The state has no sources of money other than the money people earn themselves

28 Jul 2014 Leave a comment

in liberalism, public economics Tags: Margaret Thatcher

Tax Freedom Day

04 Jun 2014 Leave a comment

in public economics, taxation Tags: taxes

HT: Daniel Mitchell

Is Thomas Piketty a double secret supply-side economist?

03 Jun 2014 Leave a comment

in entrepreneurship, labour supply, public economics Tags: laffer curve, supply-side economics, Thomas Peketty

When a government taxes a certain level of income or inheritance at a rate of 70 or 80 percent, the primary goal is obviously not to raise additional revenue (because these very high brackets never yield much).

It is rather to put an end to such incomes and large estates, which lawmakers have for one reason or another come to regard as socially unacceptable and economically unproductive…

The Company Tax Laffer curve

03 Jun 2014 Leave a comment

in public economics, taxation Tags: company tax rate, laffer curve

The Australian, New Zealand and Irish company taxes raised similar amounts of revenue as a percentage of GDP. The Irish company tax rate was 12.5% in 2003.

from The U.S. Corporate Income Tax System: Once a World Leader, Now A Millstone Around the Neck of American Business by the Tax Foundation via The Solution is the problem blog

Taxing Amazon.com sales | vox

05 May 2014 Leave a comment

in public economics Tags: amazon, substitution effects, tax incidence

When several US states passed laws to require the collection of sales tax on online purchases, households living in these states reduced their Amazon expenditures by 9.5%. In practice, only Amazon was affected by the tax.

The decline in Amazon purchases is offset by a 2% increase in purchases at local brick-and-mortar retailers and a 19.8% increase in purchases through the online operations of competing retailers. The decline in sales is sharpest (23%) for purchases above $300.

Online consumers are very sensitive to total prices, taxes and options to avoid taxes.

Enough taxation can reduce legal marijuana consumption to current regulated levels, and spare us the war on drugs

09 Apr 2014 Leave a comment

in applied welfare economics, law and economics, public economics Tags: illegal goods, marijuana, prohibition

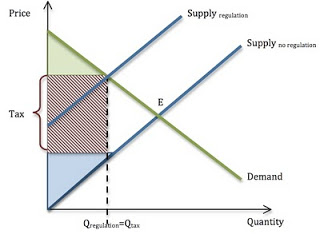

The economics of illegal goods weighs extremely heavily in favour of legalization and taxation rather than banning and enforcing, as Gary Becker, Kevin Murphy, and Michael Grossman outline in The Economic Theory of Illegal Goods: The Case of Drugs (NBER Working Paper, 1994).

….If the government seeks to regulate the quantity of marijuana consumed, it should choose to do so with a pricing mechanism such as taxation (from which it can earn revenue) rather than a ban (which is costly to enforce). The result is otherwise the same.

Opportunity for all: How to think about income inequality – AEI

02 Apr 2014 Leave a comment

in applied welfare economics, labour economics, public economics

… The conventional wisdom on inequality is built on three assumptions: (1) Income inequality is inherently unjust; (2) it is bad for the economy; and (3) government redistribution is the best way to remedy it. According to this narrative, narrowing the gap between what wealthy and working-class Americans earn should be our top political priority, and policies such as raising taxes or increasing the minimum wage are the answer.

This conventional wisdom is incorrect. A free enterprise society is not a zero-sum game in which citizens fight over resources. It should be a shared journey that empowers everyone to improve their station and earn their own success. Income differences are inevitable, and they are not inherently problematic as long as the opportunity to rise is available to everyone. Survey data show that the American people agree: narrowing the income gap is an afterthought for people who believe everyone has a shot at success, but it ranks as a top priority among those who feel the game is rigged.

While fixating on the distribution of income per se is misguided, the free enterprise movement must not neglect the reason for the debate. Mobility and opportunity are indeed falling in low-income America. And as the policy failures of the past half-decade have made painfully clear, outdated policies actually exacerbate the problematic trends they are intended to reverse.

