https://twitter.com/FurchtgottRoth/status/717362503160881152

Privatizing local bus services could save $5.7 billion

19 May 2016 Leave a comment

in industrial organisation, politics - New Zealand, politics - USA, privatisation, survivor principle, theory of the firm, transport economics, urban economics Tags: privatisation, state owned enterprises

Can private enterprise save our public lands?

17 May 2016 Leave a comment

in applied price theory, applied welfare economics, environmental economics, industrial organisation, privatisation, survivor principle Tags: economics of national parks

Saving Ocean Fisheries with Property Rights

17 May 2016 Leave a comment

in applied price theory, comparative institutional analysis, economics of regulation, environmental economics, fisheries economics, industrial organisation, international economics, law and economics, privatisation, property rights Tags: common property, economics of fisheries, individual transferable quotas, tragedy of the commons

Water Policies for People, by David Zetland

18 Apr 2016 Leave a comment

in economics, economics of regulation, environmental economics, industrial organisation, law and economics, privatisation, property rights, survivor principle Tags: Economics of water

Will @JulieAnneGenter’s KiwiBank plan bankrupt KiwiPost? @JordNZ

03 Apr 2016 Leave a comment

in financial economics, industrial organisation, politics - New Zealand, privatisation, survivor principle Tags: economics of banking, government ownership, KiwiBank, New Zealand Greens, offsetting behaviour, rational irrationality, state owned enterprises, The fatal conceit

The Greens are followed up on an earlier suggestion by Julie Anne Genter, the Green’s Shadow Minister of Finance, that KiwiBank should be refocused to keeping interest rates low. To that end, it would not be required to pay dividends to the government to help fund the effort. KiwiBank has only just started paying dividends to its parent, KiwiPost.

If that were to be the case, that KiwiBank was no longer be required to pay dividends, that would blow quite a hole in the balance sheet of its parent company KiwiPost.

KiwiPost owns the share capital of KiwiBank, which must be valued on a commercial basis to pass auditing as a state owned enterprise which is commercially orientated.

Source: Historic $21 million dividend paid by state owned bank Kiwibank | interest.co.nz.

That share capital owned by KiwiPost in KiwiBank would be have to be written off if KiwiBank were to pay no further dividends because it is no longer commercially orientated entity. Such a write-off of its investment in KiwiBank would write off most of Kiwi Post’s equity capital.

The reason why state owned enterprises are required to be valued on commercial principles is to ensure that any subsidies or other favours sought by politicians show up in the profit and loss statement or the balance sheet through asset write-offs. Section 7 of the State-Owned Enterprises Act 1986 non-commercial activities states that:

Where the Crown wishes a State enterprise to provide goods or services to any persons, the Crown and the State enterprise shall enter into an agreement under which the State enterprise will provide the goods or services in return for the payment by the Crown of the whole or part of the price thereof.

This statutory safeguard ensures that the cost of any policies proposed by ministers, and the Greens are very keen on transparency and independent costing of political promises, are plain to all.

% billionaires who made their money through political connections or resource industries

13 Feb 2016 Leave a comment

in economics of bureaucracy, economics of regulation, energy economics, entrepreneurship, industrial organisation, poverty and inequality, privatisation, rentseeking, resource economics

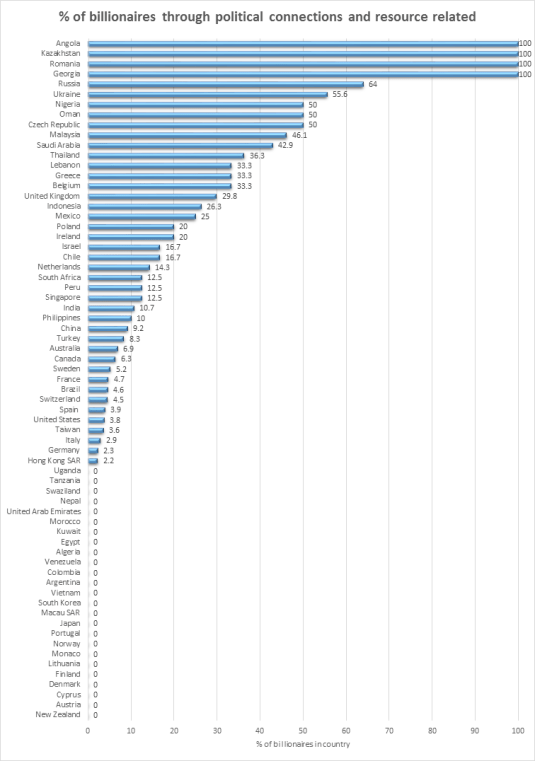

The 1826 Billionaires in the Forbes 2015 list are classified as rich through political connections if they made their money through past political positions, close relatives or friends in government, or questionable licenses, privatisations or resource extraction industries.

