@Economicpolicy shows that top CEO pay has been a miserable rollercoaster for 15 years

25 Apr 2016 Leave a comment

What a $15 Minimum Wage Would Do

20 Apr 2016 Leave a comment

in applied price theory, economics of media and culture, entrepreneurship, job search and matching, labour economics, managerial economics, minimum wage, organisational economics, personnel economics, theory of the firm Tags: living wage, offsetting behavior, The fatal conceit

McDonald’s Workers Just Lovin’ Their #ZeroHoursContracts @suemoroney @IainLG @FairnessNZ

19 Apr 2016 Leave a comment

in labour economics, labour supply, managerial economics, market efficiency, organisational economics, personnel economics, politics - New Zealand Tags: British economy, British politics, employment law, employment regulation, fixed costs of working, part-time work, The fatal conceit, The pretense to knowledge, zero hours contracts

Revealed preference rules. Not only do about half of unemployed turned down offers of zero hour contract jobs, those that switch from a zero hours contract to minimum hours are not much different from the number of people in these type of jobs who would be quitting to another job anyway.

Source: McDonald’s Workers Are Just Lovin’ Their Zero Hours Contracts – Forbes and McDonald’s offer staff the chance to get off zero-hours contracts | UK news | The Guardian.

Drug testing helps minority job applicants @jacindaardern

25 Mar 2016 Leave a comment

in discrimination, economics of information, entrepreneurship, human capital, labour economics, personnel economics Tags: asymmetric information, counter-signalling, employer discrimination, racial discrimination, screening, signalling, statistical discrimination

Statistical discrimination is a harsh mistress. If reliable measures of the quality of job applicants are unavailable for short-listing, such as credit checks, coarser, less reliable screening devices will be employed. That was the case when credit checks were prohibited in employment recruitment:

Looking at 74 million job listings between 2007 and 2013, Clifford and Shoag found that employers started to become pickier, especially in cities where there were a lot of workers with low credit scores. If a credit-check ban went into effect, job postings were more likely to ask for a bachelor’s degree, and to require additional years of experience.

There are other ways that employers could have also become more discerning, Shoag says. They might have started to rely on referrals or recommendations to make sure that applicants were high-quality. In the absence of credit information to establish trustworthiness, they may even have fallen back on racial stereotypes to screen candidates. The researchers couldn’t measure these tactics, but they’re possibilities.

Drug testing allows employers to dispel less accurate stereotypes about drug use among different ethnic and social groups. They increased hiring of minorities because a reliable measure became available of their drug use:

…after a pro-testing law is passed in a state, African-American employment increases in sectors that have high testing rates (mining, manufacturing, transportation, utilities, and government).

These increases are substantial: African-American employment in these industries increases by 7-30%. Because these industries tend to pay wage premia and to have larger firms offering better benefits, African-American wages and benefits coverage also increase. Real wages increase by 1.4-13% relative to whites. The largest shifts in employment and wages occur for low skilled African-American men.

I also find suggestive evidence that employers substitute white women for African-Americans in the absence of testing. Gains in hiring African-Americans in these sectors may have come at the expense of women, particularly in states with large African-American populations.

Employers test for drug use both for health and safety reasons and as a way of screening out less reliable employees. People who break the rules are not reliable employees and that includes taking drugs. In low skill jobs, what employers seek is a recruit who is friendly and reliable.

Testing of the skills of workers also showed similar results. What happened is that the ratio of black to white hirings do not change. The administration of these skills tests allowed the more productive of both white and black job applicants to be identified and hired.

Employers already had an accurate stereotype of the average skills of different ethnic groups. Administration of tests allow them to identify which members of each group were the most productive.

It is a standard result that statistical discrimination improves the chances of below-average applicants subject to the stereotype but harms those of above average quality. For that reason, applicants look for what methods of counter-signalling to show that they are indeed a quality applicant – make themselves stand out from the crowd.

Employers profit from developing screening devices that go beyond stereotypes to identify above-average applicants. They want screening devices that find those who do not otherwise stand out from the crowd because of difficulties in transferring credible information about their quality. This is a special difficulty with low-skilled vacancies because hiring is made based much more than on character than experience.

