Ninth Karl Brunner Distinguished Lecture by John H. Cochrane, 02.10.2025

14 Oct 2025 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, history of economic thought, macroeconomics, monetarism, monetary economics

💰 Inflation, Debt & The Future of the Economy | A Conversation with John Cochrane

12 Sep 2025 1 Comment

in budget deficits, business cycles, currency unions, fiscal policy, history of economic thought, inflation targeting, macroeconomics, Milton Friedman, monetarism, monetary economics Tags: monetary policy

*Crisis Cycle*

02 Jun 2025 Leave a comment

in budget deficits, business cycles, currency unions, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, history of economic thought, international economic law, international economics, macroeconomics, monetarism, monetary economics, Public Choice Tags: European Union

That is the new book by John H. Cochrane, Luis Garicano, and Klaus Masuch, and the subtitle is Challenges, Evolution, and Future of the Euro. Excerpt: Our main theme is not actions taken in crises, but that member states and EU institutions did not clean up between crises. They did not reestablish a sustainable framework […]

*Crisis Cycle*

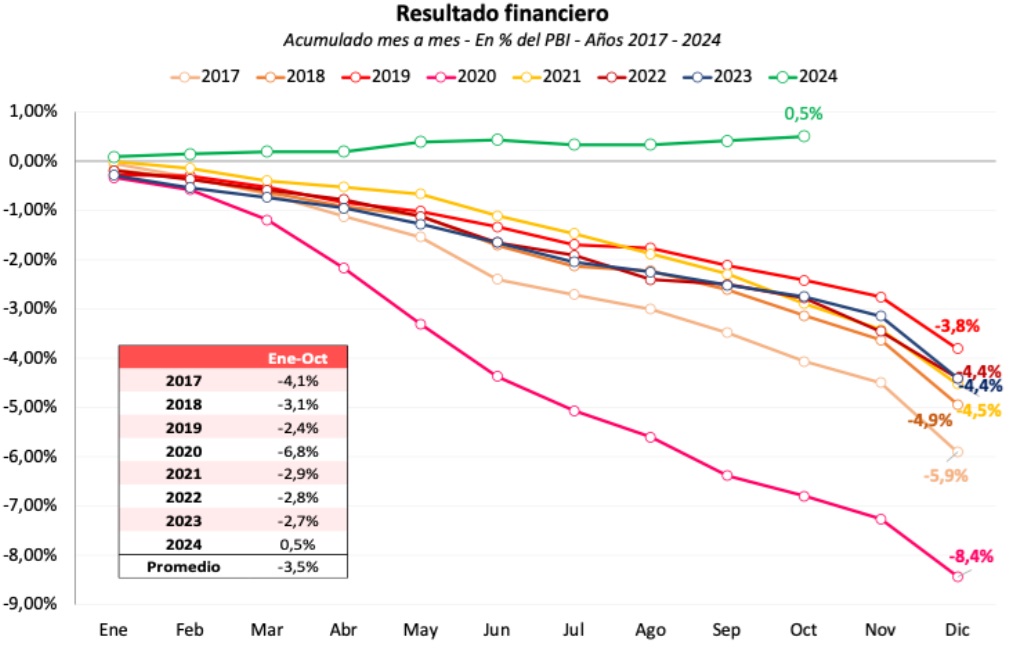

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

10 Jan 2025 Leave a comment

in applied price theory, Austrian economics, budget deficits, business cycles, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of regulation, financial economics, fiscal policy, growth disasters, growth miracles, history of economic thought, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetarism, monetary economics, political change, politics - USA, property rights, Public Choice, public economics, rentseeking, unemployment Tags: Argentina

It’s easy to mock economists. Consider the supposedly prestigious left-leaning academics who asserted in 2021 that Biden’s agenda was not inflationary. At the risk of understatement, they wound up with egg on their faces.* Today, we’re going to look at another example of leftist economists making fools of themselves. It involves Argentina, where President Javier […]

