Global energy use by source

12 Apr 2016 Leave a comment

in economic history, energy economics, environmental economics, global warming Tags: coal prices, hydroelectricity, Oil prices, solar power, wind power

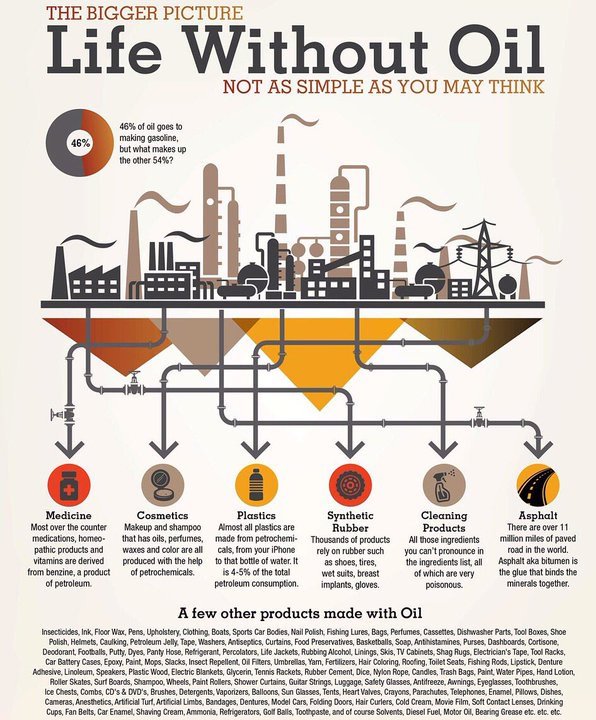

A life without oil is not so easy @GreenpeaceNZ @RusselNorman @GarethMP

08 Mar 2016 Leave a comment

in energy economics, environmental economics, global warming Tags: Oil prices, rational irrationality

HT: Mark Perry.

Oil prices were really low in the 90s

04 Mar 2016 Leave a comment

in economic history, energy economics, industrial organisation, survivor principle Tags: cartel theory, Oil prices, OPEC

Peak coal was long ago

25 Feb 2016 Leave a comment

in economic history, energy economics Tags: coal prices, Oil prices, peak oil

@OwenJones84 @K_Niemietz GDP per capita has not more than doubled @chavezcandanga

05 Feb 2016 Leave a comment

in development economics, economic history, growth disasters, growth miracles, Marxist economics Tags: Argentina, Chile, China, left-wing populism, Leftover Left, Oil prices, The Great Fact, Twitter left, Venezuela

Source: The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015, http://www.conference-board.org/data/economydatabase/

Oil prices since 1861

31 Dec 2015 Leave a comment

in economic history, energy economics Tags: Oil prices

Who controls what in Libya at the moment

13 Dec 2015 Leave a comment

in defence economics, development economics, energy economics, growth disasters Tags: Libya, Middle-East politics, Oil prices

@Greenpeace leave it in the ground campaign increases emissions @RusselNorman

06 Dec 2015 1 Comment

in economics of regulation, energy economics, environmental economics, global warming Tags: Hotelling, offsetting behaviour, Oil prices, OPEC, The fatal conceit

Matthew Kahn wrote a fascinating blog post today on the impact of climate change, regulatory risks and fossil fuels disinvestment campaigns on investment portfolios.

At the end of that post, Kahn discussed the implications of a threatened carbon tax extraction rates of fossil fuels and the level of greenhouse gases:

Suppose that Exxon is aware that there will be a rising $100 carbon tax 50 years from now. Al Gore has claimed (in a 2014 WSJ piece) that this carbon pricing will lead to “stranded assets” and Exxon shareholders will suffer greatly.

He needs to study his Hotelling no-arbitrage condition. Exxon will simply increase its extraction upfront to avoid this tax and the carbon emissions will occur earlier!

Regulatory uncertainty fostered by Greenpeace will have the same result of increasing extraction rates and carbon emissions with it because of the lower oil prices.

If Greenpeace looks like implementing any of its anti-growth, anti-poor, antidevelopment policies in a country, investors will respond by extracting as much as they can in anticipation of the regulatory crackdown.

Not long after I joined the Department of Finance from university, I remember attending a Treasury seminar that gave a property rights explanation of oil prices in the 1970s.

It was an alternative hypothesis to the OPEC cartel explanation. This was always a clumsy explanation because of the instability of cartels. Not only does OPEC not control the majority of production even in the 1970s, several members have been at war with each other and other OPEC member countries frequently in terrible financial straits with every incentive to cheat on their OPEC production quotas

Under the property rights hypothesis for oil prices, the oil companies anticipated nationalisation and pumped as much oil as they could before they were nationalised. This depressed prices prior to these nationalisations for as far back as the mid-50s. After these nationalisations, the oil companies became contractors who ran the oil fields on behalf of the national government who expropriated them.

After the nationalisation in the late 60s and early 70s, the radical change in property rights structure reduced extraction rates and with it increased oil prices in the international markets.

The oil price increases were a result of the change in control over production from the oil companies to the oil-producing countries. With these nationalisations there was a change from high rates of time preference to low rates on the part of the production decision-makers.

There was over-depletion because of insecure property rights. OPEC deserves credit for introducing long-overdue conservation policies to the benefit of generations of consumers then unborn.

The same logic applies to threats of a carbon tax. That risk encourages more depletion today so oil producers can sell at the untaxed rate. This will increase greenhouse gas emissions because oil prices will be depressed.

Policies that limit or reduce revenues in the future will induce the resource owners to bring their sales forward to the present. To quote Hans-Werner Sinn:

In my view, the Green Paradox is not simply a theoretical possibility. I believe it explains why fossil fuel prices have failed to rise since the 1980s, despite decreasing stocks of fossil fuels and the vigorous growth of the world economy.

The emergence of green policy movements around the world, rising public awareness of the climate problem, and increased calls for demand reducing policy measures, ranging from taxes and demand constraints to subsidies on green technologies, have alarmed resource owners.

In fact, while most of us perceived these developments as a breakthrough in the battle against global warming, resource owners viewed them as efforts that threatened to destroy their markets. Thus, in anticipation of the implementation of these policies, they accelerated their extraction of fossil fuels, bringing about decades of low energy prices.

New Zealand real petrol prices since 1974

06 Dec 2015 Leave a comment

in economic history, energy economics, politics - New Zealand Tags: energy poverty, Oil prices, petrol prices

Crude oil prices 1861 – 2015

07 Nov 2015 Leave a comment

in economic history, energy economics Tags: Oil prices

The wisdom of Homer Simpson: peak oil, oil pollution and the price at the pump

04 Nov 2015 Leave a comment

https://twitter.com/NZReuben/status/661793755171655680

https://twitter.com/JimRose69872629/status/661802293549887488

The number of oil spills is decreasing.

More on oil spills: OurWorldInData.org/data/environme… http://t.co/mcXEodJzYc—

Max Roser (@MaxCRoser) June 14, 2015

Recent Comments