— EPI Chart Bot (@epichartbot) December 26, 2015

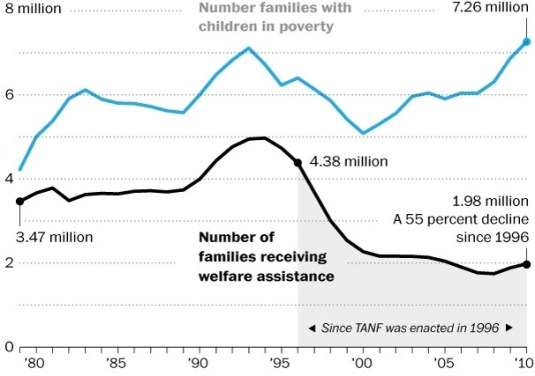

More evidence from the @economicpolicy institute of the great success of the 1996 US federal welfare reforms

17 Jan 2016 Leave a comment

in economic history, gender, labour economics, labour supply, politics - USA, welfare reform Tags: child poverty, family poverty, single mothers, single parents, US welfare reforms

Further evidence of the success of the 1996 US welfare reforms and a lack of wage stagnation

03 May 2015 1 Comment

in economic growth, economic history, labour economics, labour supply, politics - USA, welfare reform Tags: middle-class wage stagnation, top 1%, US welfare reforms, wage stagnation

http://t.co/l7NzR1byNF—

EPI Chart Bot (@epichartbot) April 27, 2015

http://t.co/VZTp2A0H8n—

EPI Chart Bot (@epichartbot) April 05, 2015

Will work-for-the-dole work in Australia?

29 Jul 2014 12 Comments

in labour economics, labour supply, macroeconomics, unemployment, welfare reform Tags: benefit exhaustion spike, search and matching, unemployment insurance, US welfare reforms, welfare reform

One of the strongest empirical findings of modern labour economics is the benefit exhaustion spike. This is the large increase, shown in the diagram, in the probability of finding a job on the eve of exhausting unemployment benefits or unemployment insurance eligibility.

This benefit exhaustion spike is mobile: when unemployment insurance eligibility is lengthened, the benefit exhaustion spike moves out to the new benefit exhaustion date. For example, from 26 weeks, then to 39 weeks, then 52 weeks and then to 99 weeks. There is also a benefit exhaustion spike where the generosity of unemployment or other insurance decreases after a certain time. The alleged decay in the human capital of the long-term unemployed does not seem to affect this benefit exhaustion spike.

In addition, in the EU, the job finding probability of unemployment insurance recipients eligible for other welfare schemes are less sensitive to changes in the level and duration of their unemployment benefits benefits.

The benefit exhaustion spike shows that job seekers have much more control over their re-employment prospects than is commonly granted even in the worst of economic conditions such as in Pittsburgh in the early 1980s in a major recession and when US manufacturing industry industry was in a long-term decline.

The individual’s reservation wage (i.e. the lowest wage wage at which individuals will accept a job offer) decreases whilst search intensity increases as they approach unemployment benefit eligibility exhaustion.

This reduction in reservation wages or the asking wages of job seekers increases the incentives for employers to post new vacancies because they can fill them at a lower cost. Both more intensive job search and more vacancies will see jobs filled faster, and more jobs created and filled.

A mechanism for reducing welfare programme entry rate while increasing welfare benefit exits is mandatory minimum job search and mandatory work requirements such as those proposed this week for Australia. These minimum hours can be spent working part time, in study and training, work preparation and job search assistance or volunteering. A work requirement is a screening device that removes any advantage of moving on to welfare in terms of more leisure time.

The proposals announced this week in Australia are most job seekers will be required to look for up to 40 jobs per month and work for the dole will be mandatory for all jobseekers younger than 50. Job seekers younger than 30 would have to work 25 hours a week under the expanded programme, while those between 30 and 49 will be asked to do 15 hours work a week, and those aged 50-60, 15 hours a week.

At least 13 OECD member countries require at least monthly visits to a local employment office by unemployment beneficiaries to present job-search evidence and also perhaps to receive advice and even referrals to specific job openings.

Reforms in a range of overseas countries that introduced more intensive monitoring of job search and stronger sanctions on benefits for non-compliance significantly reduced unemployment spells.

One of the surprising results of more intensive monitoring of job search and a requirement to sign on regularly at the local employment office or Social Security office is the sheer horror of having to sign-on and talk to caseworker for five minutes encourages 5 to 10% of unemployed beneficiaries to find a job. When unemployment and sickness beneficiaries are required to undergo a full reassessment of their eligibility, it is common for up to 30% of them simply to not reapply.

The stronger monitoring of job search and the real prospect of stiffer sanctions for non-compliance encourages all benefit claimants, current and future, and not just those actually sanctioned to search harder for jobs. This anticipation of stricter monitoring and more frequent eligibility reviews has a much larger effect of welfare dependency than the actual sanctioning of the non-complaint. People review their options and marshalled their resources to find or stay in work.

The welfare exit effect and welfare entry deterrence arises from mandatory work requirements from the relative non-financial rewards of working and not working having changed in favour of staying in full-time and semi-work for persistent workers temporarily on a welfare benefit.

Persistent workers gain from anticipating the onerous nature of work requirements and searching more intensively for jobs which are more stable and enduring. These job seekers may reduce their asking wage to win a lower paid but steadier job.

Seasonal and temporary jobs will be less attractive if there are work requirements. The incentive to cycle between the benefit and part-time and full-time work including seasonal and temporary jobs are reduce because work requirements make welfare receipt more onerous. Those job seekers with fewer outside of the workforce obligations such as young children are the most likely to move to (stable) full-time work because of work requirements.

A work requirement as a condition for a welfare benefit receive unambiguously increases net labour supply and reduces the number of people relying on the welfare system now and into the future.

The number of people working increase and some leave welfare rather than comply with the mandatory work programmes. Work requirements make welfare receipt unambiguously less attractive and will close the gap between earning full-time wages and the net rewards of not working or part-time work and partial benefit receipt.

There was a more than 60% reduction in welfare caseloads after the 1996 federal welfare reform in the USA that introduced work requirement and five year lifetime federal welfare eligibility time limits on a national basis. In the four decades preceding the 1996 welfare reform, the number of Americans on welfare had never significantly decreased.

The gains in U.S. employment after the 1996 Federal welfare reform were largest among the single mothers previously thought to be most disadvantaged: young (ages 18-29), mothers with children aged under seven, high school drop-outs, and black and Hispanic mothers. These low-skilled single mothers in the USA were thought to face the greatest barriers to employment.

The U.S. literature has many competing estimates of the relative effects of work requirements, lifetime time limits and a far more generous earned income tax credit (EITC). It is agreed that work requirements and time limits reduced entry into welfare caseloads. The relative importance of time limits, work mandates and greater EITC generosity for exits is more disputed.

The Minnesota Family Investment Program (MFIP) had a more complex experimental design that allowed separate evaluation of the mandatory welfare-to-work program and the lower benefit reduction rate. The results indicated that the lower benefit abatement rates appear to have had little labour supply effect. The increase in labour supply seems to have come almost entirely from the mandatory welfare-to-work program and its associated sanctions.

Much was initially made in the US empirical literature of the strong state of the American economy in the 1990s as an explanation for part of the drop in welfare caseloads. The relevance of this faded when welfare caseloads did not increase again when the economy deteriorated after 2007 in the USA.

Recent Comments