SNL destroys @SenWarren’s Medicare-for-all

03 Nov 2019 Leave a comment

in entrepreneurship, financial economics, health economics, human capital, income redistribution, industrial organisation, labour economics, labour supply, Marxist economics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, survivor principle Tags: 2020 presidential election, envy, The fatal conceit, top 1%, wealth tax

Duflo and Banerje are a cross between Trump and crazy Bernie on economic populism

31 Oct 2019 Leave a comment

in development economics, economic history, economics of regulation, entrepreneurship, financial economics, history of economic thought, industrial organisation, international economics, labour economics, labour supply, Marxist economics, politics - USA, poverty and inequality Tags: anti-foreign bias, economics of immigration, free trade

The Danes are awash in data. Shed a tear for your own job security if there is a death in the CEO’s family.

23 Oct 2019 Leave a comment

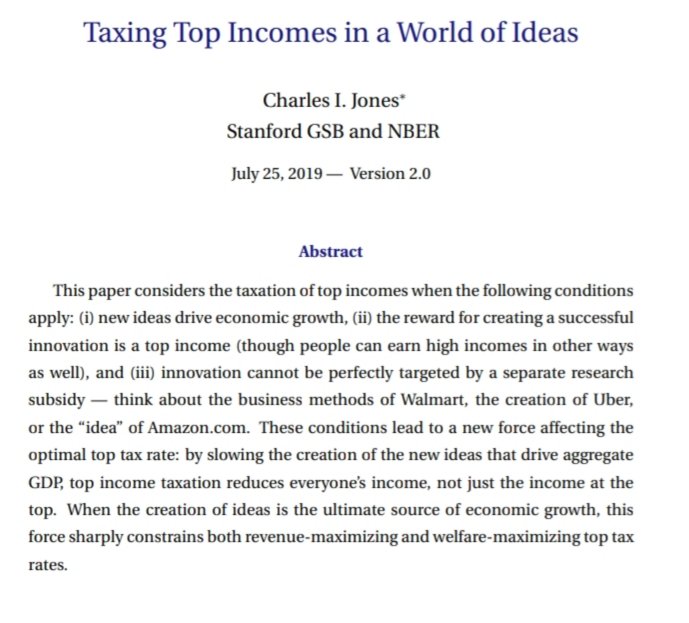

Would a “Wealth Tax” Help Combat Inequality? A Debate with Saez, Summers, and Mankiw

20 Oct 2019 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of education, entrepreneurship, financial economics, human capital, income redistribution, industrial organisation, labour economics, labour supply, Marxist economics, occupational choice, politics - USA, poverty and inequality, Public Choice, public economics, rentseeking, survivor principle Tags: envy, superstar wages, superstars, taxation and entrepreneurship, taxation and investment, taxation and labour supply, top 1%, wealth taxes

A chinese millionaire went broke after he got religion. Business partners, suppliers and customers didn’t trust him anymore.

19 Oct 2019 Leave a comment

in applied price theory, development economics, economics of bureaucracy, economics of crime, entrepreneurship, financial economics, growth disasters, growth miracles, industrial organisation, law and economics, managerial economics, organisational economics, personnel economics, property rights, Public Choice, survivor principle Tags: bribery and corruption

