By Eric Pichet, here is the abstract: Despite attempts to ‘unwind’ the Impôt de Solidarité sur la Fortune (‘Solidarity Wealth Tax,’ the French wealth tax) during the last legislature (2002-2007), ISF yields had soared by 2006, jumping from €2.5 billion in 2002 to €3.6 billion. Analysis of the economic consequences of this ISF wealth tax […]

The Economic Consequences of the French Wealth Tax

The Economic Consequences of the French Wealth Tax

17 Sep 2024 Leave a comment

in applied price theory, econometerics, economic history, entrepreneurship, fiscal policy, human capital, income redistribution, labour economics, labour supply, macroeconomics, occupational choice, poverty and inequality, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

The Santa Claus Election

15 Sep 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic growth, economics of education, entrepreneurship, fiscal policy, health and safety, income redistribution, industrial organisation, labour economics, labour supply, macroeconomics, politics - USA, Public Choice, public economics, unions Tags: 2024 presidential election, taxation and entrepreneurship, taxation and investment, taxation and labour supply

For libertarians, this is a very depressing election (a feeling we tend to have every four years, so a familiar experience). What basically happens is that two politicians try to bribe us with our own money. This year, we have Kamala Harris, who was even worse than Bernie Sanders in the big-spender contest. And we […]

The Santa Claus Election

Kamala’s Proposed Increase in the Corporate Tax Rate: The Good News and Bad News

21 Aug 2024 Leave a comment

in applied price theory, entrepreneurship, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment

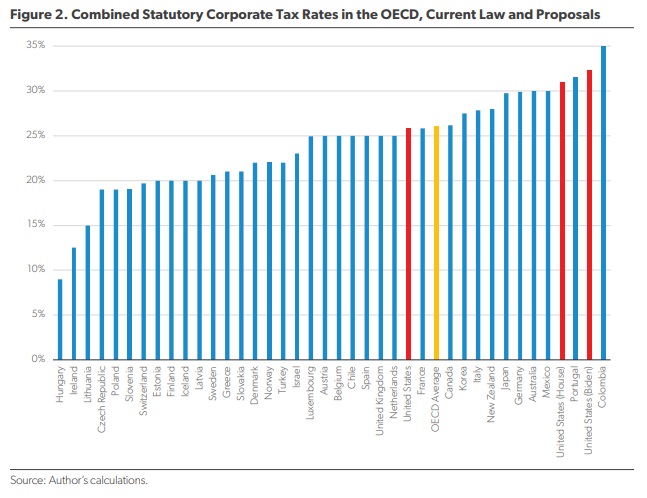

As part of her tax-and-spend agenda, Kamala Harris says she wants to increase the federal corporate tax rate from 21 percent to 28 percent. While it doesn’t seem possible, there is a tiny sliver of good news in her proposal. I’m happy that she isn’t proposing to push the rate to 35 percent, which is […]

Kamala’s Proposed Increase in the Corporate Tax Rate: The Good News and Bad News

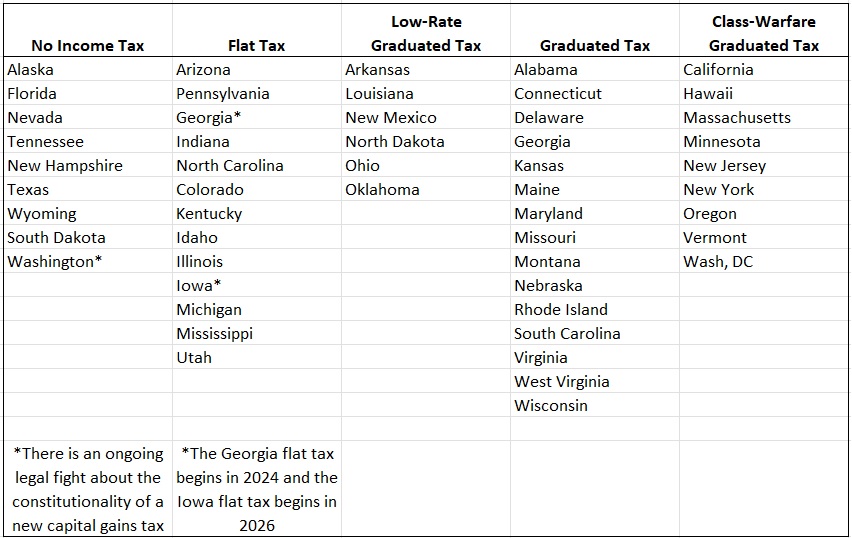

Minnesota’s Failed Class-Warfare Tax Policy

11 Aug 2024 Leave a comment

in applied price theory, applied welfare economics, economic growth, fiscal policy, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Writing about Mitt Romney’s selection of Paul Ryan in 2012, I opined that, “…it probably means nothing. I don’t think there’s been an election in my lifetime that was impacted by the second person on a presidential ticket.” I feel the same way about Tim Walz, who is Kamala Harris’ pick for Vice President. But […]

