Sugar taxes and expressive politics

11 Feb 2016 1 Comment

in applied welfare economics, economic growth, health economics, liberalism, politics - New Zealand, population economics, Rawls and Nozick

The sugar tax championed by among others the Morgan Foundation is the latest manifestation of do-gooding that dates back to sumptuary laws of mediaeval times. Black’s Law Dictionary defines them as

Laws made for the purpose of restraining luxury or extravagance, particularly against inordinate expenditures in the matter of apparel, food, furniture, etc.

These early attempts through sumptuary laws to regulate how people live their lives to make sure that they did not dress above their social rank as well as risk hellfire and damnation has been critically applied include alcohol prohibition, drug prohibition, gun control laws, bans, and restrictions on dog fighting.

The sugar tax attempts to save us from a bad diet because others know how to run our lives better than we do despite having never met us, much less lived our lives and dreamed our dreams. The calling of the do-gooder is a busy vocation.

The do-gooders want to stop smoking, overeating, and the partaking of too much sugar but undoubtedly support the decriminalisation of marijuana because of the futility of prohibition.

The right to get stoned is a civil liberties issue but sugar is a legitimate topic of public health regulation. Those who do not want to save people from sugar are ignorant or steeped in moral turpitude, preferably both.

We live in an age of obesity. When I was a kid, the poor were thin, they are now fat. I can still remember the names of the 2 boys in my high school class who were in any way overweight. Now the majority of school kids are overweight.

Sugar taxes are also when the Left stage a temporary conversion to supply-side economics. When you tax something, less will be supplied. The Left are surprisingly unwilling to admit that unless it suits their agenda of the day.

The Morgan Foundation is a curious position of advocating a great big new tax: a comprehensive capital taxation. It is also arguing that sugar taxes will cut consumption. I wonder what it estimates to be the response of saving and investment in its capital tax. Does it take the conservative estimates, or the liberal estimates of the responsiveness of savings, investment and labour supply to higher taxes?

Sugar taxes are a blunt instrument. They tax fat people, thin people and the potentially fat of tomorrow. They are not like alcohol and tobacco taxes which are narrowly tailored to taxing sin. Richard Posner said that

People who crave sugar will find no dearth of substitutes for sugar-sweetened sodas. Moreover, most consumers of these sodas are not and never will be obese. They may well be overweight, but all that that means is that they are heavier than the “ideal” weight calculated by physicians; if they are only slightly or even moderately heavier, the consequences for health or social or professional success are apparently slight. To the extent that a soda tax would cause substitution of equally sugared foods, it would not only have no effect on obesity; it would yield no revenue…

Last time I looked, people enjoy food. Some enjoy food quite a lot.

We are in a free society where some people are just simply like eating while others have a bad draw of the genes. Others like to exercise. As Richard Posner said:

The obese are people who by dietary choice and preference for a sedentary style of life have traded off the costs of obesity against the costs of being thin and have decided (at least in a “revealed preference” sense–they may not have consciously chosen a style of life that predisposes them to obesity) that the costs of thinness preponderate over the benefits. And in general we do not try to prevent people from making such trade-offs.

But there are two situations in which preventing people from choosing the style of life that maximizes their utility can be defended (provided certain assumptions are made about cost and efficacy) on economic grounds.

One is where consumers are unable to evaluate a product or to act upon their evaluation; another is where a voluntary transaction imposes costs on other people which the transactors do not take into account.

The fact that car unhealthy lifestyles may impact on the public health budget is not much of an argument for intervention. Private insurers are quite capable of working out whether they need information on people’s lifestyle and diet or not.

If you are to provide people with universal health insurance at the expense of the long-suffering taxpayer, you should at least have the decency not to try and take over their entire lives so that you can be a social justice warrior on the cheap.

As for children seeing advertising for sugar, the sugar tax and a ban on advertising is a token gesture. You trying to take over from their parents. As Gary Becker noted:

Many doctors and others who advocate taxing sugared beverages and fast foods at heart do not believe that consumer taste for sugar and fast foods should be taken into account in devising public policy.

Until the nanny state brigade and sugar tax advocates address that simple question, they have no standing in a public debate. Like all the prohibitionists who came before them, they are simply unwilling to admit the people like food, drink and sugary things.

Women demonstrating against Prohibition, 1932. https://t.co/xE30ApkNBB—

Historical Images (@Historicalmages) January 29, 2016

Until they put forward a way of balancing that common preference to enjoy life including food and risk against their meddlesome preferences in their role as the great central planner of our lives, they are just having us on. As Richard McKenzie said recently

The people most concerned with the country’s weight gain—self-appointed “fat police”—have favoured supposedly easy and direct policy solutions: tax and ban high-sugar and high-fat products.

