Bjorn Lomborg: How to fix global warming smartly

08 Apr 2016 Leave a comment

in applied price theory, applied welfare economics, climate change, economics of regulation, environmental economics, global warming

@BernieSanders @realdonaldtrump want to reverse The Great Escape in developing countries

07 Apr 2016 Leave a comment

in applied welfare economics, development economics, economic history, growth disasters, growth miracles, industrial organisation, international economics, politics - USA, Public Choice, rentseeking, survivor principle Tags: absolute poverty, extreme poverty, tariffs, The Great Escape, trade agreements, trade liberalisation

Source: TRANSCRIPT: Bernie Sanders meets with News Editorial Board – NY Daily News.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/3854986/UN-report-poverty.0.png)

Source: If you’re poor in another country, this is the scariest thing Bernie Sanders has said – Vox.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/6104377/Screen%20Shot%202016-02-25%20at%2011.48.27%20AM.png)

Source: If you’re poor in another country, this is the scariest thing Bernie Sanders has said – Vox.

.

@garethmorgannz’s @grantrobertson1’s #UBI is worse than I thought @JordNZ

03 Apr 2016 Leave a comment

in applied welfare economics, labour economics, labour supply, politics - New Zealand, poverty and inequality, welfare reform Tags: expressive voting, New Zealand Labour Party, rational irrationality, universal basic income

The Universal Basic Income of $11,000 per adult proposed by the Morgan Foundation and floated as a idea to consider by the New Zealand Labour Party leaves the poor way below even that the stingy as the poverty line switch is that 50% relative poverty line. Little wonder that the Labour Party said that increasing the Universal Basic Income to avoid leaving current beneficiaries worth off would lead to a very high tax rate.

Source: A Universal Basic Income may be a good idea – but we will still need social security that works.

Political bias, free trade and @berniesanders @realdonaldtrump

31 Mar 2016 Leave a comment

in applied price theory, applied welfare economics, economics of media and culture, industrial organisation, international economics, politics - USA, Public Choice, public economics, rentseeking Tags: 2016 presidential election, antiforeign bias, antimarket bias, makework bias, pessimism bias, rational irrationality

The brutal utilitarian calculus of @NoahSmith @livingwageNZ @berniesanders

29 Mar 2016 Leave a comment

in applied price theory, applied welfare economics, labour economics, minimum wage Tags: living wage

The bleeding heart concerns of the Left for job losses from economic policy changes such as from trade liberalisation disappears as soon as they discuss the losers from a living wage increase.

Instead of may the heavens may fall but a manufacturing job must not be lost from trade liberalisation, a brutal utilitarian calculus overtakes Noah Smith and the living wage movement about the small number of job losses that result from modest increases in the minimum wage.

Most are those who support the minimum wage shift gears their applied welfare economics in all other social context to emphasise how the losers should be given priority and greater weight when adding up the social gains and social losses of economic change.

The social cost of the minimum wage is not discussed in this way: how many jobs are lost and that these job losses are much more important than any gains to society.

All that is done is the number of jobs lost is compared with some other social metrics such as how much the wages go up for those that still have a job and that is enough to conclude that there is a socially beneficial change from a minimum wage increase.

Any low paid workers affected by the minimum wage increase are just reduced to numbers and added and subtracted with great ease and few moral compunctions about interpersonal comparisons of utility.

A minimum wage increase is not free if one worker loses their job. The Paretian Criterion states that welfare is said to increase or decrease if at least one person is made better off or worse off with no change in the positions of others.

As Rawls pointed out, a general problem that throws utilitarianism into question is some people’s interests, or even lives, can be sacrificed if doing so will maximize total satisfaction. As Rawls says:

[ utilitarianism] adopt[s] for society as a whole the principle of choice for one man… there is a sense in which classical utilitarianism fails to take seriously the distinction between persons.

Minimum wage advocates fail to take seriously that low paid workers who lose their jobs because of minimum wage increases are real living people who suffer when their interests are traded off for the greater good of their fellow low paid workers, some of whom come from much wealthier households.

It's pretty simple: Minimum Wage = Compulsory Unemployment http://t.co/6xiX6YCp9Z—

Mark J. Perry (@Mark_J_Perry) July 25, 2015

As Rawls pointed out, a general problem that throws utilitarianism into question is some people’s interests, or even lives, can be sacrificed if doing so will maximize total satisfaction. As Rawls says:

[ utilitarianism] adopt[s] for society as a whole the principle of choice for one man… there is a sense in which classical utilitarianism fails to take seriously the distinction between persons.

Minimum wage advocates fail to take seriously that low paid workers who lose their jobs because of minimum wage increases are real living people who suffer when their interests are traded off for the greater good of their fellow low paid workers, some of whom come from much wealthier households. Obviously the teenagers and adults thrown onto the scrapheap of society by an increased minimum wage don’t count in the brutal utilitarian calculus Noah Smith and the living wage movement employs.

All part of @BernieSanders’ good old days before the top 1% looted everything

26 Mar 2016 Leave a comment

in applied welfare economics, economic history, economics of media and culture, politics - USA, poverty and inequality, technological progress

Was Occupy Wall Street based on a measurement error?

