George Stigler on the extensive influence of economists on public policy

20 Mar 2015 Leave a comment

in George Stigler, history of economic thought, Public Choice, rentseeking Tags: evidence-based policy, expressive politics, expressive voting, intellectuals, politics of reform, rational ignorance, rational irrationality

France, here the New Zealand labour market comes – part 2! How the Employment Court is re-regulating

04 Mar 2015 7 Comments

in applied price theory, Austrian economics, entrepreneurship, F.A. Hayek, George Stigler, human capital, industrial organisation, job search and matching, labour economics, law and economics, Ludwig von Mises, politics - New Zealand, survivor principle Tags: Armen Alchian, employment law, employment protection laws, entrepreneurial alertness, France, Israel Kirzner, The fatal conceit, The pretence to knowledge

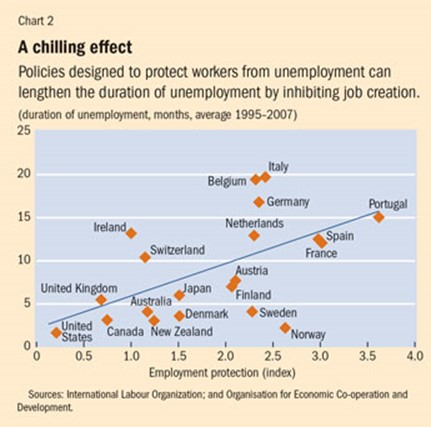

As discussed yesterday, if the Employment Court had its way, New Zealand case law under the Employment Relations Act regarding redundancies and layoffs would be as job destroying as those in France.

The Employment Court’s war against jobs goes back more than 20 years. To 1991 and G N Hale & Son Ltd v Wellington etc Caretakers etc IUW where the Court held that a redundancy to be justifiable under law it must be ‘unavoidable’, as in redundancies could only arise where the employer’s capacity for business survival was threatened.

The Court of Appeal slapped that down and affirm the right of the employer to manage his business in no uncertain terms:

…this Court must now make it clear that an employer is entitled to make his business more efficient, as for example by automation, abandonment of unprofitable activities, re-organisation or other cost-saving steps, no matter whether or not the business would otherwise go to the wall…

The personal grievance provisions … should not be treated as derogating from the rights of employers to make management decisions genuinely on such grounds. Nor could it be right for the Labour Court to substitute its own opinion as to the wisdom or the expediency of the employer’s decision.

When a dismissal is based on redundancy, it is the good faith of that basis and the fairness of the procedure followed that may fall to be examined on a complaint of unjustifiable dismissal

… the Court and the grievance committees cannot properly be concerned with an examination of the employer’s accounts except in so far as it bears on the true reason for dismissal.

The Employment Court could only inquire as to the genuineness of the employer’s decision and the procedures adopted. The Court could not substitute their views on management decisions. No second-guessing.

In Brake v Grace Team Accounting Ltd, the Employment Court found its way back into second-guessing employer’s decisions about how to manage their business. The figures used by the employer to decide that a redundancy was required were in error. The employer miscalculated.

The Employment Court had previously held in Rittson-Thomas T/A Totara Hills Farm v Hamish Davidson that the statutory test of what a fair and reasonable employer could have done in all the circumstances applies to the substantive reasoning for redundancies. Some enquiry into the employer’s substantive decision is required to establish that a hypothetical fair and reasonable employer could also make the same decision in all of the circumstances.

Subsequently in Brake v Grace Team Accounting Ltd, the Employment Court found that the actions by the employer were “not what a fair and reasonable employer would have done in all the circumstances” and “failed to discharge the burden of showing that the plaintiff’s dismissal for redundancy was justified”.

The Court found that the redundancy was “a genuine, but mistaken, dismissal”, but it still found that the dismissal was substantively unjustified. That is a major new development. Mistaken dismissals that are genuine are unlawful and grounds for compensation under the employment law.

The case was appealed where the issues were whether the correct test had been applied. The Court of Appeal, in a sad day for employers, job creation and the unemployed, found that the Employment Court was within its rights to do what it did and applied the statutory tests correctly:

GTA acted precipitously and did not exercise proper care in its evaluation of its business situation and it made its decision about Ms Brake’s redundancy on a false premise.

So it never turned its mind to what its proper business needs were but rather proceeded to evaluate its options based on incorrect information. We can see no error in the finding by the Employment Court that a fair and reasonable employer would not do this.