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

Argentina facts of the day

29 Dec 2024 Leave a comment

in budget deficits, comparative institutional analysis, development economics, economic growth, economics of bureaucracy, economics of regulation, F.A. Hayek, financial economics, fiscal policy, growth disasters, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Milton Friedman, monetarism, monetary economics, property rights, Public Choice, rentseeking, unemployment Tags: Argentina

Argentina’s bonds have already rallied dramatically. One gauge of the nation’s hard-currency debt, the ICE BofA US Dollar Argentina Sovereign Index, has generated a total return of about 90% this year. Meanwhile, the S&P Merval Index has risen more than 160% this year through Monday, far outpacing stock benchmarks in developed, emerging and frontier markets […]

Argentina facts of the day

Marginal Revolution Podcast–The New Monetary Economics!

25 Dec 2024 Leave a comment

in applied price theory, history of economic thought, macroeconomics, monetarism, monetary economics Tags: monetary policy

Today on the MR Podcast Tyler and I discuss the “New Monetary Economics”. Here’s the opening TABARROK: Today we’re going to be talking about the new monetary economics. Now, perhaps the first thing to say is that it’s not new anymore. The new monetary economics refers to a set of claims and ideas about monetary economics […]

Marginal Revolution Podcast–The New Monetary Economics!

o1 explains why you should not dismiss Fischer Black on money and prices

08 Dec 2024 Leave a comment

in applied price theory, business cycles, economic growth, financial economics, fiscal policy, history of economic thought, macroeconomics, monetarism, monetary economics Tags: monetary policy

The prediction of inflation dynamics—how prices change over time—has increasingly confounded modern macroeconomists. Throughout much of the twentieth century, there seemed to be clear relationships linking the money supply, economic slack, and price levels. Monetarism, the school of thought that posits a stable connection between the growth rate of a money aggregate and the subsequent […]

o1 explains why you should not dismiss Fischer Black on money and prices

Milei and populism

23 Nov 2024 1 Comment

in applied price theory, budget deficits, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of bureaucracy, economics of regulation, fiscal policy, growth disasters, income redistribution, macroeconomics, monetarism, monetary economics, Public Choice, rentseeking, unemployment Tags: Argentina

Bryan Caplan and Daniel Klein both opine on Milei and populism, Dan being very enthusiastic, while Bryan praising Milei but more reserved in his praise of populism. I too am a big fan of Milei, and I think he is still on a good track. If his reforms do not succeed, likely it will not […]

Milei and populism

Setelinleikkaus: When Finns snipped their cash in half to curb inflation

18 Nov 2024 Leave a comment

in applied price theory, economic history, financial economics, law and economics, macroeconomics, monetarism, monetary economics, property rights Tags: Finland, monetary policy

On the last day of 1945, with World War II finally behind it, Finland’s government announced a new and very strange policy.All Finns were required to take out a pair of scissors and snip their banknotes in half. This was known in Finland as setelinleikkaus, or banknote cutting. Anyone who owned any of the three…

Setelinleikkaus: When Finns snipped their cash in half to curb inflation

Interview with Greg Mankiw: New Keynesian Macro, Growth, and Economic Policy

04 Sep 2024 Leave a comment

in applied price theory, budget deficits, business cycles, development economics, econometerics, economic growth, economic history, Edward Prescott, fiscal policy, great depression, history of economic thought, labour economics, law and economics, macroeconomics, Milton Friedman, monetarism, monetary economics, politics - USA, Public Choice, Robert E. Lucas, unemployment

Jon Hartley interviews Greg Mankiw on topics including New Keynesian macroeconomics, growth, and economic policy more broadly at his Capitalism and Freedom website (August 20, 2024, video and transcript available). Here are a few of the comments that caught my eye. On big models and small models in studying the macroeconomy: [O]n the issue of…

