Data extracted on 25 Jan 2016 01:07 UTC (GMT) from OECD.Stat.

US, Australian and NZ all-in average personal income tax rates at average wage by family type

26 Jan 2016 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics Tags: Australia, earned income tax credit, family tax credits, family taxation, in-work tax credits, working for families

What are alternatives to the minimum wage?

30 Jun 2015 Leave a comment

in labour economics, minimum wage, poverty and inequality, public economics Tags: earned income tax credit, family tax benefits, working for families

What are alternatives to the minimum wage, and how do they effect workers and taxpayers? buff.ly/1c4BYhd http://t.co/hf67ujjvOK—

MRUniversity (@MRevUniversity) May 20, 2015

Many American families face negative affected income taxes rates

23 Jun 2015 Leave a comment

in economics of love and marriage, labour economics, politics - USA, public economics Tags: earned income tax credit, economics of families, family tax credits

US income taxes are highly progressive

19 Jun 2015 Leave a comment

in politics - USA, public economics Tags: earned income tax credit, family tax credits, progressive income taxes, tax incidence, top 1%, welfare state

In which Anglo-Saxon country is full-time work not enough to escape family poverty on the minimum wage?

07 Jun 2015 1 Comment

in labour economics, minimum wage, politics - Australia, politics - New Zealand, politics - USA, population economics, poverty and inequality, welfare reform Tags: earned income tax credit, poverty traps, single parents, taxation and the labour supply, welfare state

Figure 1: Weekly working hours needed at minimum-wage to move above a 50% relative poverty line after taxes, mandatory social or private contributions payable by workers, and family benefits for lone parent with two children, Anglo-Saxon countries, 2013

EITC is better than the Minimum Wage

15 Dec 2014 Leave a comment

in applied welfare economics, labour economics, liberalism, minimum wage, poverty and inequality Tags: earned income tax credit, family tax credits, in-work tax credits, minimum wage, negative income tax, poverty and inequality

From The Economist’s 1963 review of Capitalism and Freedom

20 Jul 2014 1 Comment

in labour economics, Milton Friedman, welfare reform Tags: capitalism and freedom, earned income tax credit, family tax credits, guaranteed minimum income, negative income tax

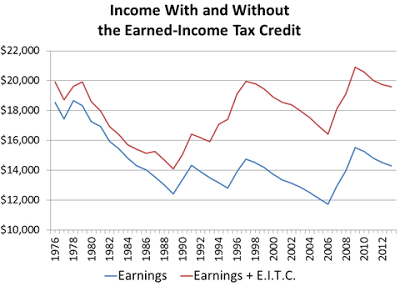

Curiously, a family tax credit or earned income tax credit is the most successful anti-poverty tool in the late 20th century. Furthermore, those on the Left are relatively convinced that the sole cause of poverty is a lack of money, and the solution is to give the poor more money.

Friedman, Hayek in the Constitution of Liberty, and George Stigler in his great paper on the minimum wage in 1946 all supported a guaranteed minimum income.

Recent Comments