The test is now that fair and reasonable employers in New Zealand do not make mistakes. A much greater burden is now laid upon employers to show that not only that redundancies are justified, but they have made careful calculations and no mistakes.

No more seat of your pants entrepreneurship in New Zealand. No more entrepreneurial hunches – the essence of entrepreneurship is acting on hunches and other judgements that are incapable of being articulated to others and about which there is mighty disagreement in many cases. As Lavoie (1991) states:

…most acts of entrepreneurship are not like an isolated individual finding things on beaches; they require efforts of the creative imagination, skillful judgments of future costs and revenue possibilities, and an ability to read the significance of complex social situations.

The essence of entrepreneurship is your hunches are better than the next guy’s and you survive in competition by backing that hunch often to the consternation of the crowd. As Mises explains:

[Economics] also calls entrepreneurs those who are especially eager to profit from adjusting production to the expected changes in conditions, those who have more initiative, more venturesomeness, and a quicker eye than the crowd, the pushing and promoting pioneers of economic improvement…

The entrepreneurial idea that carries on and brings profits is precisely that idea which did not occur to the majority… The prize goes only to those dissenters who do not let themselves be misled by the errors accepted by the multitude

In many cases, those entrepreneurial hunches are sorted, sifted and selected on the basis of trial and error in the marketplace. Central to Hayek’s conception of the meaning of competition is it is a process of trial and error with many errors:

Although the result would, of course, within fairly wide margins be indeterminate, the market would still bring about a set of prices at which each commodity sold just cheap enough to outbid its potential close substitutes — and this in itself is no small thing when we consider the insurmountable difficulties of discovering even such a system of prices by any other method except that of trial and error in the market, with the individual participants gradually learning the relevant circumstances.

Remember Hayek’s conception of competition as a discovery procedure where prices and production emerge through the clash of entrepreneurial judgements and competitive rivalry:

…competition is important only because and insofar as its outcomes are unpredictable and on the whole different from those that anyone would have been able to consciously strive for; and that its salutary effects must manifest themselves by frustrating certain intentions and disappointing certain expectations

Errors are no longer permitted in the New Zealand labour market by the Employment Court. The Court has outlawed error in redundancy decisions.

This is despite the fact that the conception by Kirzner of the market process is that it is an error correction procedure without rival and a central role of entrepreneurial alertness is to correct errors in pricing and production:

It is important to notice the role played in this process of market discovery by pure entrepreneurial profit. Pure profit opportunities emerge continually as errors are made by market participants in a changing world. The inevitably fleeting character of these opportunities arises from the powerful market tendency for entrepreneurs to notice, exploit, and then eliminate these pure price differentials.

The paradox of pure profit opportunities is precisely that they are at the same time both continually emerging and yet continually disappearing. It is this incessant process of the creation and the destruction of opportunities for pure profit that makes up the discovery procedure of the market. It is this process that keeps entrepreneurs reasonably abreast of changes in consumer preferences, in available technologies, and in resource availabilities.

Rothbard made similar arguments about the centrality of discrepancies and error in entrepreneurship:

The capitalist-entrepreneur buys factors or factor services in the present; his product must be sold in the future. He is always on the alert, then, for discrepancies, for areas where he can earn more than the going rate of interest.

In Frank Knight’s conception of profit, there were temporary profits that arise from the correction of error:

In the theory of competition, all adjustments “tend” to be made correctly, through the correction of errors on the basis of experience, and pure profit accordingly tends to be temporary.

The Employment Court misunderstands the market process as a process of error correction. Those errors are identified through entrepreneurial alertness and trial and error. These errors are both of over-optimism and over-pessimism as Kirzner explains:

Errors of over-pessimism are those in which superior opportunities have been overlooked. They manifest themselves in the emergence of more than one price for a product which these resources can create. They generate pure profit opportunities which attract entrepreneurs who, by grasping them, correct these over-pessimistic errors.

The other kind of error, error due to over-optimism, has a different source and plays a different role in the entrepreneurial discovery process. Over-optimistic error occurs when a market participant expects to be able to complete a plan which cannot, in fact, be completed.

A considerable part of entrepreneurial alertness arises from the business opportunities created by sheer ignorance and pure error as Kirzner explains:

What distinguishes discovery (relevant to hitherto unknown profit opportunities) from successful search (relevant to the deliberate production of information which one knew one had lacked) is that the former (unlike the latter) involves that surprise which accompanies the realization that one had overlooked something in fact readily available. (“It was under my very nose!”)

