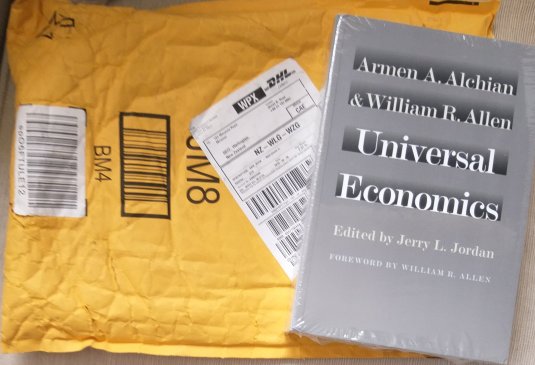

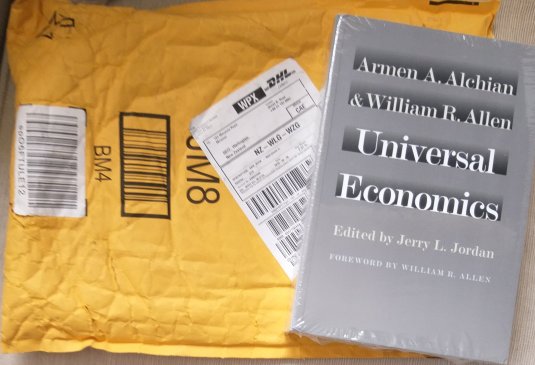

After 1000s of spam emails, I finally received real DHL delivery pending emails

04 Oct 2018 Leave a comment

by Jim Rose in administration, economics Tags: Armen Alchain

Friedrich von Hayek and Armen Alchian Part I

11 Oct 2017 Leave a comment

by Jim Rose in Armen Alchian, F.A. Hayek Tags: Armen Alchain

Rate this:

Austrian economics, labour economics and the economics of unemployment

18 Jun 2014 Leave a comment

by Jim Rose in Austrian economics, labour economics, macroeconomics, Murray Rothbard Tags: Armen Alchain, FA Hayek, Israel Kirzner, Ludwig von Mises, Murray Rothbard, unemployment

Austrian economists seem not to be as thorough as they could be in applying the concepts of dispersed knowledge, tendency to equilibrium and entrepreneurial appraisal, discovery and learning to the labour market.

In a nutshell, the position of Mises and Rothbard is the problem of unemployment is not jobs being fewer than workers. On some terms, a job is always available in an open market. But a wage and the hours of labour required to earn it can be so unrewarding that a person is rational to decline the job offer and remain unemployed. Of course, they acknowledge institutional unemployment that results from are laws and arrangements which inhibit adjustment of prices of labour services.

Kirzner and Rothbard argue that the market is a process that is always in disequilibrium. Does this disequilibrium not imply some unemployment in the labour market? Why should the tendency toward equilibrium be any stronger in the labour market that elsewhere? Bill Allen explained search unemployment this way:

…many officially counted as unemployed are heavily and rationally investing their resources in looking for work. They are sampling the market, seeking information on employment alternatives. That information is valuable, but it is not obtained either freely or instantaneously, and generally, the faster it is to be acquired, the more costly it will be…

as output falls [because of a demand or supply shock], there will be some rise in unemployment, for the economy’s adjustment to the new circumstances of supply and prices will not be made instantaneously, without frictions and lags.

Rothbard was well aware of search unemployment:

It might be objected that workers often do not know what job opportunities await them. This, however, applies to the owner of any goods up for sale. The very function of marketing is the acquisition and dissemination of information about the goods or services available for sale.

Except to those writers who posit a fantastic world where everyone has “perfect knowledge” of all relevant data, the marketing function is a vital aspect of the production structure.

The marketing function can be performed in the labour market, as well as in any other, through agencies or other means for the discovery of who or where the potential buyers and sellers of a particular service may be. In the labour market this has been done through “want ads” in the newspapers, employment agencies used by both employer and employee, etc.

Mises also spoke of search unemployment:

Unemployment is a phenomenon of a changing economy. The fact that a worker discharged on account of changes occurring in the arrangement of production processes does not instantly take advantage of every opportunity to get another job but waits for a more propitious opportunity is not a consequence of the tardiness of the adjustment to the change in conditions, but is one of the factors slowing down the pace of this adjustment.

It is not an automatic reaction to the changes which have occurred , independent of the will and the choices of the job-seekers concerned, but the effect of their intentional actions. It is speculative, not frictional

These are good discussions of search unemployment. But when discussing mismatch unemployment as identified by Hayek after a shortening of the production structure on the market where there might be temporary unemployment of workmen in the higher stages, lasting until the workers can be reabsorbed in the shorter processes of the later stages, Rothbard’s repost to this possible case of involuntary unemployment on the free market is:

It is also true that the shortening of the structure means that there is a transition period when, at final wage rates, there will be unemployment of the men displaced from the longer processes. However, during this transition period there is no reason why these workers cannot bid down wage rates until they are low enough to enable the employment of all the workers during the transition. This transition wage rate will be lower than the new equilibrium wage rate. But at no time is there a necessity for unemployment.

