The economics of low wages: When what comes down doesn’t go up econ.st/1zlP1G0 http://t.co/AujgeDIAUX—

The Economist (@EconEconomics) May 02, 2015

Unions have been on the way out for a long time

03 Jun 2015 Leave a comment

in economic history, labour economics, politics - Australia, politics - New Zealand, politics - USA, unions Tags: the withering away of the proletariat, union power, union wage premium

Many unions have exemptions from local minimum wage laws they helped pass

31 May 2015 Leave a comment

in income redistribution, labour economics, minimum wage, politics - USA, Public Choice, rentseeking, unions Tags: bootleggers and baptists, cartels, rent seeking, union power, union wage premium

The Problem With Unions

26 May 2015 Leave a comment

in labour economics, unions Tags: union membership, union power, union wage premium, voter demographics

As wages go nowhere, labor unions are increasingly making sense to American workers read.bi/1WzeXX4 http://t.co/sbxQzcuUkC—

BI Markets (@themoneygame) August 17, 2015

From a macro-level by Richard Posner:

Current union hostility to immigrant workers is consistent with the unions’ former hostility to blacks and women–which is to say, to workers willing to work for a wage below the union wage. And by raising labor costs, unions accelerate the substitution of capital for labor, further depressing the demand for labor and hence average wages. Union workers, in effect, exploit nonunion workers, as well as reducing the overall efficiency of the economy. The United Auto Workers has done its part to place the Detroit auto industry on the road to ruin.

From a micro-level by Pajamas Media:

One afternoon I was helping oversee the plant while upper management was off site. The workers brought an RV into the loading yard with a female “entertainer” who danced for them and then “entertained” them in the RV. With no other management around, I went…

View original post 4,036 more words

Trade union density, Australia, Canada, New Zealand, UK and USA, 1960–2012

25 May 2015 Leave a comment

in economic history, labour economics, politics - Australia, politics - New Zealand, politics - USA, unions Tags: Australia, British economy, Canada, trade union density, union power, union wage premium

@WJRosenbergCTU How the unions argued for the Employment Contracts Act when arguing strongly against it

25 May 2015 1 Comment

in economic growth, economic history, economics of regulation, industrial organisation, job search and matching, labour economics, unions Tags: Employment Contracts Act, employment law, employment protection laws, employment regulation, labour market deregulation, lost decades, union power

The Council of Trade Unions scored something of an own goal in the 2014 election campaign when it was denouncing the Employment Contracts Act 1991 as the reason for wages growth have not kept up with GDP per capita growth since its passage in 1991. Its evidence in chief against the deregulation of the New Zealand labour market is in the snapshot below showing their graph of real GDP per capita and average real wages from 1965 to 2014.

Source: Low Wage Economy | New Zealand Council of Trade Unions – Te Kauae Kaimahi.

The chart selected by the Council of Trade Unions shows several distinct trends in wages growth and real GDP growth per capita in New Zealand. None of these trends nor breaks in trends support the hypothesis that the days prior to the Employment Contracts Act 1991 were the good old days where workers shared generally in gains from economic growth.

From about 1970 to 1975 in the snapshot below of the Council of Trade Unions chart there was rapid real wages growth, well in excess of real growth in per capita GDP. This wages breakout was followed by some ups and downs but essentially wages in 1995 were no different from what they were in 1975. Real wages were about $24 per hour in real terms in New Zealand for about 20 years – from 1975 to 1995.

These are the good old days in the eyes of the Council of Trade Unions. No real wages growth for 20 years. There was no real GDP per capita growth from 1975 until 1979 nor in the five years leading up to the passage of the Employment Contracts Act 1991 in the chart selected by the Council of Trade Unions in the snapshot above.

The period leading up to 1975 in the preceding wages breakout was the zenith of union membership with nearly 70% of all workers belonging to a union – see figure 1. What followed from 1975 was a long declining in trade union membership that did not end until just after the Employment Contracts Act in 1991 – see figure 1.

Figure 1: Trade union densities, New Zealand, Australia, United Kingdom and United States, 1970–2013

Source: OECD StatExtract.

Whatever happened to union power in New Zealand happened before the passage of the Employment Contracts Act 1991 and with it the deregulation of the New Zealand labour market. 20 years of no real wages growth and economic stagnation may explain part of the decline of unions in New Zealand.