Such policy courses are a snare and delusion, especially if Americans’ cherished freedoms of choice, which are at the heart of the country’s economic engine, are to be preserved.

The great driver of obesity is prosperity, not sugar. People can simply afford to buy more and enjoy the food they have more.

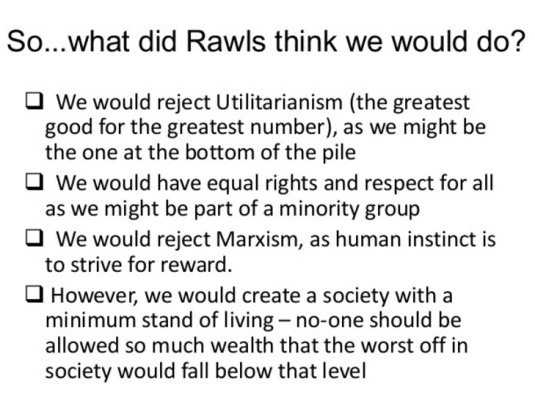

John Rawls argued that people should have every right to live their lives according to their own lights. In nanny state brigade just do not accept that point of view.

Rawls believed the most distinctive feature of human nature is our ability freely to choose our own ends. The state’s first duty with its citizens is to respect this capacity for autonomy.

Instead, the fat police and the do-gooders want to engage in the futile gesture of pestering you and taxing you when you buy a sugary drink even though there are almost unlimited alternative supplies of sugar laden products.

The fat police are far too busy feeling good about themselves in the expressive politics of public health. They cheer for sugar taxes, boo obesity and feel good about themselves for having told other people how to live their lives better. A good number of them then celebrate by lighting-up a joint. Many of the rest have a wine, not beer.

The particularly annoying ones ride a bike, which is a dangerous activity, or are so boorish as to exercise in a public place, much to the annoyance of the rest of us who are getting on with having a good time.

Adam Smith versus Jamie Whyte or is there poverty on the Starship Enterprise?

07 Jan 2016 2 Comments

in Adam Smith, applied welfare economics, politics - New Zealand, poverty and inequality, Rawls and Nozick Tags: child poverty, family poverty, star trek

Jamie Whyte today wrote an excellent op-ed on the meaninglessness of current measures of poverty. His point was that defining poverty as 60% of the median income means the poor will always be with us. This relative definition of poverty misleads us as to the level of hardship and deprivation in society as Jamie Whyte says today:

There is no poverty in New Zealand. Misery, depravity, hopelessness, yes; but no poverty.

The poorest in New Zealand are the unemployed. They receive free medical care, free education for their children and enough cash to pay for basic food, clothing and (subsidised) housing. Most have televisions, refrigerators and ovens. Many even own cars. That isn’t poverty.

I agree that this definition of poverty in relative income terms is misleading and reflects a political agenda. When I was young, the poor were thin, now they are fat.

Poverty rates have not changed despite a greater abundance of food. Indeed, child poverty rates have increased since I was young despite this relative opulence of food.

Over the Christmas break I read Simon Chapple and Jonathan Boston’s Child Poverty in New Zealand. They included a discussion of what was poverty drawing on the relative concept of poverty of Adam Smith. Smith spoke about wrote about the differences in poverty between countries and across time:

A linen shirt … is, strictly speaking, not a necessary of life. The Greeks and Romans lived, I suppose, very comfortably though they had no linen.

But in the present times, through the greater part of Europe, a creditable day-labourer would be ashamed to appear in public without a linen shirt, the want of which would be supposed to denote that disgraceful degree of poverty which, it is presumed, nobody can well fall into without extreme bad conduct.

In any society, a certain level of material well-being is necessary to not be in poverty. Smith also talked about how poverty lines differ between countries starting with the discussion about shoes:

The poorest creditable person of either sex would be ashamed to appear in publick without them. In Scotland, custom has rendered them a necessary of life to the lowest order of men; but not to the same order of women, who may, without any discredit, walk about bare-footed. In France, they are necessaries neither necessaries neither to men nor to women; the lowest rank of both sexes appear there publickly, without any discredit, sometimes in wooden shoes, and sometimes bare-footed.

Under necessaries, I comprehend, not only those things which nature, but those things which the established rules of decency have rendered necessary to the lowest rank of people.

All other things I shall call luxuries; without meaning by this appellation, to throw the smallest degree of reproach upon the temperate use of them. Beer and ale, for example, in Great Britain, and wine, even in the wine countries, I call luxuries. A man of any rank may, without any reproach, abstain totally from tasting such liquors. Nature does not render them necessary for the support of life; and custom nowhere renders it indecent to live without them.

