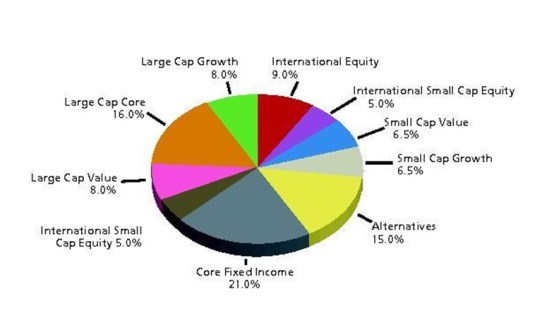

The Green Party of New Zealand wants the New Zealand superannuation fund to sell its $676 million in fossil fuel investments. For those not in the know, this government investment fund is worth about $25 billion and is funded by present taxes to pay for the universal old age pension in New Zealand. Its current investment strategy seems to rely heavily on index linked funds that minimise management and trading costs.

The Government uses the Fund to save now in order to help pay for the future cost of providing universal superannuation.

In this way the Fund helps smooth the cost of superannuation between today’s taxpayers and future generations.

In common with the endowment funds of the American universities, that $676 million is about 2% of the total New Zealand superannuation portfolio of about NZ$25 billion.

Any portfolio manager risks considerable fees if she must monitor the entire portfolio because 2% is of dubious moral stature.

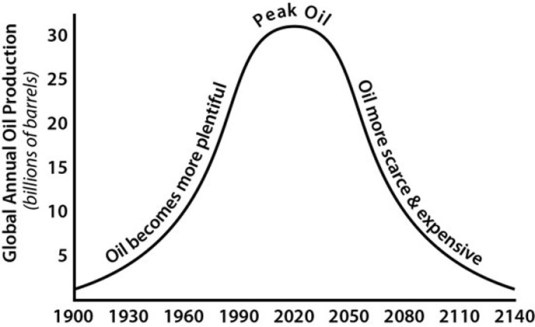

The main cost of divestiture is compliance costs to prevent fossil fuel investments drifting back into the portfolio through the routine day to day investments of other companies within their portfolios as these other firms expand into new businesses or diversified. The entire portfolio must be monitored for this risk.

American universities found that fossil fuels divestment rules out indexed linked funds as a class, along with their low management and trading fees. Ethical investors must move to actively managed investment funds which are perhaps a third more expensive in management fees.

If a move to a fossil fuel free portfolio rules out passive indexed linked funds, that is a major risk to future returns of the New Zealand superannuation fund. Would this fossil fuels disinvestment including selling the recently acquired Z petrol station network by the New Zealand superannuation fund?

Z Energy now owns and manages these businesses, which include:

- a 15.4 per cent stake in Refining NZ who runs New Zealand’s only oil refinery.

- a 25 per cent stake in Loyalty New Zealand who run Fly Buys

- over 200 service stations

- about 90 truck stops

- pipelines, terminals and bulk storage

As usual, in the course of argument for disinvestment by the government investment fund, the Green Party makes an excellent argument for the privatisation not only of state owned enterprises but of the New Zealand superannuation fund.

Rather than have one victory at a time, the Greens want the NZ superannuation fund to use the funds from the disinvestment to reinvest in pet projects of politicians. The green party co-leader said:

Money released from divestment can be reinvested in the rapidly growing renewable energy and energy efficiency sectors, helping to hasten the transition of our economy to a low-carbon future.

This makes government investment funds the playthings of politicians so they can never match the returns of a genuinely privately owned investment fund.

Recent Comments