At more than $700 billion, Apple is worth 2 Googles, 2.5 Walmarts, 12 GMs, or 24 Twittershttp://t.co/IyAcNuPqJZ pic.twitter.com/7tRStxL3YR

— Conrad Hackett (@conradhackett) February 22, 2015

Is the best share price forecast whatever it is today?

20 Feb 2015 Leave a comment

in financial economics Tags: efficient markets hypothesis, random walk

More correctly, for the share market, it’s a random walk with a positive drift.

What were they thinking? NZ government super fund loses the lot on loan to already failing bank in one of the PIGS.

20 Feb 2015 Leave a comment

in economics of bureaucracy, entrepreneurship, financial economics, politics - New Zealand Tags: active investing, corruption, euro crisis, Index of Economic Freedom, junk bonds, passive investing, Portugal, risk diversification, state owned enterprises

A Portuguese bank on the verge of collapse – what were they thinking?

That would have been the response of many newspaper readers this morning upon learning the New Zealand Superannuation Fund has lost nearly $200 million in taxpayers’ cash on a "risk-free" loan it provided to Lisbon-based Banco Espirito Santo (BES) on July 3.

The loan – part of a US$784 million credit package US investment bank Goldman Sachs put together through its Oak Finance vehicle – was made exactly one month before Portugal’s central bank broke up BES and split the country’s biggest lender into two, with one part holding the good assets and the toxic assets placed in the other.

Unfortunately, the Oak Finance loan is now stranded in the so-called "bad bank" following a retrospective law change by the Bank of Portugal.

Christopher Adams: What were they thinking? – Business – NZ Herald News.

This is what the 2015 index of Economic Freedom has to say about Portugal on the rule of law:

In 2013, the OECD expressed concern over Portugal’s reluctance to crack down on foreign bribery, particularly in regard to its former colonies Brazil, Angola, and Mozambique.

Since 2001, Portugal had officially acknowledged only 15 bribery allegations, and there had been no prosecutions. The judiciary is constitutionally independent, but staff shortages and inefficiency contribute to a considerable backlog of pending trials.

Actively managed share funds are on the way out

20 Feb 2015 Leave a comment

in entrepreneurship, financial economics, industrial organisation, survivor principle Tags: active investing, efficient markets hypothesis, passive investing, William F. Shape

After costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar for any time period.

—William F. Sharpe, 1990 Nobel Laureate

4 out of 5 actively managed fund portfolios underperformed all index fund portfolios in all scenarios tested.

via The tide is turning as investors switch from high-cost, actively managed funds to index funds for lower costs, higher returns » AEI | Carpe Diem Blog » AEIdeas and Mutual Fund Expenses | Lion’s Share.

.

It’s not easy to be green: the cost of fossil fuels divestments to the New Zealand superannuation fund

17 Feb 2015 Leave a comment

in economics of bureaucracy, energy economics, environmental economics, environmentalism, financial economics, global warming, Public Choice, rentseeking Tags: efficient market hypothesis, fossil fuel disinvestment, Global disinvestment day, Green Party of New Zealand, index linked investing, privatisation, state ownership

The Green Party of New Zealand wants the New Zealand superannuation fund to sell its $676 million in fossil fuel investments. For those not in the know, this government investment fund is worth about $25 billion and is funded by present taxes to pay for the universal old age pension in New Zealand. Its current investment strategy seems to rely heavily on index linked funds that minimise management and trading costs.

The Government uses the Fund to save now in order to help pay for the future cost of providing universal superannuation.

In this way the Fund helps smooth the cost of superannuation between today’s taxpayers and future generations.

In common with the endowment funds of the American universities, that $676 million is about 2% of the total New Zealand superannuation portfolio of about NZ$25 billion.

Any portfolio manager risks considerable fees if she must monitor the entire portfolio because 2% is of dubious moral stature.

The main cost of divestiture is compliance costs to prevent fossil fuel investments drifting back into the portfolio through the routine day to day investments of other companies within their portfolios as these other firms expand into new businesses or diversified. The entire portfolio must be monitored for this risk.

