Popular New Keynesian macroeconomic models predict that cuts in various types of distortionary taxes are contractionary when monetary policy is constrained at the zero lower bound. We turn to a long span of history in the United Kingdom to test this hypothesis. Using a new long-run dataset of narrative-identified tax changes from 1918to 2020, we […]

Another zero lower bound prediction bites the dust

Another zero lower bound prediction bites the dust

28 Sep 2024 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, fiscal policy, history of economic thought, labour economics, macroeconomics, monetary economics, public economics, unemployment Tags: New Keynesian macroeconomics

Interview with Greg Mankiw: New Keynesian Macro, Growth, and Economic Policy

04 Sep 2024 Leave a comment

in applied price theory, budget deficits, business cycles, development economics, econometerics, economic growth, economic history, Edward Prescott, fiscal policy, great depression, history of economic thought, labour economics, law and economics, macroeconomics, Milton Friedman, monetarism, monetary economics, politics - USA, Public Choice, Robert E. Lucas, unemployment

Jon Hartley interviews Greg Mankiw on topics including New Keynesian macroeconomics, growth, and economic policy more broadly at his Capitalism and Freedom website (August 20, 2024, video and transcript available). Here are a few of the comments that caught my eye. On big models and small models in studying the macroeconomy: [O]n the issue of…

Interview with Greg Mankiw: New Keynesian Macro, Growth, and Economic Policy

Fiscal and monetary policy

27 Aug 2024 Leave a comment

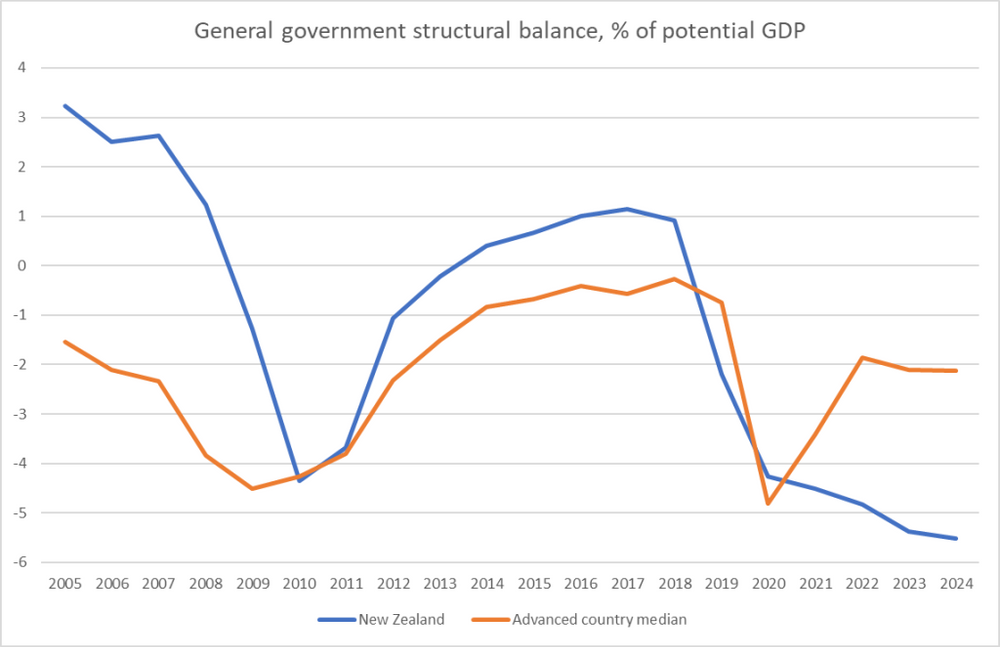

in budget deficits, business cycles, econometerics, economic growth, economic history, financial economics, fiscal policy, history of economic thought, inflation targeting, macroeconomics, monetary economics, politics - New Zealand Tags: monetary policy

Over the last few years, The Treasury seems to have been toying with bidding for a more significant role for fiscal policy as a countercyclical stabilisation tool It seemed to start when Covid hubris still held sway – didn’t we do well? – and the first we saw of it in public was at a […]

Fiscal and monetary policy

Finally, exchange rate models seem to work pretty well

14 Aug 2024 Leave a comment

in budget deficits, business cycles, econometerics, economic history, financial economics, history of economic thought, inflation targeting, macroeconomics, monetary economics, politics - USA Tags: exchange rates, monetary policy