@TBillTheProf unintentionally destroys the case for a #livingwage @Mark_J_Perry @arindube

13 Mar 2016 Leave a comment

in applied price theory, labour economics, managerial economics, minimum wage, organisational economics, personnel economics, politics - New Zealand, politics - USA Tags: living wage, rational irrationality, The fatal conceit, The pretense to knowledge

Living wage advocate William Lester published a briefing for the Washington Centre for Equitable Growth that destroys the case for a living wage. He did not intend this but he documented in detail the exclusion of inexperienced workers from the restaurant industry in San Francisco after a living wage was imposed. He compared San Francisco’s minimum wage of $12 per hour with North Carolina which only pays the federal minimum of $7.25 per hour.

What Lester found was a systematic increase in hiring standards. The living wage in San Francisco of $12 all but ended the hiring of inexperienced workers as shown in the chart below. This is exactly what basic price theory predicts. I put the two pie charts in his paper into a single bar chart so this powerful effect of the living wage on hiring standards is not lost.

Source: The consequences of higher labor standards in full service restaurants – Equitable Growth.

The most fundamental criticism of living wage and minimum wage increases is they exclude workers who do not meet the new labour productivity level required to make it profitable for employers to hire them. UK research found the same thing – an increase in hiring standards and tougher shortlisting. Lester welcomes this transition of the restaurant industry in San Francisco into a career for professionals. As he says in his briefing paper:

Concurrent with this wage compression was a rise in professional standards as employers sought to hire and keep already well-trained workers at higher wages and with expanded benefits. Both developments reduced turnover and attracted more professional employees who maintain a high level of customer service.

As with all minimum wage and living wage advocates, he is incurious as to what happens to those low skilled, inexperienced workers and new workforce entrants who no longer meet the hiring standards of San Francisco restaurants because of the large minimum wage increase.

Best 2 Minimum Wage Cartoons Ever, from Henry Payne, Updated for Seattle's $15 "Economic Death Wish" @HenryEPayne http://t.co/vatUzkHMss—

Mark J. Perry (@Mark_J_Perry) August 18, 2015

As Lester concedes in his conclusions about what will happen if the San Francisco minimum wage of $12 an hour, the highest in the country, is extended to other cities and states:

Higher professional standards may limit entry-level opportunities within the industry, while lower standards may result in more employer-provided training for new workers.

Employer funded on-the-job training is often a major part of a job package. It is well-known in the labour economics literature since the time of Adam Smith that any job is a package of wages and other attributes including learning opportunities.

Workers sell their services and buy learning opportunities; firms buy labour services and sell jobs with varying learning possibilities (Rosen 1972, 1975, 1976). The rational allocation of time results in most careers starting with large investments in full-time schooling and then mostly investments in on-the-job training (Becker 1975; Ben-Porath 1967, 1970; Weiss 1987).

As the training provided by restaurant employers is useful to other employers, the trainee must fund it through trading off wages for this training. Once trained, the employee can command a higher pay because other employers are willing to pay them more now that they are trained. Again, this is a standard result in the human capital literature.

Where the human capital is more specialised to one firm or job, the employer and the trainee share the cost. A classic example of this is an apprenticeship.

Source: IZA World of Labor – Do firms benefit from apprenticeship investments?

In San Francisco, employers expect recruits to be fully trained and experienced. They provide little in the way of on-the-job training. Their recruits must have been able to afford to fund this in their previous jobs by trading off wages for training as Lester notes in his working paper:

…San Francisco employers were less likely to report lengthy formal training periods for either front-of-house or back-of-house workers. Instead, there is an overall higher level of skill expectation and—as is the case for many professions—workers are expected to acquire and exhibit industry specific knowledge on their own.

In North Carolina, as Lester notes, the restaurant industry hires younger workers with less formal education and offers them intensive on-the-job training:

The restaurant industry in the Research Triangle region tends to hire younger workers with a lower level of formal education. Specifically, 49.5 percent of workers in there are under age 24 or have less than a high school education, compared to 38.9 percent in San Francisco. Conversely, 40.6 percent of workers in San Francisco have some college or a bachelor’s degree or higher, compared to 29.7 percent in the Research Triangle Region.

North Carolina restaurants sought to hire unskilled workers who were friendly and reliable as Lester notes:

One manager of a neighbourhood bistro in Raleigh explained what he looks for in a new front-of-house worker: “Basically, we require [that a server] can work a four-shift minimum per week and go an entire shift, an entire eight-hour shift without smoking a cigarette and [without] any facial piercings or anything. Beyond that, just come in with a smile on your face.”

