https://twitter.com/Mark_J_Perry/status/688469218719830016

Who-d a-Thunk It? DC raises min wage and food job growth falls from 182/month to only 9/month? #economicdeathwish pic.twitter.com/HKl6Qq7vr2

— Mark J. Perry (@Mark_J_Perry) January 16, 2016

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

21 Jan 2016 Leave a comment

in applied price theory, applied welfare economics, labour economics, minimum wage, politics - New Zealand, politics - USA Tags: expressive loading, living wage, rational irrationality

17 Jan 2016 Leave a comment

in labour economics, labour supply, minimum wage, politics - New Zealand, unemployment Tags: Denmark, employment law, equilibrium unemployment rate, labour market deregulation

https://twitter.com/KiwiLiveNews/status/688503382181449728

The Labour Party wants the New Zealand labour market to be more like that in Denmark. The early 1990s recession New Zealand aside, New Zealand has always had a lower equilibrium unemployment rate than Denmark.

Data extracted on 17 Jan 2016 03:29 UTC (GMT) from OECD.Stat.

13 Jan 2016 Leave a comment

in applied price theory, labour economics, minimum wage, personnel economics, politics - USA Tags: living wage

Recent field research in San Francisco and North Carolina restaurants found that after San Francisco living wage increase, managers were pickier about whom they hire, because they want workers to be worth the higher cost. The San Francisco minimum wage is now $12.25, and all employers are required to offer paid sick days and contribute to their employees’ health insurance.

Source: How worker-friendly laws changed life as a server in San Francisco restaurants – The Washington Post.

The study is useful because of instead of studying the myths and realities about how a higher minimum wage somehow motivates workers to be more productive and offset part or all of its cost to employers, the study investigates how the minimum wage, a living wage, affects hiring standards.

Employers of low skilled, low-wage workers look for workers who are friendly and reliable. As the study concedes, you can teach people the skills they need as long as they are friendly and reliable.

In San Francisco, recruits not only have to be friendly and reliable, they are expected to have experience. The living wage shuts out inexperienced and new workers, which promotes social exclusion.

Minimum wage workers in San Francisco are noticeably older and better educated than those in North Carolina and recruited after more intensive sorting and screening against the hiring standards for the vacancy:

Rather than viewing servers as essentially interchangeable labourers who can be quickly and easily trained if they possess a modicum of personal hygiene and a friendly personality, employers in San Francisco exhibited a clear description of what a professional server was and the explicit and implicit skills required.

The study did not enquire into what happened to applicants who failed to meet the higher hiring standard induced by the living wage increase. As is standard with the champions of the living wage, they do not want to talk about those excluded by the living wage rise.

12 Jan 2016 Leave a comment

in applied price theory, applied welfare economics, labour economics, minimum wage Tags: expressive voting, living wage, rational irrationality, Twitter left

10 Jan 2016 Leave a comment

in labour economics, labour supply, minimum wage, poverty and inequality, unemployment Tags: living wage, rational irrationality

06 Jan 2016 Leave a comment

in entrepreneurship, industrial organisation, labour economics, minimum wage, survivor principle, technological progress Tags: creative destruction, do gooders, expressive voting, induced innovation, rational irrationality

16 Dec 2015 1 Comment

in applied price theory, labour economics, Marxist economics, minimum wage, politics - New Zealand, politics - USA, poverty and inequality Tags: expressive voting, Leftover Left, living wage

09 Dec 2015 1 Comment

in applied price theory, discrimination, economic history, gender, minimum wage, politics - New Zealand, politics - USA

Geoff Simmons is one of many to argue that the gender wage gap is smaller at the bottom end of the labour market because of the minimum wage. For example, the explanation of the Economic Policy Institute for greater gender pay equality at the bottom is the minimum wage:

The minimum wage is partially responsible for this greater equality among the lowest earners—it sets a wage floor that applies to everyone, which means that people near the bottom of the distribution are likely to make more equal wages. Also, low-wage workers are disproportionately women, which means that the minimum wage particularly bolsters women’s wages.

This is plainly wrong as a question of economic theory and political history. One effect of minimum wages is it lowers the cost of discrimination against the employment of less-preferred workers. Since the employer has to pay the minimum wage hour no matter whom he hires, the cost of discriminating on the basis of sex or race is less.

That is why South African whites at the beginning of and all through the apartheid era demanded that blacks be paid the minimum wage: they wanted to cheapen the cost of discrimination.