Much of the Wealth of Nations was about the natural progress of opulence under a capitalist system. There is nothing wrong with inequality as John Rawls has explained.

The fact that citizens have different talents can be used to make everyone better off. In a society governed by the difference principle, those better endowed with talents are welcome to use their gifts to make themselves better off, so long as they also contribute to the good of those less well endowed.

With his emphasis on fair distribution of income, Rawls’ initial appeal was to the Left, but left-wing thinkers started to dislike his acceptance of capitalism and tolerance of large discrepancies in income.

Will the poor always be with us? I once had an argument with a colleague at work about whether there was poverty on the Starship Enterprise.

Star Trek was supposed to be a society that had abolished money and a post-scarcity economy because everything was available through a replicator. To quote Captain Picard:

A lot has changed in three hundred years. People are no longer obsessed with the accumulation of ‘things’. We have eliminated hunger, want, the need for possessions.

The economics of the future is somewhat different. You see, money doesn’t exist in the 24th century… The acquisition of wealth is no longer the driving force in our lives. We work to better ourselves and the rest of Humanity.

The Ferengi and their 285 rules of acquisition were a satire on capitalism. The Ferengi was originally meant to replace the Klingons as the Federation’s arch-rival but they were too comical.

Gene Roddenberry’s love story with socialism was a class-ridden society. In Star Trek, higher ranked officers had larger cabins, and most of all they always beamed back from the planet.

An old mate reminded me years ago that anyone who beamed down with Captain Kirk dressed in those red security officer tops were expendables. They were lucky to last 60 seconds in most episodes I watched.

Death and accommodation were class based on Star Trek but it was a supremely opulent society for everyone. That is the point to remember.

Standards are living are much better today than before for everyone despite inequalities that are quite acceptable under the difference principle of John Rawls.

Current definitions of poverty do not take into account the natural progress of opulence. In the 1970s, US Department of Energy started collecting its Household Energy Consumption Survey. This survey is one of the few accurate measures of growing affluence among the poor in America.

Not only does this survey ask about household appliances, it asked about on income. The survey is conducted every 4 years or so since the 1970s. Because of that, it is able to track the diffusion of appliances to households of varying incomes across America.

Yesterday’s luxuries at today’s necessities in poor households with a rapid diffusion of everything from air-conditioners to digital appliances. Many poor households in the USA have more space than middle-class households in Western Europe. Food is also much cheaper in the USA than in Europe.

https://twitter.com/VisualEcon/status/644080191841640448

This growing affluence of poorer Americans is despite higher measured family poverty in America according to the relative poverty measure based on the median income. That makes no sense.

Why John Rawls rejected utilitarianism behind the veil of ignorance

19 Dec 2015 Leave a comment

in applied welfare economics, constitutional political economy, Rawls and Nozick

How @MaxRashbrooke showed housing costs is the main driver of poverty when trying to argue rising inequality was not driven by housing costs

13 Oct 2015 Leave a comment

in applied welfare economics, economics of regulation, politics - New Zealand, poverty and inequality, Rawls and Nozick, rentseeking, urban economics

Rashbrooke then goes on to discuss how housing costs were not a main driver of the growing gap between the top 10% and the bottom 10% of the income distribution in New Zealand. My point is he is more concerned with the politics of envy than with building political support for action against poverty.

What children say about poverty #childpovertynz #itsnotchoice http://t.co/vYfxTn7aG7—

Child Poverty NZ (@povertymonitor) September 07, 2015

Rashbrooke showed that the main driver of poverty in New Zealand is rising housing costs. That is easy to redress but for the opposition of the left-wing parties to reforms to the Resource Management Act that will increase the supply of land and thereby drive down housing costs and rents.

Children's views on poverty #childpovertynz occ.org.nz/assets/Uploads… http://t.co/wZHJ19QcpN—

Child Poverty NZ (@povertymonitor) September 08, 2015

Housing costs gobbled up much of the rising incomes of the poor for many years now in New Zealand as Rashbrooke showed today. The New Zealand Labor Party and New Zealand Greens are doing nothing about it. The regulatory constraints on the supply of land could be gone by lunchtime if the self-proclaimed champions of the poor and social justice supported the reform of the RMA.

The proposals of the New Zealand Labour Party and Greens for the government to build more houses is pointless unless there is more land is supplied. If there is no increase in land supply, all the building of more houses by government does is build the same houses of private developers would have built on the same fixed supply of land. There must be an increase in the supply of land to drive housing costs down for the poor.

