Must be a lot of them about

15 Mar 2025 Leave a comment

in economic history, economics of media and culture, entrepreneurship, monetary economics Tags: Roman empire

My Former Economics MPhil and DPhil Class-Mate for many hard years, Mark Carney, becomes PM of Canada.

10 Mar 2025 Leave a comment

in business cycles, economic history, economics of bureaucracy, economics of education, history of economic thought, human capital, inflation targeting, labour economics, labour supply, macroeconomics, monetary economics, occupational choice, politics - New Zealand, Public Choice Tags: Canada, monetary policy

Congratulations Mark Carney. When I went to the UK to study economics, we started off doing a degree called Master of Philosophy in…

My Former Economics MPhil and DPhil Class-Mate for many hard years, Mark Carney, becomes PM of Canada.

Bernanke on inflation targeting

09 Mar 2025 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, financial economics, fiscal policy, history of economic thought, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, unemployment Tags: monetary policy

Former chairman of the Federal Reserve Board of Governors (and FOMC), Ben Bernanke, was yesterday the first of two keynote speakers at the Reserve Bank’s conference to mark 35 years of inflation targeting, which first became a formalised thing here in New Zealand. He indicated that he’d be speaking about inflation targeting in general and […]

Bernanke on inflation targeting

Adrian Orr resigns

05 Mar 2025 Leave a comment

in business cycles, economic history, economics of bureaucracy, fiscal policy, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, Public Choice, unemployment Tags: economics of pandemics, monetary policy

Adrian Orr has resigned as Reserve Bank Governor. I normally try to highlight the good as well as the bad when someone resigns, but I have to admit in this case I struggle. I welcomed his appointment in 2017. I noted the currency rose on his appointment and that he had a very good legacy […]

Adrian Orr resigns

Australia’s Pandemic Exceptionalism

05 Mar 2025 Leave a comment

in applied price theory, applied welfare economics, budget deficits, economic growth, economics of bureaucracy, economics of natural disasters, economics of regulation, health economics, labour economics, labour supply, macroeconomics, monetary economics, politics - Australia, politics - New Zealand, Public Choice, unemployment Tags: economics of pandemics

That’s the title of a 2024 book by a couple of Australian academic economists, Steven Hamilton (based in US) and Richard Holden (a professor at the University of New South Wales). The subtitle of the book is “How we crushed the curve but lost the race”. It is easy to get off on the wrong […]

Australia’s Pandemic Exceptionalism

The cost of Reserve Bank regulation

02 Mar 2025 Leave a comment

in applied price theory, business cycles, economics of bureaucracy, economics of natural disasters, economics of regulation, inflation targeting, macroeconomics, monetary economics, politics - New Zealand, Public Choice Tags: monetary policy

Roger Partridge writes: A new submission to the Committee from banking experts Andrew Body and Simon Jensen provides fresh evidence of these costs. Their analysis shows the Reserve Bank’s capital rules add between 0.25 and 0.375 percentage points to mortgage rates compared with Australia. For a million-dollar mortgage, that means between $2,500 and $3,750 in […]

The cost of Reserve Bank regulation

Forty years of floating

01 Mar 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, global financial crisis (GFC), great recession, history of economic thought, inflation targeting, macroeconomics, monetary economics Tags: floating exchange rates

Last year there was an interesting new book out, made up of 29 collected short papers by (more or less) prominent economists given at a 2023 conference to mark Floating Exchange Rates at Fifty. The fifty years related to the transition back to generalised floating of the major developed world currencies in 1973 (think USD, […]