Minimum wages were initially introduced in the USA shortly after 1900 solely for women and children. The express aim was to price women out of jobs and raise men’s wages by enough so that they could provide for their families.

Tim Leonard in Protecting Family and Race The Progressive Case for Regulating Women’s Work showed that these women-only minimum wages were justified by political progressive including women on grounds that they would:

(1) Protect the biologically weaker sex from the hazards of market work;

(2) Protect working women from the temptation of prostitution;

(3) Protect male heads of household from the economic competition of women; and

(4) Ensure that women could better carry out their eugenic duties as “mothers of the race.”

These days some argue that minimum wages actually increase employment. Times change, and the slopes of supply and demand curves for labour must change with them.

If there is a minimum wage, the cost to employers of indulging their conscious prejudices or an unconscious bias are less. This is because a minimum wage set above the market clearing wage will cause unemployment. Because jobs must be rationed, the costs of indulging a prejudice or succumbing to an unconscious bias are reduced and along with that the market mechanisms that wear down discrimination by employers.

Part of the explanation of the gender wage gap is interruptions in labour force participation because of motherhood reduces the time available to them for job shopping. The first 10 to 15 years of most careers, most working lives, is spent job shopping.

Job shopping is where wages grow through the accumulation of search capital. By moving between 6 to 10 jobs in their first 10 to 15 years in the workforce, a worker finds better and better matches for their skills and talents. They worked their way into the better paying job simply because they have had more time to find a good job match between the changing array of vacancies and their idiosyncratic set of skills and work history.

Great quote on the cruelty of the minimum wage from Nobel economist Vernon Smith, illustrated by Henry Payne https://t.co/Lwch51acEY—

Mark J. Perry (@Mark_J_Perry) October 24, 2015

The minimum wage frustrates this job shopping by denying some women their initial stepping stone into the labour market both when they are a teenager and when they are returning from time spent caring for children. This is in addition to the minimum wage increasing the gender wage gap from reducing the costs of discrimination to employers.

The minimum wage reduces women’s opportunities to get a foothold in the labour market and build on that foothold through job shopping.

30 Nov 2015 1 Comment

in discrimination, gender, minimum wage, politics - New Zealand

The minimum wage was pretty stable as a percentage of the median wage in New Zealand until recently. Nonetheless, the gender wage gap narrowed at the bottom of the labour market rapidly in the 1980s and 1990s.

Source: OECD Employment Database and Data extracted on 30 Nov 2015 04:03 UTC (GMT) from OECD.Stat.

In common with the USA, that narrowing of the gender wage gap stopped in the early 2000s after the minimum wage started increasing as a percentage of the median wage.

Again, that is contrary to the idea that the minimum wage is a failsafe that narrows the gender wage gap at the bottom. This failsafe is said to be the leading reason why the gender wage gap is much smaller at the bottom of the labour market than higher-up such as the median and in particular at the top.

30 Nov 2015 1 Comment

in discrimination, gender, labour economics, minimum wage, politics - USA

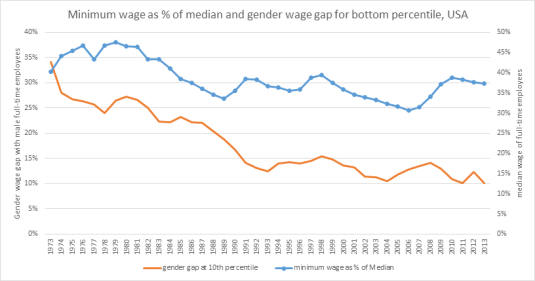

When feuding with strangers on Twitter about the gender wage gap, a common explanation for the much smaller gender wage gap at the bottom of the labour market is the power is the minimum wage to uplift women’s wages and with it narrow the gender wage gap at the bottom of the labour market.

Below I have plotted the minimum wage as a percentage of the median wage for the USA along with the gender wage gap for the bottom 10% of the U.S. labour market. Both are expressed as percentages of the median wage.

Source: OECD Employment Database and Data extracted on 30 Nov 2015 04:03 UTC (GMT) from OECD.Stat.

From what I can make of the above chart, the gender wage gap at the bottom of the labour market was closing rapidly when the minimum wage was falling as a percentage of the median wage. That gender wage gap then stabilised when the minimum wage stabilised as a percentage of the median. The gender wage gap increased when the minimum wage increased as a percentage of the median wage for full-time employees.

