That is the topic of my latest Bloomberg column. The opener is this: Can a single self-published paper really refute decades of work by three famous economists? If the paper is the modestly titled “Income Inequality in the United States: Using Tax Data to Measure Long-Term Trends,” then the answer — with qualifications — is yes. And…

America’s top one percent has not been seeing a rising income share

America’s top one percent has not been seeing a rising income share

18 Nov 2023 Leave a comment

in economic history, entrepreneurship, human capital, income redistribution, labour economics, labour supply, occupational choice, poverty and inequality, Public Choice, public economics Tags: top 1%

Book Presentation with John Cochrane: “The Fiscal Theory of the Price Le…

09 Nov 2023 Leave a comment

in budget deficits, business cycles, econometerics, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, inflation targeting, macroeconomics, Milton Friedman, monetarism, monetary economics, public economics Tags: monetary policy

Caplan-Singer Debate Video

05 Nov 2023 Leave a comment

in economic growth, economics of education, entrepreneurship, history of economic thought, human capital, income redistribution, labour economics, labour supply, macroeconomics, occupational choice, poverty and inequality, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

A year ago, Jonah Franks, who runs Public Intellectuals for Charity, organized a debate between me and Peter Singer on “Do the rich pay their fair share?” I already posted my opening statement, my reflections on the debate, along with two follow-ups on Singer’s “Noble Lie.” The debate video itself, however, was gated for paying…

Caplan-Singer Debate Video

Liberal Hypocrisy is Fueling American Inequality. Here’s How. | NYT Opinion well worth watching

04 Nov 2023 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of bureaucracy, economics of education, economics of regulation, income redistribution, labour economics, labour supply, law and economics, liberalism, Marxist economics, politics - USA, property rights, Public Choice, public economics, rentseeking, urban economics Tags: housing affordability, top 1%, zoning

South Africa’s Slow, Inevitable March Towards Collapse

04 Nov 2023 Leave a comment

in development economics, economic history, economics of crime, energy economics, entrepreneurship, growth disasters, growth miracles, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, poverty and inequality, Public Choice, public economics, urban economics Tags: South Africa

More Evidence for Trump’s Corporate Tax Reform, Part I

03 Nov 2023 Leave a comment

in applied price theory, econometerics, economic growth, entrepreneurship, fiscal policy, macroeconomics, public economics Tags: taxation and investment

I’m very critical of bad policies we got during the Trump years, most notably profligacy and protectionism. But I shower praise on the good policies, such as the 2017 tax legislation (especially the lower corporate tax rate and the curtailing of the state and local tax deduction). Today, we’re going to focus on the positive. […]

More Evidence for Trump’s Corporate Tax Reform, Part I

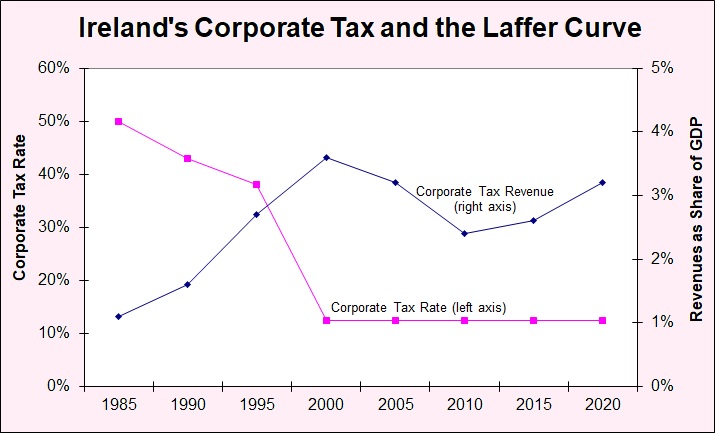

Ireland’s Corporate Tax and the Laffer Curve

19 Oct 2023 Leave a comment

in economic growth, economic history, fiscal policy, macroeconomics, Public Choice, public economics Tags: taxation and investment

About 15 years ago, I narrated a three-part series on the Laffer Curve. Here’s Part II, which looks at real-world evidence. About halfway through the video (3:15-3:55), I discuss what happened when Ireland dramatically lowered its corporate tax rate. The net result was an increase in tax revenue. But not just by a small amount. […]

Ireland’s Corporate Tax and the Laffer Curve

“It is a paradoxical truth that tax rates are too high and tax revenues are too low…”

14 Oct 2023 Leave a comment

I gather that the National Party has run into some problems defending its tax proposals in the face of an unending attack not just from Labour but also our fair and balanced MSM. In light of that I put this post up as a suggestion as to how National might start to fight back, since […]

“It is a paradoxical truth that tax rates are too high and tax revenues are too low…”

The problems of a tax-free threshold

05 Oct 2023 Leave a comment

in politics - New Zealand, public economics

Jim Rose details the problems with a tax-free threshold for the NZ Taxpayers Union. Running one that’s revenue-neutral means you have to increase marginal rates further up. Increasing marginal rates to fund inframarginal transfers mightn’t make the most sense. And there are better ways of targeting support, if that’s what you want to do. He writes:The introduction…

The problems of a tax-free threshold

Thomas Sargent Delivers the 2022 Simpson Lecture

11 Aug 2023 Leave a comment

in budget deficits, economic history, fiscal policy, history of economic thought, macroeconomics, monetary economics, public economics

The risk the Greens’ wealth tax poses to our economy

21 Jul 2023 Leave a comment

in applied price theory, applied welfare economics, economic history, entrepreneurship, financial economics, income redistribution, industrial organisation, labour economics, labour supply, occupational choice, politics - New Zealand, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment

Dropping Money from Helicopters: John Cochrane on Inflation

01 Mar 2023 Leave a comment

in budget deficits, business cycles, comparative institutional analysis, development economics, economic growth, economic history, economics of regulation, entrepreneurship, environmental economics, financial economics, global financial crisis (GFC), great recession, growth miracles, history of economic thought, inflation targeting, macroeconomics, Milton Friedman, monetarism, monetary economics, public economics

Recent Comments