Climate economics: Optimal climate policy

11 Apr 2017 Leave a comment

in applied price theory, applied welfare economics, economics of regulation, energy economics, environmental economics, global warming Tags: carbon tax, carbon trading

When is international action on global warming justified?

07 May 2016 Leave a comment

in applied price theory, development economics, energy economics, environmental economics, global warming Tags: carbon tax, carbon trading, climate alarmism, global warming

When countries *do* tax carbon, it’s usually $15/ton or less @GreenCatherine @RusselNorman @Greenpeacenz

30 Apr 2016 Leave a comment

in energy economics, environmental economics, global warming Tags: carbon price, carbon tax, carbon trading, expressive voting

#Morganfoundation discovers that #Ukraine is a dodgy place to buy credence goods

19 Apr 2016 Leave a comment

in economics of climate change, economics of crime, economics of information, environmental economics, global warming, industrial organisation, international economic law, international economics, International law, law and economics, politics - New Zealand, survivor principle Tags: adverse selection, asymmetric information, carbon trading, climate alarmism, climate alarmists, credence goods, experience goods, inspection goods

Morgan Foundation yesterday put out a report pointing out that many of the carbon credits purchased from the Ukraine under the carbon trading scheme are fraudulent.

That comes with no surprise to anyone vaguely familiar with business conditions and the level of official corruption in the former Soviet Union. Russia is a more honest place to do business.

Carbon traders who buy from the Ukraine are not buying an inspection good. An inspection good is a good whose quality you can ascertain before purchase.

They are not buying an experience good. An experience good is a good whose quality is ascertained after purchase in the course of consumption.

Source: Russia, Ukraine dodgy carbon offsets cost the climate – study | Climate Home – climate change news.

What these carbon traders in New Zealand are doing is buying credence goods from the Ukraine. The credence goods are the carbon credits, which the Morgan Foundation and others have found often to be fraudulent.

A credence good is a good whose value is difficult or impossible for the consumer to ascertain. A classic example of a credence good is motor vehicle repairs.

You must trust the seller and their advice as to how much you need to buy of a credence good. Many forms of medical treatment also require you to trust the seller as to how much you need.

Carbon credits are such a credence good. You know there is corruption in the Ukraine and many other countries that supply them. You may never know at any reasonable cost whether the specific carbon credits you buy were legitimate.

The reason why carbon credits are purchased from such an unreliable source is expressive voting. As is common with expressive politics, what matters is whether the voters cheer or boo the policy. The fact whether it works or not does not matter too much.

The Greens are upset about this corruption in carbon trading. They did not mention the corruption in international carbon trading and climate aid when they welcomed the recent Paris treaty on global warming but that is for another day.

https://twitter.com/kadhimshubber/status/721831502372302849

Co-ordinated international action on global warming is rather pointless if some of the key countries with carbon emission caps are corrupt, which they are.

As Geoff Brennan has argued, CO2 reduction actions will be limited to modest unilateral reductions of a largely token character. There are many expressive voting concerns that politicians must balance to stay in office and the environment is but one of these.

Once climate change policies start to actually become costly to swinging voters, expressive voting support for these policies will fall away, and it has.

Networked Carbon Markets

Source: World Bank Networked Carbon Markets.

One way to stem that fading support is to buy carbon credits on the cheap and there is plenty of disreputable suppliers of cheap carbon credits. Buying dodgy carbon credits as a way of doing something on global warming without it costing more than expressive voters will pay.

One of the predictions of the adverse selection literature is that if consumers cannot differentiate good and bad goods from each other, such as with used cars, the market will contract sharply or even collapse because buyers cannot trust what is on offer. This risk of adverse selection undermining a market applies with clarity to carbon trading.

