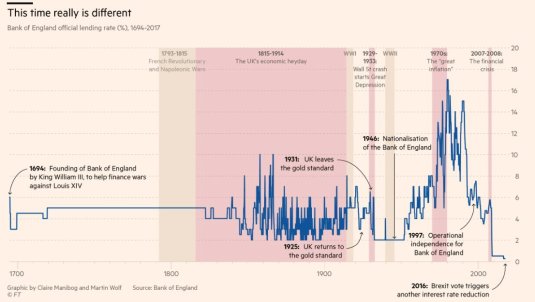

Central banks can’t raise interest rates so what chance of bankers’ cartel fixing interest rates

15 Nov 2018 Leave a comment

Antitrust economists still worry about a lack of new entry into oligopolistic industry that rarely makes a proft

15 Nov 2018 Leave a comment

in Austrian economics, economics of regulation, industrial organisation, law and economics, politics - USA, survivor principle Tags: competition law, pretence to knowledge

The EU would have sued MySpace, given time

21 Jul 2018 Leave a comment

in applied price theory, entrepreneurship, industrial organisation, law and economics, survivor principle Tags: competition law

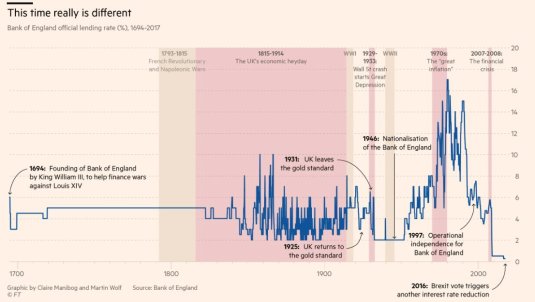

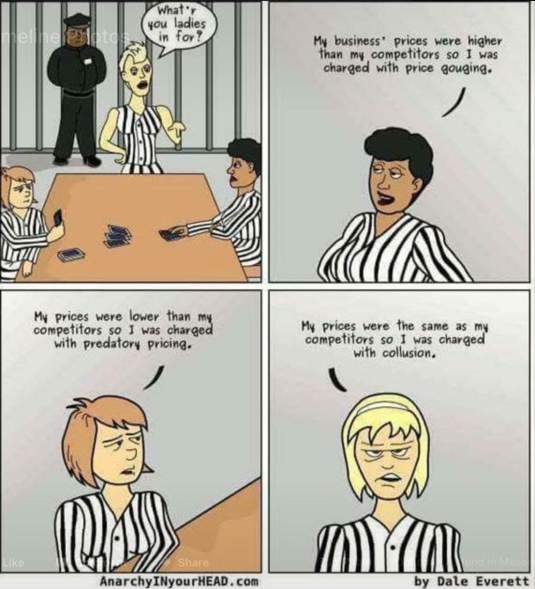

Demsetz on why anti-competitive mergers are rare

10 Jul 2018 Leave a comment

in applied price theory, economics of regulation, entrepreneurship, industrial organisation, law and economics, survivor principle Tags: competition law, Harold Demsetz

