Why does an industry need regulation when incidents of malfeasance are front page news that closes the offending business for good? Social media is another market discipline of quality.

Market-based assurance of quality and performance alert

12 May 2017 Leave a comment

in economics of information, industrial organisation, survivor principle Tags: competition as a discovery procedure, experience goods, The meaning of competition experience goods

#Morganfoundation discovers that #Ukraine is a dodgy place to buy credence goods

19 Apr 2016 Leave a comment

in economics of climate change, economics of crime, economics of information, environmental economics, global warming, industrial organisation, international economic law, international economics, International law, law and economics, politics - New Zealand, survivor principle Tags: adverse selection, asymmetric information, carbon trading, climate alarmism, climate alarmists, credence goods, experience goods, inspection goods

Morgan Foundation yesterday put out a report pointing out that many of the carbon credits purchased from the Ukraine under the carbon trading scheme are fraudulent.

That comes with no surprise to anyone vaguely familiar with business conditions and the level of official corruption in the former Soviet Union. Russia is a more honest place to do business.

Carbon traders who buy from the Ukraine are not buying an inspection good. An inspection good is a good whose quality you can ascertain before purchase.

They are not buying an experience good. An experience good is a good whose quality is ascertained after purchase in the course of consumption.

Source: Russia, Ukraine dodgy carbon offsets cost the climate – study | Climate Home – climate change news.

What these carbon traders in New Zealand are doing is buying credence goods from the Ukraine. The credence goods are the carbon credits, which the Morgan Foundation and others have found often to be fraudulent.

A credence good is a good whose value is difficult or impossible for the consumer to ascertain. A classic example of a credence good is motor vehicle repairs.

You must trust the seller and their advice as to how much you need to buy of a credence good. Many forms of medical treatment also require you to trust the seller as to how much you need.

Carbon credits are such a credence good. You know there is corruption in the Ukraine and many other countries that supply them. You may never know at any reasonable cost whether the specific carbon credits you buy were legitimate.

The reason why carbon credits are purchased from such an unreliable source is expressive voting. As is common with expressive politics, what matters is whether the voters cheer or boo the policy. The fact whether it works or not does not matter too much.

The Greens are upset about this corruption in carbon trading. They did not mention the corruption in international carbon trading and climate aid when they welcomed the recent Paris treaty on global warming but that is for another day.

https://twitter.com/kadhimshubber/status/721831502372302849

Co-ordinated international action on global warming is rather pointless if some of the key countries with carbon emission caps are corrupt, which they are.

As Geoff Brennan has argued, CO2 reduction actions will be limited to modest unilateral reductions of a largely token character. There are many expressive voting concerns that politicians must balance to stay in office and the environment is but one of these.

Once climate change policies start to actually become costly to swinging voters, expressive voting support for these policies will fall away, and it has.

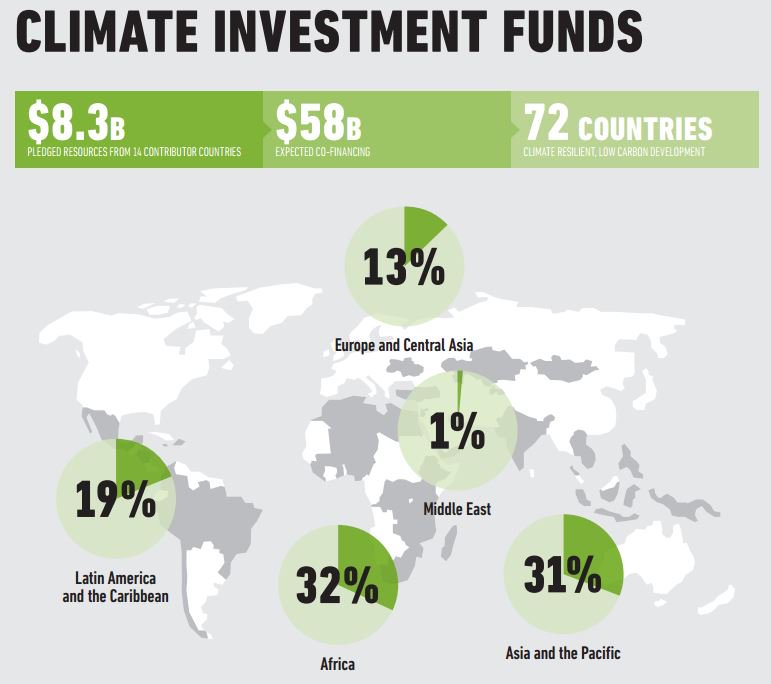

Networked Carbon Markets

Source: World Bank Networked Carbon Markets.

One way to stem that fading support is to buy carbon credits on the cheap and there is plenty of disreputable suppliers of cheap carbon credits. Buying dodgy carbon credits as a way of doing something on global warming without it costing more than expressive voters will pay.

One of the predictions of the adverse selection literature is that if consumers cannot differentiate good and bad goods from each other, such as with used cars, the market will contract sharply or even collapse because buyers cannot trust what is on offer. This risk of adverse selection undermining a market applies with clarity to carbon trading.

Source: How Can Your Vote Shape a Low Carbon Future? It Starts with Carbon Pricing.

Recent Comments