The market process is a selection procedure where the more efficient survive for reasons that may be unknown to the entrepreneurs directly concerned as well as to observers and officious judges. Alchian pointed out the evolutionary struggle for survival in the face of market competition ensured that only the profit maximising firms survived:

- Realised profits, not maximum profits, are the marks of success and viability in any market. It does not matter through what process of reasoning or motivation that business success is achieved.

- Realised profit is the criterion by which the market process selects survivors.

- Positive profits accrue to those who are better than their competitors, even if the participants are ignorant, intelligent, skilful, etc. These lesser rivals will exhaust their retained earnings and fail to attract further investor support.

- As in a race, the prize goes to the relatively fastest ‘even if all the competitors loaf.’

- The firms which quickly imitate more successful firms increase their chances of survival. The firms that fail to adapt, or do so slowly, risk a greater likelihood of failure.

- The relatively fastest in this evolutionary process of learning, adaptation and imitation will, in fact, be the profit maximisers and market selection will lead to the survival only of these profit maximising firms.

The surviving firms may not know why they are successful, but they have survived and will keep surviving until overtaken by a better rival. All business needs to know is a practice is successful.

One method of organising production and supplying to the market will supplant another when it can supply at a lower price (Marshall 1920, Stigler 1958). Gary Becker (1962) argued that firms cannot survive for long in the market with inferior product and production methods regardless of what their motives are. They will not cover their costs.

The more efficient sized firms are the firm sizes that are currently expanding their market shares in the face of competition; the less efficient sized are those firms that are currently losing market share (Stigler 1958; Alchian 1950; Demsetz 1973, 1976). Business vitality and capacity for growth and innovation are only weakly related to cost conditions and often depends on many factors that are subtle and difficult to observe (Stigler 1958, 1987). The Employment Court pretends to know better than the outcome of the competitive struggle in the market for survival.

The Employment Court also believes employers have something akin to academic tenure. In 2010, the Court found that an employee’s redundancy was unjustified because the employer did not offer redeployment and there is no requirement that the right of the redeployment be written into the employment agreement (Wang v Hamilton Multicultural Services Trust). The particulars of this case were quite interesting:

- A new management role was created with significantly more responsibility for training, supervision and decision making than the redundant finance administrator role, with a 50% salary increase to recognise the increased responsibilities and duties.

- The vacancy was advertised externally but the existing finance administrator was encouraged to apply.

- His experience and qualifications meant that he could fulfil the new role, albeit with some up-skilling.

- He decided not to apply for it to avoid jeopardising a personal grievance claim that his redundancy was not genuine and therefore unjustified.

In the case at hand, the Employment Court held that the employer was obliged to look for alternatives to making the employee redundant. Given that he would be able to perform the new finance manager position with some up-skilling, the employer should have offered him the position rather than simply inviting him to apply for it.

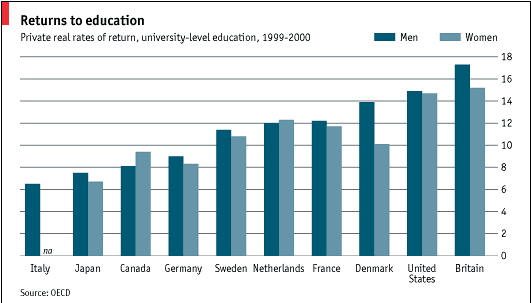

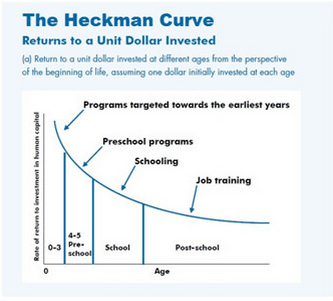

The notion that an employee through training can quickly increase their marginal productivity by 50% to fill a more senior role contradicts the modern labour economics of human capital. A 50% salary increase through a bit of training would imply extraordinary annual returns on other forms of on-the-job training and formal education as well as the training at hand in the Employment Court case.

I would very much like to be in the position where I can get a 50% salary increase after a bit of training. As I recall, I required about 5-10 years of on-the-job human capital acquisition before my starting salary as a graduate was 50% higher through promotion and transfers.