American universities found that fossil fuels divestment rules out indexed linked funds as a class, along with their low management and trading fees. Ethical investors must move to actively managed investment funds which are perhaps a third more expensive in management fees.

If a move to a fossil fuel free portfolio rules out passive indexed linked funds, that is a major risk to future returns of the New Zealand superannuation fund. Would this fossil fuels disinvestment including selling the recently acquired Z petrol station network by the New Zealand superannuation fund?

Z Energy now owns and manages these businesses, which include:

- a 15.4 per cent stake in Refining NZ who runs New Zealand’s only oil refinery.

- a 25 per cent stake in Loyalty New Zealand who run Fly Buys

- over 200 service stations

- about 90 truck stops

- pipelines, terminals and bulk storage

As usual, in the course of argument for disinvestment by the government investment fund, the Green Party makes an excellent argument for the privatisation not only of state owned enterprises but of the New Zealand superannuation fund.

Rather than have one victory at a time, the Greens want the NZ superannuation fund to use the funds from the disinvestment to reinvest in pet projects of politicians. The green party co-leader said:

Money released from divestment can be reinvested in the rapidly growing renewable energy and energy efficiency sectors, helping to hasten the transition of our economy to a low-carbon future.

This makes government investment funds the playthings of politicians so they can never match the returns of a genuinely privately owned investment fund.

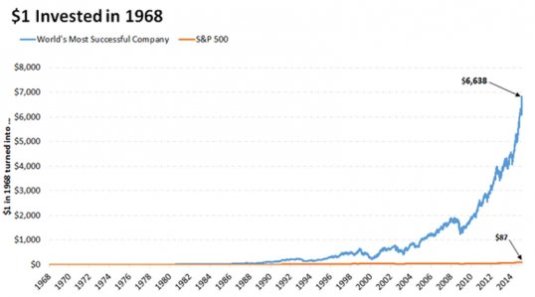

The most successful company in the world

17 Feb 2015 Leave a comment

in economic history, economics of regulation, financial economics, health economics Tags: tobacco regulation, wages of vice

The wages of vice. It’s Altria, the cigarette company.

HT: http://www.businessinsider.com/the-most-successful-company-in-the-world-2015-2?IR=T

Is fossil fuels disinvestment a cheap or expensive futile gesture?

15 Feb 2015 Leave a comment

in environmentalism, financial economics, Public Choice Tags: expressive politics, Fossil Fuels, futile gestures, Global disinvestment day

It is actually expensive to divest from fossil fuels both from the trading costs of selling, and more particularly, continuously monitoring your portfolio to make sure that fossil fuel companies have not entered surreptitiously in the course of companies in your portfolio buying shares in other companies that have subsidiaries in the fossil fuel industry.

Fischel’s study bases its conclusions on a historical comparison of two hypothetical, diversified, value-weighted stock indices for the period 1965-2014. One index included typical fossil fuel stocks, the other did not. The result: The fund that excluded the fossil fuel investments performed worse than the one that included them. Adding in a variety of other factors — attitudes toward risk, compliance and transaction costs — the analysis suggests that the climate-friendly fund would have earned 23 percent less over the last 50 years.

The Guardian quotes studies that argue the following:

Here are some studies, not funded by the oil industry, which indicate recent divestment would, if anything, have had a positive impact on returns and can reduce investment risk

That actually makes their arguments a wee suspicious. Too good to be true. It’s too much of a happy coincidence that moral choices such as disinvestments are also profitable.

Indeed, if disinvestment was profitable, actively managed portfolios would already have disinvested or marked down the returns and exposure from those shares already to account for the risks of fossil fuel and the temporary profits of peak oil.

The environmental movement manages to believe in both peak oil – oil will run out in the next two decades or so – and global warming based on runaway carbon emissions for the rest of the century burning the increasingly expensive and increasingly scarce crude oil that had ran out a long time ago previously. Global warming will solve itself as long as we are willing to accept that the environmental movement is genuine in its predictions about peak oil.

At bottom, the Guardian is trying to argue that an actively managed portfolio offers superior returns to an index linked passive portfolio that minimises trading costs. Furthermore, that form of active management requires detailed monitoring of the entire portfolio to ensure that fossil fuel investments do not inadvertently re-enter through the investment decisions of each company in that portfolio.