Exchange-rate models fit very well for the U.S. dollar in the 21st century. A “standard” model that includes real interest rates and a measure of expected inflation for the U.S. and the foreign country, the U.S. comprehensive trade balance, and measures of global risk and liquidity demand is well-supported in the data for the U.S. […]

Finally, exchange rate models seem to work pretty well

Thought and Details on the Fiscal Theory of the Price Level

30 Jul 2024 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, history of economic thought, labour economics, macroeconomics, monetarism, monetary economics, unemployment Tags: monetary policy

The Fiscal Theory of the Price Level has been percolating among monetary theorists for over three decades: Eric Leeper being the first to offer a formalization of the idea, with Chris Sims and Michael Woodford soon contributed to its further development. But the underlying idea that the taxation power of the state is essential for […]

Thought and Details on the Fiscal Theory of the Price Level

Treasury says one thing in a speech but quite another in the BEFU

28 Jul 2024 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, unemployment Tags: monetary policy

I picked up The Post this morning to find the lead story headlined “Recession hits homes harder than businesses”, reporting a speech given earlier this week by Treasury’s deputy secretary and chief economic adviser Dominick Stephens. There was an account of the same speech, but with some different material, on BusinessDesk a couple of days […]

Treasury says one thing in a speech but quite another in the BEFU

What does RN stand for in the pending French election?

28 Jun 2024 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, income redistribution, labour economics, macroeconomics, monetary economics, Public Choice Tags: France

The RN intends to move ahead with a proposed law that states as its aim “to combat Islamist ideologies”. It includes measures to make it easier to close mosques and deport imams deemed to be radicalised, and a ban on clothing that “constitute in themselves an unequivocal and ostentatious affirmation” of Islamist ideology. Bardella said […]

What does RN stand for in the pending French election?

Comparing Treasury and Reserve Bank forecasts

06 Jun 2024 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, macroeconomics, monetary economics, politics - New Zealand Tags: monetary policy

I put a range of charts on Twitter late last week illustrating why, from a macroeconomic perspective, I found the government’s Budget deeply underwhelming. I won’t repeat them but will just show two here. The first is the Treasury’s estimate of how the bit of the operating deficit not explained just by swings in the […]

Comparing Treasury and Reserve Bank forecasts

MPS

22 May 2024 Leave a comment

in budget deficits, business cycles, economic growth, financial economics, fiscal policy, inflation targeting, macroeconomics, monetary economics

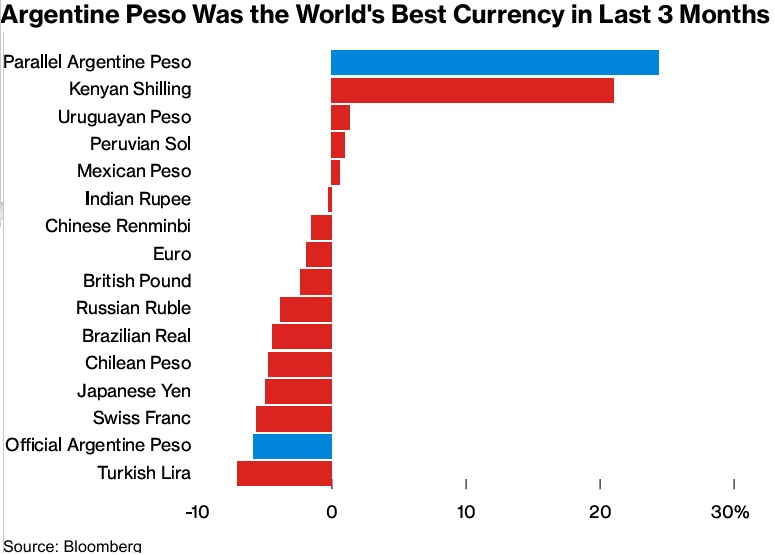

More Good Results from Argentina

28 Apr 2024 Leave a comment

in budget deficits, business cycles, comparative institutional analysis, development economics, economic growth, economic history, economics of bureaucracy, economics of regulation, fiscal policy, growth disasters, income redistribution, labour economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetary economics, Public Choice, rentseeking, unemployment Tags: Argentina