Should not this relationship between the minimum wage and the gender wage gap be the other way around if the minimum wage is a force for closing the gender wage gap at the bottom of the labour market?

25 Nov 2015 1 Comment

in applied price theory, labour economics, minimum wage, politics - USA

25 Nov 2015 Leave a comment

in applied price theory, energy economics, labour economics, minimum wage, politics - USA Tags: 2016 presidential election, carbon tax, climate alarmism, expressive voting, Leftover Left, living wage, rational irrationality, Twitter left

24 Nov 2015 2 Comments

in applied price theory, labour economics, minimum wage, politics - New Zealand, politics - USA

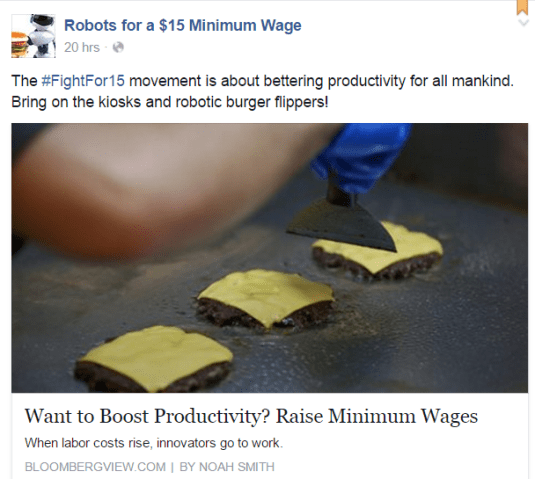

Noah Smith overnight argued that increasing the minimum wage to $15 an hour in the USA will induce innovation that will, in time, mitigate much of the costs of the minimum wage increase to employers:

So minimum-wage laws, by forcing us to abandon low-skilled labour, might actually increase technological innovation. Some people even speculate that this effect might have started the Industrial Revolution itself! Economic historian Robert Allen has argued that the Industrial Revolution began in Europe, rather than in China, because European employers were forced to pay more for labour. Since labour was more expensive, companies invested in technology, which then raised productivity so much that it boosted wages even higher, forcing companies to invest more in technology, even as their increased incomes allowed them to make those investments. A 1987 theory by growth economics pioneer Paul Romer operated on a similar principle — expensive labour causes an upward spiral of technological improvement.

Smith is confusing induced innovation with standard substitution effects and offsetting behaviour. When you make something more expensive, buyers look for cheaper alternatives including technologies that were previously unprofitable to employ.

Up until the minimum wage increase, these labour saving technologies were not profitable investments because the best available choice was still lawful to employ, which was low skilled labour. A minimum wage increase makes it unlawful to employ the best available alternative. As Modeled Behaviour explains better than me:

If throwing the costly challenges of artificially expensive Labor at businesses drives economic growth, then perhaps we should have an Office of Government Hurdles that is designed to generate arbitrary restrictions for businesses. After all, if this innovation is a driver of economic growth it should have value by itself and not simply as a by-product of some other regulatory goal, e.g. keeping out immigrants or raising wages. Consider a law that banned bending over in the workplace. Is there any doubt that this would spur innovative products that aided in grabbing without bending? Or consider a law that mandated everyone work from home. This would spur massive investment in broadband and telecommunications. But there is no doubt we would be poorer from both of these regulations.

One of the reasons demand curves slope downwards is as the price of the good increases, buyers have other options so they stop buying and pursue these other options which include innovation.

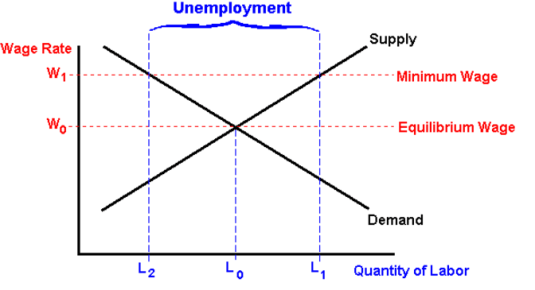

It's pretty simple: Minimum Wage = Compulsory Unemployment http://t.co/6xiX6YCp9Z—

Mark J. Perry (@Mark_J_Perry) July 25, 2015

Smith also falls for the standard labour market policy response in a crisis, which is to send them on a course:

And as workers raise their own skill levels, that new technology would raise their wages as well. The entire economy, including any workers who temporarily lost their low-wage jobs, would benefit in the long run. Of course, this theory is fairly speculative — theories that play out over years or decades are hard to test with real-world data. But it’s a potential benefit of the minimum wage that is worth thinking about.