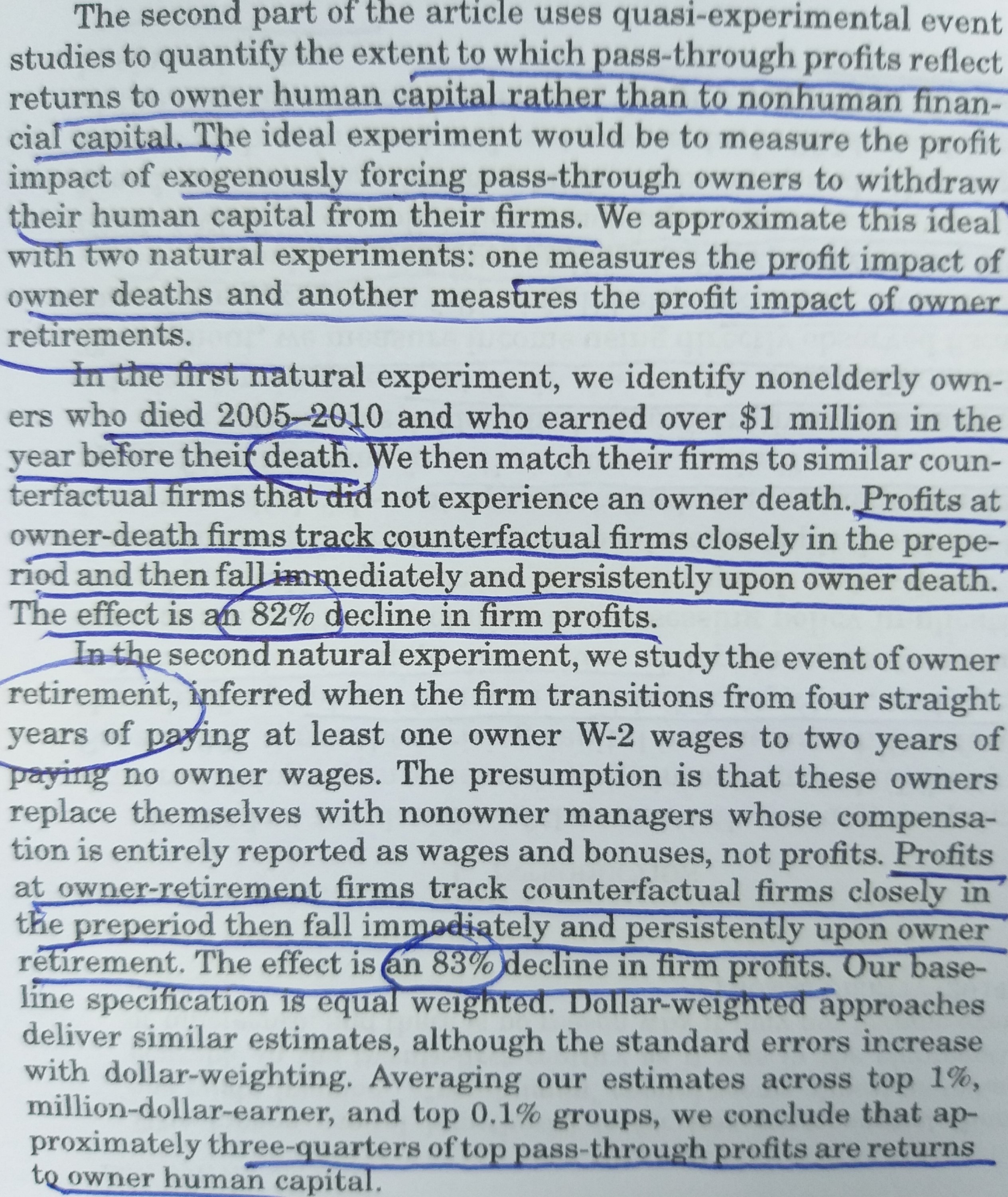

Do bosses take your labour surplus with them when they die? More on the rise of a working rich @AOC @BernieSanders

19 Oct 2019 Leave a comment

in applied price theory, entrepreneurship, financial economics, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, Marxist economics, occupational choice, poverty and inequality, property rights, Public Choice, survivor principle Tags: labour theory of value, top 1%

from http://www.ericzwick.com/capitalists/capitalists.pdf

Matthew Smith, Danny Yagan, Owen Zidar, Eric Zwick, Capitalists in the Twenty-First Century, The Quarterly Journal of Economics, Volume 134, Issue 4, November 2019, Pages 1675–1745,

Douglass North and Timur Kuran: Institutions and Economic Performance

17 Oct 2019 Leave a comment

in applied price theory, applied welfare economics, Austrian economics, comparative institutional analysis, constitutional political economy, defence economics, development economics, economic history, economics of bureaucracy, economics of education, economics of regulation, economics of religion, financial economics, growth disasters, growth miracles, history of economic thought, income redistribution, industrial organisation, law and economics, property rights, Public Choice, rentseeking, survivor principle Tags: The Great Enrichment

“I vividly remember traders screaming, ‘The market’s broken! I can’t get a price, any price! Said @JARRODWKERR IN @THESPINOFFTV?

