The unambiguously favourable labour supply effects of work requirements are often contrasted with the ambiguous results of changes in benefit abatement regimes.

The twist is work requirements need to be accompanied by a categorisation of the welfare population into those who can work and those who cannot work. The latter do need welfare support because they are unable to earn a wage in the labour market or have carer responsibilities such as for pre-schoolers.

There is already a large population on other welfare benefits with short and long-term barriers to work because of sickness or invalidity classifications.

The favourable labour supply effects of work requirements depend on an ability to adequately categorise the welfare population into different groups. The large differences between otherwise comparable countries in the number on sickness and disability benefits suggest that this classification and sorting process is knowledge intensive and error prone.

The original support for negative income taxes from Friedman (1962) and Stigler (1946) was born of the notion that welfare bureaucracies are unable to adequately screen, categorise and tag welfare claimants by their capacity to work and diligent job search in a dynamic world with dispersed knowledge and moral hazard.

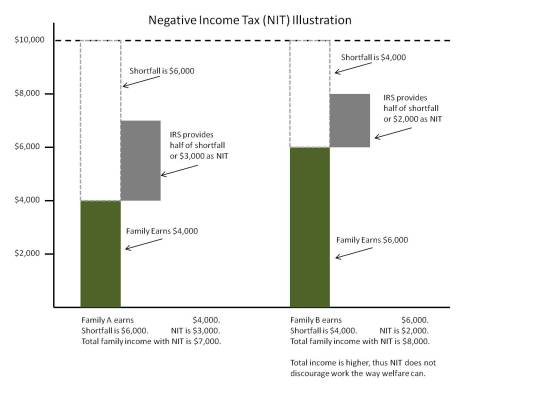

Negative income taxes were proposed as an administratively simple welfare reform to give adequate income support to the low paid, out of work and unable to work, while still providing reasonable work incentives for the low paid. The negative income tax was originally intended to replace existing welfare benefits for families at least.

The modern incarnations of negative income taxes manifest as in-work tax credits that supplement welfare benefits and reduce poverty among the working poor.

The ambiguous effect of negative income taxes on the net labour supply among the low-paid was acknowledged at the outset, and was borne out in experimental trials and experience with in-work tax credits.

The existing system of domestic purpose, unemployment, sickness and invalid benefits are all examples of screening, categorising and tagging of welfare claimants with varying degrees of success.

The tagging is based on relatively coarse screening devices such as job loss, sole parenthood and medical grounds.

Akerlof (1978) noted that the truly needy—those with low job skills who have extreme difficulty in becoming employed—can be partly identified by some measurable, observable characteristic, which he called tagging the poor. Some combination of indications of poor health, low levels of education and spotty employment histories might be indicators of low job skills.

If the government moves from a negative income tax, in which all those with income are paid benefits regardless of their characteristics, to a tagged system in which only the subset who have the particular set of characteristics indicating that they are needy are paid benefits, then higher benefits could be paid to the tagged individuals without changing total expenditure.

Depending on whether the welfare tag is job loss, sole parenthood, sickness or invalidity, different abatement regimes, benefit levels and work tests apply. ACC is another example of tagging with the screening based on accidental injury.

Most welfare systems tag Akerlof partly with family structure in mind as a characteristic, with benefits heavily concentrated on families with a single parent.

Family tax credits are based on tagging through the number of hours worked and the number of children that are dependent upon the wage earner.

Nichols and Zeckhauser (1982) argued that the imposition of “ordeals” on welfare recipients, of which work requirements were one example, but onerous application procedures and participation requirements are others, could serve to deter entry of the able-bodied.

The experience with tagging to date suggest that it’s not particularly accurate. social insurance systems for injury and illness have significant issues with moral hazard.

For example, before 15 July 1980, an employee injured in a workplace accident in Kentucky received compensations proportional to his or her wage with an upper limit of $131 per week.

On 15 July 1980, this limit was raised to $217 per week. The better paid wage-earners were substantially better compensated for accidents that occurred after that date.