The labour market is a process just as is any other market: it is a communication network that mobilises dispersed knowledge to overcoming ignorance. Why should knowledge unfold in the labour market process through entrepreneurial discovery any faster than elsewhere? There should be disequilibrium wages, entrepreneurial errors, unemployed and mispriced resources, and a process of entrepreneurial learning and error correction. Hayek held that unemployment is always a pricing problem:

The normal cause of recurrent waves of widespread unemployment is … a discrepancy between the way in which demand is distributed between products and services, and the proportions in which resources are devoted to producing them.

Unemployment is the result of divergent changes in the direction of demand and the techniques of production. If labour is not deployed according to demand for products, there is unemployment…

It is the continuous change of relative market prices and particularly wages which can alone bring about that steady adjustment of the proportions of the different efforts to the distribution of demand, and thus a steady flow of the stream of products.

True, but the correction of erroneous wage rates and the reallocation of labour and other resources to new jobs, new firms and new industries is neither instantaneous nor a free process. Kirzner explains:

The entrepreneurial forces acting on the market for any one commodity are thus continually pushing that market toward the market-clearing point—that is, to where (a) the quantity produced is such that (only) all units “worth producing” are indeed produced, and (b) the market price for this commodity is just high enough to make it, as a practical matter, worthwhile for producers to produce this quantity, and is just low enough to make it worthwhile for consumers to buy it…

The process through which the market tends to generate the “right” quantity of a commodity, and the “right” price for it, can be seen as a series of steps during which market participants gradually tend to discover the gaps or errors in the information on which they had previously been basing their erroneous production and/or buying decisions…

The market process is one in which, driven by the entrepreneurial sense for grasping at pure profit opportunities (and for avoiding entrepreneurial losses), market participants, learning more accurate assessments of the attitudes of other market participants, tend toward the market-clearing price-quantity combination.

Alchian, Demsetz and Barzel were on the mark when they pointed out that too frequently the process of change and reaching a new equilibrium is assumed to be a free good, having no resource costs. Hayek also spoke of the time that is takes to reach a new equilibrium because the new constellation of prices and wages must emerge through the free-play of the market:

The primary cause of the appearance of extensive unemployment, however, is a deviation of the actual structure of prices and wages from its equilibrium structure. Remember, please: that is the crucial concept. The point I want to make is that this equilibrium structure of prices is something which we cannot know beforehand because the only way to discover it is to give the market free play; by definition, therefore, the divergence of actual prices from the equilibrium structure is something that can never be statistically measured.

As Kirzner has well argued, entrepreneurs thrive on alertness to disequilibrium prices and they buy and sell to profit from their discoveries, thereby correcting the mispricing, but this takes time. The knowledge and intentions of the different members of society both across all markets and in the labour market about how to match workers to new jobs must come into agreement through a process of discovery and mutual learning that takes time. Phelps (1969) put forward a fine metaphor for how this process of learning and discovery takes place:

I have found it instructive to picture the economy as a group of islands between which information flows are costly: to learn the wage paid on an adjacent island, the worker must spend the day travelling to that island to sample its wage instead of spending the day at work.

Beveridge has similar views of a multiplicity of markets in 1912:

Why should it be the normal condition of the labour market to have more sellers than buyers, two men to every job and at least as often two jobs for every man? The explanation of the paradox is really a very simple one … that there is no one labour market but only an infinite number of separate labour markets.

Gary Becker drew a parallel between the theory of marriage and the theory of job search and matching. In both cases, it takes time to sort among the options and find a suitable pairing. Some are clearly unacceptable. Good matches will often take a long time to find unless people are just plain lucky. Involuntary unemployment is like saying you are involuntarily unmarried. You could marry the first person you meet, if they will have you, but few would say that is wise.

Workers must search for and discover each other. Both are entrepreneurs. The information, knowledge and forecasts of future wages and prices each needs to improve co-ordination of supply and demand will not be discovered immediately:

- The behavioural responses of employers and workers to change are so pronounced because the cost of acquiring new information is profound (Alchian 1969). Many such costs impede wages from instantly fluctuating to rebalance labour supply with demand.

- A job seeker does not initially know the location of suitable vacancies, the wages for various skills, differences in job security and other factors. Job seekers must search for this information, keep this knowledge current and forecast whether better vacancies may open soon.

- Employers must search to learn the location, availability and asking wages of applicants.