15 Oct 2019 Leave a comment

in economic history, financial economics, global financial crisis (GFC), macroeconomics, monetary economics

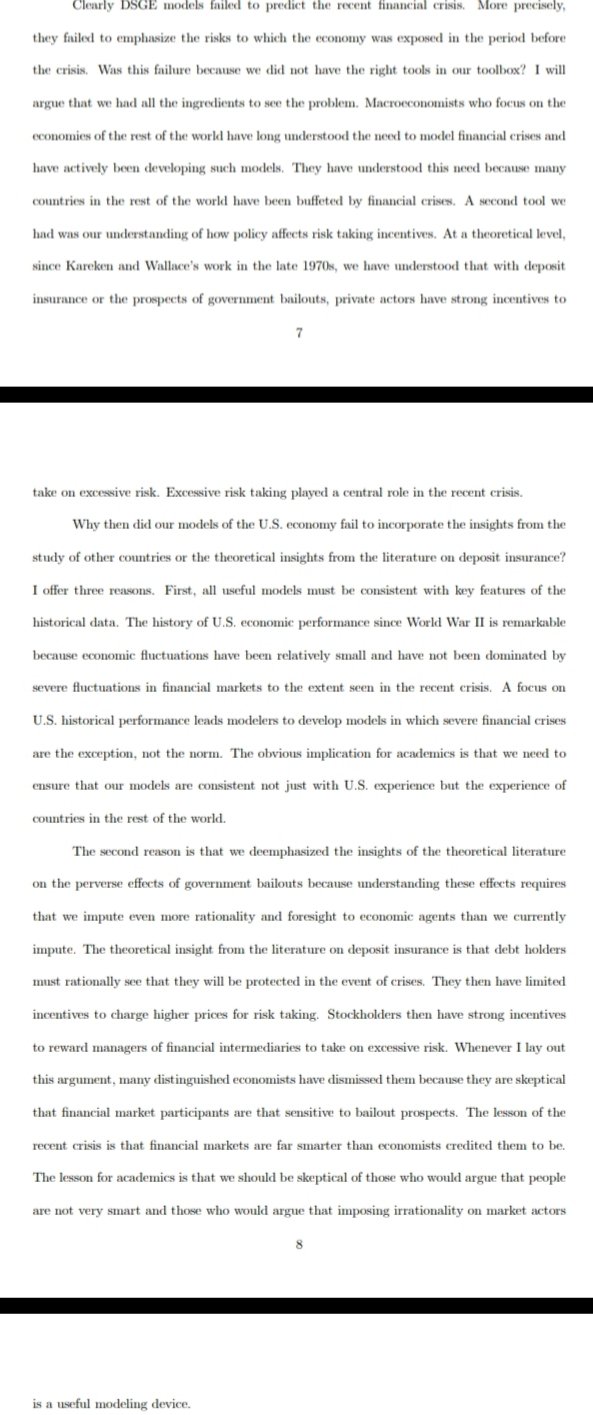

Figures 7A and 7B display data for the interest rate on commercial paper with a maturity of 90 days for financial and non-nancial corporations2 . These figures show that, during the financial crisis, this interest rate has risen for financial institutions and has barely budged for non-financial institutions with a AA rating. It has risen fairly dramatically for non-financial corporations with an A2/P2 rating. Note that, even though the interest rate for financial institutions has risen recently, it is still well below the levels that prevailed from the beginning of 2006 to the middle of 2007. These figures show that the financial crisis has not led commercial paper rates to rise to levels well beyond historical levels. Taken together, Figures 6A through 7B show that the third claim is false, at least as of October 15.

