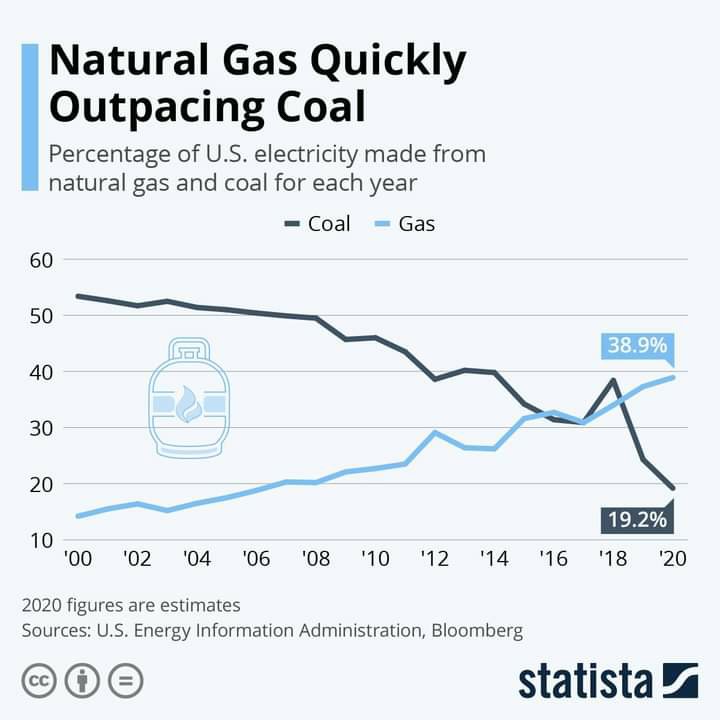

Gas is ending coal @Greens @AOC @NZGreens

21 Oct 2020 Leave a comment

in energy economics, environmental economics, global warming Tags: climate alarmists, pretence to knowledge, The fatal conceit

#COVID19

27 Apr 2020 Leave a comment

in health economics, Thomas Sowell Tags: economics of pandemics, pretence to knowledge

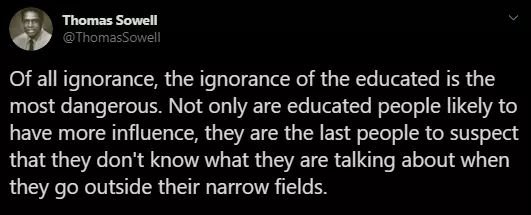

Antitrust economists still worry about a lack of new entry into oligopolistic industry that rarely makes a proft

15 Nov 2018 Leave a comment

in Austrian economics, economics of regulation, industrial organisation, law and economics, politics - USA, survivor principle Tags: competition law, pretence to knowledge

How High Would You Make the Minimum Wage? (Did @fightfor15 ever expect to win their ambit claim to double the minimum wage?)

26 Aug 2018 Leave a comment

in labour economics, minimum wage, politics - USA, unemployment Tags: pretence to knowledge, unintended consequences

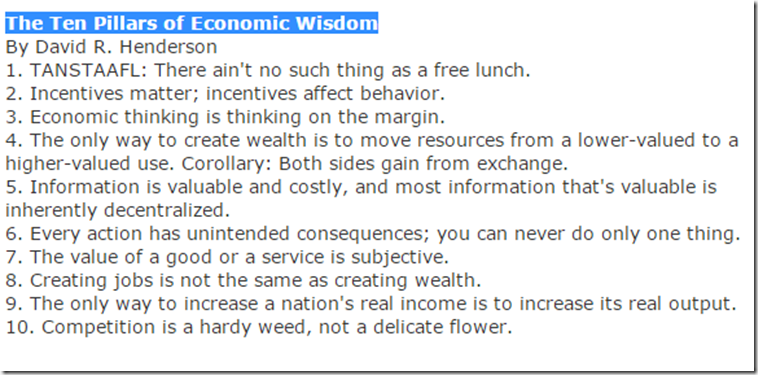

The Ten Pillars of Economic Wisdom

10 May 2015 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, constitutional political economy, development economics, economic history, economics of education, economics of information, economics of media and culture, economics of regulation, energy economics, entrepreneurship, financial economics, health economics, history of economic thought, industrial organisation, survivor principle Tags: David Anderson, evidence-based policy, offsetting behaviour, pretence to knowledge, The fatal conceit, unintended consequences

via The Ten Pillars of Economic Wisdom, David Henderson | EconLog | Library of Economics and Liberty.