The periods of convalescence of these better-paid workers grew 20 per cent longer. For accidents that occurred before 15 July, these employees had been off work for an average of 4.3 weeks; for accidents after 15 July caused the same employees to stay home for an average of 5.2 weeks.

The average convalescence period for injured workers who were less well paid was unaffected by the rise in the upper limit stayed the same before and after 15 July. It is absurd to suggest that workplace accidents had suddenly become more serious for these better-paid workers and only for them after 15 July 1980.

In the past three decades, the number of people who are on disability benefit has skyrocketed but incidence of disabling health conditions among the working age population is not rising. Autor (2006) found that disability rolls in the USA expanded because:

- congressional reforms to disability screening in 1984 that enabled workers with low mortality disorders such as back pain, arthritis and mental illness to more readily qualify for benefits;

- a rise in the after-tax income replacement rate, which strengthened the incentives for lower-skilled workers to seek benefits; and

- a rapid increase in female labour force participation that expanded the pool of insured workers.

Autor found that the aging of the baby boom generation has contributed little to the growth of disability benefit numbers to date.

David Autor and Mark Duggan (2003) found that low-skills and a poor education is predictor of disability: in the USA in 2004, nearly one in five male high school dropouts between ages 55 and 64 were in the disability program; that was more than double that of high school graduates of the same age and more than five times higher than the 3.7 % of college graduates of that age who collect disability. Unemployment is another driver of disability.

The only major success in reducing beneficiary numbers anywhere has been time limits in the USA in 1996. Time limits on welfare for single parents reduced caseloads by two thirds, 90% in some states.

The subsequent declines in welfare participation rates and gains in employment were largest among the single mothers previously thought to be most disadvantaged: young (ages 18-29), mothers with children aged under seven, high school drop-outs, and black and Hispanic mothers. These low-skilled single mothers were thought to face the greatest barriers to employment. Blank (2002) found that

nobody of any political persuasion predicted or would have believed possible the magnitude of change that occurred in the behaviour of low-income single-parent families.

Rebecca Blank is the field leader on the economics of welfare reform and got as high as Acting Secretary of the Department of Commerce for Obama.

Employment are never married mothers increased by 50% after the US reforms: employment a single mothers with less than a high school education increased by two thirds: employment of single mothers aged of 18 in 24 approximately doubled.

With the enactment of welfare reform in 1996, black child poverty fell by more than a quarter to 30% in 2001. Over a six-year period after welfare reform, 1.2 million black children were lifted out of poverty. In 2001, despite a recession, the poverty rate for black children was at the lowest point in national history.

This great success of US welfare reforms was that after decades of no progress, poverty among single mothers and among black children declined dramatically.

The best solution to poverty is to move people into a job. Simon Chapple is also quite clear in his mid-year book with Jonathan Boston that a sole parent in full-time work, and a two parent family with one earner with one full-time and one part-time worker, even at low wages, will earn enough to lift their children above most poverty thresholds. Welfare benefits trap children in poverty.

The best available analysis, the most credible analysis, the most independent analysis in New Zealand or anywhere else in the world that having a job and marrying the father of your child is the secret to the leaving poverty is recently by the Living Wage movement in New Zealand.

According to the calculations of the Living Wage movement, earning only $18.80 per hour with a second earner working only 20 hours affords their two children, including a teenager, Sky TV, pets, international travel, video games and 10 hours childcare.

This analysis of the Living Wage movement shows that finishing school so your job pays something reasonable and marrying the father of your child affords a comfortable family life.

Blogs so far:

part-one-the-labour-leisure-trade-off-and-the-rewards-for-working

part-two-the-labour-supply-effects-of-welfare-benefit-abatement-rate-changes

part-3-abatement-free-income-thresholds-and-labour-supply

part-4-in-work-tax-credits-and-labour-supply

part-5-higher-abatement-rates-and-labour-supply

Recent Comments