Whenever there is a crisis in the labour market, the standard policy response is send them on a course. That makes you look like you care and by the time they graduate, the problem might have fixed itself. I encountered this policy response to labour market crises to repeat itself over and over again while working in the bureaucracy.

Clever geeks such as yourself sitting at your desk as a policy analysis, public intellectual, politician, activist or minister did well at university. University graduates succumb to the fatal conceit when they assume others will as well, including those who have neither the ability or aptitude to succeed in education.

Educational romanticism will not solve the disemployment problems of a minimum wage increase. People don’t go on from high school to higher education for a range of reasons that include a lack of motivation to study or a simple lack of ability no matter how hard they try.

Charles Murray believes many students make poor investments by going to college, in part, because many don’t complete their degrees:

…even though college has been dumbed down, it is still too intellectually demanding for a large majority of students, in an age when about 50 per cent of all high school graduates are heading to four-year colleges the next fall. The result is lots of failure. Of those who entered a four-year college in 1995, only 58 per cent had gotten their BA five academic years later

Murray does not want to abandon these teenagers:

…Too few counsellors tell work-bound high-school students how much money crane operators or master stonemasons make (a lot). Too few tell them about the well-paying technical specialties that are being produced by a changing job market. Too few assess the non-academic abilities of work-bound students and direct them toward occupations in which they can reasonably expect to succeed. Worst of all: As these students approach the age at which they can legally drop out of school, they are urged to take more courses in mathematics, literature, history and science so that they can pursue the college fantasy. Is it any wonder that so many of them drop out?

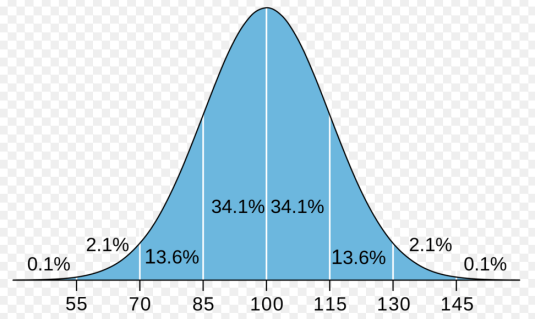

Charles Murray is frank about educational romanticism. Half the population is of below average IQ. That is before considering the necessary personality traits to be a successful student. Asking people without the necessary IQ and personality traits to waste their time with up skilling insults them.

Carrying that send them on a course educational romanticism over to the minimum wage and living wage debates is to use the low skilled as lab rats in the social experiments that are bound to fail as they failed in the past.

One of the purposes of applied price theory, the study of economic history and even labour econometrics is to spare us policy experiments we already know will not turn out well.

We do know what will happen if the minimum wage is raised to $15 per hour. Some people will lose their jobs. More importantly, there is a reduced incentive for the low paid to invest in skills to improve their earning power because the minimum wage is already delivered that assuming they still have a job. Human capital effects of minimum wage increases is under discussed.

As for investing in up skilling, active labour market programs that invest heavily in upskilling the unemployed have a dreadful record. This dreadful record is when there are subsidies direct to the unemployed going on prearranged courses focused on work skills. We’re not talking about indirect incentives such as raising the minimum wage and hoping for the best regarding their upskilling both on the job or while on the unemployment benefit.

Back to Noah Smith. He admits that increases in the minimum wage reduce employment. He tries to ride out on the conclusion that that increase in unemployment after a small minimum wage increase isn’t much.

Great quote on the cruelty of the minimum wage from Nobel economist Vernon Smith, illustrated by Henry Payne https://t.co/Lwch51acEY—

Mark J. Perry (@Mark_J_Perry) October 24, 2015

Obviously the teenagers and adults thrown onto the scrapheap of society by the increased minimum wage don’t count in the brutal utilitarian calculus employed by Noah Smith and other champions of the low paid.

Smith is now trying to fortify his argument by arguing that minimum wage activists have spotted an untapped innovation right under the noses of entrepreneurs who profit from exploiting gaps in the market faster than the rest. Bureaucrats and politicians notice these gaps in the market before those who gain from superior entrepreneur alertness to hitherto untapped opportunities for profit do so and instead leave that money on the table.