26 Mar 2016 Leave a comment

in applied welfare economics, economic history, entrepreneurship, human capital, labour economics, poverty and inequality Tags: entrepreneurial alertness, superstar wages, superstars, top 0.1%, top 1%

Piketty and Saez (2003, updated) estimated the share of income held by the top 1% from 13 percent in 1991 to 23 percent in 2012. The new Bricker et al. research shows only a 7 percentage point increase to 18 percent in 2012. The share held by the super-rich, the top 0.1% has increased much at all.

Source: Measuring income and wealth at the top using administrative and survey data via How super-rich Americans get that way is changing – AEI | Pethokoukis Blog » AEIdeas.

Source: Measuring income and wealth at the top using administrative and survey data via How super-rich Americans get that way is changing – AEI | Pethokoukis Blog » AEIdeas.

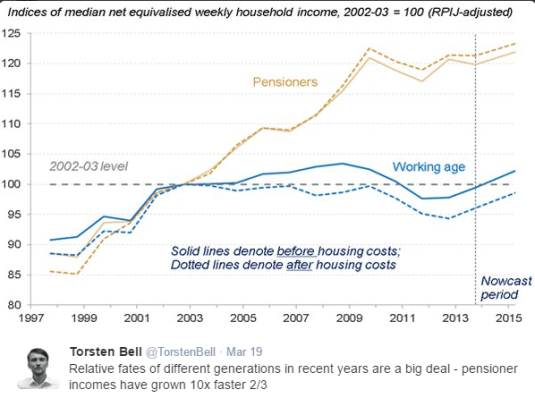

Bugger the top 1% – it is the retired who are going from strength to strength

24 Mar 2016 Leave a comment

Externalities: When Is a Potato Chip Not Just a Potato Chip?

24 Mar 2016 Leave a comment

in applied price theory, applied welfare economics, industrial organisation, law and economics, property rights Tags: externalities

It takes three to have an externality.

Poverty reduction in Africa is even greater than previously thought

24 Mar 2016 Leave a comment

in applied welfare economics, econometerics, economic history, growth disasters, growth miracles Tags: Africa, extreme poverty, global poverty, The Great campus game

#EarthHour 10 great public health achievements of 20th century #HAH2016

19 Mar 2016 Leave a comment

in applied welfare economics, economic history, health economics Tags: economics of smoking, fluoridation, public health, The Great Escape, vaccines

Pizza and Conversation with James Heckman

19 Mar 2016 Leave a comment

in applied price theory, applied welfare economics, economics, economics of education, human capital, labour economics, labour supply, poverty and inequality Tags: James Heckman

@James_ARobins yet another @MaxRashbrooke #inequality fact check

17 Mar 2016 Leave a comment

in applied welfare economics, economic growth, economic history, labour economics, poverty and inequality, unemployment Tags: antimarket bias, pessimism bias, rational irrationality, The Great Enrichment, top 1%

Source: Do inequality and poverty matter? | Pundit – Brian Easton (2016) .

I will outsource to Brian Easton, the CTU, the CTU’s Bill Rosenberg and Closer Together Whakatata Mai – reducing inequalities because the continual correction of Max Rashbrooke on poverty and inequality is becoming tiring.

Source: Love in the time of crisis, James Robins, Wednesday, 16 March 2016, Newstalk NZ.

A brief history of inequality-from Treasury paper Fig4. Note Employment Contracts Act,GST,income tax,benefit cuts,WFF http://t.co/y4w3cUsgjD—

Bill Rosenberg (@WJRosenbergCTU) June 27, 2015

Inequality has not risen for at least 20 years as Bill Rosenberg tweeted. The rise in inequality in the late 1980s and early 1990s was followed by an employment boom that lasted to 2009.

Unemployment was as low as 3 1/2% for several years despite a large increase in labour force participation. Furthermore, the gender wage gap in New Zealand fell rapidly to now be the smallest in any industrialised country.

As the Facebook photos show, there has been strong income and wage growth despite the grizzling of the left. The return of income growth and wages growth after 20 years of real wage stagnation followed the economic reforms of the 1980s and the passage of the Employment Contracts Act in 1991.

As the CTU shows below, the economic reforms in the 1980s put an end to a sharp decline in the relative economic performance of the New Zealand economy.

The value of New Zealand owner occupied homes, net capital stock and human capital stock since 1987

17 Mar 2016 Leave a comment

in applied welfare economics, economic history, economics of education, entrepreneurship, human capital, labour economics, politics - New Zealand, poverty and inequality, urban economics Tags: household wealth, housing prices, pessimism bias, top 1%

Tring Le found that the human capital stock was consistently 2.6 times the value of the physical capital stock of New Zealand.

I decided to apply that ratio to the net capital stock of New Zealand estimates of Statistics New Zealand back to 1987 to see what we get. It is pretty standard for the value of human capital to be two to two and one-half times the value of physical capital.

Source: National Accounts (Industry Benchmarks): Year ended March 2013 and Lˆe Thi. Vˆan Tr`ınh, Estimating the monetary value of the stock of human capital for New Zealand, University of Canterbury PhD thesis (September 2006), Table 4.8: Human and physical capital stocks.

All the above chart says it is most wealth in New Zealand is held by ordinary people either as their human capital or the value of their homes.

Recent Comments