The most important election of 2023 took place in Argentina, where that nation’s voters elected the libertarian candidate, Javier Milei, as their new president. I discussed the outlook for Milei’s agenda on a recent appearance of the Schilling Show. Here’s a brief excerpt. As you can see, I’m worried that Milei faces enormous obstacles. Argentina […]

More Good Results from Argentina

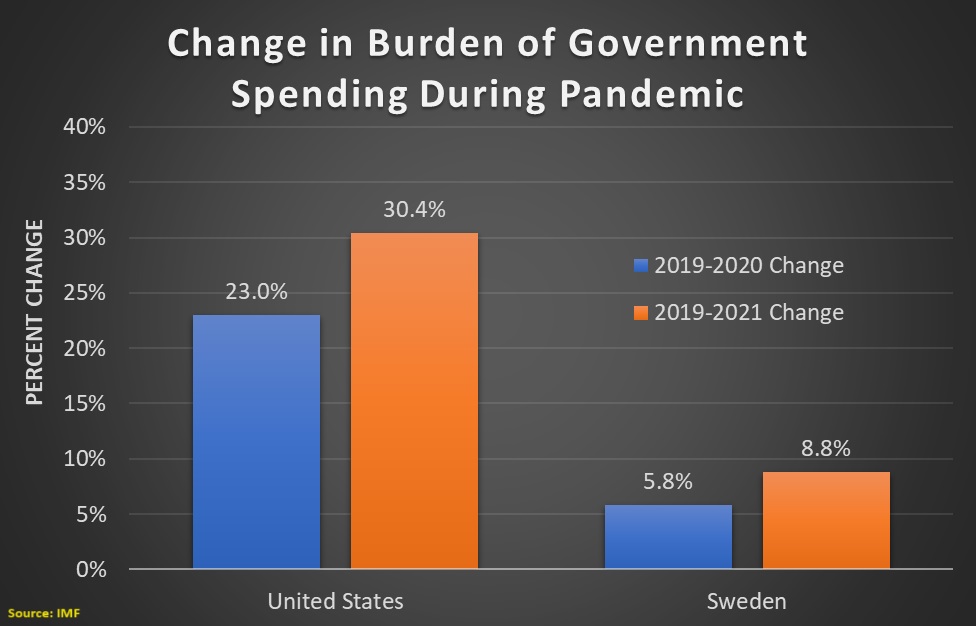

The Pandemic and Swedish Fiscal Policy

21 Apr 2024 Leave a comment

in budget deficits, fiscal policy, health economics, macroeconomics, public economics Tags: economics of pandemics, Sweden

When I wrote about long-run policy lessons from the pandemic, I mostly focused on the incompetence of the bureaucrats at the FDA and CDC. I also wrote that Sweden had a very sensible approach. Politicians did not panic. They advised prudence, but kept schools open and did not mandate lockdowns. Interestingly, Sweden also had better […]

The Pandemic and Swedish Fiscal Policy

19 Apr 2024 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, great depression, history of economic thought, labour economics, macroeconomics, monetarism, monetary economics, unemployment

The US debt is worse than it was after WWII

17 Apr 2024 Leave a comment

in budget deficits, defence economics, economic history, fiscal policy, macroeconomics, Public Choice, public economics Tags: economics of pandemics, World War II

Over the last few years I’ve made a number of posts about the ever growing US government spending, deficits and debt, which has reached the point where US Debt is now rising $1 trillion every 100 days. But there are many people who look at the debt as 120% of GDP and shrug their shoulders that […]

The US debt is worse than it was after WWII

12 Apr 2024 Leave a comment

in budget deficits, business cycles, fiscal policy, macroeconomics, politics - New Zealand, public economics

MICHAEL REDDELL: Not very bothered by deficits

03 Apr 2024 Leave a comment

in budget deficits, business cycles, economic history, fiscal policy, macroeconomics, monetary economics, politics - New Zealand

I was away last week so have been rather late in getting to the Budget Policy Statement and associated material released last Wednesday. It does not make for pleasant reading, at least if one cares at all about governments not borrowing to pay for the groceries. Once upon a time – still not that long…

MICHAEL REDDELL: Not very bothered by deficits

Recent Comments