Unraveling the Mysteries of Money – Cochrane and Uhlig

01 Feb 2020 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, economics of information, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great recession, macroeconomics, monetary economics, Public Choice Tags: fiscal stimulus, monetary policy

Econ Duel: Does Fiscal Policy Work?

26 May 2019 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, macroeconomics, Public Choice, public economics Tags: fiscal stimulus

Econ Duel: Does Fiscal Policy Work?

23 Dec 2016 Leave a comment

in business cycles, fiscal policy, monetary economics Tags: fiscal stimulus

Does inflation stimulate the economy? | Robert E. Lucas

19 Oct 2016 Leave a comment

in fiscal policy, macroeconomics, monetary economics, Robert E. Lucas Tags: fiscal stimulus

Milton Friedman – Congressional House Economic Task Force (1993)

15 Oct 2016 Leave a comment

in economic history, fiscal policy, great depression, history of economic thought, macroeconomics, Milton Friedman, monetarism, monetary economics Tags: fiscal stimulus

Did Obama’s fiscal stimulus work?

30 Aug 2015 Leave a comment

in budget deficits, business cycles, fiscal policy, great recession, macroeconomics, politics - USA Tags: fiscal stimulus, obama

@sjwrenlewis The stimulus package ignored what we have learned in the last 60 years of macroeconomic research

02 Aug 2015 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, global financial crisis (GFC), great recession, history of economic thought, macroeconomics, monetarism, monetary economics Tags: Brad Delong, fiscal multiplier, fiscal stimulus, Larry Summers, New Keynesian macroeconomics, Thomas Sargent

Keynesian macroeconomic policy in a nutshell

22 May 2015 Leave a comment

in budget deficits, business cycles, fiscal policy, macroeconomics Tags: fiscal stimulus, Keynesian macroeconomic policy

Zombie lending and lower Japanese productivity growth

15 Jan 2015 Leave a comment

in economic growth, macroeconomics, politics - New Zealand, public economics Tags: fiscal stimulus, Japan, Lost Decade, Think Big

The low Japanese productivity growth throughout the 1990s could have been the result of subsidies to inefficient firms and declining industries both directly and through a banking system rolling over loans in arrears to insolvent firms.

This policy is known as zombie lending, and it lowered productivity because higher cost firms kept producing a greater share of Japanese output than would otherwise have been the case (Hayashi and Prescott 2003; Ahearne and Shinada 2005).

- Zombie firms are insolvent firms often propped up with new loans and loan rollovers from Japanese banks.

- Zombie banks are insolvent banks propped up with loans from the central bank and by lax regulatory inspections of their weak loan portfolios and lack of adequate capital.

Japan’s economic policies have until recently kept insolvent banks operating, further encouraging zombie lending, which impeded the flow of capital to the more efficient firms.

The competitive process where zombies shed workers and lose market share was thwarted. The Japanese authorities subsidised insolvent banks and firms and provided credit to some firms and not to others (Prescott 2002; Hayashi and Prescott 2002; Caballero et al. 2005; Hoshi and Kashyap 2004).

The pervasiveness and long-term persistence of zombie lending as a shock to Japanese productivity growth cannot be understated. As Kashyap noted:

The government allowed even the worst banks to continue to attract financing and support their insolvent borrowers

…By keeping these unprofitable borrowers alive, banks allowed the zombies to distort competition throughout the rest of the economy.

Caballero et al. (2008) estimated that 30 per cent of all publicly traded Japanese manufacturing, construction, real estate, retail, wholesale, and service sector firms were on life support from banks in the early 2000s, and that most large Japanese banks only complied with capital standards because regulators were lax in their inspections.

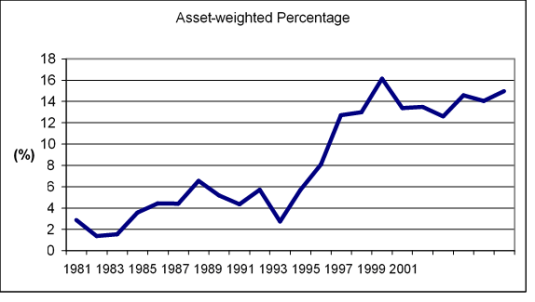

The percentage of zombies hovered between 5 and 15 per cent up until 1993 and rose sharply over the mid-1990s to exceed 25 per cent for every year after 1994 (Caballero et al. 2008).

Figure 1: Prevalence of Firms Receiving Subsidized Loans in Japan

Source: Caballero et al. (2008) Zombie Lending and Depressed Restructuring in Japan. American Economic Review.

Zombie lending is a more serious problem for Japanese non-manufacturing firms than for manufacturing firms (Caballero et al. 2008). Small and medium size firms were also major beneficiaries of zombie lending.