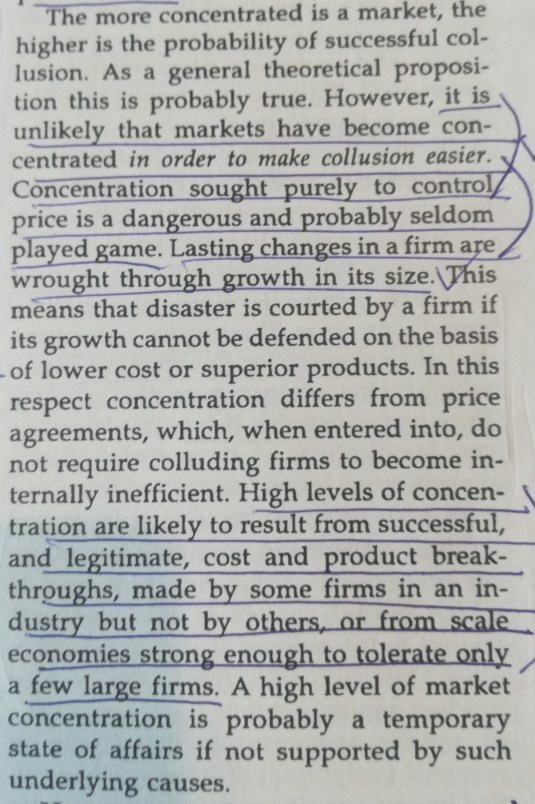

Interesting point by Richard Epstein

02 Jul 2018 Leave a comment

in applied price theory, discrimination, economic history, economics of regulation, gender, labour economics, law and economics, Public Choice, rentseeking, Richard Epstein, transport economics Tags: competition law, creative destruction, racial discrimination

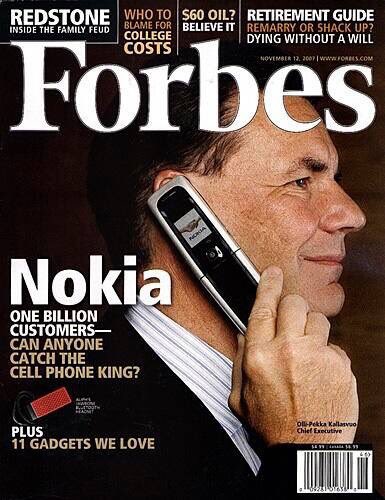

Monopolistic demons of recent yesteryear slayed by the Guardian

26 Jun 2018 Leave a comment

in economic history, industrial organisation, survivor principle Tags: competition law, creative destruction

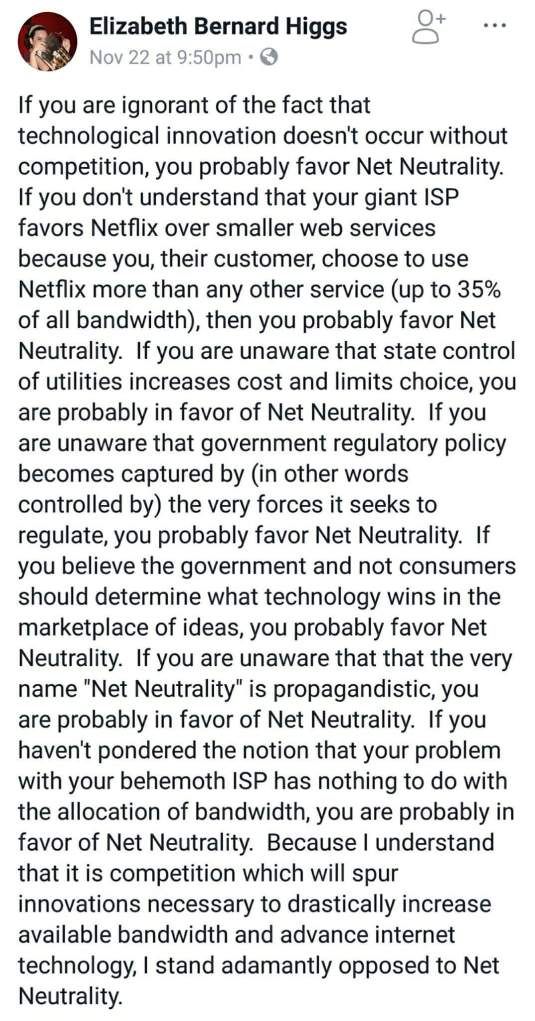

Net neutrality explained in the spirit of Schumpeter

26 May 2018 Leave a comment

in applied price theory, Austrian economics, economics of regulation, entrepreneurship, industrial organisation, Joseph Schumpeter, law and economics, property rights, Public Choice, rentseeking, survivor principle Tags: antitrust economics, competition law, creative destruction

Remember MySpace?

15 Apr 2018 Leave a comment

in entrepreneurship, industrial organisation, survivor principle Tags: competition law, creative destruction

HT Lorenzo Warby

Recent Comments