Forty years of floating

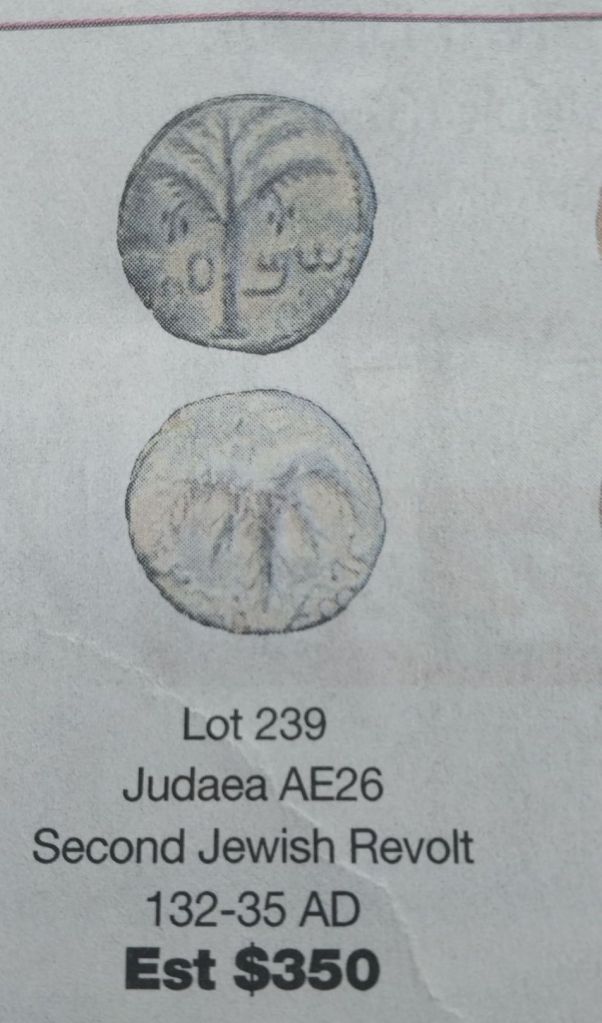

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

11 Feb 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, law and economics, macroeconomics, monetary economics, public economics Tags: Ireland, taxation and investment

I’m a big fan of Ireland’s low corporate tax rate for three reasons. First, it shows that good tax policy generates positive economic outcomes as per-capita GDP in Ireland has grown by record amounts. Second, it shows that lower tax rates can in some cases lead to more revenue. Sort of a turbo-charged version of […]

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

Good Riddance, Joe Biden

20 Jan 2025 Leave a comment

in applied price theory, budget deficits, economic growth, economic history, economics of regulation, energy economics, environmental economics, fiscal policy, global warming, industrial organisation, labour economics, macroeconomics, monetary economics, politics - USA, Public Choice, rentseeking, survivor principle Tags: 2024 presidential election, regressive left

This is the last full day of Joe Biden’s dismal presidency, so let’s do what we did with Justin Trudeau and reflect on his pathetic legacy. I’ve already provided my own economic assessment of Biden’s record, so now let’s review how he is seen by others. We’ll start with the American people. According to a […]

Good Riddance, Joe Biden

US Federal Reserve withdraws from global regulatory climate change group

19 Jan 2025 Leave a comment

in economics of climate change, economics of regulation, energy economics, environmental economics, environmentalism, global warming, macroeconomics, monetary economics, politics - USA

The Fed, which some claim is an unconstitutional body anyway, has noticed the US is changing its leader, so has performed a political manoeuvre by deciding that from now on ‘greening the financial system’ – whatever that means – is somebody else’s problem, officially at least. The decision follows on from various leading banks leaving […]

US Federal Reserve withdraws from global regulatory climate change group

Some Links

12 Jan 2025 Leave a comment

in applied price theory, budget deficits, development economics, economic growth, economic history, economics of regulation, entrepreneurship, fiscal policy, global financial crisis (GFC), great recession, growth disasters, growth miracles, human capital, income redistribution, industrial organisation, international economics, job search and matching, labour economics, labour supply, macroeconomics, monetary economics, poverty and inequality, Public Choice, rentseeking, survivor principle, unemployment

