Japan’s population is roughly equal to the five most-populous states of the U.S. — California, Florida, New York, Pennsylvania, and Texas — concentrated in a nation that has approximately the land area of Montana, which is only about a fourth as large as those five most-populous states. Moreover, well over … Continue reading →

Addressing the Housing Crisis

Addressing the Housing Crisis

10 Oct 2024 Leave a comment

in applied price theory, economics of bureaucracy, economics of regulation, income redistribution, law and economics, politics - New Zealand, politics - USA, property rights, Public Choice, rentseeking, urban economics Tags: affordable housing, land supply, regressive left

The Case Against Affordable Housing

06 Nov 2023 Leave a comment

in applied price theory, applied welfare economics, econometerics, economic history, urban economics Tags: affordable housing

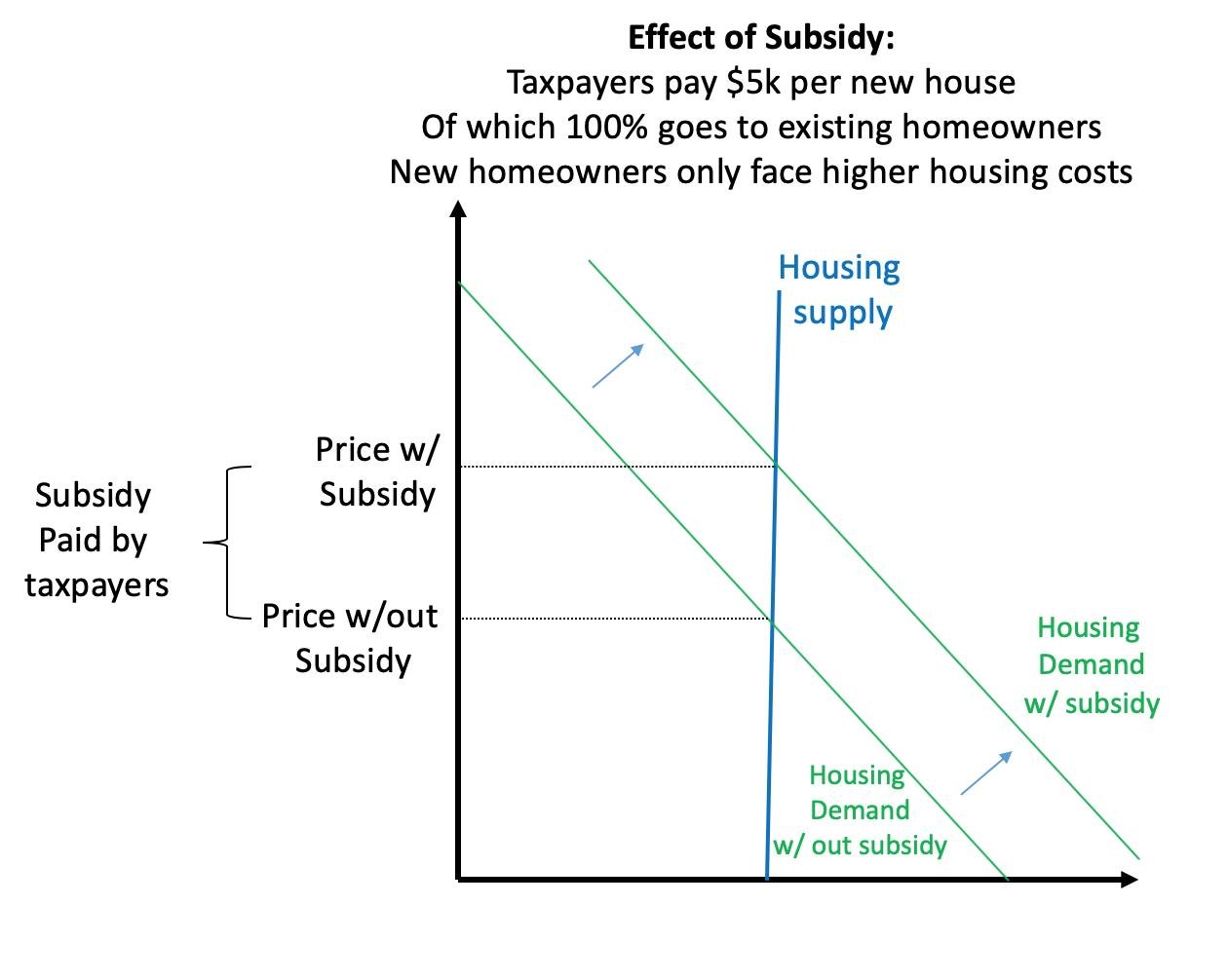

Affordable housing projects aren’t making housing more affordable. In fact, says a new study by an MIT economist, construction of new subsidized housing displaces new unsubsidized housing for little net gain in the housing supply. Specifically, the study found, ten new subsidized housing units resulted in eight fewer unsubsidized units. … Continue reading →