John Rawls and Robert Nozick could not agree more the fundamentals of liberalism

18 Aug 2015 Leave a comment

in liberalism, Rawls and Nozick Tags: individual rights, John Rawls, liberalism, political philosophy, Robert Nozick

Unexpected kind word for Parliament House protesters @GreenpeaceNZ @RusselNorman @NZGreens @greencatherine

15 Aug 2015 2 Comments

in constitutional political economy, economics of crime, environmental economics, global warming, law and economics, liberalism, politics - New Zealand, Public Choice, Rawls and Nozick, rentseeking Tags: civil disobedience, climate alarmism, expressive voting, Greenpeace, John Rawls, Justice Scalia, Leftover Left, rule of law

PRESS RELEASE: Greenpeace Parliament Climbers Convicted of Trespass bit.ly/1DRfKMG #realclimateaction http://t.co/sxRokpwRNk—

Greenpeace NZ (@GreenpeaceNZ) August 13, 2015

The Greenpeace vandals who trespassed at Parliament, climbing up to put signs down the front in flagrant disregard of the most ample possible options for peaceful protest right outside at least had the integrity to plead guilty. That shows some sort of fidelity to law and an acknowledgement that what they did was a criminal offence.

John Rawls makes the point that the purpose of civil disobedience is not to impose your will upon others but through your protest to implore them to reconsider their position and change the law or policy you are disputing.

Rawls argues that civil disobedience is never covert or secretive; it is only ever committed in public, openly, and with fair notice to legal authorities. Openness and publicity, even at the cost of having one’s protest frustrated, offers ways for the protesters to show their willingness to deal fairly with authorities. Rawls argues:

- for a public, non-violent, conscientious yet political act contrary to law being done (usually) with the aim of bringing about a change in the law or policies of the government;

- that appeals to the sense of justice of the majority;

- which may be direct or indirect;

- within the bounds of fidelity to the law; and

- whose protesters are willing to accept punishment. Although civil disobedience involves breaking the law, it is for moral rather than selfish reasons; the willingness to accept arrest is proof of the integrity of the act.

Rawls argues, and too many forget, that civil disobedience and dissent more generally contribute to the democratic exchange of ideas by forcing the champions of dominant opinion to defend their views.

Legitimate non-violent direct action are publicity stunts to gain attention and provoke debate within the democratic framework, where we resolve our differences by trying to persuade each other and convince the electorate.

Too many acts of non-violent direct action aim to impose their will on others rather than peaceful protests designed to bring about democratic change in the laws or policies of the incumbent government. That ‘might does not make right’ is fundamental to the rule of law. As United States Supreme Court Justice Antonin Scalia said

The virtue of a democratic system [with a constitutionally guaranteed right to free speech] is that it readily enables the people, over time, to be persuaded that what they took for granted is not so and to change their laws accordingly..

Both sides passionately but respectfully attempt to persuade their fellow citizens to accept their views. Win or lose, advocates for today’s losing causes can continued pressing their cases, secure in the knowledge that an electoral loss today can be negated by a later electoral win, which is democracy in action as Justice Kennedy explains:

…a democracy has the capacity—and the duty—to learn from its past mistakes; to discover and confront persisting biases; and by respectful, rationale deliberation to rise above those flaws and injustices…

It is demeaning to the democratic process to presume that the voters are not capable of deciding an issue of this sensitivity on decent and rational grounds.

The process of public discourse and political debate should not be foreclosed even if there is a risk that during a public campaign there will be those, on both sides, who seek to use racial division and discord to their own political advantage. An informed public can, and must, rise above this. The idea of democracy is that it can, and must, mature.

Freedom embraces the right, indeed the duty, to engage in a rational, civic discourse in order to determine how best to form a consensus to shape the destiny of the Nation and its people. These First Amendment dynamics would be disserved if this Court were to say that the question here at issue is beyond the capacity of the voters to debate and then to determine.

John Rawls’ view that fidelity to law and democratic change through trying to persuade each other is at the heart of civil disobedience reflects the difference between the liberal and the left-wing on democracy and social change as Jonathan Chait observed this week:

Liberals treat political rights as sacrosanct. The left treats social and economic justice as sacrosanct. The liberal vision of political rights requires being neutral about substance.

To the left, this neutrality is a mere guise for maintaining existing privilege; debates about “rights” can only be resolved by defining which side represents the privileged class and which side represents the oppressed…

Liberals believe that social justice can be advanced without giving up democratic rights and norms. The ends of social justice do not justify any and all means.

How the left-wing and liberal visions of democracy are different nymag.com/daily/intellig… http://t.co/Qk5vS9SaV4—

Jonathan Chait (@jonathanchait) August 13, 2015

Recent Comments