Zombie lending also discourages new investments that increase Japanese productivity, encourages inefficient firms to avoid making the decisions necessary to raise their profitability, and impedes the solvent Japanese banks from finding good lending opportunities (Caballero et al. 2008; Sekine et al. 2003). As Kashyap noted:

Usually when an industry is hit by a bad shock, many firms exit… In Japan, firms never exited. Given that they never exited, it is not surprising that new firms weren’t created.

Under normal conditions, higher cost firms would go bankrupt and be replaced by new and better ideas and firms. Instead, firms that were more efficient than the zombie firms tended to exit industries because their demise does not require the banks to acknowledge large bad loans. This exit of the firms of intermediate efficiency rather than the exit of the least efficient firms dragged productivity down even further (Nishimura et al. 2005; Okana and Horioka 2008). New Zealand in the 1970s and in the early 1980s also had a range of policy measures that supported high-cost firms and declining industries.

When bankrupt firms can stay in business, they retain workers who otherwise would be willing to work for lower wages at a healthy firm and depress market prices for their products. Low prices and high wages reduce the profits that more productive firms can earn which discourages entry and investment.

The creation of new jobs is a measure of industry dynamism. In manufacturing, which suffered the least from the zombie problem, job creation hardly changed from the early 1990s to the late 1990s. In contrast, there was a large decline in job creation in the non-manufacturing sectors, particularly in construction (Caballero et al. 2008; Hoshi 2006; Caballero et al. 2008).

There was less restructuring of employment and market shares in favour of the more productive firms. The gap in productivity growth between the Japanese manufacturing and non-manufacturing sectors more than doubled over the 1990s (Caballero et al. 2008).

Japanese R&D spending has also slowed down significantly since the start of the 1990s (Comin forthcoming). The gap in the rate of computer adoption between Japan and USA also increased in the 1990s. The speed of diffusion of new technologies slowed to the point that South Körea has now surpassed Japan in the diffusion of computers and the Internet (Comin forthcoming).

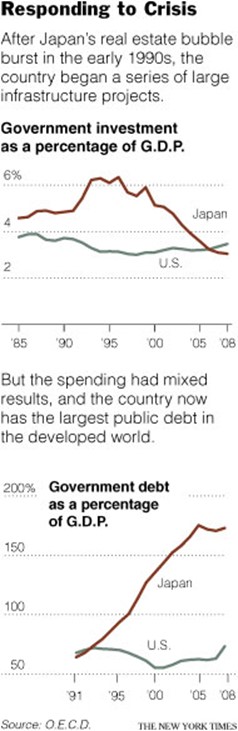

Over the 1990s, there were ten massive fiscal packages to maintain employment and investment. Much of this additional Japanese government spending was on public works and other projects whose social payoffs have been queried by independent observers. The consumption tax was increased from 3 per cent to 5 per cent in 1997. There were two rounds of temporary tax cuts – for 2 years only.

Japan pursued economic policies in response to a recession that stifled total factor productivity by providing bad incentives to the private sector.

The unproductive firms depressed Japanese productivity because they competed for labour and capital that could have been used by the more productive firms. Zombie lending allowed many firms to stay in business long after the monetary policy changes that uncovered their unprofitable petered out. The diversion of resources to these insolvent firms prevented a productivity recovery. The lack of a productivity recovery depressed wages, incomes and consumer demand.

The zombie lending and fiscal packages compounded the 1990 monetary contraction into the highly persistent shocks that were required to be able to depress Japanese productivity growth for more than a decade.

More and more resources were tied up in high cost firms and in declining industries. This was rather than be reallocated to more productive uses by the normal market processes of relative price and wage changes, free entry and profit and loss. Kashyap argues that:

The experience in Japan definitely shows that providing subsidized credit to dying firms will be costly over time. Keeping an industry from restructuring only delays the day of reckoning and raises the cost substantially

…There are many examples besides Japan where people fail to recognize that it is dangerous to keep people attached to businesses that are fundamentally unprofitable

The massive Japanese government investments have echoes of the ‘Think Big’ energy investments in New Zealand in the late 1970s.

The productivity impact of ‘Think Big’ was suspect. In addition, state-owned enterprises offering a net return of zero to the Crown in the 1980s has Japanese parallels.

The propping up of high cost state owned and private firms in the 1970s and 1980s in New Zealand helped to depress productivity growth rates. State-owned enterprises offered a net return of about zero to the taxpayer, even as recently as last year in New Zealand.

More and more resources were tied up in New Zealand in the high cost firms and declining industries than be reallocated to more productive uses by the market processes of price and wage changes, free entry and profit and loss. The lack of productivity growth depressed wages, incomes and consumer demand in New Zealand.

The productivity based explanations for the slumps in New Zealand from 1974 to 1992 and in Japan from 1990 to 2003 have a number of common threads.

Recent Comments