Fighting to lift up vulnerable people is a mission with universal resonance. It is time for advocates of free enterprise to join the conversation, explain the truth about inequality and redistribution, and articulate the principles that will restore opportunity for all.

—Arthur C. Brooks, AEI President

Read the full compilation.

via Opportunity for all: How to think about income inequality – Economics – AEI.

Contents

INTRODUCTION 1

Arthur Brooks

CONSUMPTION AND THE MYTHS OF INEQUALITY 3

Kevin A. Hassett and Aparna Mathur

IF YOU REALLY CARE ABOUT ENDING POVERTY, STOP TALKING ABOUT INEQUALITY 7

W. Bradford Wilcox

THE INEQUALITY ILLUSION 12

Aparna Mathur

DEFINE INCOME INEQUALITY 18

Jonah Goldberg

MORE THAN THE MINIMUM WAGE 21

Michael R. Strain

2014’S REAL ECONOMIC CHALLENGE 24

James Pethokoukis

INCOME INEQUALITY IN THE UNITED STATES 27

Aparna Mathur

A NEW MEASURE OF CONSUMPTION INEQUALITY 45

Kevin A. Hassett and Aparna Mathur

SHOULD THE TOP MARGINAL INCOME TAX RATE BE 73 PERCENT? 82

Aparna Mathur, Sita Slavov, and Michael R. Strain

John Rawls and are the super-rich unjustly over-taxed?

28 Mar 2014 1 Comment

in labour economics, public economics, Rawls and Nozick Tags: company tax, economic growth, flat rate consumption tax, higher wages, income tax, inequality

John Rawls is often put forward by political progressives as the starting point for political philosophy. Rawls pointed out that behind the veil of ignorance, people will agree to inequality as long as it is to everyone’s advantage.

Rawls was attuned to the importance of incentives in a just and prosperous society. If unequal incomes are allowed, this might turn out to be to the advantage of everyone.

Rawls lent qualified support to the idea of a flat-rate consumption tax (see A Theory of Justice, pp. 278-79). He said that:

A proportional expenditure tax may be part of the best scheme [and that adding such tax] can contain all the usual exemptions.

The reason why Rawls lent qualified support to the idea of a flat-rate consumption tax was because these taxes:

impose a levy according to how much a person takes out of the common store of goods and not according to how much he contributes.

A simple way to have a progressive consumption tax is to exempt all savings from taxation. Taxable consumption is calculated as income minus savings minus a large standard deduction. Different countries use different terms to describe the minimum amount that must be earned before any taxes are paid.

Income tax must be opposed on social justice grounds, but not progressive consumption taxes.

Given that the super-rich – the top 0.1% of income earners – do not spend much of their incomes, especially on the way up building their businesses, they could be rather over-taxed!

Steven Kaplan and Joshua Rauh’s “It’s the Market: The Broad-Based Rise in the Return to Top Talent”, Journal of Economic Perspectives (2013) found that:

- Rising inequality is due to technical changes that allow highly talented individuals or “superstars” to manage or perform on a much larger scale.

- These superstars can now apply their talents to greater pools of resources and reach larger numbers of people and markets at home and abroad. They thus became more productive, and higher paid.

- Those in the Forbes 400 richest are less likely to have inherited their wealth or have grown up wealthy.

- Today’s rich are working rich who accessed education in their youth and then applied their natural talents and acquired skills to the most scalable industries such as ICT, finance, entertainment, sport and mass retailing.

- The U.S. evidence on income and wealth shares for the top 1% is most consistent with a “superstar” explanation. This evidence is less consistent with the gains in earnings of the top 1% coming from greater managerial power over the determination of their own pay in the corporate world, or changes in social norms about what managers could earn.

Today’s super-rich are highly productive because they produce new and better products and services that people want and are willing to pay for. These rewards for entrepreneurship and hard work guide people of different talents and skills into the occupations and industries where their talents are valued the most. The efficient allocation of talent and income maximising occupational choices were important to Rawls’ framework.