The Case Against Affordable Housing

Unlocking the Potential of Post-Industrial Cities: Investing in Startups with Arpit Gupta 4/6/21

02 May 2021 Leave a comment

in applied price theory, comparative institutional analysis, economics of bureaucracy, human capital, income redistribution, labour economics, labour supply, occupational choice, politics - USA, poverty and inequality, property rights, Public Choice, transport economics, urban economics Tags: affordable housing, zoning

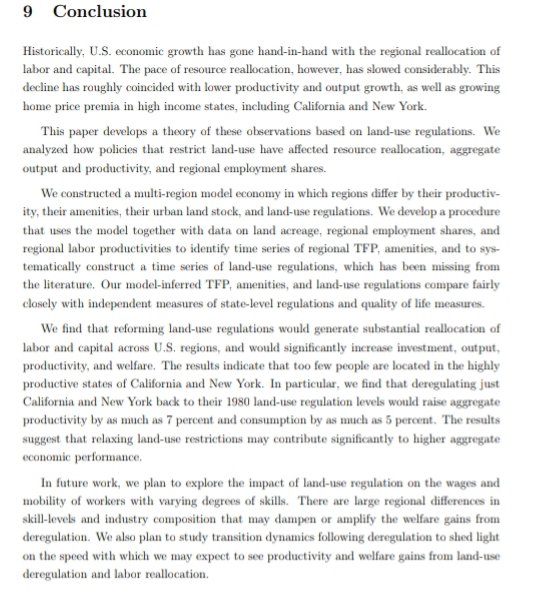

How an obsession with home ownership can ruin the economy | The Economist

07 Feb 2020 Leave a comment

in economic growth, economics of bureaucracy, economics of regulation, Edward Prescott, income redistribution, law and economics, macroeconomics, politics - USA, property rights, Public Choice, public economics, rentseeking, urban economics Tags: affordable housing, land supply, zoning

Bad Laws Cause Homeless Crisis

25 Jan 2020 Leave a comment

in economics of regulation, industrial organisation, law and economics, politics - USA, property rights Tags: affordable housing, land supply, rent control, zoning

