How to Cure Inflation Milton Friedman

29 Oct 2021 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, great depression, history of economic thought, macroeconomics, monetarism, monetary economics, unemployment

Finn E. Kydland’s (Nobel Laureate) Speech at the WHU – New Year’s Conference 17

27 Oct 2021 Leave a comment

in budget deficits, business cycles, development economics, econometerics, economic growth, economic history, economics of regulation, entrepreneurship, fiscal policy, global financial crisis (GFC), great recession, growth disasters, growth miracles, human capital, labour economics, labour supply, macroeconomics, monetary economics, poverty and inequality, Robert E. Lucas Tags: real business cycles

How intangible capital may explain rising labour productivity during recessions

26 Oct 2021 Leave a comment

in applied price theory, business cycles, economic growth, economic history, Edward Prescott, entrepreneurship, financial economics, global financial crisis (GFC), great recession, macroeconomics, monetary economics

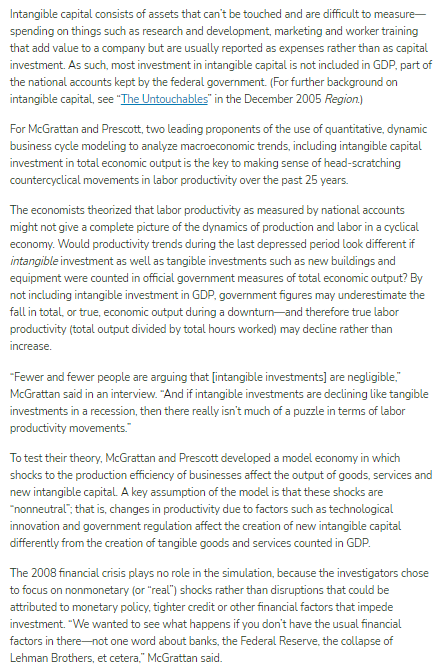

“The sharp drop in intangible investment contributes to a decline in actual economic output greater than that measured by official government GDP accounts. This implies that in the actual U.S. economy, true labor productivity declined significantly during the recent recession—a finding consistent with established aggregate theory based on the neoclassical model of economic growth. Thus, McGrattan and Prescott’s experiment solves the labor productivity puzzle by reconciling the apparent mismatch between theory and economic data that show labor productivity bucking the GDP trend. “The addition of intangible capital and non- neutral technology to the model was crucial in accounting for high productivity and low GDP during the period,” they write.”

From https://www.minneapolisfed.org/article/2012/unmeasured-investment

Prescott on booms and busts

25 Oct 2021 Leave a comment

in budget deficits, business cycles, economic growth, history of economic thought, macroeconomics, monetarism, monetary economics

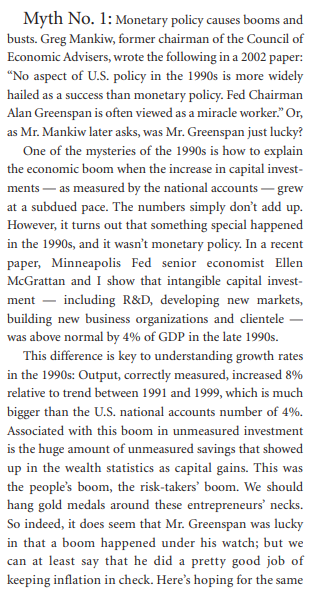

From Five Macroeconomic Myths, By Edward Prescott, The Wall Street Journal, December 11, 2006 https://www.minneapolisfed.org/~/media/files/research/prescott/wsj/wsj_12-11-06_five_macroeconomic_myths.pdf?la=en via https://www.minneapolisfed.org/research/prescott/wsj

When will #COVID19 job support cross into the zombie quagmire?

25 Oct 2021 Leave a comment

in budget deficits, business cycles, economic history, history of economic thought, income redistribution, industrial organisation, labour economics, macroeconomics, monetary economics, survivor principle, unemployment Tags: economics of pandemics, Japan, unintended consequences

Ricardo Versus Thornton on the Appropriate Monetary Response to Supply Shocks

23 Oct 2021 Leave a comment

in business cycles, economic growth, history of economic thought, macroeconomics, monetary economics Tags: monetary policy, real business cycles

Recent Comments