Interview with Greg Mankiw: New Keynesian Macro, Growth, and Economic Policy

Thought and Details on the Fiscal Theory of the Price Level

30 Jul 2024 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, history of economic thought, labour economics, macroeconomics, monetarism, monetary economics, unemployment Tags: monetary policy

The Fiscal Theory of the Price Level has been percolating among monetary theorists for over three decades: Eric Leeper being the first to offer a formalization of the idea, with Chris Sims and Michael Woodford soon contributed to its further development. But the underlying idea that the taxation power of the state is essential for […]

Thought and Details on the Fiscal Theory of the Price Level

Monetary Policy and the Great Crash of 1929: A Bursting Bubble or Collapsing Fundamentals?

11 Jun 2024 Leave a comment

in business cycles, economic growth, economic history, great depression, history of economic thought, macroeconomics, monetarism, monetary economics Tags: monetary policy

By Timothy Cogley. He was then at the Federal Reserve Bank of San Francisco (1999). He is now at New York University. “In recent years, a number of economists have expressed concern that the stock market is overvalued. Some have compared the situation with the 1920s, warning that the market may be headed for a…

Monetary Policy and the Great Crash of 1929: A Bursting Bubble or Collapsing Fundamentals?

19 Apr 2024 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, great depression, history of economic thought, labour economics, macroeconomics, monetarism, monetary economics, unemployment

Solow on Market Advantages and Market Failures

31 Dec 2023 Leave a comment

in applied price theory, business cycles, economic growth, economic history, economics of regulation, entrepreneurship, history of economic thought, labour economics, macroeconomics, Milton Friedman, monetarism, monetary economics, unemployment

Robert Solow (1924-2023) died last week. As a starting point for understanding his life and his work on growth theory, the Nobel prize website, since he won the award in 1987, includes an overall description, a biographical essay, and his Nobel lecture. I can also strongly recommend an interview that Steven Levitt carried out with…

Solow on Market Advantages and Market Failures

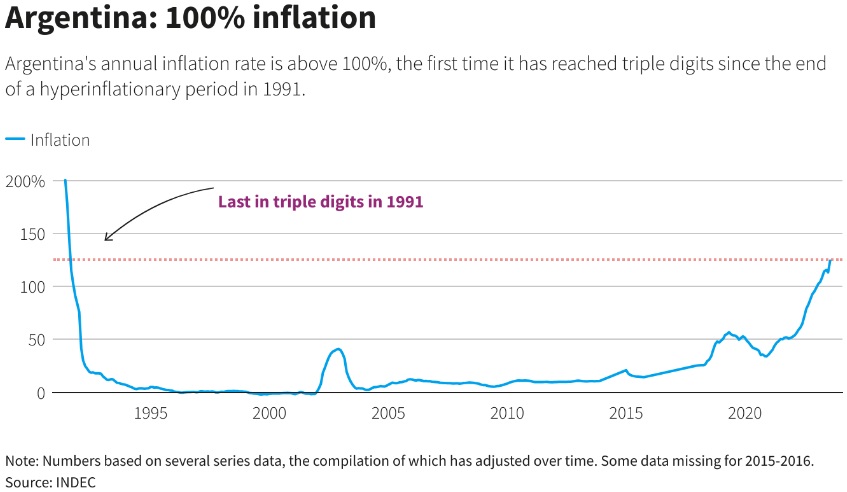

The Worst Journalism of 2023

29 Dec 2023 Leave a comment

in budget deficits, business cycles, development economics, economic history, fiscal policy, growth disasters, macroeconomics, monetarism, monetary economics Tags: Argentina

Writing about the economic tragedy of Argentina, I’ve explained that one major problem is inflation, thanks to that country’s version of “modern monetary theory.” This is not a trivial problem. Here’s a chart, from a recent report by Reuters, showing how prices have been rising for nearly 10 years and skyrocketing for the past three […]

The Worst Journalism of 2023

Recent Comments