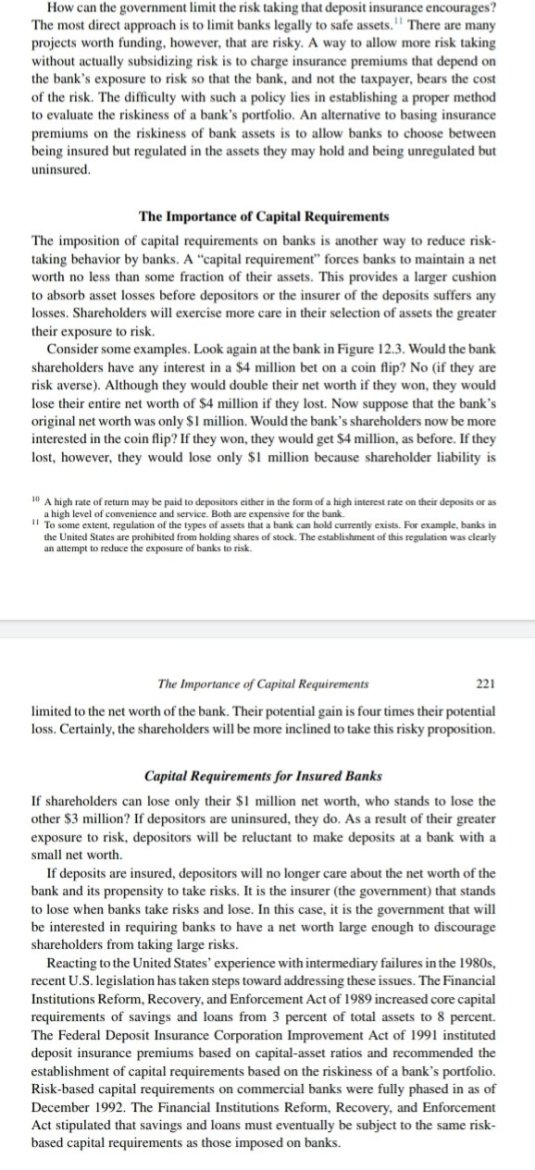

Champ and Freeman on bank capital reserves

05 Dec 2019 Leave a comment

in applied price theory, applied welfare economics, business cycles, economic history, economics of information, economics of regulation, financial economics, global financial crisis (GFC), great depression, great recession, industrial organisation, macroeconomics, monetary economics, politics - New Zealand, Public Choice, survivor principle Tags: adverse selection, agent principal problem, deposit insurance, economics of central banking, monetary policy, moral hazard, prudential regulation

The day Minsky macroeconomics died! Instability can’t be fixed so easily?

23 Nov 2019 Leave a comment

in budget deficits, business cycles, economic history, Euro crisis, financial economics, global financial crisis (GFC), great depression, great recession, macroeconomics, monetarism, monetary economics, Public Choice Tags: asymmetric information, bank runs, banking panics, deposit insurance, economics of central banking, Keynesian macroeconomics, moral hazard, Post-Keynesian macroeconomics

Tirole on the difficulties of network and utility regulation. Tradeoff between high cost, low profit firms v. low cost, high profit firms

