13 Apr 2015

by Jim Rose

in development economics, economic growth, global financial crisis (GFC), great recession, growth miracles, macroeconomics

Tags: GFC, great recession, Japan, Lost Decade

Source: Computed from OECD StatExtract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics.

Note: When the line is flat, the economy is growing at its trend growth rate. A falling line means below trend growth; a rising line means of above trend growth. Detrended with values used by Edward Prescott.

The Japanese decline after 1992 are the Lost Decades. Japan recently returned to its 3.2% trend growth rate of the 1970s and 1980s for working age Japanese.

It could be argued that Japan is now on a permanently lower growth rate that implies no further catch up with the USA.

12 Apr 2015

by Jim Rose

in business cycles, global financial crisis (GFC), great recession, macroeconomics, politics - Australia, politics - New Zealand, politics - USA, urban economics

Tags: GFC, housing prices, land supply, zoning

The housing spikes in Australia and New Zealand preceded the global financial crisis, starting in about 1999, and were largely unaffected by the GFC. Housing prices in the USA were pretty calm except in the lead up to the GFC, and took a dive with the onset of the global financial crisis and great recession.

Source: Dallas Fed; Housing prices deflated by personal consumption expenditure (PCE) deflator.

.

17 Dec 2014

by Jim Rose

in budget deficits, business cycles, economic growth, fiscal policy, global financial crisis (GFC), great depression, great recession, macroeconomics, monetarism, monetary economics

Tags: bank runs, GFC, great depression, great recession, Robert E. Lucas

01 Nov 2014

by Jim Rose

in business cycles, Euro crisis, global financial crisis (GFC), great depression, great recession, macroeconomics

Tags: financial crises, GFC

Identifying financial crises after the fact is problematic: researchers will disagree on what their characteristics were, when they started and ended, and what actually counts as a crisis. This is particularly true of crises before World War II or involving developing economies, for which accurate data are harder to come by.

So the Romers created a measure of financial distress based on real-time accounts of developed-economy conditions prepared semiannually by the Organisation for Economic Co-Operation and Development between 1967 and 2007. And to check that the OECD wasn’t for some reason off-base on conditions, they crosschecked it with central bank annual reports and articles in The Wall Street Journal.

They then scored the severity of financial conditions from zero to 15, thus avoiding quibbles over what is and isn’t a crisis and allowing for more precise readings of economic effects.

Their finding: Declines in economic output, as measured by gross domestic product and industrial production, following crises were on average moderate and often short-lived. There was a lot of variation in outcomes, so there was nothing cut and dried about how economies respond to crises…

via Romer and Romer vs. Reinhart and Rogoff – MoneyBeat – WSJ.

Romers’ work suggests the poor performance of economies around the world in the wake of the 2008 financial crisis shouldn’t be cast as inevitable. In The Current Financial Crisis: What Should We Learn From the Great Depressions of the 20th Century? de Cordoba and Kehoe note that:

Kehoe and Prescott [2007] conclude that bad government policies are responsible for causing great depressions. In particular, they hypothesize that, while different sorts of shocks can lead to ordinary business cycle downturns, overreaction by the government can prolong and deepen the downturn, turning it into a depression.

31 Oct 2014

by Jim Rose

in economic growth, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, macroeconomics

Tags: Eurosclerosis, GFC, Great Geviation, great recession

Figure 1: Actual and potential GDP in the US

Sources: Congressional Budget Office, Bureau of Economic Analysis

Figure 2: Actual and potential GDP in the Eurozone

Sources: IMF World Economic Outlook Databases, Bloomberg

HT: Larry Summers

31 Oct 2014

by Jim Rose

in fiscal policy, global financial crisis (GFC), macroeconomics, monetary economics

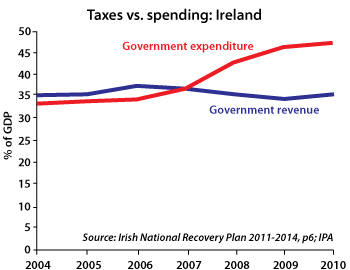

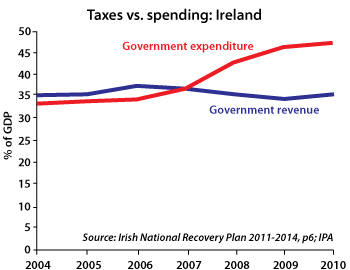

Tags: GFC, Ireland

I am planning to blog on why the Irish economic crisis of recent years was caused exclusively by government, and in particular, government responses that made an ordinary recession into a depression

Roger Kerr, New Zealand Business Roundtable Executive Director

Roger Kerr, New Zealand Business Roundtable Executive Director

This is a graph courtesy of the Institute of Public Affairs in Melbourne, an impressive Australian thinktank.

It comes from the Irish government’s own 140 page ‘National Recovery Plan‘ published last week.

It is amazing reading.

- From 2000 to 2009 average public sector salaries increased 59%

- In 2004, 34% of income earners were exempt from tax. In 2010, 45% were exempt

- In 2007 property taxes generated 6.7 billion euros. In 2010 that figure will be 1.6 billion

- In 2009 interest on government debt was 8% of tax revenues. In 2014 it will be 20%.

Naysayers try to tell you that the Celtic Tiger was a myth and that free-market policies brought the Irish economy down.

The truth is exactly the opposite. Liberalisation caused the Irish economy to surge until a return to big government crushed it. Membership of the eurozone, poor banking regulation and the government guarantee of…

View original post 34 more words

19 Oct 2014

by Jim Rose

in business cycles, fiscal policy, global financial crisis (GFC), macroeconomics, Public Choice

Tags: GFC, Ireland

Dot point 4 is the key. The bank guarantee caused the depression.

Roger Kerr, New Zealand Business Roundtable Executive Director

Roger Kerr, New Zealand Business Roundtable Executive Director

Philip Lane is Professor of International Macroeconomics at Trinity College Dublin. He is also a managing editor of the journal Economic Policy, the founder of The Irish Economy blog, and a research fellow of the Centre for Economic Policy Research. His research interests include financial globalisation, the macroeconomics of exchange rates and capital flows, macroeconomic policy design, European Monetary Union, and the Irish economy.

Last week he visited New Zealand as a guest of the Treasury, the Reserve Bank, and Victoria University. During his visit he presented this guest lecture on the troubled Irish economy, drawing on his recent report to the Irish Parliament’s finance committee on ‘Macroeconomic Policy and Effective Fiscal and Economic Governance’.

Some highlights from his talk (also reported here by Brian Fallow in the New Zealand Herald) were:

- Ireland’s is a real depression: 15% fall in GDP 2007-2010

- The Celtic Tiger 1994-2001 was no…

View original post 216 more words

Previous Older Entries

Recent Comments