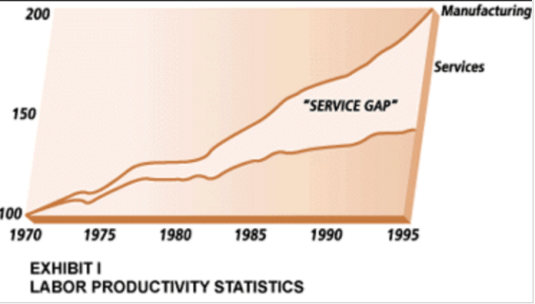

What is even richer in this induced innovation hypothesis of Noah Smith and others is many of these minimum wage workers are in the services sector. Services suffer from Baumol’s disease: the limited ability to innovate in labour-intensive areas.

The optimal timing of innovation spawned a vast literature. So has offsetting behaviour to regulation. The former innovation is welfare enhancing. The latter is mitigation of the dead weight social losses of regulation.

What and where to innovate is a process of market discovery. The life cycle of many industries starts with a burst of new entrants with similar products and production processes. These new or upgraded products and the different ways of making them often use ideas that cross-fertilise.

In time, there is an industry shakeout where a few leapfrog the rest with cost savings and design breakthroughs to yield the mature product (Boldrin and Levine 2008, 2013). Fast-seconds and practical minded latecomers often imitate and successfully commercialise ideas seeded by the market pioneers using prior ideas as their base.

This entire dynamic market process of competitive selection, competition as a discovery procedure, trial and error and leapfrogging is distorted if one or more of the contending entrepreneurs as their hand forced by regulation on labour imports rather than because of competitive merits. The government cannot enable this process because neither the outcome nor even the direction of the competitive struggle for survival is known in advance. To quote Thomas Babington (1830):

The maxim, that governments ought to train the people in the way in which they should go, sounds well. But is there any reason for believing that a government is more likely to lead the people in the right way than the people to fall into the right way of themselves?

The firms that survive and grow in competition with rival ways of doing business are the more efficient simply because they survived. What will survive in market competition will not be known in advance to politicians and activists when they decide to make one specific input more expensive. The results of the competitive market process that weeds out the less efficient firm are known at the end of this long race, not at the start.

Knowing that innovation is induced by changing relative prices and wages doesn’t help wise bureaucrats and farsighted politician know which one of those relative prices or wages will be decisive in determining the direction of innovation. As Alfred Marshall explains in The Social Possibilities of Economic Chivalry (1907):

A Government could print a good edition of Shakespeare’s works, but it could not get them written… I am only urging that every new extension of Governmental work in branches of production which need ceaseless creation and initiative is to be regarded as prima facie anti-social, because it retards the growth of that knowledge and those ideas which are incomparably the most important form of collective wealth.

What is not explored adequately in this debate by either Noah Smith or the New Zealand Living Wage Movement is why limit the efficiency wage and induced innovation hypotheses to low skilled workers.

Why not increase the wages of all workers by 20-30%? There will not be a large disemployment effect and the induced innovation will mitigate the costs, if Noah Smith and his efficiency wage and induced innovation hypotheses are to be believed.

30% would be a good number for increasing all New Zealand wages was that is about the wage gap with Australia. Let’s go for broke. What’s the risk other than massive unemployment and economic chaos?

Does a higher minimum wage really reduce employment? econ.st/1gp4Jbs http://t.co/WGMZGLKHmI—

The Economist (@EconBizFin) July 30, 2015

The living wage sought in New Zealand and the fight for $15 campaign in the USA presuppose massive offsetting labour productivity gains. A doubling in labour productivity overnight in low-paid service and other jobs or at least within a few years because of higher work morale.

The labour productivity increase required to offset even some of the costs of the double-digit living wage increases proposed at home and abroad are large, very large:

Looking first at the 2016 position, the proposed wage floor increase would require productivity growth of around 11% between 2015 and 2016. By 2020, the cumulative productivity gains from 2015 would need to rise above 37%, implying an average annual increase of 6.6%… the pace of productivity growth implied by our thought exercise is unprecedented: the annual average increase during the economic growth years of 1991-2008 was 2.2%. That points to two conclusions. First, firms are likely to need support in meeting the productivity challenge. And second, any productivity plan should look beyond the obvious forms of high-tech wizardry in high value-added sectors to encompass new forms of organisational approaches and business models in our most labour-absorbing industries.

