportance of monetary policy

29 Apr 2020 Leave a comment

in business cycles, economic history, Edward Prescott, financial economics, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, macroeconomics, monetary economics

See lecture at https://www.mediatheque.lindau-nobel.org/videos/37267/panel-conditions-monetary-fiscal-policy/laureate-prescott

Edward Prescott, co-recipient of the Nobel Prize in 2004, took a different view in a presentation with the title ‘The Unimportance of Monetary Policy and Financial Crises on Output and Unemployment’. He cited financial crises that saw countries experiencing contrasting outcomes at the same time: the US and Asia in the 2008 crisis; Chile and Mexico in 1980; and Scandinavia and Japan in 1992.

‘Financial crises do not impede development,’ he claimed. While the 2008 financial crisis was localised in North America and the euro area, there was a short recession and quick recovery in Japan, Taiwan and South Korea and no recession in Scandinavia and Australia. ‘Countries where fiscal policy was irresponsible had problems’, he maintained. ‘Fiscal responsibility is crucial: to spend is to tax and to tax is to depress. That’s what happens every time.’

Recent Comments