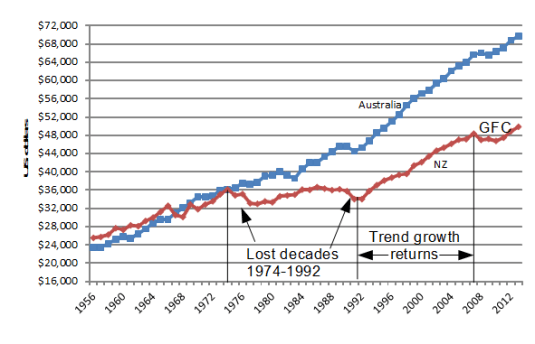

Real GDP per capita growth was pretty stagnant after 1975 to 1994 in the chart of data selected by the Council of Trade Unions, which is why I have previously referred to 1974 to 1992 as New Zealand’s Lost Decades – see figures 2 and 3.

Figure 2: Real GDP per New Zealander and Australian aged 15-64, converted to 2013 price level with updated 2005 EKS purchasing power parities, 1956-2013, $US

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

Figure 2 shows that New Zealand lost two decades of productivity growth between 1974 and 1992 after level pegging with Australia for the preceding two decades.

These lost decades of growth are the unions’ good old days but workers cannot share in the general gains of economic growth when there isn’t any economic growth as the chart selected by the Council of Trade Unions and figure 2 both show.

New Zealand returned to trend growth in real GDP per working age New Zealander between 1992 and 2007, which is straight after the passage of the Employment Contracts Act 1991 – see figure 2. Coincidence?

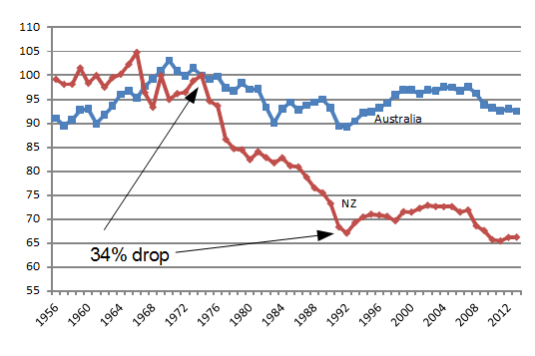

Figure 3: Real GDP per New Zealander and Australian aged 15-64, converted to 2013 price level with updated 2005 EKS purchasing power parities, 1.9 per cent detrended, base 100 = 1974, 1956-2013, $US

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

In Figure 3, a flat line equates to a 1.9% annual growth rate in real GDP per working age person; a falling line is a below trend growth rate; a rising line is an above 1.9% growth rate of real GDP per working age person. The trend growth rate of 1.9% per working age person is the 20th century trend growth rate that Edward Prescott currently estimates for the global industrial leader, which is the United States of America.

Figure 3 shows that there was a 34% drop against trend growth in real GDP per working age New Zealander between 1974 and 1992; a return to trend growth between 1992 and 2007; and a recession to 2010. this 34% drop against trend productivity growth is looked upon by the Council of Trade Unions as some sort of good old days.

A long period of no labour productivity growth and little real GDP per capita growth are pretty good reasons to rethink New Zealand’s economic policies at a fundamental level, which is exactly what happened after 1984 with the election of a Labour Government.

The unions have conveniently provided another explanation for the Lost Decades of growth in New Zealand from 1974 to 1992. That is the rapid growth of real wages ahead of real GDP per capita in the seven years before growth stalled in New Zealand in 1974 in the snapshot above. This real wages breakout was followed by two decades of lost growth.

Most ironically of all, steady growth in real wages in New Zealand did not return until after the passage of the Employment Contracts Act in 1991! After nearly 20 years of no real wages growth, real wages growth returned at long last in 1995.

After staying at about $24 per hour for 20 years from 1975 in the good old days of union power and collective bargaining, average wages in New Zealand have increased from $24 an hour to about $28 per hour by 2014 in one of the most deregulated labour markets in the world.

The Council of Trade Unions regards the return of real wages growth after a 20 year hiatus as an unwelcome development or something to complain about.