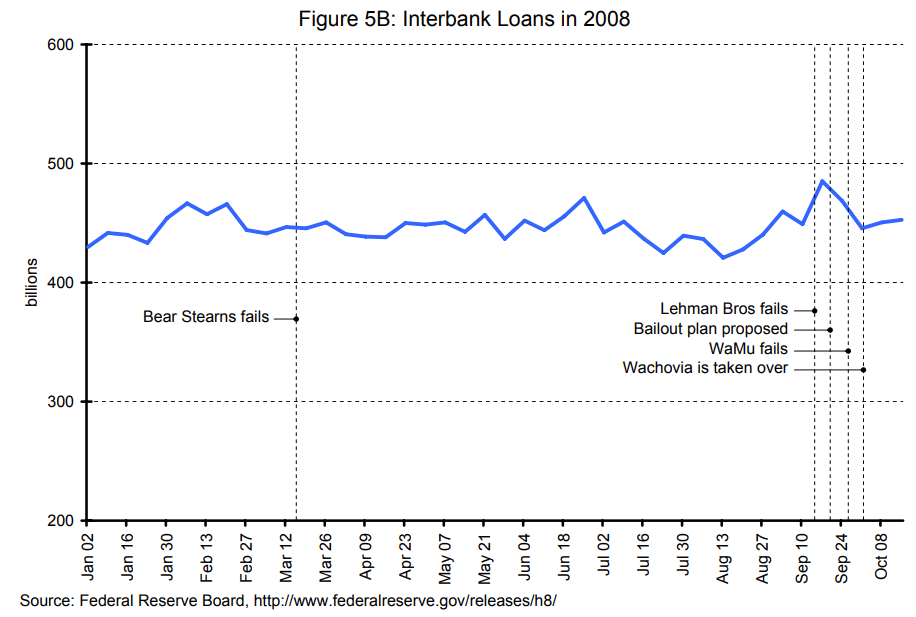

Did interbank lending dry up at onset of the #GFC as claimed by @JarrodWKerr in @TheSpinoffTV?

15 Oct 2019 1 Comment

in economic history, financial economics, global financial crisis (GFC), macroeconomics, monetary economics

“We knew we were witnessing history, but at the same time, we were haemorrhaging,” he wrote in a piece for The Spinoff marking the crash’s 10th anniversary. “I vividly remember traders screaming, ‘The market’s broken! I can’t get a price, any price!’… The fear of contagion crippled financial markets, and each bank was asking the same question of the other: ‘what dodgy exposure do you have?'”

From https://thespinoff.co.nz/business/sme/15-10-2019/the-economist-who-forgot-everything-he-learned/

BTW, what Kerr really said:

We knew we were witnessing history, but at the same time, we were haemorrhaging. I vividly remember traders screaming, ‘The market’s broken, the market’s broken! I can’t get a price, any price!’. Screens and keyboards were smashed, and millions were lost. I still to this day struggle to believe the so-called ‘major banks’ refused to deal with each other. The fear of contagion crippled financial markets, and each bank was asking the same question of the other: ‘What dodgy exposure do you have?’ The market for bank bills, the short-term pieces of paper (IOUs) that banks buy off each other and which account for a large part of their funding, froze. An interest rate that was ‘always’ 7bps (percentage points) above the cash rate (OCR) sudden became 180bps above cash. That’s banker talk for ‘bloody hell, the cost of everything we do has just blown out’. Credit, the availability of money to do stuff like buy a home, is the oil in the economic engine and when it dries up the engine seizes. What we had was a recession, and it was a bad one. Bailouts came in a number of forms but many feared it wasn’t enough. (emphasis by this blog)

BTW, one basis point (BP) is one hundredth of one percentage point, not a whole percentage point as the editor of his article suggested.

Want to Make a Big Bet on Oil Prices? Try Measuring Shadows | @WSJ

13 Oct 2019 Leave a comment

in defence economics, economic history, economics of information, energy economics, entrepreneurship, financial economics, industrial organisation, international economics, market efficiency, survivor principle, transport economics, war and peace Tags: entrepreneurial alertness

V.V. Chari testifies on modern macroeconomics and information prerequisites to predicting the GFC

09 Oct 2019 Leave a comment

Richard Posner: Fiscal Irresponsibility Clouds the Future

23 Sep 2019 Leave a comment

in economic history, economics of bureaucracy, financial economics, fiscal policy, global financial crisis (GFC), great recession, industrial organisation, law and economics, macroeconomics, monetary economics, Public Choice, Richard Posner Tags: bank panics

Recent Comments