All privatizations were included in the politically-connected/resource-related category despite my data source acknowledging the possibility that the new owners may have transformed the company. Resource billionaires were all deemed to be lucky or cronies by my data source rather than diligent as some most certainly were. This is something of a slur by my data source given the industriousness of some resource billionaires some of whom were even geologists.

Political cronyism is a path to billionaire wealth mainly in the developing countries. Less than 10% of Chinese billionaires made their money through political connections, which is surprising.

NZ taxpayers made a $20 million profit on its $30 billion state owned enterprises portfolio!

11 Mar 2015 Leave a comment

in economics of bureaucracy, industrial organisation, politics - New Zealand, privatisation Tags: privatisation, state owned enterprises

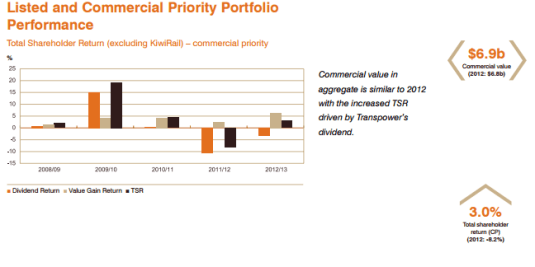

KiwiRail is such a dog that the Treasury reports on the rate of return to the taxpayer on the state owned enterprises portfolio by excluding KiwiRail from its calculations of rates of return.

The Treasury doesn’t do similar adjustments for state owned enterprises that are performing unusually well, so total shareholder return figures should be reported without this KiwiRail exception. If you buy a dog, you should own up to the fleas it spreads to the rest of your portfolio.

Trying to pretend that KiwiRail is just not there, or survives on the largess of someone other than the one and only New Zealand taxpayer, does no one any favours. This KiwiRail exception will have to apply for at least 10 years to the annual commercial portfolio report of the Treasury. I want to know the total shareholder return, including KiwiRail every year without exception or special pleading.

That total shareholder return of -8.2% in 2012 is worthy of comment too:

The portfolio generated a net loss after tax of $1.8 billion driven by a restructuring of KiwiRail’s balance sheet and reductions in bottom line results for Meridian and Solid Energy, affected by hydrology and coal market deterioration respectively.

Six of the world’s seven billion people have mobile phones – but only 4.5 billion have a toilet, according to a U.N. report

06 Sep 2014 Leave a comment

Privatisation screw-ups are the best case for privatisation

26 Mar 2014 2 Comments

in entrepreneurship, politics - New Zealand, privatisation, Public Choice Tags: government as business owners, government asset sales, government privatisations

Governments are so bad as business owners and so incapable of running a commercial process free of politics that governments cannot even sell a state-owned enterprise for a good price under the full glare of the media and public.

Anyone can sell an asset. It is the simplest task of ownership. Hire some consultants and go for the best price. Governments lack this ability.

Privatisations are often politicised, with discounts for small buyers from the middle class, for employees and other special interests. These messy privatisations are the best case out there against state ownership of businesses.

“No asset sales” was the Labour Party’s most coherent slogan in the 2011 general election in New Zealand. It cannot be claimed that the more recent privatisations in New Zealand were not subject to the maximum amount of public and parliamentary scrutiny possible in a democracy. The 2011 election was said to be a referendum on asset sales.

This inability to sell state-owned enterprises for a profit and free of politics calls into question the ability of governments to make complicated day-to-day business management and entrepreneurial judgements as owners of business enterprises. Imagine the quality of the day-to-day state-owned enterprise decision making that is further away from the glare of an election?

Private asset owners have a strong incentive to sell assets at a profit as it will otherwise hurt their share price and their personal wealth. Inferior entrepreneurs and owners are punished by losses. Any assets that inferior entrepreneurs either mismanaged or sell at a bargain price will, through further buying and selling, end up in the hands of more alert entrepreneurs and owners.

There are no similar feedback and error correction measures disciplining governments as asset owners and in their day-to-day monitoring of their business portfolios. Governments who own business assets have an inherently softer budget constraint.

Recent Comments