What is missing in most discussions of the efficiency wage hypothesis and the latest discussion of induced innovation and wage increases is, as the Washington Centre for Equitable Growth notes is the upper limit on the wage increase that carries only minimal disemployment risks:

Many activists and policymakers across the country are vigorously pushing for an increase in the minimum wage at the federal, state, and local levels. Of course, while many people agree that the minimum wage needs to be higher, that still leaves the question of how high it should be… The trouble, however, is taking that research and applying it to potential minimum wage increases that would be outside the range of previous hikes. For example, raising the current federal minimum wage from $7.25 to $15—more than doubling it—would be significantly larger than prior increases.

That upper bound discussion is a small hole in their arguments compared to their failure to advocate massive efficiency wage increases and massive induced innovation wage increases across the entire economy. Why is the efficiency wage and induced innovation hypotheses only extended to the low paid? Why not hire wages for everyone?

One of the reasons for the high labour productivity in Western Europe is their minimum wages, employment protection laws and high taxes made it unprofitable to employee low skilled service workers.

European consumers innovated in the face of these high costs of taxes and regulation by doing for themselves what Americans buy on the market be it anything from takeaways to home help. That is well known as Richard Rogerson explains:

The empirical work establishes two results. First, hours worked in Europe decline by almost 45 percent compared to the United States over this period [from 1956 to 2003]. Second, this decline is almost entirely accounted for by the fact that Europe develops a much smaller market service sector than the United States… relative increases in taxes and technological catch-up can account for most of the differences between the European and American time allocations over this period.

The phenomena that developed in Europe as the result of the additional costs of taxes and labour market regulation is known as Eurosclerosis, not a productivity breakout through efficiency wages and induced innovation.

22 Nov 2015 Leave a comment

in applied price theory, discrimination, economic history, gender, human capital, labour economics, labour supply, minimum wage, occupational choice, poverty and inequality Tags: asymmetric marriage premium, Claudia Goldin, compensating differentials, economics of fertility, gender wage gap, marriage and divorce, power couples

As part of a large paper calling for massive government intervention, the Economic Policy Institute, impeccably left-wing, massed a considerable amount of evidence about the withering away of the gender wage gap and anomalies in what is left of that gap. None of these anomalies bolster the case for more regulation of the labour market.

The first of their charts showed the large reduction in the gender wage gap in the USA. Women’s wages have been increasing consistently over the last 40 years or so. The second of their tweeted charts shows that women of all races consistently outperformed men in wages growth, often by a large margin.

Their most interesting chart is about how the gender gap is not only highest among top earners, their pay gap has not fallen at all in the last 40 years. If anything, that gender wage gap is rising at the top end of the labour market albeit slowly. Progress in closing the gender gap been pretty consistent at the lower pay levels. That progress is certainly better than no progress at all.

The Economic Policy Institute didn’t enquire in any detail into why women with the most options in the labour market had made the least progress in closing the gender wage gap.

None of their solutions such as more collective-bargaining and a higher minimum wage will help the top end of the job market.

There is an anomaly in the Economic Policy Institute’s reasoning. The women who would suffer least from a purported inequality of bargaining power inherent in the capitalist system and have plenty of human capital have had least success in closing the gender pay gap. These women can shop around for better job offers and start their own businesses. Many do because they are professionals where self-employment and professional partnerships are common.

The better discussions of the gender wage gap emphasise choice. Women choosing at the top end of the labour market to balance career and family and choosing the occupation and education where the net advantages of doing that are the greatest. As the Economic Policy Institute itself notes:

In 2014, the gap was smallest at the 10th percentile, where women earned 90.9 percent of men’s wages. The minimum wage is partially responsible for this greater equality among the lowest earners, as it results in greater wage uniformity at the bottom of the distribution.

The gap is highest at the top of the distribution, with 95th percentile women earning 78.6 percent as much as their male counterparts. Economist Claudia Goldin (2014) postulates that the gap is larger for women in high-wage professions because they are penalized for not working long, inflexible hours that often come with many professional jobs, due in large part to the arrival of children and long-standing social expectations about the division of household labour between men and women.

What the Economic Policy Institute does not explain is why these long-standing social expectations about the division of household labour should be strongest among well-paid women with plenty of options.