The primary school teachers union has done very well in New Zealand in recent times

12 May 2015 Leave a comment

in economics of bureaucracy, economics of education, labour economics, labour supply, occupational choice, Public Choice, rentseeking, unions Tags: public sector wage premium, union power, union wage premium

Unions have been on the way out just about everywhere since 1980

24 Apr 2015 Leave a comment

in labour economics, unions Tags: union power, union wage premium, Withering away of the proletariat

*53* years of trade #union trends: compare your country among OECD/G7 bit.ly/1rS3hOS (scroll down for Excel) http://t.co/9NHj1YV7sL—

(@OECD) April 06, 2015

The role of unions in prolonging the Great Depression

20 Apr 2015 1 Comment

in business cycles, fiscal policy, great depression, labour economics, labour supply, macroeconomics, politics - USA, unemployment, unions Tags: capital taxation, FDR, Herbert Hoover, Leftover Left, Leo Ohanian, New Deal, union power, union wage premium, unionisation

Our friends on the left at the Economic Policy Institute were good enough to remind us of the link between rapid unionisation of the US labour market in the early and mid-1930s and the petering out of the recovery from the great depression. That recession within a depression is the Roosevelt recession.

New blog on Mind The Gap: on labour #unions and income #inequality

oxfamblogs.org/mindthegap/201… http://t.co/FyrOboCaRk—

Ricardo FuentesNieva (@rivefuentes) April 17, 2015

Harold Cole and Lee Ohanian analysed in depth this double-dip depression in the USA in a paper in the Journal of Political Economy titled “New Deal Policies and the Persistence of the Great Depression: A General Equilibrium Analysis” about 10 years ago:

The recovery from the Great Depression was weak… Real gross domestic product per adult, which was 39 percent below trend at the trough of the Depression in 1933, remained 27 percent below trend in 1939. Similarly, private hours worked were 27 percent below trend in 1933 and remained 21 percent below trend in 1939.

The weak recovery is puzzling because the large negative shocks that some economists believe caused the 1929–33 downturn—including monetary shocks, productivity shocks, and banking shocks—become positive after 1933. These positive shocks should have fostered a rapid recovery, with output and employment returning to trend by the late 1930s.

The focus of the paper by Cole and Ohanian in explaining the weak recovery – the double-dip depression in the 1930s – are the New Deal cartelisation policies designed to limit competition and increase labour bargaining power through extensive unionisation of workforce.

The recovery from the depths of the Great Depression was weak but real wages in several sectors rose significantly above trend despite mass unemployment.

The view that limiting competition in product markets and the labour market was essential for economic prosperity was influential in the 1920s and 1930s. Both FDR and Hoover believed high wages were the key to prosperity.

FDR’s recipe for economic recovery from the great depression when he came to office in 1933 was raising prices and wages and the promotion of unions:

Union membership rose from about 13 percent of employment in 1935 to about 29 percent of employment in 1939, and strike activity doubled from 14 million strike days in 1936 to about 28 million in 1937.

The result of this suppression of market competition and the encouragement of unions was real wages increase despite the weak recovery:

The coincidence of high wages, low consumption, and low hours worked indicates that some factor prevented labour market clearing during the New Deal.

The combination of government interference with competition and strong unions stifled the recovery from the great depression rather than speed it up as was the plan of FDR:

New Deal labour and industrial policies did not lift the economy out of the Depression as President Roosevelt had hoped.

Instead, the joint policies of increasing labour’s bargaining power and linking collusion with paying high wages prevented a normal recovery by creating rents and an inefficient insider-outsider friction that raised wages significantly and restricted employment.

Not only did the adoption of these industrial and trade policies coincide with the persistence of depression through the late 1930s, but the subsequent abandonment of these policies coincided with the strong economic recovery of the 1940s.

U.S. unemployment fell from 22.9% in 1932 to 9.1% in 1937, a reduction of 13.8%, but was back up to 13% by 1938. The Social Security payroll tax debuted in 1937 on top of tax increases in the Revenue Act of 1935. In 1937, the economy fell into recession again. Cooley and Ohanian argue that:

The economy did not tank in 1937 because government spending declined. Increases in tax rates, particularly capital income tax rates, and the expansion of unions, were most likely responsible.

The Great Depression in the USA was unique in the fact that it was so long and the recovery, so weak:

Total hours worked per adult in 1939 remained about 21% below their 1929 level, compared to a decline of 27% in 1933… Per capita consumption did not recover at all, remaining 25% below its trend level throughout the New Deal, and per-capita non-residential investment averaged about 60% below trend.

After 1933, productivity growth was rapid, the banking system was stabilized, deflation was eliminated and there was plenty of demand stimulus as the Fed more than doubled the monetary base between 1933 and 1939. As Lee Ohanian noted:

Depressions are periods of low employment and low living standards. The normal forces of supply and demand should have reduced wages, which would have lowered business costs and increased employment and output. What prevented the normal forces of supply and demand from working?