TweetGMU Econ alum Holly Jean Soto busts the myth of “greedflation.” Scott Lincicome identifies an interesting contrast between the facts and opinion about China. George Will decries the spinelessness of the modern U.S. Congress. A slice: The incoming president will be able, on a whim, to unilaterally discombobulate international commerce — and the domestic economy…

Some Links

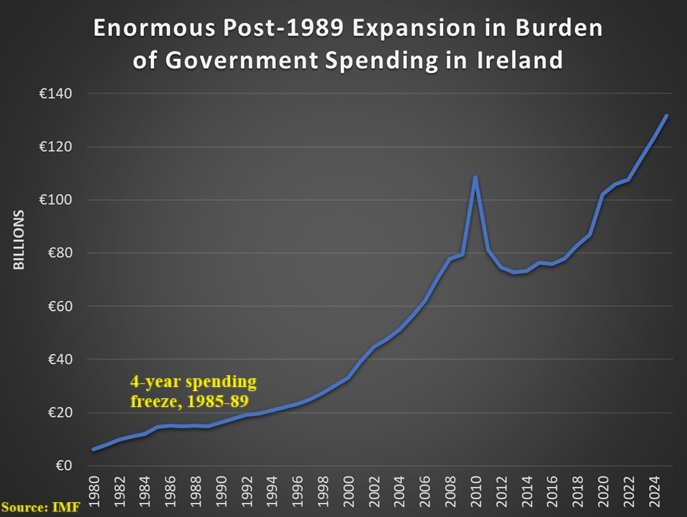

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

10 Jan 2025 Leave a comment

in applied price theory, Austrian economics, budget deficits, business cycles, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of regulation, financial economics, fiscal policy, growth disasters, growth miracles, history of economic thought, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetarism, monetary economics, political change, politics - USA, property rights, Public Choice, public economics, rentseeking, unemployment Tags: Argentina

It’s easy to mock economists. Consider the supposedly prestigious left-leaning academics who asserted in 2021 that Biden’s agenda was not inflationary. At the risk of understatement, they wound up with egg on their faces.* Today, we’re going to look at another example of leftist economists making fools of themselves. It involves Argentina, where President Javier […]

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

Some Jimmy Carter observations from the 1970s

01 Jan 2025 Leave a comment

in business cycles, defence economics, economic history, economics of regulation, energy economics, macroeconomics, monetary economics, politics - USA, war and peace Tags: Middle-East politics

Usually I am reluctant to criticize or even write about the recently departed, but perhaps for former Presidents there is greater latitude to do so. I never loved Jimmy Carter, and I saw plenty of him on TV and read about his administration on a daily basis in The New York Times. I fully appreciate […]

Some Jimmy Carter observations from the 1970s

Argentina facts of the day

29 Dec 2024 Leave a comment

in budget deficits, comparative institutional analysis, development economics, economic growth, economics of bureaucracy, economics of regulation, F.A. Hayek, financial economics, fiscal policy, growth disasters, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Milton Friedman, monetarism, monetary economics, property rights, Public Choice, rentseeking, unemployment Tags: Argentina

Argentina’s bonds have already rallied dramatically. One gauge of the nation’s hard-currency debt, the ICE BofA US Dollar Argentina Sovereign Index, has generated a total return of about 90% this year. Meanwhile, the S&P Merval Index has risen more than 160% this year through Monday, far outpacing stock benchmarks in developed, emerging and frontier markets […]

Argentina facts of the day

Marginal Revolution Podcast–The New Monetary Economics!

25 Dec 2024 Leave a comment

in applied price theory, history of economic thought, macroeconomics, monetarism, monetary economics Tags: monetary policy

Today on the MR Podcast Tyler and I discuss the “New Monetary Economics”. Here’s the opening TABARROK: Today we’re going to be talking about the new monetary economics. Now, perhaps the first thing to say is that it’s not new anymore. The new monetary economics refers to a set of claims and ideas about monetary economics […]

Marginal Revolution Podcast–The New Monetary Economics!

Recent Comments