Market inefficiency is revealed through a process of entrepreneurial discovery

13 Sep 2014 Leave a comment

Hayek Explains Why He Did Not Challenge Keynes’ General Theory

03 Sep 2014 Leave a comment

in Austrian economics, business cycles, F.A. Hayek, fiscal policy, great depression, macroeconomics Tags: FA Hayek, General Theory, Keynes

Knowledge, ignorance and equilibrium in the market process – Israel Kirzner

27 Aug 2014 Leave a comment

What Austrian Economics IS and What Austrian Economics Is NOT with Steve Horwitz

28 Jul 2014 Leave a comment

in Austrian economics Tags: Pete Boetkke, Steve Horwitz

Pete Boettke’s entry on “Austrian Economics” at the Concise Encyclopedia of Economics, also offered 10 propositions that define Austrian economics:

- Only individuals choose.

- The study of the market order is fundamentally about exchange behaviour and the institutions within which exchanges take place.

- The “facts” of the social sciences are what people believe and think.

- Utility and costs are subjective.

- The price system economizes on the information that people need to process in making their decisions.

- Private property in the means of production is a necessary condition for rational economic calculation.

- The competitive market is a process of entrepreneurial discovery.

- Money is non-natural.

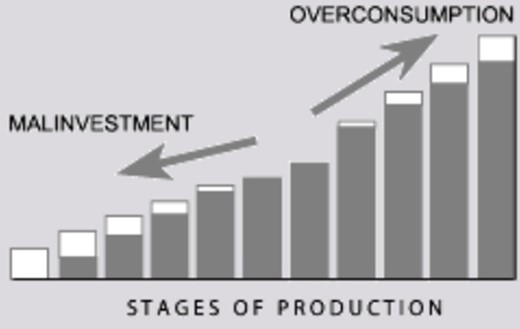

- The capital structure consists of heterogeneous goods that have multispecific uses that must be aligned.

- Social institutions often are the result of human action, but not of human design.

Costs do not determine prices!

21 Jun 2014 Leave a comment

in applied price theory, Austrian economics, F.A. Hayek Tags: price determination

The misconception that costs determined prices prevented economists for a long time from recognizing that it was prices which operated as the indispensable signals telling producers what costs it was worth expending on the production of the various commodities and services, and not the other way around. It was the costs which they had expended which determined the prices of things produced.

The entrepreneur forecasts whether consumers are willing to pay enough to justify him bringing his product to the market. If consumers are unwilling to pay enough for him to make a profit, he will not supply in the first place.

Recent Comments