Income taxes in the USA and UK didn’t change all that much after the mid-70s. Prior to that, income tax rose quite steadily in the UK in the 1950s and 1960s and not surprisingly, Britain was the sick man of Europe in the 1970s. Income taxes rose quite steadily in Canada for most of the post-war period up until 1990 and then levelled out for most of that decade before a small tapered downwards.

Source: Cara McDaniel.

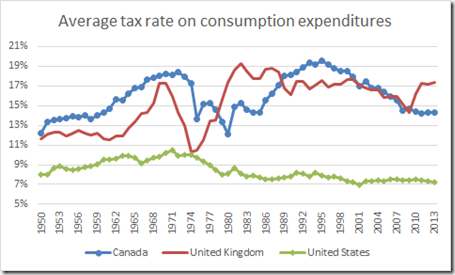

Taxes on consumption expenditure were very different stories across the Atlantic. There has been a tapering down in the average tax rate on American consumption expenditure since 1970 after modest increases before that. Canadian taxes on consumption expenditure rose steadily until the 1970s, then drop steadily in the 1970s and than rose in the 1980s and dropped again after 1992. British taxes on consumption expenditure rose sharply in the late 1960s, dropped sharply and then rose again in the 1970s and was pretty steady after that.

The sleeper tax in all three countries was payroll taxes to fund social security and the welfare state. These rose steadily in the USA, UK and Canada up until the 1990s.

Source: Cara McDaniel.

Despite all that nonsense about neoliberalism from the Left over Left, the average rate of tax on capital income did not appear to change much at all over the last 50 years. There was a modest taper in US capital income taxation from the mid-30s to the mid-20s over the entire post-war period. The average Canadian tax rate on income from capital rose steadily in the 60s, fell steadily in the 70s before rising again in the mid-1980s and fell again after 2000. The average British tax rate on capital income rose steadily in the 60s and 70s, coinciding with the emergence of Britain as a sick man of Europe, and then stabilised in the the 1980s onwards but with a dip in the late 80s before a rise in the early 1990s.. Despite the large cuts in the statutory corporate tax rate in the UK, there was only a mild taper in the average tax rate on capital income in the UK.

Source: Cara McDaniel.

The average tax rate on investment expenditures is pretty stable in the USA for the entire post-war period. The only significant increase in the average tax rate on investment expenditures in the UK coincided with the emergence of the sick man in Europe after a drop in the early 70s. The average tax rate on investment expenditures do not change at all in the UK after the 1970s. The Canadian average tax rate on investment expenditures is higher than elsewhere. It rose steadily in the 50s and 60s, dropped in the 70s and rose again in the 80s before tapering from 1992 onwards.

Source: Cara McDaniel.

These higher on rising taxes and the UK and Canada did nothing for either country in catching up with the USA. The figure 1 below shows real GDP per working age per American, Canadian and British.

Figure 1: Real GDP per Canadian, British and American aged 15-64, converted to 2013 price level, updated 2005 EKS purchasing power parities, 1950-2013

Source: Computed from OECD StatExtract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

The USA is pulling away from Canada and the UK in GDP per working age person. The exception is British economy from about 1990 onwards which caught up with Canada.

Figure 2, which is detrended GDP data, illustrates the British economic boom in the 1990s. Each country’s annual economic growth rate is detrended by 1.9%, the detrending value currently used by Ed Prescott. A flat line is growth at 1.9%, a rising line is above trend growth, a falling line is below trend growth.

Figure 2: Real GDP per Canadian, British and American aged 15-64, converted to 2013 price level, updated 2005 EKS purchasing power parities, detrended 1.9%, 1950-2013

Source: Computed from OECD Stat Extract and The Conference Board, Total Database, January 2014, http://www.conference-board.org/economics

Figure 2 shows that Canada has been in a long-term decline since the mid-1980s with much of this decline coinciding with periods of rising taxes on income from labour.

The British economy boomed in the 1990s, after the tax hikes of the 1970s and early 80s were reversed. This growth dividend was squandered by the Blair government in the 2000.

Figure 2 also shows that US growth was rather stable with some ups and downs up until 2007, expect during the productivity slowdown in the 1970s. The first major departure from trend growth of 1.9% was with the onset of the great recession.

Dec 09, 2016 @ 16:16:29

So what this all says, essentially, is that the big tax difference between these countries is the tax on capital investment as equity. But this doesn’t account for the de-trended GDP data, which is the most interesting graph. So why is GDP per capita decreasing steadily in Canada?

LikeLike

Dec 09, 2016 @ 17:39:10

Canada has been in long-term decline

LikeLike

Dec 10, 2016 @ 04:17:12

Yes, that is what the data says, but WHY? Is the GDP measure no longer correct in a digital economy? Or are we producing less costly goods? or are we getting lazy?

LikeLike

Dec 10, 2016 @ 10:47:11

If digital economy, decline would be common to many economies. Aghion estimates US measurement error due to digital economy is 0.5%

LikeLike

Dec 10, 2016 @ 13:44:04

OK. Even- 0.5% compounds; but leaving that, there are still at least 2 explanations left. Care to rebut those?

LikeLike