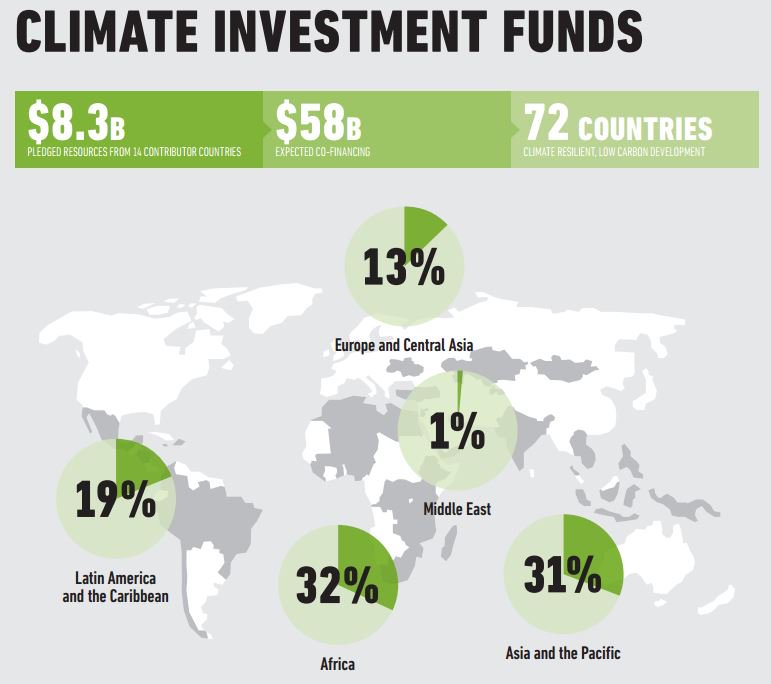

Source: How Can Your Vote Shape a Low Carbon Future? It Starts with Carbon Pricing.

The opportunity cost of expressive politics: fossil fuels disinvestment versus actually doing something that might help

17 Jun 2015 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, environmental economics, global warming, politics - Australia, politics - New Zealand, politics - USA, Public Choice, rentseeking Tags: cap and trade, carbon tax, carbon trading, climate alarmism, expressive voting, fossil fuel disinvestment, global warming, rational irrationality, Robert Stavins

The numbers behind any shift to a lower carbon economy simply don’t add up

24 Mar 2015 Leave a comment

in energy economics, environmental economics, global warming Tags: carbon trading, climate alarmism, expressive voting, global warming, Kyoto Protocol, power prices, rational ignorance, rational irrationality

It is not smart to subsidise electric cars

23 Mar 2015 Leave a comment

in energy economics, environmental economics, environmentalism, global warming, transport economics Tags: carbon credits, carbon trading, electic cars

Europe’s Climate Fail

17 Mar 2015 Leave a comment

in environmental economics, politics - USA Tags: Carbon cap, carbon tax, carbon trading, European Union

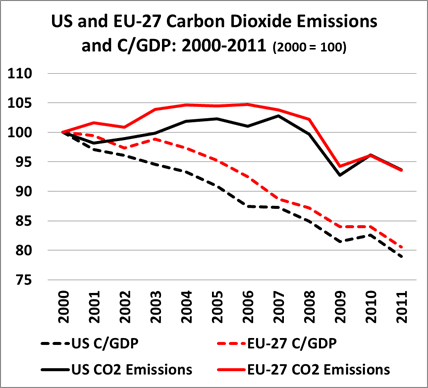

Europe’s rate of decarbonization was essentially identical before and after the ETS was introduced. If the program has effects, decarbonization has not been detectable beyond historical business-as-usual rates.

HT: http://thebreakthrough.org/index.php/voices/roger-pielke-jr/europes-climate-fail

EU’s rate of decarbonisation is identical before and after the ETS was introduced in 2000

13 Dec 2014 Leave a comment

in climate change, economics of climate change, environmental economics, global warming Tags: carbon tax, carbon trading, climate alarmism, European Union, expressive voting, global warming

Whatever impact the EU ETS has had, the US achieved similar results with no carbon market (and some might argue, with no climate policy at all. Both the US and EU reduced aggregate emissions by 6.4 percent from 2000.

Whatever impact the EU ETS has had, the US achieved similar results with no carbon market (and some might argue, with no climate policy at all. Both the US and EU reduced aggregate emissions by 6.4 percent from 2000.

Recent Comments