Yes, I do still favor it, but here is part of the problem, as I explain in my latest Bloomberg column: The simplest way for Argentina to dollarize would be to inflate the peso even more. For purposes of argument, imagine a peso inflation rate of one billion percent a year. Pesos would be worthless, […]

Why Argentina’s dollarization is likely to come in sudden, messy ways

Why Argentina’s dollarization is likely to come in sudden, messy ways

30 Nov 2023 Leave a comment

in budget deficits, business cycles, currency unions, development economics, fiscal policy, growth disasters, macroeconomics, monetary economics Tags: Argentina, dollarisation

Review of “Milton Friedman: The Last Conservative” by Jennifer Burns

29 Nov 2023 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, macroeconomics, Milton Friedman, monetarism, monetary economics

Milton Friedman: The Last Conservative by Jennifer Burns 592 pages Farrar, Straus and Giroux Published: Nov 2023 Released two weeks ago, Jennifer Burns’s “Milton Friedman: The Last Conservative” is the most significant biography of Friedman ever published. Burns is an associate professor of history at Stanford and a research fellow at the Hoover Institution. She […]

Review of “Milton Friedman: The Last Conservative” by Jennifer Burns

Understanding Fiscal Inflation — Keynote Speech by Eric Leeper

22 Nov 2023 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, inflation targeting, macroeconomics, monetary economics Tags: monetary policy

George Selgin on the New Deal and Recovery (and Relief and Reform)

18 Nov 2023 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, great depression, labour economics, labour supply, macroeconomics, monetary economics, unemployment

TweetWant to get a few hours’ worth of solid learning in less than 35 enjoyable minutes? Listen to my Mercatus Center colleague David Beckworth’s podcast (from October 2022) with George Selgin on the New Deal. Seriously. It will be 34-plus minutes very well spent. George’s book – False Dawn – is forthcoming from the University…

George Selgin on the New Deal and Recovery (and Relief and Reform)

Shameless central bankers

15 Nov 2023 Leave a comment

in business cycles, economics of bureaucracy, financial economics, fiscal policy, inflation targeting, macroeconomics, monetary economics, Public Choice Tags: monetary policy

It was in mid-August that this particular bit of shameless Reserve Bank spin got going. From a post in late August It proved to be nonsense of course. Once we had access to the short little IMF piece, published at the back of the Fund’s Article IV review, it was clear that it all amounted […]

Shameless central bankers

Milton Friedman: The Last Conservative | Hoover Institution

15 Nov 2023 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, inflation targeting, labour economics, macroeconomics, Milton Friedman, monetarism, monetary economics, unemployment Tags: monetary policy

Filling in the Gaps: Next Steps for the Fiscal Theory of the Price Level

15 Nov 2023 Leave a comment

in applied price theory, budget deficits, business cycles, econometerics, economic history, financial economics, fiscal policy, great depression, great recession, history of economic thought, inflation targeting, macroeconomics, monetarism, monetary economics Tags: monetary policy

Jennifer Burns on Milton Friedman 11/13/23

14 Nov 2023 Leave a comment

in applied price theory, Austrian economics, business cycles, comparative institutional analysis, econometerics, economic history, economics of education, economics of regulation, fiscal policy, great depression, history of economic thought, labour economics, liberalism, libertarianism, macroeconomics, Milton Friedman, monetarism, monetary economics Tags: monetary policy

Book Presentation with John Cochrane: “The Fiscal Theory of the Price Le…

09 Nov 2023 Leave a comment

in budget deficits, business cycles, econometerics, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, inflation targeting, macroeconomics, Milton Friedman, monetarism, monetary economics, public economics Tags: monetary policy

Ralph Hawtrey, Part 1: An Overview of his Career

06 Nov 2023 Leave a comment

in business cycles, economic history, fiscal policy, great depression, history of economic thought, labour economics, macroeconomics, monetary economics, unemployment

One of my goals when launching this blog in 2011 was to revive interest in the important, but unfortunately neglected and largely forgotten, contributions to monetary and macroeconomic theory of Ralph Hawtrey. Two important books published within the last year have focused attention on Ralph Hawtrey: The Federal Reserve: A New History by Robert Hetzel, […]

Ralph Hawtrey, Part 1: An Overview of his Career

More Evidence for Trump’s Corporate Tax Reform, Part I

03 Nov 2023 Leave a comment

in applied price theory, econometerics, economic growth, entrepreneurship, fiscal policy, macroeconomics, public economics Tags: taxation and investment

I’m very critical of bad policies we got during the Trump years, most notably profligacy and protectionism. But I shower praise on the good policies, such as the 2017 tax legislation (especially the lower corporate tax rate and the curtailing of the state and local tax deduction). Today, we’re going to focus on the positive. […]

More Evidence for Trump’s Corporate Tax Reform, Part I

Finding external balance

26 Oct 2023 Leave a comment

in business cycles, economic growth, fiscal policy, international economics, macroeconomics, monetary economics

That was the title of a ten page piece published last week by the ANZ economics team (chief economist Sharon Zollner and one of her offsiders, who appears to be a temporary secondee from the Reserve Bank). You can find a link to the paper here. The gist is captured in the paper’s summary I […]

Finding external balance

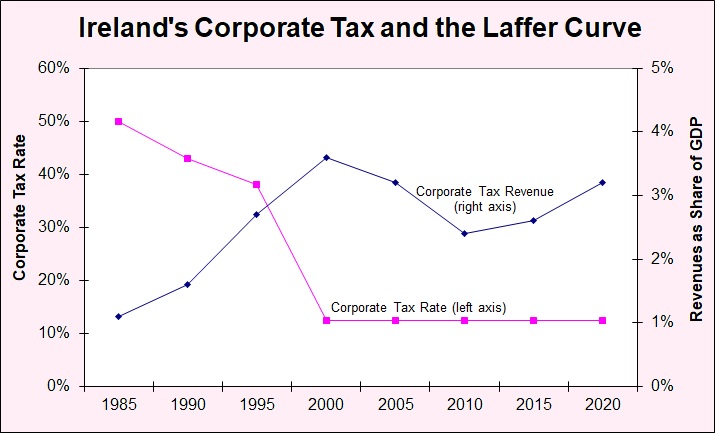

Ireland’s Corporate Tax and the Laffer Curve

19 Oct 2023 Leave a comment

in economic growth, economic history, fiscal policy, macroeconomics, Public Choice, public economics Tags: taxation and investment

About 15 years ago, I narrated a three-part series on the Laffer Curve. Here’s Part II, which looks at real-world evidence. About halfway through the video (3:15-3:55), I discuss what happened when Ireland dramatically lowered its corporate tax rate. The net result was an increase in tax revenue. But not just by a small amount. […]

Ireland’s Corporate Tax and the Laffer Curve

Heterogeneous Agent Fiscal Theory

14 Oct 2023 Leave a comment

in budget deficits, business cycles, fiscal policy, macroeconomics, monetary economics

Today, I’ll add an entry to my occasional reviews of interesting academic papers. The paper: “Price Level and Inflation Dynamics in Heterogeneous Agent Economies,” by Greg Kaplan, Georgios Nikolakoudis and Gianluca Violante. One of the many reasons I am excited about this paper is that it unites fiscal theory of the price level with heterogeneous agent…

Heterogeneous Agent Fiscal Theory

Recent Comments