The restaurant industry in North Carolina is willing to give people low skilled, poorly educated and inexperienced a chance to work if they are willing to work. Lester reports this when quoting an upscale bar-and-grill manager on his hiring standards:

We look for at least one year’s experience, but the biggest thing we look for is we look for the person. We don’t look for the skill. I could teach anybody how [to] wait tables [and] pour drinks. I can teach anybody how to cook steaks. What I can’t teach is how to be a good person.

Lester then discusses with some degree of approval the hiring standards in the San Francisco where restaurants are professional careers:

Rather than viewing servers as essentially interchangeable labourers who can be trained quickly and easily if they possess a modicum of personal hygiene and a friendly personality, employers in San Francisco exhibited a clear description of what a “professional server” was.

One mid-scale restaurant employer said of her front-of-house staff: “We have a lot of people who have made it a career and they’re investing in the knowledge of the product and learning their trade or already know their trade because they’ve done it for years.”

Much to the surprise of believers in the inherent inequality of bargaining power between employers and workers, employers invest heavily in low-skilled employees despite the fact this makes them employable elsewhere. Lester again:

“Training is a huge investment for us and it is constant,” [a manager] said. “Training days depend on the position. Bartending training is ten days and servers require eight days. In the kitchen it’s probably about ten days. Every day they write note cards on all their recipes. But they’ll take a final. When they take their final, their test in the kitchen, they have to know every ingredient, every ounce, and every item, for the entire station. That’s why we require them to write note cards.

Even at higher-end restaurants, employers in the region have built a human resource system that accepts a high rate of turnover. “We try to stay ahead of the game so that we’re always hiring, we’re always interviewing, but hopefully it’s not desperation hires,” says another manager. “And we try to have a mix of needs like people who need fulltime, who can work lunches and brunches and all of that, to servers who really want very part time so that you can kind of over staff on busy shifts and then there’s always someone that wants to go home. There’s always a student that would like a Saturday night off.”

Lester paints a picture of a San Francisco restaurant industry that expects workers to fund their own industry specific human capital. In North Carolina, employers provide those training opportunities to minimum wage workers despite this making these up-skilled employees an attractive proposition for rivals to poach. By depriving low skilled workers of this opportunity of both wages and employer-funded training, a living wage would make them worse off.

I am at a loss here. How can the progressive left regard the exclusion of low paid, low skilled workers as a good thing? How do they put food on the table in San Francisco other than through a welfare check? How do they get their first job?

It's pretty simple: Minimum Wage = Compulsory Unemployment http://t.co/6xiX6YCp9Z—

Mark J. Perry (@Mark_J_Perry) July 25, 2015

Downsizing, morale & productivity @SueMoroney @GreenCatherine #livingwage

13 Mar 2016 Leave a comment

in applied price theory, labour economics, labour supply, personnel economics, survivor principle

It comes as a surprise to living wage advocates that entrepreneurs are so alert to the impact of downsizing and firm closures on employee morale that they keep these a secret to the last possible minute.

Entrepreneurs are not fools. They profit from alertness to the effects of changes in the fortunes of the firm on labour productivity. There is a vast literature on how to motivate workers towards more effort and diligence and honesty.

I worked at a Japanese private university whose financial survival was always in question. We spent a lot of time gossiping about the security of our jobs.

I refer to one year at one employer as the year of doing nothing because management was so consumed with restructuring and downsizing. They were too busy to sign out the output of their staff.

I have come across an estimate the effect of downsizing announcement on productivity at a German bakery chain of 193 shops.

The study found that announcements of a sale to a new owner and closure reduced sales by six and 21 percent, respectively. This negative effect increased with the share of workers on a permanent contract, even though these workers faced a much lower unemployment risk. Fewer customers were served per unit of time because of less employee effort at the bakery chain.

Going back to my year of doing nothing, which dragged out through worker consultations sought by the unions under the collective agreement, I remember chatting to a mate whose father was in the downsizing consulting business. He told me that private businesses get downsizing over as quickly as possible because of the impact on morale and productivity. Entrepreneurs are perfectly aware that uncertainty promotes office gossip and valuable staff moving on.

Big bills left on the #livingwage sidewalk?

10 Mar 2016 Leave a comment

in applied price theory, entrepreneurship, managerial economics, minimum wage, personnel economics, politics - New Zealand

Living wage activists believe that businesses can profitably pay their low-paid workers a lot more. The living wage pay increase will not jeopardise the survival of the business or jobs because their workers will be more productive because of the living wage increase. Morale will be higher and job turnover will be lower. Both of these will increase productivity perhaps enough to offset the increase in labour costs.

In a nutshell, living wage activists have discovered a hitherto untapped entrepreneurial opportunity for profit. These living wage activists are happy to disclose this secret to lower costs to the world at no fee.

What they are arguing is businesses do not notice a profit opportunity that these political activists have noticed and are now publicising widely. Entrepreneurs are leaving money on the table that could easily be snapped up simply by paying their low-paid employers higher wages.

Source: Mancur Olson (1996) “Distinguished Lecture on Economics in Government: Big Bills Left on the Sidewalk: Why Some Nations Are Rich, and Others Poor.” Journal of Economic Perspectives 3-24.

This money on the table metaphor is similar to the big bills left on the sidewalk metaphor. There is easy money to be had from paying low-paid workers more because these workers will quickly become more productive because of the higher wages.

Living wage activists do not address why entrepreneurs had not discovered this insight into cost saving themselves. After all, every entrepreneur, every employer knows that if they pay more, they will get a better class of job applicant.

Of course, if this insight by the living wage activists is true, all workers should be given a similar increase in their pay because their productivity will go through the roof as well.

Entrepreneurs profit directly from spotting every new opportunity for profit. They have no reason to turn money down particularly when it is obvious and straight under their nose.

The modern theories of the firm focus, in part or in full on reducing opportunistic behaviour, cheating and fraud in employment relationships. The cost of discovering prices and making and enforcing contracts and getting what you pay for are central to Coase’s theory of the firm put forward in 1937.

The profits of entrepreneurs for running a firm is directly linked from their successful policing of the efforts of employees and sub-contractors to ensure the team and each member perform as promised and individual rewards matched individual contributions (Alchian and Demsetz 1972; Barzel 1987). Alchian and Demsetz’s (1972) theory of the firm focused on moral hazard in team production. As they explain:

Two key demands are placed on an economic organization-metering input productivity and metering rewards.

The main rationale in personnel economics from everything ranging from employer funding of retirement pensions to the structure of promotions and executive pay including stock options is around better rewarding self-motivating employees who strive harder and reducing the costs of monitoring employee effort.

Does a higher minimum wage really reduce employment? econ.st/1gp4Jbs http://t.co/WGMZGLKHmI—

The Economist (@EconBizFin) July 30, 2015

At bottom, the efficiency wage hypothesis is entrepreneurs are unaware of the higher quality and greater self-motivation of better paid recruits for vacancies but wise bureaucrats and farsighted politicians notice these gaps in the market. Bureaucrats and politicians notice these gaps in the market before those who gain from superior entrepreneur alertness to hitherto untapped opportunities for profit do so and instead leave that money on the table.

David Mitchell – Customer Service Rant

17 Feb 2016 Leave a comment

in economics, labour economics, occupational choice, personnel economics

HT: Helen Dale.

Harvard business School survey discovers that workers want more

12 Feb 2016 Leave a comment

in human capital, labour economics, labour supply, occupational choice, personnel economics, poverty and inequality, unions Tags: compensating differentials, union wage premium, unions

Mandatory severance pay by length of job tenure in the G7, Australia, New Zealand, Ireland, Scandinavia, Greece and Spain

11 Feb 2016 Leave a comment

in human capital, job search and matching, labour economics, labour supply, law and economics, managerial economics, organisational economics, personnel economics, property rights, unemployment Tags: employment law, employment protection laws, employment regulation, firm-specific human capital, job search, labour market regulation, severance pay

There are a wide differences across the OECD in mandatory severance pay in the event of a layoff.

Source: Labor Market Regulation – Doing Business – World Bank Group.

Severance pay makes it more expensive to fire and therefore more expensive to hire. This means fewer job vacancies will be created but they will last longer.

The presence of mandatory severance pay could increase or reduce the unemployment rate but unemployment durations will increase because it takes longer to find a suitable job match among the fewer available vacancies.

Mandating severance pay does not make the job match inherently more profitable. It just redistributes some of the surplus from the job match to the end when it is terminated.

Employers and jobseekers may agree to severance pay where investments in firm specific and job specific human capital for the job is profitable.

Severance pay in these circumstances gives the employer and more reasons to invest in specific human capital. The promise to pay severance pay will make the employer hesitate to lay them off. The employer will instead retain them over a slack period or redeploy them within the company rather than pay them out. This pre-commitment encourages investment in firm specific and job specific human capital by both sides more secure, which makes the job match more profitable overall for both sides.

Of course, if it was possible to negotiate completely around severance pay mandated by law, there would be no effects on hiring, firing and unemployment durations. All it would mean is take-home pay would be less but in the event of a layoff, these employees would get that this wage reduction back as a lump sum.

@LivingWageUK documents the Achilles heel of the #livingwage

09 Feb 2016 1 Comment

in applied price theory, economics of bureaucracy, economics of regulation, entrepreneurship, managerial economics, minimum wage, organisational economics, personnel economics, politics - New Zealand, Ronald Coase, theory of the firm

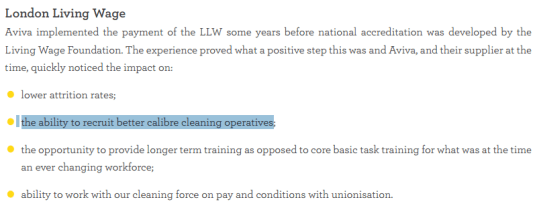

Research publicised by a Living Wage UK highlighted the Achilles heel of any living wage proposal. This Achilles heel applies to the voluntary adoption of the living wage and a living wage mandated through minimum wage laws.

The critique to follow accepts pretty much everything claimed by the living wage movement about the benefits of the living wage but simply traces out the consequence of this one promised benefit.

Source: New evidence of business case for adopting Living Wage Living Wage Foundation.

The living wage is substantially above the minimum wage. Offering the living wage will change the composition of the recruitment pool of low-wage employers. This is the Achilles heel of the living wage which Living Wage UK documents in its study it tweeted about and from which I have taken the above snapshot.

Jobseekers would not have considered vacancies by these employers will now apply because of the living wage increase. These better calibre applicants will win those jobs ahead of the jobseekers whose current productivity levels are less than that to justify the cost of the living wage.

Central to the living wage rhetoric is that somehow employees will be more productive because of the adoption of the living wage.

The simplest way of doing that for an employer is to hire more qualified, more productive employers are no longer a hire the type of people you currently hire. They will be unemployed or pushed into the non-living wage sector of the low-wage market.

Best 2 Minimum Wage Cartoons Ever, from Henry Payne, Updated for Seattle's $15 "Economic Death Wish" @HenryEPayne http://t.co/vatUzkHMss—

Mark J. Perry (@Mark_J_Perry) August 18, 2015

A living wage is an exclusionary policy where ordinary workers, often with families who are not productive enough to produce $19.25 per hour living wage plus overheads will never be interviewed.

The workers with the type of skills that currently win those jobs covered by a living wage increase will not be shortlisted because the quality of the recruitment pool will increase because of the living wage.

There will be an influx of more skilled workers attracted by the higher wages for living wage jobs. They will go to the head of the queue and displaced workers who currently apply for and win these jobs before the adoption of the living wage.

Any extra labour productivity from paying a living wage increase is in doubt because low skilled service sectors are notorious for their low potential for productivity gains. They are the bread-and-butter of Baumol’s disease.

The modern theories of the firm focus, in part or in full on reducing opportunistic behaviour, cheating and fraud in employment relationships. The cost of discovering prices and making and enforcing contracts and getting what you pay for are central to Coase’s theory of the firm put forward in 1937.

The profits of entrepreneurs for running a firm is directly linked from their successful policing of the efforts of employees and sub-contractors to ensure the team and each member perform as promised and individual rewards matched individual contributions (Alchian and Demsetz 1972; Barzel 1987). Alchian and Demsetz’s (1972) theory of the firm focused on moral hazard in team production. As they explain:

Two key demands are placed on an economic organization-metering input productivity and metering rewards.

The main rationale in personnel economics from everything ranging from employer funding of retirement pensions to the structure of promotions and executive pay including stock options is around better rewarding self-motivating employees who strive harder and reducing the costs of monitoring employee effort.

At bottom, the efficiency wage hypothesis is entrepreneurs are unaware of the higher quality and greater self-motivation of better paid recruits for vacancies but wise bureaucrats and farsighted politicians notice these gaps in the market. Bureaucrats and politicians notice these gaps in the market before those who gain from superior entrepreneur alertness to hitherto untapped opportunities for profit do so and instead leave that money on the table.

It’s kicking the living wage movement when it is down to mention that low paid workers with families will lose a considerable part of the living wage increase because of reductions in family tax credits and in-kind assistance from the government that are linked to their pay.

Their jobs are put at risk because of a large increase in the cost of employing them to their employers. Their take-home pay after taxes, family tax credits and other government assistance increases by much less. This is a pointless gamble with job security because of the much small increase in the take-home pay of many breadwinners on the living wage.

Why @HelenClarkUNDP will not be UN Secretary General

04 Feb 2016 2 Comments

in economics of bureaucracy, International law, personnel economics, politics - New Zealand

Back in the day, I was having a beer in Bob Hawke’s office along with the rest of the economic division staff from his department. We were told to avoid discussing racing as Hawke would never stop talking about it.

Somehow the conversation got on to Malcolm Fraser becoming secretary general of the Commonwealth Secretariat. He had recently lost the race.

Bob Hawke told us a story about a conversation he had with Margaret Thatcher on the candidature of Malcolm Fraser.

Hawke said that Thatcher said do you really want Malcolm Fraser beating down your door every day about apartheid. She had a point.

Hawke said that Thatcher said do you really want Malcolm Fraser beating down your door every day about apartheid. She had a point.

I took that remark by Hawke to mean that Fraser had independent stature as a former prime minister. He could annoy powerful people because he had nothing to lose and everything to gain.

The Nigerian chief who got the job will be so grateful for the appointment that he would not upset his sponsors. That is why Helen Clark will not become UN Secretary General. She is overqualified.

UN Secretary General is not the best job Clark has ever had. She has independent gravitas and everything to gain and nothing to lose by being an activist secretary general.

All previous Secretary Generals were obscure foreign ministers who will be just so grateful for the big promotion. They did not have independent gravitas.

If you look at positions such as president of the European commission, managing director of the IMF or president of the World Bank and other international appointments, they do not go to statesman.

@TBillTheProf shows that SF #livingwage sends hiring standards through the roof

13 Jan 2016 Leave a comment

in applied price theory, labour economics, minimum wage, personnel economics, politics - USA Tags: living wage

Recent field research in San Francisco and North Carolina restaurants found that after San Francisco living wage increase, managers were pickier about whom they hire, because they want workers to be worth the higher cost. The San Francisco minimum wage is now $12.25, and all employers are required to offer paid sick days and contribute to their employees’ health insurance.

Source: How worker-friendly laws changed life as a server in San Francisco restaurants – The Washington Post.

The study is useful because of instead of studying the myths and realities about how a higher minimum wage somehow motivates workers to be more productive and offset part or all of its cost to employers, the study investigates how the minimum wage, a living wage, affects hiring standards.

Employers of low skilled, low-wage workers look for workers who are friendly and reliable. As the study concedes, you can teach people the skills they need as long as they are friendly and reliable.

In San Francisco, recruits not only have to be friendly and reliable, they are expected to have experience. The living wage shuts out inexperienced and new workers, which promotes social exclusion.

Minimum wage workers in San Francisco are noticeably older and better educated than those in North Carolina and recruited after more intensive sorting and screening against the hiring standards for the vacancy:

Rather than viewing servers as essentially interchangeable labourers who can be quickly and easily trained if they possess a modicum of personal hygiene and a friendly personality, employers in San Francisco exhibited a clear description of what a professional server was and the explicit and implicit skills required.

The study did not enquire into what happened to applicants who failed to meet the higher hiring standard induced by the living wage increase. As is standard with the champions of the living wage, they do not want to talk about those excluded by the living wage rise.

Do they have academic tenure anymore?

23 Dec 2015 Leave a comment

in economics of education, human capital, labour economics, managerial economics, occupational choice, organisational economics, personnel economics Tags: academic tenure, compensating differentials, occupational choice

https://twitter.com/mileskimball/status/541219532032212993/photo/1

Academic Deadlines phdcomics.com/comics.php?f=1… http://t.co/tazByBNUzI—

Jorge Cham (@phdcomics) August 01, 2015

Time spent writing your thesis.

**Need a graduation gift? Visit phdcomics.com/store http://t.co/PJNbG3C7PY—

Jorge Cham (@phdcomics) May 01, 2015

Labour productivity growth in the New Zealand retail services confounds Baumol’s cost disease

17 Dec 2015 Leave a comment

in applied price theory, economic history, industrial organisation, managerial economics, market efficiency, organisational economics, personnel economics, politics - New Zealand, survivor principle Tags: Baumol's disease, labour productivity

Recent Comments