In summary, the Employment Court stands apart from the modern labour economics of human capital and job search and matching as well as the modern theory of entrepreneurial alertness, and the market as a discovery procedure and an error correction mechanism. The Employment Court has fallen for both the pretence to knowledge and the fatal conceit.

George Stigler and that peculiar requirement to dumb down economics for politicians and the public

20 Feb 2015 Leave a comment

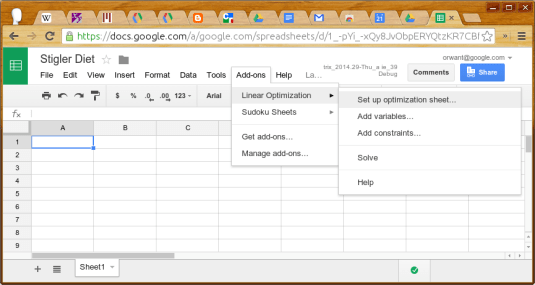

The Stigler diet is still as cheap as can be

12 Feb 2015 Leave a comment

in George Stigler, labour economics, poverty and inequality Tags: cost of subsistence, poverty and inequality, school breakfast programmes, School lunches

The always excellent Matthew Kahn reminded me today of the Stigler diet: George Stigler’s famous 1945 journal article The Cost of Subsistence in the Journal of Farm Economics. Stigler posed this problem:

For a moderately active man (economist) weighing 154 pounds, how much of each of 77 foods should be eaten on a daily basis so that the man’s intake of nine nutrients (including calories) will be at least equal to the recommended dietary allowances suggested by the National Research Council in 1943, with the cost of the diet being minimal.

Stigler managed to find a nearly optimal daily diet of:

- 1.6 pounds of wheat flour,

- 0.3 pounds of cabbage,

- 0.6 ounces of spinach,

- 0.4 pounds of pancake flour,

- 1.1 ounces of pork liver.

All of this food necessary to sustain health and weight of a moderately active man amounted to $0.16 per day in 1944, which is an annual cost of $39.93, not including leap years. A recent update for inflation put the annual cost of the Stigler diet at $561.43 in 2005. Not more than two dollars a day .

Stigler later concluded that the main issue about food consumption is a preference for a variety rather than a nutritional diet which could be obtained very low cost if you like cabbage, spinach, flour and a little bit of pork liver. For many years, pork liver was not available in my local supermarkets in Australia and New Zealand until recently when Asian buyers started to buy again.

When various claims made about child poverty and children going without food, and adults too, the purpose of the Stigler diet in the calculations of the cost of subsistence is to show that it is actually extremely cheap to get the necessities of life in a capitalist society. Something more than either a lack of income in a modern welfare state or far from high prices of this extremely cheap, but spartan diet must be playing a role.

George Stigler on income redistribution policies

23 Jan 2015 Leave a comment

in George Stigler, income redistribution, liberalism, Public Choice, rentseeking Tags: evidence-based policy

The marvel of the market: the remarkable foresight of young adults in choosing what to study

16 Jan 2015 1 Comment

in Alfred Marshall, Armen Alchian, economics of education, George Stigler, human capital, job search and matching, labour economics, occupational choice, politics - New Zealand, rentseeking Tags: 2nd laws of supply and demand, Alfred Marshall, Armen Alchian, george stigler, search and matching, skills shortgaes

Known but yet to be exploited opportunities for profit do not last long in competitive markets, including hitherto unnoticed opportunities for the greater utilisation and development of skills and experience (Hakes and Sauer 2006, 2007; Ryoo and Rosen 2004; and Kirzner 1992). Moneyball is the classic example of entrepreneurial alertness to hitherto unexploited job skills which were quickly adopted by competing firms (Hakes and Sauer 2006, 2007).

There is considerable evidence that the demand and supply of human capital responds to wage changes. For example, over- or under-supplied human capital moves either in or out in response to changes in wages until the returns from education and training even out with time (Ryoo and Rosen 2004; Arcidiacono, Hotz and Kang 2012; Ehrenberg 2004).

As evidence of this equalisation of returns on human capital investments across labour markets, the returns to post-school investments in human capital are similar – 9 to 10 percent – across alternative occupations, and in occupations requiring low and high levels of training, low and high aptitude and for workers with more and less education (Freeman and Hirsch 2001, 2008). There is evidence that workers with similar skills in similarly attractive jobs, occupation and locations earn similar pay (Hirsch 2008; Vermeulen and Ommeren 2009; Rupert and Wasmer 2012; Roback 1982, 1988).

