I have updated my 2014 report on corporate welfare for the 2015 budget. My report was published today by the Taxpayers’ Union.

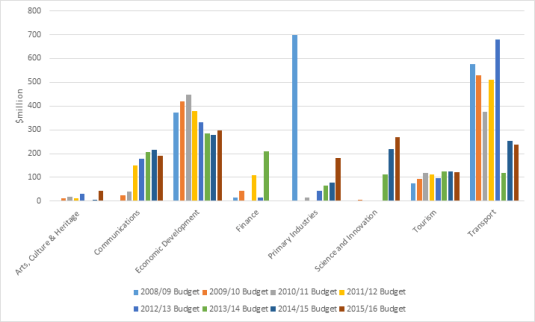

My key finding was that corporate welfare increased in the 7th budget of the National Party-led Government from $1.178 billion in its 2014 budget to $1.344 billion in the 2015 budget – see figure 1 and table 1.

Figure 1: Corporate welfare, Budgets 2008/09 to 2015/16

Source: New Zealand budget papers, various years.

Table 1: Corporate welfare in Budgets 2008/09 to 2015/16, $million

| 08/09 | 09/10 | 10/11 | 11/12 | 12/13 | 13/14 | 14/15 | 15/16 | |

| Arts, Culture & Heritage |

3 |

11 |

19 |

10 |

29 |

4 |

4 |

42 |

| Commerce and Consumer Affairs |

6 |

6 |

6 |

6 |

7 |

7 |

6 |

7 |

| Communications |

0 |

25 |

39 |

150 |

178 |

205 |

215 |

190 |

| Economic Development |

372 |

419 |

446 |

379 |

332 |

284 |

280 |

297 |

| Finance |

16 |

44 |

3 |

108 |

15 |

210 |

0 |

0 |

| Primary Industries |

700 |

0.3 |

14 |

0.0 |

43 |

65 |

77 |

180 |

| Science and Innovation |

0 |

4 |

0 |

0 |

0 |

112 |

219 |

269 |

| Tourism |

76 |

94 |

119 |

113 |

98 |

124 |

124 |

121 |

| Transport |

578 |

530 |

376 |

510 |

680 |

119 |

255 |

239 |

| Total $million |

1,751 |

1,134 |

1,022 |

1,277 |

1,382 |

1,130 |

1,178 |

1,344 |

Source: New Zealand budget papers, various years.

Corporate welfare has ranged between about $1 billion and $1.4 billion per year in each of the seven budgets presented by the current National-led Government – see Table 1 and Figures 1 and 2.

Figure 2: Corporate welfare, Budgets 08/09 to 15/16 by Vote

Source: New Zealand budget papers, various years; note: Vote Commerce and Consumer Affairs omitted in all years from Figure 2.

The predominant recipient of corporate welfare in this year’s budget, and all of those since 2008 is KiwiRail. Vote Transport accounts for a third of all corporate welfare – see Figures 3 and 4. Vote Economic Development is the next largest source of corporate welfare and accounts for 28% of the total since 2008 – see Figures 3 and 4.

Figure 3: Distribution of total corporate welfare across votes, 2008/09 to 2015/16

Source: New Zealand budget papers, various years.

Figure 4: State-owned enterprise welfare, Vote Transport and Vote Finance (KiwiRail), Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

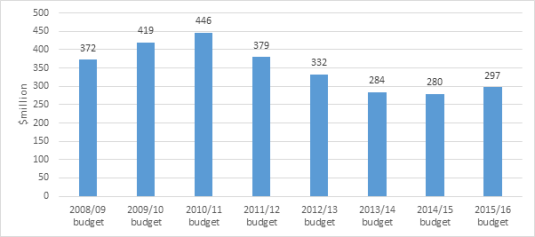

$280 – $450 million in corporate welfare has been under the patronage of the Minister for Economic Development over the last eight budgets – see Figure 5. In this year’s budget, corporate welfare under the Minister’s hand has increased slightly from $280 million to $297 million.

Figure 5: Corporate welfare, Vote Economic Development, Budgets 2008/09 to 2015/16

Source: New Zealand budget papers, various years.

Up until the 2013/14 budget, science and innovation spending was targeted at research that would not find private sponsors because it could not capture the returns from their discoveries – see Figure 6. Figure 6 shows that there is being rapid growth within Vote Science and Innovation of various forms of start-up and commercialisation grants in recent budgets.

Figure 6: Corporate welfare, Vote Science and Innovation, Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

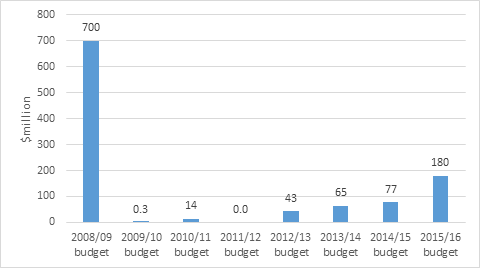

Figure 7 shows that the Government is getting back into the business of subsidising agriculture. The Primary Growth Partnership (PGP) is an R&D grants programme for the primary industry sector. There are 18 PGP programmes underway with a funding commitment from government and from industry combining to $708 million by 2017.

Figure 7: Farm welfare, Vote Primary Industries, Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

Figure 8 shows that the National Party-led government is a major investor in ultrafast broadband – going where private entrepreneurs fear to tread.

Figure 8: Corporate welfare, Vote Communications, Budgets 08/09 to 15/16

Source: New Zealand budget papers, various years.

The corporate welfare in the Budget 2015 adds about six percentage points to the company tax rate. Should these corporate indulgences should continue or should the company tax rate drop six percentage points?

If that six percentage points on top of the company tax rate was renamed a business subsidies levy, how many businesses would want to pay it rather than developing their own business under much lower company tax rate?

Jun 09, 2015 @ 08:46:56

Excellent work. Hope it gets a good dose of publicity. Nice conclusion too.

LikeLiked by 1 person

Jun 09, 2015 @ 09:32:57

Thanks, and thanks for plug at Kiwiblog. Some delay in going live at Taxpayers Union.

LikeLike