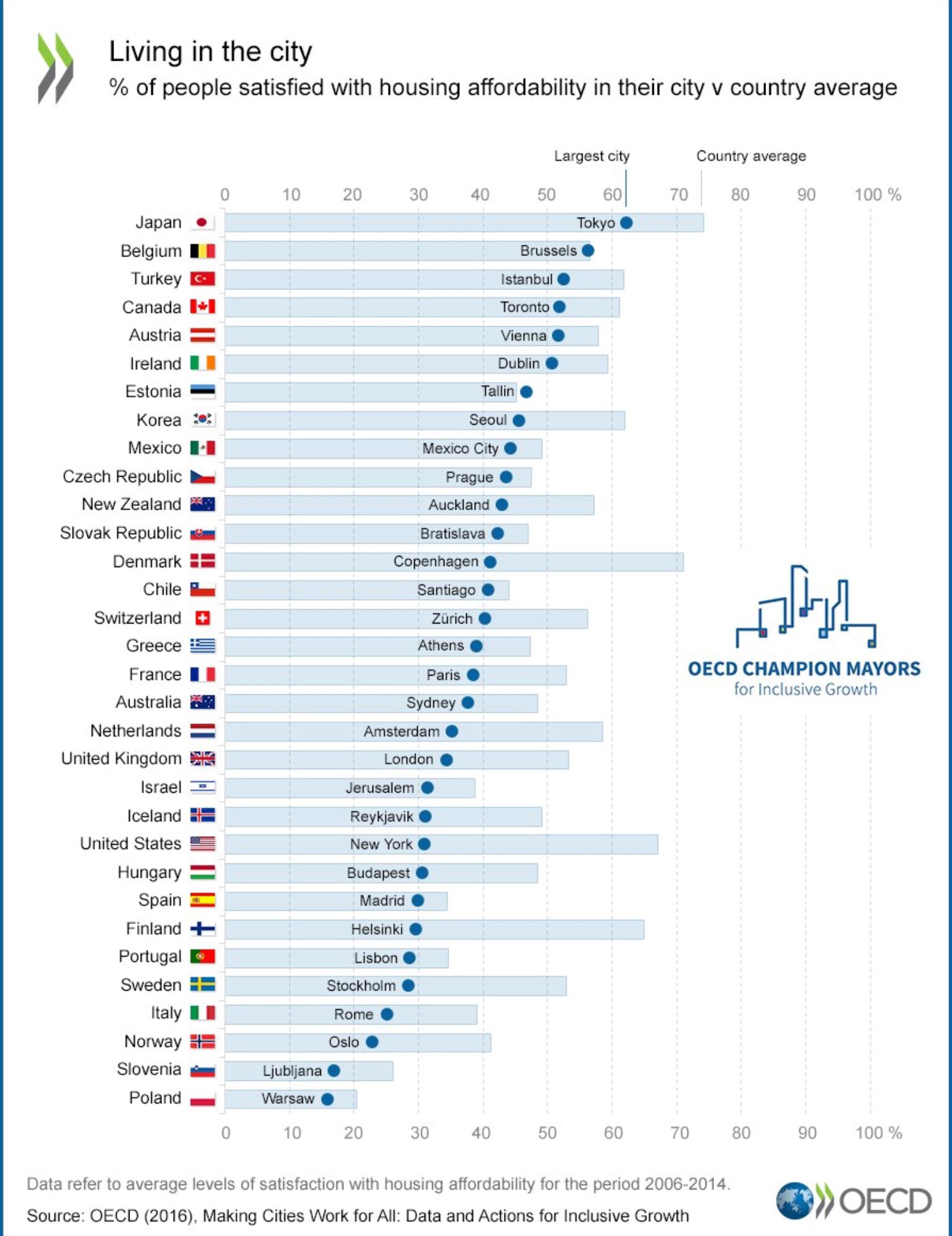

Many Kiwis think housing affordability is not that bad!?

09 Feb 2018 Leave a comment

in politics - New Zealand, urban economics Tags: affordable housing, land supply

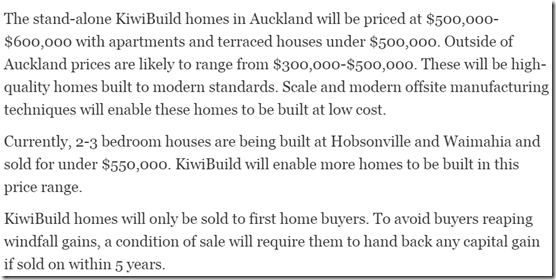

How will @nzlabour @NZGreens ration their 100,000 affordable homes?

27 Aug 2016 Leave a comment

in applied price theory, politics - New Zealand, urban economics Tags: affordable housing, housing affordability, land supply, New Zealand Greens, New Zealand Labour Party, price controls

The Labour Party (and Greens) both plan to build 100,000 affordable homes and sell them within a specific price range. In Auckland, where houses cost in excess of $800,000 on average, they hope to enter the market at the $550,000 point with still quite reasonable housing.

What I ask you is how will Labour and the Greens make sure the affordable houses both are proposing are not snapped up by well-to-do buyers rather than families currently locked out of the market? What will the rationing mechanism be?

Source: KiwiBuild – New Zealand Labour Party.

How will Labour and the Greens ration these desirable houses given that they are priced well below the competition? If two buyers both offer $550,000 for the house, which bid will be accepted?

If the next best available house in Auckland is worth more than that because it is not sold by the proposed Housing Affordability Authority, the first bid for these houses will be $550,000 which is the maximum the government under a Labour Party is willing to accept? What happens then?

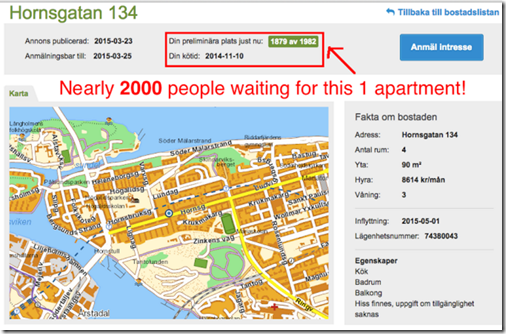

It is basic economics that if you price at less than the market clearing rate which in Auckland is somewhere near $800,000, people will queue to buy what you have unless you raise the price. The exercise of building 100,000 affordable houses makes no sense unless the purpose is to undercut what the market currently supplies.

As the houses are to be sold by a government agency, there can be no black market nor dilution of quality to even up supply with demand. How will a deadlock in price bids be resolved if the maximum bid for an affordable house starts at $550,000?

Labour acknowledges the possibility of flipping by restricting resale for 5 years. But what stops investors just waiting 5 years as there is any significant price gap between these affordable houses and the private market alternatives.

What stops more affluent buyers living in these houses because they so much cheaper than the competing options in Auckland? If you miss out in bidding on one affordable home, do you go back to the end of the queue for the next that is built or get some priority?

Recent Comments