Minnesota’s Failed Class-Warfare Tax Policy

Current state of knowledge on the Trump tax cuts

25 Jul 2024 Leave a comment

in applied price theory, econometerics, economic history, fiscal policy, macroeconomics, politics - USA, public economics Tags: taxation and entrepreneurship, taxation and investment

That is the topic of my latest Bloomberg column. Here is one summary excerpt: One result: Total tangible corporate investment went up by about 11%. That has been a welcome shot in the arm for an economy that was by some measures suffering from an investment drought. The strong state of the Biden economy may, in…

Current state of knowledge on the Trump tax cuts

Will France Opt for Bernie Sanders-Style Taxation?

23 Jul 2024 Leave a comment

in applied price theory, entrepreneurship, income redistribution, Public Choice, public economics Tags: France, regressive left, taxation and entrepreneurship, taxation and investment

Some folks on the left have a deep-seated resentment of successful investors, entrepreneurs, business owners, and other high-income people. They want to hit them with confiscatory tax rates, even if the tax is so punitive that the government doesn’t wind up with more revenue. Heck, some of them are so consumed by hate and envy […]

Will France Opt for Bernie Sanders-Style Taxation?

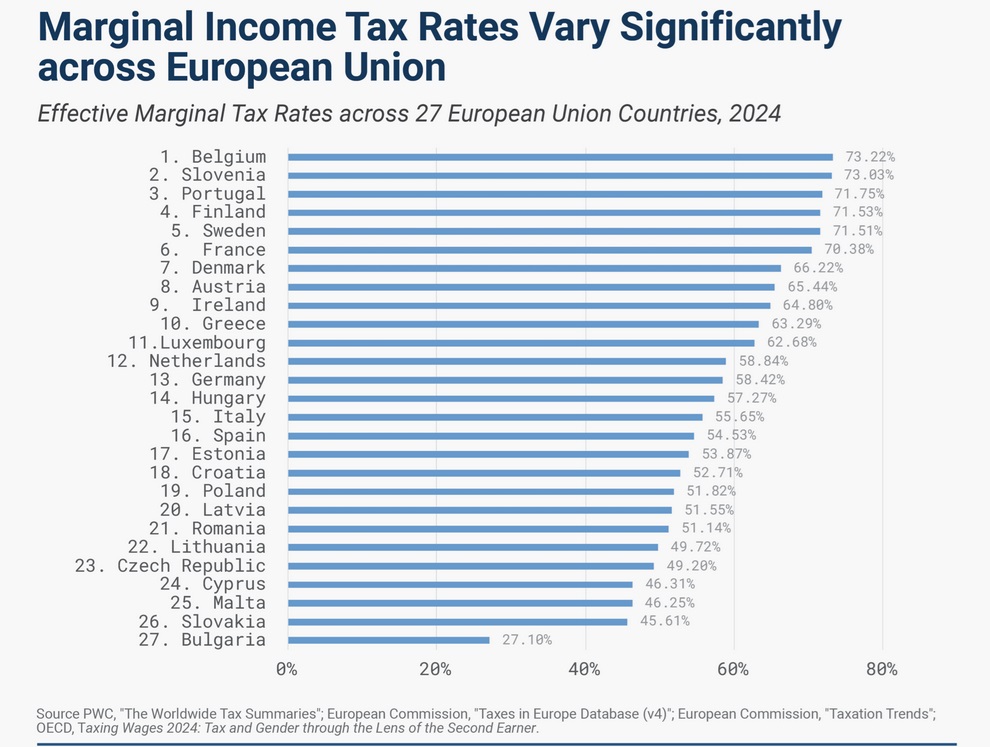

A Primer on Marginal Tax Rates, Part IV: The Combined Burden of Levies on Income, Payroll, and Consumption

02 Jun 2024 Leave a comment

in Public Choice, public economics Tags: taxation and investment, taxation and labour supply

When I think of the world’s most mistreated taxpayers, a few options come to mind. Cam Newton, the quarterback who faced a marginal tax rate of nearly 200 percent on his Super Bowl bonus. The 8,000 French households who had to surrender more than 100 percent of their income in 2012. The unfortunate Spanish laborer […]