16 Oct 2019 Leave a comment

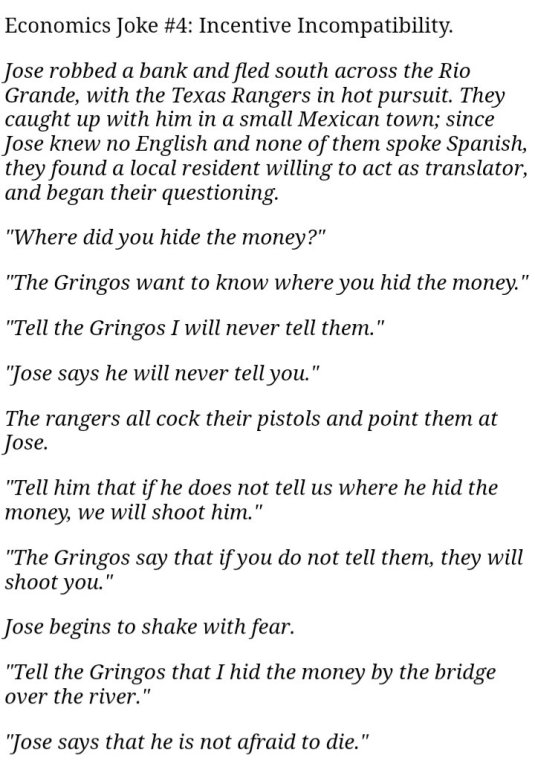

My favourite economist joke as told by David Friedman

10 Oct 2019 Leave a comment

in applied price theory, David Friedman, economics of crime, economics of information, law and economics Tags: agent principal problem, asymmetric information, moral hazard

Richard A. Posner, “The Embattled Corporation”

12 Sep 2019 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of information, economics of regulation, financial economics, industrial organisation, law and economics, managerial economics, organisational economics, property rights, Public Choice, Richard Posner, survivor principle Tags: adverse selection, moral hazard

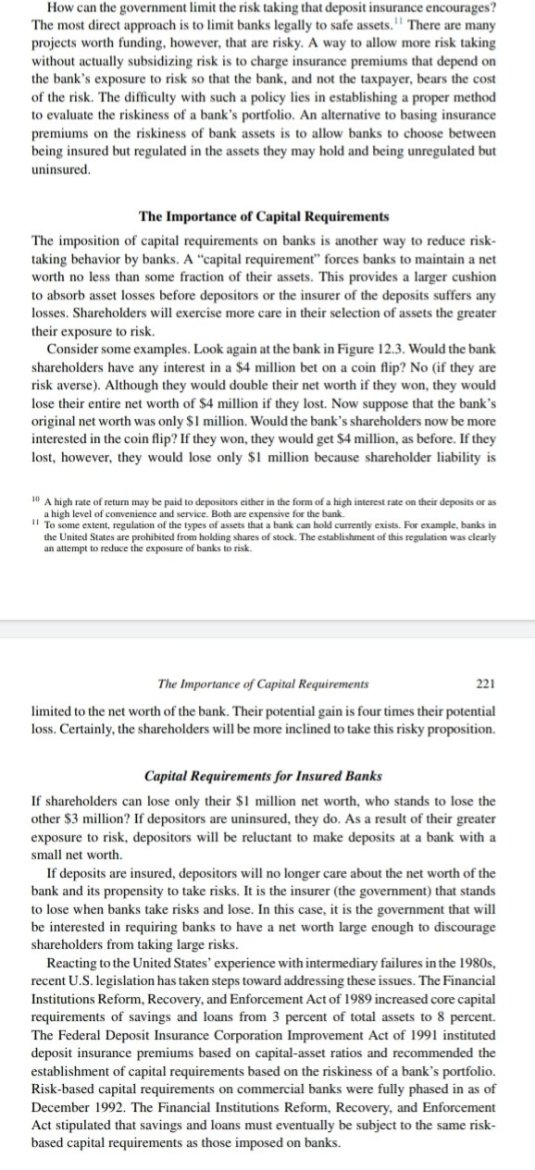

Sargent explains how deposit insurance is a pure bad that seeds banking crises

26 Jun 2019 Leave a comment

in applied price theory, financial economics, global financial crisis (GFC), macroeconomics, monetary economics Tags: deposit insurance, moral hazard

Signaling

25 Jun 2019 Leave a comment

in applied price theory, economics of information, entrepreneurship, industrial organisation, law and economics, survivor principle Tags: adverse selection, moral hazard, signaling

Joe Stiglitz was a consultant to Freddie and Fanny in 2002 on the chances of their mortgage underwriting portfolio going south

07 Jun 2019 Leave a comment

in applied price theory, business cycles, financial economics, global financial crisis (GFC), great recession, law and economics, macroeconomics, monetary economics, politics - USA Tags: moral hazard

Recent Comments