I can’t remember whether its 70% or 80% of actively managed share portfolios fail to beat the market in any one year. The Guardian’s previously warned in its business pages about actively managed share portfolios swallowing up to 1/3rd of investment returns as management fees.

Figure 1: Who Routinely Trounces the Stock Market?

Actively managed portfolios fail to beat a passively managed portfolio with the same composition and diversification as the whole share market itself which trades in shares only for liquidity and to rebalance the portfolio to match new compositions of the share market. Just 2 out of 2,862 actively managed funds managed to beat the market five years a row in the US stock market.

Divestiture from fossil fuels is not a one-off act. There are continual compliance costs and an investment strategy that forecloses using a whole range of low-cost index linked passive investment share portfolio managers. That cannot be denied. . American University said that divesting from these companies would require that AU investments be withdrawn from index funds and commingled funds in favour of more actively managed funds [and] estimated this withdrawal would cause management fees to double.

Why do economic consulting firms exist?

02 Feb 2015 1 Comment

in applied price theory, economics of bureaucracy, economics of information, financial economics, law and economics, managerial economics, organisational economics, survivor principle Tags: advice giving industries, corporate law, Deirdre McCloskey, directors duties, economic consultants

Directors’ duties are the reason why the companies hire economic consultants. What consultants say isn’t important; the fact that simply the directors of a company sought advice is what matters. Same goes for the public sector: you must know what you’re doing, you took advice from outside experts.

Central to avoiding being sued if the company goes broke, or otherwise gets into a spot of bother, is the directors show that they acted responsibly.

Central to this is they can show they took advice from esteemed advisers: an accountant, a lawyer and an economist. If they did so, they must be responsible prudent directors because they took advice.

Deirdre McCloskey argued that the advising industry lives off 19th century case law on directors’ and trustees’ duties.

If you take advice – from an accountant, a lawyer or an economist – and the business or investment still fails, it can’t be your fault that you lost the widow’s and orphans’s inheritance.

You took advice. That is what that 19th-century court held with regard to what directors do and do not have to do given the fact that are not involved in the business on a day to day basis.

James Burk, a sociologist and former stockbroker… found that the advice giving industry sprang from legal decisions in the early 19th century.

The courts began to decide that the trustee of the pension fund or a child’s inheritance could be held liable for bad investing if they did not take advice. The effect would have been the same had the court decided that prudent man should consult a Ouija boards or the flight of birds…

America decided through its courts than an industry giving advice on the stock market should come into existence, whether or not it was worthless.

Therefore, it doesn’t matter what you say as a consultant economist to a company, the fact you’ve said something to them is more important to them than what you are saying. Seeking and receiving your advice excused them from being sued for breach of their directors duties for a couple of days.

Would Keynes Have Been Fired as a Money Manager Today?

30 Jan 2015 Leave a comment

in entrepreneurship, financial economics Tags: active investing, efficient markets hypothesis, index linked investing, John Maynard Keynes

An excellent link by a great blog I have just come across.

Interesting post by Ben Carlson.

Keynes managed an average return of 13.2% in the period 1928-45. The markets gave a return of -0.5% in the same period. This was an exceptional performance albeit came with much higher volatility. So would he have been fired for this performance?

View original post 360 more words

Can you invest in a trend?

14 Dec 2014 Leave a comment

in entrepreneurship, financial economics, industrial organisation, survivor principle Tags: creative destruction, efficient market hypothesis, market selection, survivor principle, The meaning of competition

What are the rewards of investing in vice?

05 Dec 2014 Leave a comment

in entrepreneurship, financial economics Tags: efficient markets hypothesis

What is the Vice Fund? It invests in a collection of sinful stocks. As its managers describe it:

Designed with the goal of delivering better risk-adjusted returns than the S&P 500 Index.

It invests primarily in stocks in the tobacco, alcohol, gaming and defense industries.

We believe these industries tend to thrive regardless of the economy as a whole.

via Investing in Vice.

Recent Comments