A Primer on Marginal Tax Rates, Part IV: The Combined Burden of Levies on Income, Payroll, and Consumption

Claude 3 on why the US leads China and the EU in economic dynamism

21 May 2024 Leave a comment

in applied price theory, comparative institutional analysis, development economics, economics of regulation, entrepreneurship, growth miracles, industrial organisation, managerial economics, organisational economics, public economics, survivor principle Tags: taxation and entrepreneurship, taxation and investment

QUESTION TO CLAUDE 3: The EU and China lag behind the US in economic dynamism, measured by start-up activity, number of unicorns, age of unicorns (younger indicates more rapid innovation), and in productivity growth. Can you document this and tell me why?ANSWER: Here is the data to document the economic dynamism gap between the US,…

Claude 3 on why the US leads China and the EU in economic dynamism

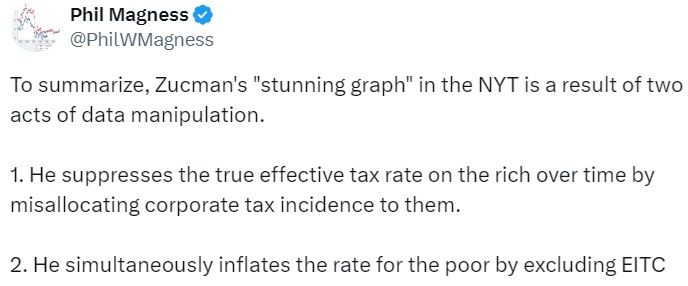

Debunking Bad Class Warfare and Debunking Nonsensical Class Warfare

19 May 2024 Leave a comment

in applied price theory, economic history, economics of education, entrepreneurship, human capital, income redistribution, industrial organisation, labour economics, labour supply, occupational choice, politics - USA, poverty and inequality, Public Choice Tags: taxation and entrepreneurship, taxation and investment

Like Thomas Piketty, Gabriel Zucman is a French economist who promotes economically destructive class-warfare tax policy. He’s also infamous for dodgy data manipulation, as Phil Magness explains in this Reason discussion. The interview lasts for 64 minutes, and I recommend the entire discussion. Yes, that’s a lot of time, but Phil has encyclopedic knowledge and […]

Debunking Bad Class Warfare and Debunking Nonsensical Class Warfare

Dishonest Pimping for a Global Wealth-Tax Cartel

07 May 2024 Leave a comment

in applied price theory, economic growth, economic history, entrepreneurship, human capital, income redistribution, industrial organisation, labour economics, labour supply, macroeconomics, Marxist economics, politics - USA, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, wealth tax

Everything you need to know about wealth taxation can be summarized in two sentences. The biggest problem with most tax systems is the pervasive tax bias against income that is saved and invested, which discourages the accumulation of capital that helps to finance future growth. Wealth taxes would dramatically increase the tax bias against saving […]

Dishonest Pimping for a Global Wealth-Tax Cartel

Eat the Rich: Warren Plan Would Impose Wealth Tax, Captivity Tax, and $100 Billion for Increasing Tax Audits

23 Mar 2024 Leave a comment

in applied price theory, applied welfare economics, economic growth, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, poverty and inequality, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

The wealth tax is back. We have previously discussed the constitutional and policy concerns surrounding the push by Democrats like Sen. Elizabeth Warren (D., Mass.) to introduce a wealth tax that would start with billionaires. It would not likely end there. The law would also apply the same type of California approach to wealthy families […]

Eat the Rich: Warren Plan Would Impose Wealth Tax, Captivity Tax, and $100 Billion for Increasing Tax Audits

Tide turning in Washington State?

07 Mar 2024 Leave a comment

in economics of crime, law and economics, liberalism, Marxist economics, politics - USA, property rights Tags: Age of Enlightenment, regressive left, taxation and investment

From an MR reader: Good story here about one man in Washington state fighting the battle against the progressive tide. He single handedly got six initiatives on the ballot to repeal progressive reforms over the past few years. These include a police pursuit law that prevents police from chasing criminals in most cases, and a […]

Tide turning in Washington State?