Among these options of high-powered women in well-paid jobs is the ability to buy every labour-saving appliance, hire a nanny and ample childcare and acquire everything else on the list of demands of the Economic Policy Institute on closing the gender pay gap. Something doesn’t add up?

Of course, the Economic Policy Institute discusses the unadjusted gender wage rather than the adjusted gender wage. When you study the gender wage gap after making adjustments for demographic and other obvious factors, it is clear that this pay gap is driven by the choices women make between career and family.

Claudia Goldin did a great study of Harvard MBAs using online surveys of their careers. This is the very group that according to the Economic Policy Institute have made the least progress in bringing down patriarchy in the labour market. Specifically, the overturning of traditional expectations about the marital division of labour in childcare and parenthood.

https://twitter.com/alyssalynn7/status/669219008747610113

Goldin found that three proximate factors accounted for the large and rising gender gap in earnings among MBA graduates as their careers unfold:

The greater career discontinuity and shorter work hours for female MBAs are largely associated with motherhood. There are some careers that severely penalise any time at all out of the workforce or working less than punishingly long and rigid hours.

A 2014 Harvard Business School study found that 28 percent of recent female alumni took off more than six months to care for children; only 2 percent of men did.

Claudia Goldin found one counterfactual that cancels out the gender wage gap amongst MBA professionals: hubby earns less! Female MBAs who have a partner who earn less than them earn as much as the average MBA professional on an hourly basis but work a few less hours per week.

The gender wage gap is persisted in high-paying jobs because career women have so many options. Studies of top earning professionals show that they make quite deliberate choices between family and career. The better explanation of why so many women are in a particular occupation is job sorting: that particular job has flexible hours and the skills do not depreciate as fast for workers who take time off, working part-time or returning from time out of the workforce.

Low job turnover workers will be employed by firms that invest more in training and job specific human capital:

This is the choice hypothesis of the gender wage gap. Women choose to educate for occupations where human capital depreciates at a slower pace.

The gender wage gap for professionals can be explained by the marriage market combined with assortative mating:

This two-year age gap means that the husband has two additional years of work experience and career advancement. This is likely to translate into higher pay and more immediate promotional prospects.

An interesting and informed look at the pay gap between men and women economist.com/blogs/freeexch… https://t.co/0nxtC9ILWo—

Charles Read (@EconCharlesRead) November 06, 2015

Maximising household income would imply that the member of the household with a higher income, and greater immediate promotional prospects stay in the workforce. This is entirely consistent with the choice hypothesis and equalising differentials as the explanation for the gender wage gap. As Solomon Polachek explains:

At least in the past, getting married and having children meant one thing for men and another thing for women. Because women typically bear the brunt of child-rearing, married men with children work more over their lives than married women. This division of labour is exacerbated by the extent to which married women are, on average, younger and less educated than their husbands.

This pattern of earnings behaviour and human capital and career investment will persist until women start pairing off with men who are the same age or younger than them. That is, more women will have to start marrying down in both income and social maturity.

21 Nov 2015 1 Comment

in applied price theory, applied welfare economics, entrepreneurship, industrial organisation, labour economics, minimum wage, politics - New Zealand, poverty and inequality, survivor principle Tags: British economy, living wage

A brilliant point by @FlipChartRick in the reblog. What sort of single year labour productivity increase is required to cover a UK living wage increase. Basic arithmetic kills.

A 6.6% annual productivity growth would be required to fund a living wage. This will be far above trend and would be required in sectors such as services that are not at all known for rapid productivity growth because of Baumol’s disease.

A subsequent Twitter exchange updated a key chart to include Australia and New Zealand.

The CIPD and the Resolution Foundation are collaborating on a piece of research into the impact of the National Living Wage (NLW). According to their first study over half of the country’s employers expect to be affected by it. Around a third said they would meet the increased cost by improving productivity and 22 percent said they would take lower profits. Only 15 percent said they would lay off workers or slow down recruitment.

That all sounds promising but, as Matt Whittaker points out, the productivity increase needed to cover the cost of the NLW could be pretty steep. As you might expect, there is a strong relationship between rising minimum wages and rising productivity. Most countries in the OECD have not strayed very far from this line of best fit.

In the absence of any productivity growth, the proposed NLW would move some way from the line (the green circle) by 2016 and…

In the absence of any productivity growth, the proposed NLW would move some way from the line (the green circle) by 2016 and…

View original post 565 more words

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments