Source: Review of Michael J. Sandel’s What Money Can’t Buy: The Moral Limit of Markets by Deirdre McCloskey August 1, 2012. Shorter version published in the Claremont Review of Books XII(4), Fall 2012 via Deirdre McCloskey: editorials.

Deirdre McCloskey summarises Rawls and Nozick on unequal incomes

02 Jan 2017 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, development economics, economic history, Gordon Tullock, growth miracles, history of economic thought, James Buchanan, James Buchanan, labour economics, law and economics, poverty and inequality, property rights, Public Choice, Rawls and Nozick Tags: creative destruction, Deirdre McCloskey, industrial revolution, John Rawls, Robert Nozick, The Great Enrichment, The Great Escape, The Great Fact, top 1%, veil of ignorance, veil of uncertainty

Gordon Tullock on avoiding difficult decisions about saving lives – updated

24 Jan 2015 Leave a comment

in constitutional political economy, economics of bureaucracy, economics of regulation, Gordon Tullock, health and safety, health economics, income redistribution, James Buchanan, labour economics, Rawls and Nozick Tags: expressive voting, health and safety, James Buchanan, rational ignorance, rational irrationality, statistical life, veil of ignorance, veil of insignificance, veil of uncertainty

Gordon Tullock wrote a 1979 New York Law Review book about avoiding difficult choices. His review was of a book by Guido Calabresi and Philip Bobbitt called Tragic Choices which was about the rationing: the allocation of kidney dialysis machines (a “good”), military service in wartime (a “bad”), and entitlements to have children (a mixed blessing).

Tullock argued that we make a decision about how to allocate resources, how to distribute the resources, and then how to think about the previous two choices. People do not want to face up to the fact resources are scarce and they face limits on their powers.

To reduce the personal distress of making these tragic choices, Tullock observed that people often allocate and distribute resources in a different way so as to better conceal from themselves the unhappy choices they had to make even if this means the recipients of these choices are worse off and more lives are lost than if more open and honest choices were made up about there only being so much that can be done.

The Left over Left and union movement spends a lot of time pontificating about how we must not let economics influence health and safety policy rather than help frame public policy guidance on what must be done because scarcity of resources requires the valuation of life in everything from health, safety, and environmental regulations to road building. health budgeting is full of tragic choices about how much is spend to save so lives and where and for how long.

The Left over Left and the union movement deceive themselves and others into make futile gestures to make themselves feel good. These dilettantes cannot assume that they are safely behind a veil of insignificance. They have real influence on how public policy on health and safety are made.

A major driver of the opposition among the Left over Left and the union movement to the use of cost-benefit analysis and the valuation of statistical lives is its adoption makes people confront the tragic consequence of any of the choices available to them.

By saying how dare you value a statistical life does not change the fact that choices made without this knowledge will still have tragic consequences, and more lives may be lost because people want to conceal from themselves the difficult choices that they are making about others as voters and as policy-makers.

One of the purposes of John Rawls’ veil of ignorance and Buchanan and Tullock’s veil of uncertainty is that the basic social institutions be designed and agreed when we have abstracted from the grubby particulars of our own self-interest. Buchanan and Tullock explain the thought experiment this way

Agreement seems more likely on general rules for collective choice than on the later choices to be made within the confines of certain agreed-upon rules. …

Essential to the analysis is the presumption that the individual is uncertain as to what his own precise role will be in any one of the whole chain of later collective choices that will actually have to be made.

For this reason he is considered not to have a particular and distinguishable interest separate and apart from his fellows.

This is not to suggest that he will act contrary to own interest; but the individual will not find it advantageous to vote for rules that may promote sectional, class, or group interests because, by supposition, he is unable to predict the role that he will be playing in the actual collective decision-making process at any particular time in the future.

He cannot predict with any degree of certainty whether he is more likely to be in a winning or a losing coalition on any specific issue. Therefore, he will assume that occasionally he will be in one group and occasionally in the other.

His own self-interest will lead him to choose rules that will maximize the utility of an individual in a series of collective decisions with his own preferences on the separate issues being more or less randomly distributed.

Behind the veil of ignorance and the veil of uncertainty, we would all agree that resources are limited, including in the health sector and some drugs can’t be funded – choices must be made.

Once we go in front of the veil of ignorance and find out that we are the one missing out on that drug, naturally, our views will change. We agreed to these rules as fair for the distribution of basic social resources when, as John Rawls put it:

…no one knows his place in society, his class position or social status; nor does he know his fortune in the distribution of natural assets and abilities, his intelligence and strength, and the like.

Is always the case that someone just falls on the other side of any line in the sand. If you move that line, there is always another set of people who are just on the other side.

Constitutions are brakes, not accelerators

30 Nov 2014 Leave a comment

in constitutional political economy, Gordon Tullock, James Buchanan, liberalism, Public Choice Tags: checks and balances, constitutional political economy, economics of constitutions, public choice

Much of constitutional design is about checks and balances. This division of power slows the impassioned majority down.

Constitutional constraints are basically messages from the past to the present that you must think really hard, and go through extra hurdles before you do certain things.

The 18th and 19th century classical liberals were highly sceptical about the capability and willingness of politics and politicians to further the interests of the ordinary citizen, and were of the view that the political direction of resource allocation retards rather than facilitates economic progress.

Governments were considered to be institutions to be protected from but made necessary by the elementary fact that all persons are not angels. Constitutions were to constrain collective authority.

The problem of constitutional design was ensuring that government powers would be effectively limited. The constitutions were designed and put in place by the classical liberals to check or constrain the power of the state over individuals.

The motivating force of the classical liberals was never one of making government work better or even of insuring that all interests were more fully represented. Built in conflict and institutional tensions were to act as constraints on the power and the size of government.

Unfettered power loses its shine when it must be shared with your opponents for more than a brief time

05 Aug 2014 Leave a comment

in constitutional political economy, Federalism, James Buchanan, Public Choice Tags: democracy, Leftover Left, rotation of power, separation of powers

The rotation of power is common in democracies, and the worst rise to the top, so it is wise to design constitutional safeguards to minimise the damage done when those crazies to the right or left of you get their chance in office, as they will.

Too many policies and ideas of the Left assume that they are the face of the future, rather than just another political party that will hold power as often as not.

Privatisation and deregulation is a lot slower in a federal system with an effective upper house elected by proportional representation. Regulatory powers and public asset ownership is spread over different levels of federations, with different parties always in power at various levels at the same time, all worried about losing office by going to far away from what the majority wants.

The will of the people is constantly tested and measured in a federal system with elections at one level or another every year or so contested on a mix of local and national issues. Any failings of privatisation or deregulation in pioneering jurisdictions would quickly become apparent and would not be copied by the rest of the country. These errors could be undone where they originated by incoming progressive governments.

The Left may want to protect the rights of the unpopular and the unpleasant, and to want constitutional safeguards to slow an impassioned majority down is, in part, because they could be next if they lose the next election to the latest right-wing populist.

In a unitary unicameral parliament, those crazies to the right or left of you are tempered by an occasional general election only every 3 to 5 years. Little wonder that UK Labor reconsidered devolution, an assembly for London, and regional government after 15 years of Maggie Thatcher, good and hard, with her unfettered right to ask the house of commons to make or unmake any law whatsoever.

Developing positive alternatives on the Left includes what to do about the rotation of power and fettered versus unfettered parliamentary and executive power. The failure of the Left to develop its own constitutional political economy is a major strategic shortcoming. Frequenting wine bars, cafes and blogs muttering to each other ‘our day will come, our day will come’ is not enough.

State power was something that the classical liberals feared, and the problem of constitutional design is insuring that such power would be effectively limited.

Sovereignty must be split among several levels of collective authority; federalism was designed to allow for a decentralization of coercive state power.

At each level of authority, separate functional branches of government were deliberately placed in continued tension, one with the other. The legislative branch is further restricted by the establishment of two strong houses, each of which organised on a separate principle of representation

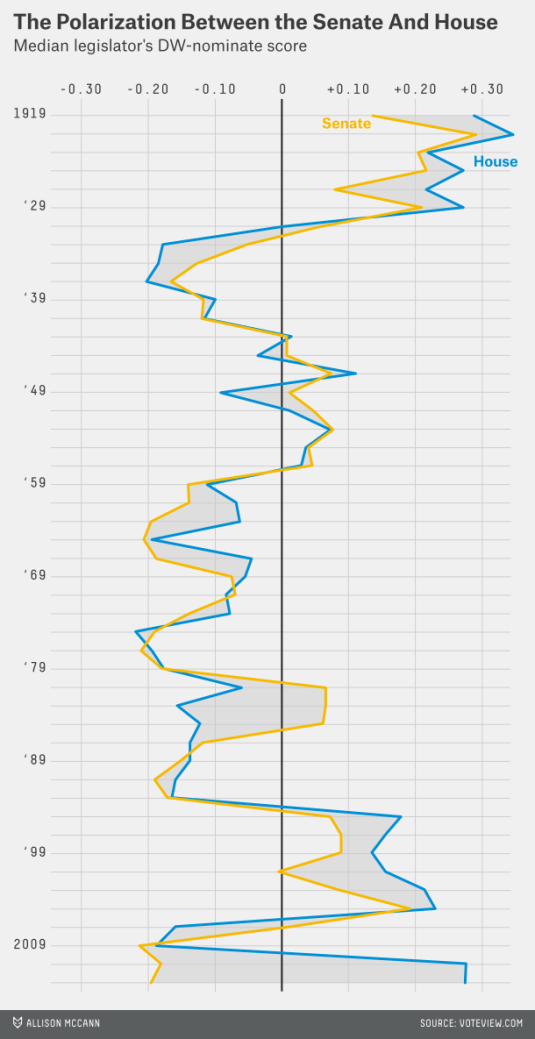

The system is working at last: The House And Senate Are the Most Divided in Our Lifetimes

06 Jul 2014 Leave a comment

in Gordon Tullock, James Buchanan, politics - USA, Public Choice Tags: bicameralism, constitutional design, public choice

One of the lessons of public choice for constitutional design is there should be two Houses of Parliament and each should be elected by a different method and different geographical basis.

Lower houses tend to be elected in single member constituencies; upper houses tend to be elected in larger multi-member, state-wide or national constituencies by proportional representation.

This diversity in legislative arrangements ensures that more people are participating in decision-making and it is harder to pass new laws without majority support.

The two elected chambers will clash as each exerts its mandate to represent the will of the people who elected it. The laws that pass these two chambers elected by different methods must have substantial popular support.

When upper and lower houses are elected by similar methods, it is much easier to assemble a majority through vote trading and lobbying.

Data via fivethirtyeight.com

Neoclassical economists think the economy is freestanding and ignore institutions!

22 Jun 2014 Leave a comment

in Adam Smith, comparative institutional analysis, constitutional political economy, James Buchanan, Ronald Coase Tags: Adam Smith, Douglass North, Elinor Ostrom, James Buchanan, Robert Fogel, The institutional structure of production

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1991 was awarded to Ronald H. Coase:

for his discovery and clarification of the significance of transaction costs and property rights for the institutional structure and functioning of the economy

The Royal Swedish Academy of Sciences has decided to award The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel for 2009 to

Elinor Ostrom “for her analysis of economic governance, especially the commons” and Oliver E. Williamson “for his analysis of economic governance, especially the boundaries of the firm”

The Royal Swedish Academy of Sciences has decided to award the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel for 1993 jointly to Robert W. Fogel and Douglass C. North

for having renewed research in economic history by applying economic theory and quantitative methods in order to explain economic and institutional change.

The Royal Swedish Academy of Sciences has decided to award the1986 Alfred Nobel Memorial Prize in Economic Sciences to Professor James McGill Buchanan for

his development of the contractual and constitutional bases for the theory of economic and political decision-making.

The Greens want to ban… | Kiwiblog

10 Jun 2014 Leave a comment

in James Buchanan, politics - New Zealand, Public Choice Tags: Ban-it left, fatal conceit, meddlesome preferences, political correctness, pretense to knowledge

- Ban fizzy drinks from schools

- Ban fuel inefficient vehicles

- Ban all gaming machines in pubs

- Ban the GCSB

- Ban violent TV programmes until after 10 pm

- Ban feeding of antibiotics to animals that are not sick

- Ban companies that do not comply with a Code of Corporate Responsibility

- Ban ACC from investing in enterprises that provide products or services that significantly increase rates of injury or illness or otherwise have significant adverse social or environmental effects

- Ban commercial Genetic Engineering trials

- Ban field testing on production of GE food

- Ban import of GE food

- Ban Urban Sprawl

- Ban non citizens/residents from owning land

- Ban further corporate farming

- Ban sale of high country farms to NZers who do not live in NZ at least 185 days a year

- Ban the transport by sea of farm animals, for more than 24 hours

- Ban crates for sows

- Ban battery cages for hens

- Ban factory farming of animals

- Ban the use of mechanically recovered meat in the food chain

- Ban the use of the ground-up remains of sheep and cows as stock feed

- Ban animal testing where animals suffer, even if of benefit to humans

- Ban cloning of animals

- Ban use of animals in GE

- Ban GE animal food

- Ban docking of dogs tails

- Ban intrusive animal experimentation as a teaching method in all educational institutions

- Ban smacking

- Ban advertising during children’s programmes

- Ban alcohol advertising on TV and radio

- Ban coal mining

- Ban the export of indigenous logs and chips

- Ban the use of bio-accumulative and persistent poisons

- Ban the establishment of mustelid farms

- Ban new exploration, prospecting and mining on conservation land and reserves

- Ban mining activities when rare and endemic species are found to present on the mining site

- Ban the trading conservation land for other land to facilitate extractive activities on.

- Ban the further holding of marine mammals in captivity except as part of an approved threatened species recovery strategy

- Ban the direct to consumer advertising of pharmaceuticals

- Ban sale of chips and lollies on school property

- Ban any additional use of coal for energy

- Ban fixed electricity charges

- Ban further large hydro plants

- Ban nuclear power

- Ban further thermal generation

- Ban private water management

- Ban imported vehicles over seven years old

- Ban the disposal of recyclable materials at landfills

- Ban the export of hazardous waste to non OECD countries

- Ban funding of health services by companies that sell unhealthy food (so McDonalds could not fund services for young cancer sufferers)

- Ban healthcare organizations from selling unhealthy food or drink

- Ban advertising of unhealthy food until after 8.30 pm

- Ban all food and drink advertisements on TV if they do not meet criteria for nutritious food

- Ban the use of antibiotics as sprays on crops

- Ban food irradiation within NZ

- Ban irradiated food imports

- Ban growth hormones for animals

- Ban crown agency investments in any entity that denies climate change!!

- Ban crown agency investments in any entity that is involved in tobacco

- Ban crown agency investments in any entity that is involved in environmentally damaging oil extraction or gold mining

- Ban non UN sanctioned military involvement (so China and Russia gets to veto all NZ engagements)

- Ban NZ from military treaties which are based on the right to self defence

- Ban NZers from serving as mercenaries

- Ban new casinos

- Allow existing casinos to be banned

- Ban promotion of Internet gambling

- Ban advertising of unhealthy food to children

- Ban cellphone towers within 300 metres of homes

- Ban new buildings that do not confirm to sustainable building principles

- Ban migrants who do not undertake Treaty of Waitangi education programmes

- Ban new prisons

- Ban semi-automatic weapons

- Ban genetic mixing between species

- Ban ocean mineral extractions within the EEZ

- Ban limited liability companies by making owners responsible for liability of products

- Ban funding of PTEs that compete with public tertiary institutes

- Ban the importation of goods and services that do not meet quality and environmental certification standards in production, lifecycle analysis, and eco-labelling

- Ban goods that do not meet quality and sustainability standards for goods which are produced and/or sold in Aotearoa/New Zealand

- Ban new urban highways or motorways

- Ban private toll roads

- Ban import of vehicles more than seven years old unless they meet emission standards

- Ban imported goods that do not meet standards for durability and ease of recycling

- Ban landfills

- Ban new houses without water saving measures

- Ban programmes on TVNZ with gratuitous violence

via Kiwiblog

Do monopoly concessions increase or decrease gambling?

17 Apr 2014 1 Comment

in economics of regulation, industrial organisation, James Buchanan, law and economics, market efficiency Tags: monopoly and competition, organised crime

Do monopoly concessions such as for casinos and the TAB increase or decrease gambling? Is the under-supply of output by a monopoly a good or a bad thing when the good itself is seen as a bad.

James Buchanan started his 1973 paper ‘A defence of organised crime?’ quoting Samuel Butler:

… we should try to make the self-interest of cads a little more coincident with that of decent people

Buchanan’s simple idea is that if a monopoly restricts the output of goods, a standard analytical result, then it must also restrict the output of bads! Buchanan end’s his paper with:

It is not from the public-spiritedness of the leaders of the Cosa Nostra that we should expect to get a reduction in the crime rate but from their regard for their own self-interests

The Cosa Nostra did have a reputation for running honest casinos and keeping crime down nearby.

If an illegal monopoly or cartel becomes competitive and barriers to entry are eliminated, in the long run, more illegal goods will be traded at the new equilibrium.

Should gambling outlets be public monopolies because they would be smaller, badly run and slow to innovate? The monopolisation of bads may shift us in the direction of social optimality. Buchanan, of course, adds that:

The analysis does nothing toward suggesting that enforcement agencies should not take maximum advantage of all technological developments in crime prevention, detection and control.

Tax reforms lead to higher taxes

22 Mar 2014 3 Comments

in constitutional political economy, James Buchanan, Public Choice, public economics, taxation Tags: Casey Mulligan, efficient taxes, Gary Becker, growth of government, James M. Buchanan, tax reform, taxation in Nordic countries

After the 1970s tax revolts and California’s Proposition 13, Buchanan and Brennan wrote The Power to Tax. Their message was that if you don’t always trust governments, beware of efficient taxes.

More efficient taxes make it easier for government to extract more tax revenue from the population with less resistance. Taxes can be made more efficient by broadening tax bases and removing loopholes while lowering marginal rates. A GST that replaces a web of sales taxes is a common example. The GST always goes up over time, never down over time. Most tax reforms are revenue neutral.

When Brennan said at a tax reform conference in Australia 20 years or so ago that efficient taxes and tax reforms are both bad because they lead to higher taxes and a larger government, no one understood him.

Idealists all, the audience including me assumed they were advising a benevolent government, not a revenue-maximising leviathan government – a beast that needed to be staved with constitutional constraints on the number and size of tax bases and tax instruments.

Fiscal arrangements were analysed by Buchanan and Brennan in The Power to Tax in terms of the preferences of citizen-taxpayers who are permitted at some constitutional level of choice to select the fiscal institutions they are to be subject to over an uncertain future.

Those in elected office are assumed to exploit the power assigned to them to the maximum possible extent: government is a revenue-maximising leviathan.

Buchanan and Brennan were all for inefficient tax systems because they do not raise as much revenue. A government that cannot raise much revenue cannot grow very large.

Gary Becker and Casey Mulligan attributed the growth in the size of governments in the 20th century to demographic shifts, more efficient taxes, more efficient spending, a shift in the political power from the taxed to the subsidised, shifts in political power among taxed groups, and shifts in political power among the subsidised groups:

An improvement in the efficiency of either taxes or spending would reduce political pressure for suppressing the growth of government and thereby increase total tax revenue and spending.

Tax reform saved the late 20th century welfare state by raising the same or more revenue with less taxpayer resistance. Taxes are very efficient in the Nordic countries – high tax rates on labour income and consumption but lower on capital income. And light regulation too.

Recent Comments