Florida’s One-Man Laffer Curve

16 Feb 2024 Leave a comment

in applied price theory, entrepreneurship, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Inflation is having an effect on everything, even policy analysis. Back in 2013, I wrote that Phil Mickelson was “California’s One-Man Laffer Curve” because he wanted to escape the Golden State to save about $1.2 million per year in taxes. But now, when a goose that lays golden eggs wants to escape, the numbers are […]

Florida’s One-Man Laffer Curve

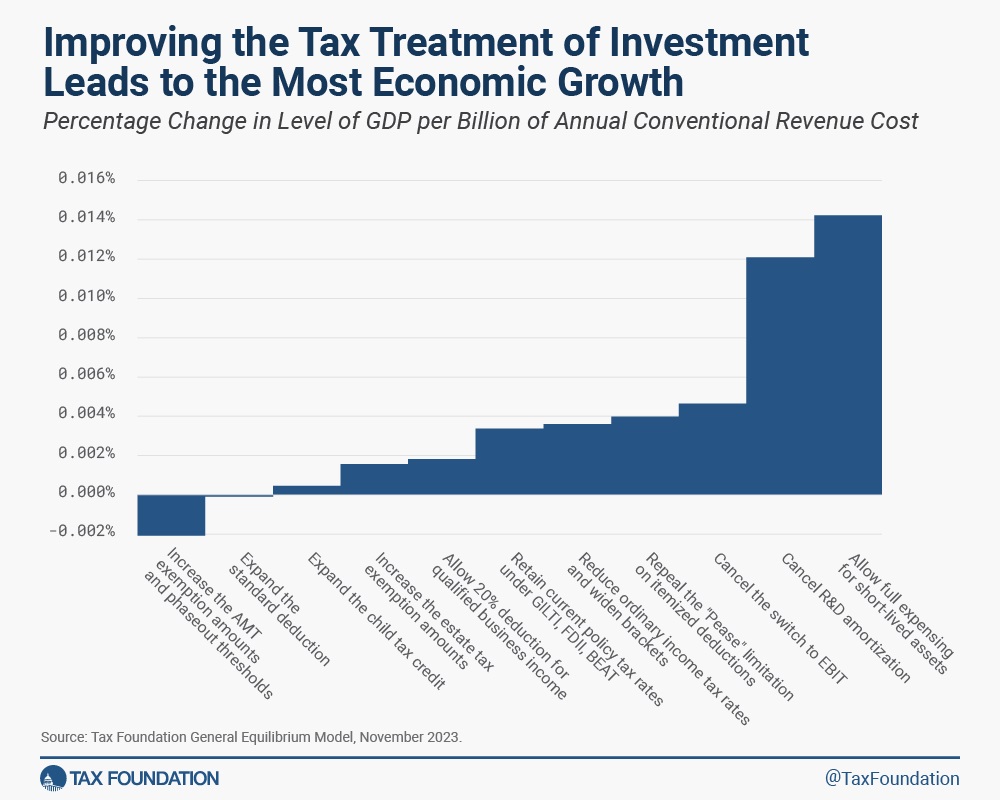

Not All Tax Cuts Are Created Equal

12 Jan 2024 Leave a comment

in applied price theory, Austrian economics, public economics Tags: taxation and investment

There are three reasons to be a knee-jerk supporter of tax cuts (or to be a knee-jerk opponent of tax increases). The morality-driven libertarian argument that people should be able to keep the income they earn. The starve-the-beast argument that less revenue at some point may translate into less spending. The economic argument that lower […]

Not All Tax Cuts Are Created Equal

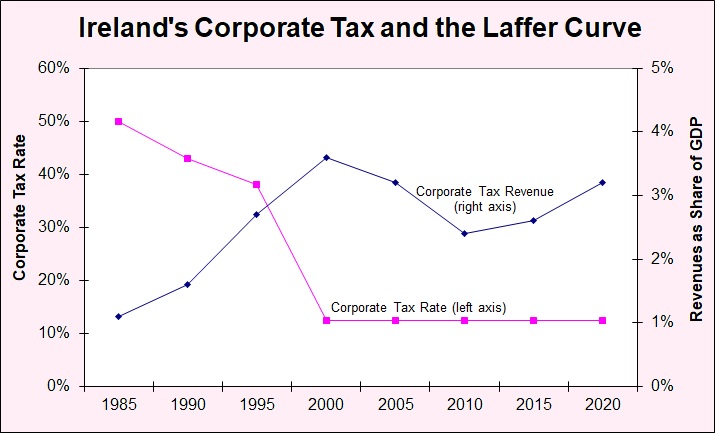

Corporate Taxation, Ireland, and Jealousy

24 Dec 2023 Leave a comment

in applied price theory, economic growth, economic history, macroeconomics, public economics Tags: Ireland, taxation and entrepreneurship, taxation and investment

Two months ago, I wrote about a remarkable example of the Laffer Curve, involving Ireland’s low 12.5 percent corporate tax rate. According to the New York Times, Ireland was collecting so much corporate tax revenue that the government was having a hard time figuring out what to do with all the money (as you might […]

Corporate Taxation, Ireland, and Jealousy

Recent Comments