Ryoo and Rosen (2004) found that the labour supply and university enrolment decisions of engineers is “remarkably sensitive” to career earnings prospects. Graduates are the main source of new engineers. Engineers who moved out into other occupations such as management did not often moved back to work again as professional engineers. Ryoo and Rosen (2004) observed when summarising their work that:

Both the wage elasticity of demand for engineers and the elasticity of supply of engineering students to economic prospects are large. The concordance of entry into engineering schools with relative lifetime earnings in the profession is astonishing.

Ryoo and Rosen (2004) found several periods of surplus in the market for engineers. These periods of shortage or surplus corresponded to unexpected demand shocks in the market for engineers such as the end of the Cold War.

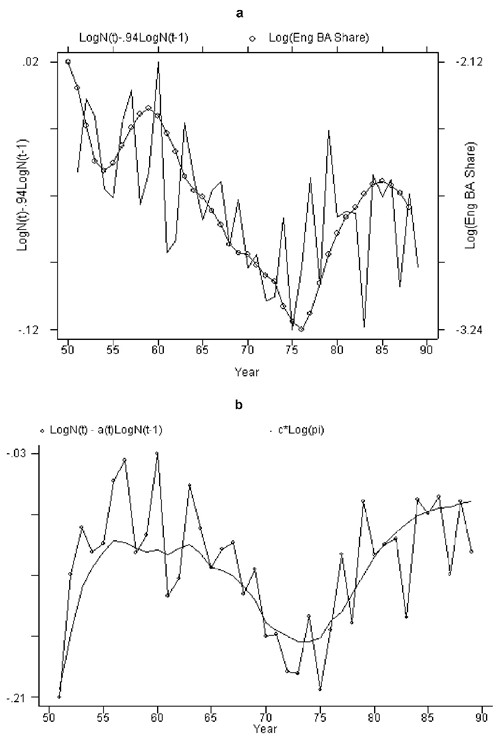

Figure 1: New entry flow of engineers: a, actual vs. imputed from changes in stock of engineers; b, time-varying coefficients.

Source: Ryoo and Rosen (2004)

Ryoo and Rosen (2004) noted that importance of permanent versus transitory changes in earnings. Transitory rises and falls in earnings prospects have much less influence on occupational choices and the educational investments of students.

In light of these findings that the supply of engineers rapidly adapted to changing market conditions, Ryoo and Rosen (2004) questioned whether public policy makers have better information on future labour market conditions than labour market participants do. When politicians get worked up about skill shortages, the markets for scientists and engineers often where they make extravagant claims about the ability of the market to adapt to changing conditions because of the long training pipeline involved in university study, including at the graduate level.

There can be unexpected shifts in the supply or demand for particular skills, training or qualifications. These imbalances even themselves out once people have time to learn, update their expectations and adapt to the new market conditions (Rosen 1992; Ryoo and Rosen 2004; Bettinger 2010; Zafar 2011; Arcidiacono, Hotz and Kang 2012; Webbink and Hartog 2004).

For example, Arcidiacono, Hotz and Kang (2012) found that both expected earnings and students’ abilities in the different majors are important determinants of student’s choice of a college major, and 7.5% of students would switch majors if they made no forecast errors.

The wage premium for a tertiary degree was low and stable in New Zealand in the 1990s (Hylsop and Maré 2009) and 2000s (OECD 2013). This stability in the returns to education suggests that supply has tended to kept up with the demand for skills at least over the longer term at the national level. There were no spikes and crafts that would be the evidence of a lack of foresight among teenagers in choosing what to study.

All in all, the remarkable sensitivity of engineers to a career earnings prospects, the frequent changes of college majors by university students in response to changing economic opportunities, and the stability of the returns on human capital over time suggest that the market for human capital is well functioning.

The argument that the market was not working well was assumed rather than proven. Likewise, the case for additional subsidies for science, technology, engineering and mathematics because of perceived skill shortages has not been made out. There is a large literature showing that the market for professional education works well.

The onus is on those who advocate intervention to come up with hard evidence, rather than innate pessimism about markets that are poorly understood because of a lack of attempts to understand it. Studies dating back to the 1950s by George Stigler and by Armen Alchian found that the market for scientists and engineers works well and the evidence of shortages were more presumed than real.

Recent Comments