The time consumed in labour market search is why Rothbard’s views below that wages just adjust to clear the market has been over taken by developments in economic thinking:

To talk of unemployment or employment without reference to a wage rate is as meaningless as talking of “supply” or “demand” without reference to a price. And it is precisely analogous. The demand for a commodity makes sense only with reference to a certain price.

In a market for goods, it is obvious that whatever stock is offered as supply, it will be “cleared,” i.e., sold, at a price determined by the demand of the consumers…

Whatever supply of labour service is brought to market can be sold, but only if wages are set at whatever rate will clear the market…

We conclude that there can never be, on the free market, an unemployment problem. If a man wishes to be employed, he will be, provided the wage rate is adjusted according.

Mises in the quote below treated unemployment as a investment in prospecting for a better wage offer very much along the lines of W.H. Hutt:

If a job-seeker cannot obtain the position he prefers, he must look for another kind of job. If he cannot find an employer ready to pay him as much as he would like to earn, he must abate his pretensions. If he refuses, he will not get any job. He remains unemployed.

What causes unemployment is the fact that–contrary to the above-mentioned doctrine of the worker’s inability to wait–those eager to earn wages can and do wait. A job-seeker who does not want to wait will always get a job in the unhampered market economy in which there is always unused capacity of natural resources and very often also unused capacity of produced factors of production. It is only necessary for him either to reduce the amount of pay he is asking for or to alter his occupation or his place of work.

Alchian (1969) lists three ways to adjust to unanticipated demand fluctuations:

• output adjustments;

• wage and price adjustments; and

• Inventories and queues (including reservations).

Alchian (1969) suggests that there is no reason for wage and price changes to be used regardless of the relative cost of these other options:

• The cost of output adjustment stems from the fact that marginal costs rise with output;

• The cost of price adjustment arises because uncertain prices and wages induce costly search by buyers and sellers seeking the best offer; and

• The third method of adjustment has holding and queuing costs.

There is a tendency for unpredicted price and wage changes to induce costly additional search. Long-term contracts including implicit contracts arise to share risks and curb opportunism over sunken investments in relationship-specific capital such as firm-specific human capital and specialised machinery. These factors lead to queues, unemployment, spare capacity, layoffs, shortages, inventories and non-price rationing in conjunction with wage stability. Alchian and Woodward in their 1987 paper ‘Reflections on a theory of the firm’ say that :

… the notion of a quickly equilibrating market price is baffling save in a very few markets. Imagine an employer and an employee. Will they renegotiate price every hour, or with every perceived change in circumstances? If the employee is a waiter in a restaurant, would the waiter’s wage be renegotiated with every new customer? Would it be renegotiated to zero when no customers are present, and then back to a high level that would extract the entire customer value when a queue appears?

… But what is the right interval for renegotiation or change in price? The usual answer ‘as soon as demand or supply changes’ is uninformative.

Alchian and Woodward then go on to a long discussion of the role of protecting composite quasi-rents from dependent resources as the decider of the timing of wage and price revisions. Alchian and Woodward explain unemployment to the side effect of the purpose of wage and price rigidity, which is the prevention of hold-ups over dependent assets. They note that unemployment cannot be understood until an adequate theory of the firm that explains the type of contracts the members of a firm contract with one another.

Walter Oi has also written on slack capacity as being productive and he included references back to W.H. Hutt. Oi’s work on retailing and supermarkets spends a lot of time explaining how an empty store is efficient because the owners are waiting for a mass of customers to arrive at unpredictable time. Oi redeveloped the term the economies of massed reserves to describe this. Oi thought that this was a better term than Hutt’s pseudo-idleness. Oi argued that all resource idleness could, in principle, be eliminated, but to accomplish this, the synchronization of the arrival rates of customers, sales clerks, and just-in-time inventories would be prohibitively expensive.

Benjamin Klein’s theory of rigid wages in American Economic Review in 1984 is one of the few that explored rigid wages as an industrial organisation issue. Klein treated rigid wages as a response to opportunism and hold-up problems over specialised assets and are forms of exclusive dealership or take-or-pay contracts.

The labour market is better understood by forgetting it is the labour market and treating it as a market for long-term contracts for relationship-specific services, firm-specific human capital and mutually dependent assets owned by multiple parties.

Labour is more heterogeneous than capital. The notion that buyers and sellers in the labour market can pair up instantly contradicts the Austrian traditions that markets only tend to equilibrium and entrepreneurs are needed to move things along.

Morgan O. Reynolds makes a good point in his labour economics textbook about how labour markets are different from other markets because there are no speculators and no forward markets in labour to quickly clear the market and allow entrepreneurs to drive the market towards equilibrium through arbitrage as quickly as they do elsewhere.

Rate this:

Recent Comments