Central to the faltering of this recovery by 1937 was the regime change when the Supreme Court finally upheld revised laws promoting unionisation:

The downturn of 1937-38 was preceded by large wage hikes that pushed wages well above their NIRA levels, following the Supreme Court’s 1937 decision that upheld the constitutionality of the National Labor Relations Act. These wage hikes led to further job loss, particularly in manufacturing.

The "recession in a depression" thus was not the result of a reversal of New Deal policies, as argued by some, but rather a deepening of New Deal polices that raised wages even further above their competitive levels, and which further prevented the normal forces of supply and demand from restoring full employment.

Lee Ohanian argues that the defining characteristic of the Great Depression was this failure of real wages to fall in the face of mass unemployment:

The defining characteristic of the Great Depression is a substantial and chronic excess supply of labour, with employment well below normal, and real wages in key industrial sectors well above normal.

Policies of Hoover and of FDR of propping up wages and encouraging unions and work sharing were the most important factors in precipitating and prolonging the Great Depression. The Great Depression was the first time U.S. wages did not fall in that you were administered a period of significant deflation.

The manufacturing sector, where unions and the threat of unionisation was much stronger which was much harder hit initially than the agricultural sector both in terms of loss of jobs and wages not falling. The Great Depression did not start as an ordinary garden variety recession, as argued by Milton Friedman. It was immediately severe and sector specific with industrial production declining by about 35% between late 1929 and the end of 1930.

This decline in industrial production occurs before any banking crises. Despite this sector specific nature of the onset that Great Depression, monetary policy might have some role in explaining the start of the Great Depression but not in its prolongation:

any monetary explanation of the Depression requires a theory of very large and very protracted monetary non-neutrality. Such a theory has been elusive because the Depression is so much larger than any other downturn, and because explaining the persistence of such a large non-neutrality requires in turn a theory for why the normal economic forces that ultimately undo monetary non-neutrality were grossly absent in this episode.

Source: A different view of the Great Depression’s cause | VOX, CEPR’s Policy Portal.

The withering away of union militancy in New Zealand

03 Apr 2015 Leave a comment

in labour economics, unions Tags: strikes, union power, union wage premium, Withering away of the proletariat

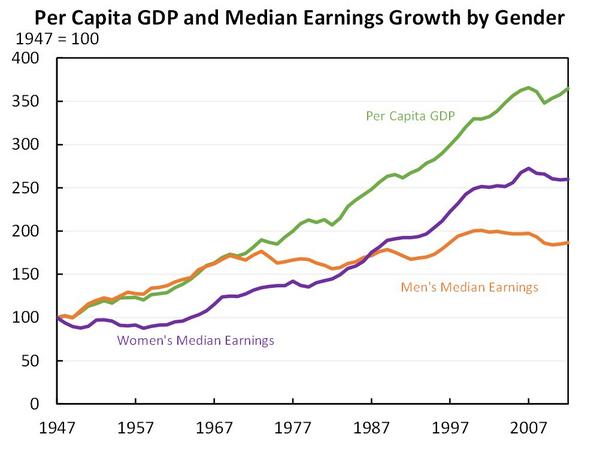

Another boy’s own analysis by the IMF of the decline of unions and inequality in recent decades

06 Mar 2015 Leave a comment

in discrimination, gender, human capital, labour economics, labour supply Tags: decline of unions, female labour force participation, gender analysis, gender wage gap, IMF, reversing gender wage gap, union power

we find strong evidence that lower unionization is associated with an increase in top income shares in advanced economies during the period 1980–2010

Gender analysis! Gender analysis! Where is the gender analysis, which is central to any analysis of inequality in and outside of the labour market!

Women have done swimmingly over the last few decades in terms of closing the gender wage gap, increasing labour force participation and overtaking men in investment in higher education.

Who's the weaker sex? Women now make up the majority of university students around the world econ.st/1x1cUli http://t.co/6YWv6SuQc4—

The Economist (@TheEconomist) March 13, 2015

As for unions and women, their record of discrimination against women as threat to the union wage premium was so appalling that even Hollywood was willing to take a swipe at unions and the hostility with which mining unions, for example, greeted the first female miners.

In spite of women’s early involvement in labour struggles, deeply ingrained prejudices against women taking a full role in the workplace were often reinforced by labour unions themselves. Women were seen as mere auxiliaries to the movement, or worse, as threats to men’s jobs.

HT: whitehouse.gov

The US teaching workforce is disproportionately unionized

03 Mar 2015 Leave a comment

in economics of education, labour economics, unions Tags: charter schools, teachers union, union power, union wage premium, which school choice

HT: Vox

Recent Comments