Henry Hazlitt on wise bureaucrats and farsighted politicians

21 Aug 2014 Leave a comment

in applied price theory, comparative institutional analysis, entrepreneurship, liberalism, Public Choice, rentseeking, survivor principle Tags: fatal conceit, Henry Hazlitt, pretence to knowledge

The living wage

28 Apr 2014 Leave a comment

in applied welfare economics, labour economics, politics - New Zealand Tags: family tax credit, fatal conceit, living wage, pretence to knowledge

Why not just increase the family tax credit? That would increase the incomes of poor families without putting their jobs at particular greater risk.

The local calculation of the living wage includes cable TV and an overseas holiday.

Milton Friedman provides some critical truths on the living wage:

Do-Gooders believe passing a law saying nobody shall get less than [a minimum wage] is helping poor people (who need the money).

You’re doing nothing of the kind.

What you’re doing is to ensure that people whose skills do not justify that wage will be unemployed.

‘Recycling is garbage’ from the NY Times in 1996; it broke the record for hate mail | AEIdeas

22 Apr 2014 Leave a comment

in applied welfare economics, market efficiency Tags: fatal conceit, John Tierney, Mark Perry, pretence to knowledge, recycling

Mark Perry for Earth Day linked to the classic 1996 New York Times Magazine article “Recycling is Garbage” by New York Times columnist John Tierney. He wrote about those millions who suffer from “garbage guilt,” as Tierney describes the religious components of recycling.

Tierney’s argument was that recycling may be the most wasteful activity in modern America:

Rinsing out tuna cans and tying up newspapers may make you feel virtuous, but it’s a waste of time and money, a waste of human and natural resources.

You can understand why Tierney’s article set the record for the greatest amount of hate mail in New York Times history.

Institutional Economics: Robert Shiller, Ex-Ante and Ex-Post

21 Apr 2014 Leave a comment

in behavioural economics, entrepreneurship, industrial organisation, macroeconomics, market efficiency Tags: beating the market, luck versus skill, pretence to knowledge

In his 2009 book with George Ackerlof, Robert Shiller, who shared a Nobel Prize in economics for his work developing behavioural finance wrote:

there has been one way, at least in the past, in which almost everyone could become at least moderately rich

… Invest it for the long term in the stock market, where the rate of return after adjustment for inflation has been 7% per year’

Shiller’s ex-post observations on stock market returns in 2009 do not sit well with his ex-ante prediction in 1996:

long run investors should stay out of the market for the next decade.

via Institutional Economics: ‘Light Reading It’s Not’ – Forbes.

The joint advice of both the efficient market advocates such as Eugene Fama and the behavioural finance theorists on how to manage your retirement and other long-term savings are the same:

Buy and hold. Diversify. Put your money in index funds.

Pay attention to the one thing you can control–costs–and keep them as low as possible.

Index-linked or passive investment funds minimise their trading of shares and do not hire research departments so their costs and fees are far lower than investments funds that trade actively in the market trying to beat the market.

About 97% of these active funds fail to beat the market. The rest may just have been lucky.

- The average actively managed investment must underperform the indexed investment when all costs are deducted.

- The actively managed investments that beat the indexed investments this year fail to consistently beat the index in the future.

Investors can win higher returns by shouldering more risk and all that entails, and the reward for bearing risk vary over time and across assets.

Recent Comments