Another important role for incentives is it rewards entrepreneurial alertness. People will look for and take advantage of hitherto unnoticed business opportunities if they are rewarded for doing so. These private rewards for greater effort, excellence and superior alertness are the driving force of the market. Most of the innovation that drives modern prosperity would not have occurred but for the lure of profit.

Rawls was keen on stiff inheritance taxes to prevent the “large-scale private concentrations of capital from coming to have a dominant role in economic and political life”. His support for inheritance taxes was out of concern with a concentration of political power rather than improving incentives.

Rawls overrated the power of the rich to buy political influence as do many on the Left. They do not understand Director’s law of public expenditure and the theories of the median voter and the expressive voter. The major political parties all chase the swinging voter in the middle class.

Rawls’ views on incomes taxes and the rich are rather under-discussed among his champions on the progressive Left. Google John Rawls and income taxes and you do not get many hits or papers of any substance.

With his emphasis on fair distribution of income, Rawls’ initial appeal was to the Left, but left-wing thinkers started to dislike his acceptance of capitalism and tolerance of large discrepancies in income. Many moved on. Rawls excluded envy from deliberations behind the veil of ignorance. This may be why he lost some of his initial appeal to some.

You must admire his consistency. Rawls was happy for people to be super-rich as long as they saved and invested their resources. Everyone in society gains from those investments and is better off.

Robert Lucas (1990) estimated that a revenue neutral elimination of all taxes on income from capital and on capital gains would increase the U.S. capital stock by about 35% and consumption by 7%. Hans Fehr, Sabine Jokisch, Ashwin Kambhampati, and Laurence J. Kotlikoff (2014) found that eliminating the corporate income tax would raise the U.S capital stock (machines and buildings) by 23%, output by 8% and the real wages of unskilled and skilled workers by 12%. Is taxing the rich worth this large a lost wage rise?

Tax reforms lead to higher taxes

22 Mar 2014 3 Comments

in constitutional political economy, James Buchanan, Public Choice, public economics, taxation Tags: Casey Mulligan, efficient taxes, Gary Becker, growth of government, James M. Buchanan, tax reform, taxation in Nordic countries

After the 1970s tax revolts and California’s Proposition 13, Buchanan and Brennan wrote The Power to Tax. Their message was that if you don’t always trust governments, beware of efficient taxes.

More efficient taxes make it easier for government to extract more tax revenue from the population with less resistance. Taxes can be made more efficient by broadening tax bases and removing loopholes while lowering marginal rates. A GST that replaces a web of sales taxes is a common example. The GST always goes up over time, never down over time. Most tax reforms are revenue neutral.

When Brennan said at a tax reform conference in Australia 20 years or so ago that efficient taxes and tax reforms are both bad because they lead to higher taxes and a larger government, no one understood him.

Idealists all, the audience including me assumed they were advising a benevolent government, not a revenue-maximising leviathan government – a beast that needed to be staved with constitutional constraints on the number and size of tax bases and tax instruments.

Fiscal arrangements were analysed by Buchanan and Brennan in The Power to Tax in terms of the preferences of citizen-taxpayers who are permitted at some constitutional level of choice to select the fiscal institutions they are to be subject to over an uncertain future.

Those in elected office are assumed to exploit the power assigned to them to the maximum possible extent: government is a revenue-maximising leviathan.

Buchanan and Brennan were all for inefficient tax systems because they do not raise as much revenue. A government that cannot raise much revenue cannot grow very large.

Gary Becker and Casey Mulligan attributed the growth in the size of governments in the 20th century to demographic shifts, more efficient taxes, more efficient spending, a shift in the political power from the taxed to the subsidised, shifts in political power among taxed groups, and shifts in political power among the subsidised groups:

An improvement in the efficiency of either taxes or spending would reduce political pressure for suppressing the growth of government and thereby increase total tax revenue and spending.

Tax reform saved the late 20th century welfare state by raising the same or more revenue with less taxpayer resistance. Taxes are very efficient in the Nordic countries – high tax rates on labour income and consumption but lower on capital income. And light regulation too.

Recent Comments