Steven Landsburg: taxing capital

02 Dec 2018 Leave a comment

in applied price theory, applied welfare economics, economic growth, financial economics, fiscal policy, macroeconomics, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour

Spot on

26 Nov 2018 2 Comments

in defence economics, economics of information, economics of media and culture, energy economics, entrepreneurship, financial economics Tags: cranks

Same applies to those who say they predicted the #GFC

24 Nov 2018 Leave a comment

in applied price theory, economics of crime, economics of regulation, entrepreneurship, financial economics, law and economics Tags: securities fraud

Why Should My Boss Get All the Profits?

28 Oct 2018 Leave a comment

in applied welfare economics, Austrian economics, entrepreneurship, financial economics, labour economics, labour supply, poverty and inequality Tags: labour theory of value

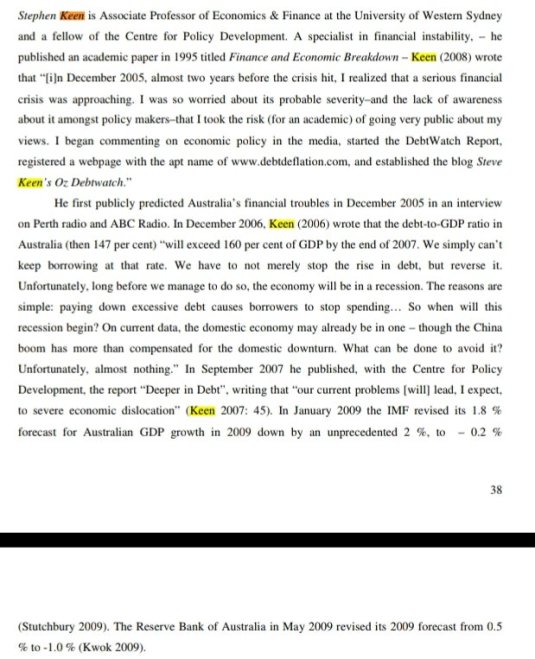

@ProfSteveKeen cites Bezemer when claiming he predicted #GFC (by predicting recession in Oz in radio interviews)

27 Oct 2018 Leave a comment

in business cycles, financial economics, macroeconomics, monetary economics Tags: cranks, forecasting, Post-Keynesian macroeconomics

@ProfSteveKeen never predicted GFC

22 Oct 2018 Leave a comment

in financial economics, macroeconomics

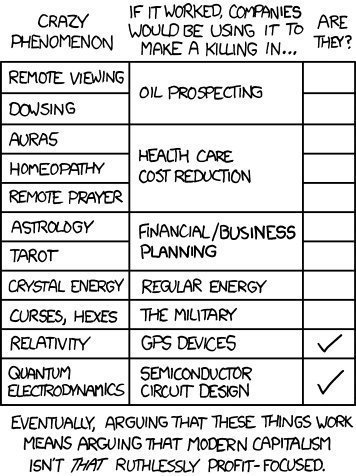

Post-Keynesian macroeconomists believe business cycle theory starts and finishes with recurrent private debt bubbles that lead to inevitable financial crashes because private investors repeatedly borrow more than they can pay back and never learn.

Bold, risky science in the finest tradition of Karl Popper. Keen strictly forbids a recession not following a build up of private debt. His theory is too bareboned to have a protective belt of auxiliary hypotheses that save him from refutation.

Post-Keynesians identified a great business opportunity shorting these recurrent debt bubbles but must crowd source further development of the Minsky Software that successfully predicted the GFC.

Top hedge fund managers earn at least $400 million a year so they could easily spare a few million dollars over lunch on the off chance that there is something in Post-Keynesian macroeconomics and the Minsky software.

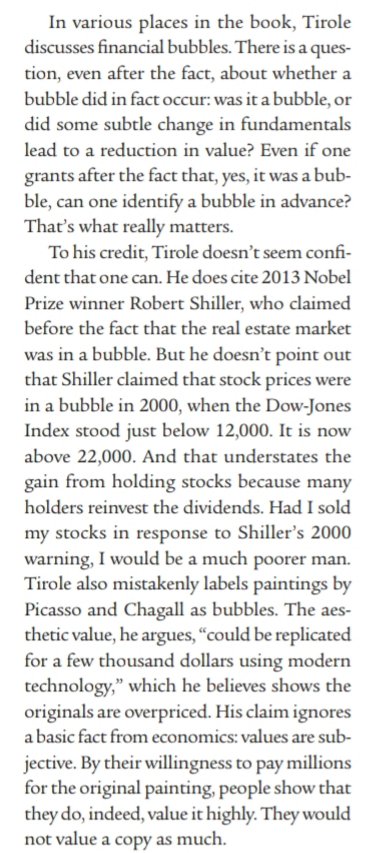

The Efficient Market Hypothesis, An Update

16 Oct 2018 Leave a comment

in financial economics Tags: efficient markets hypothesis

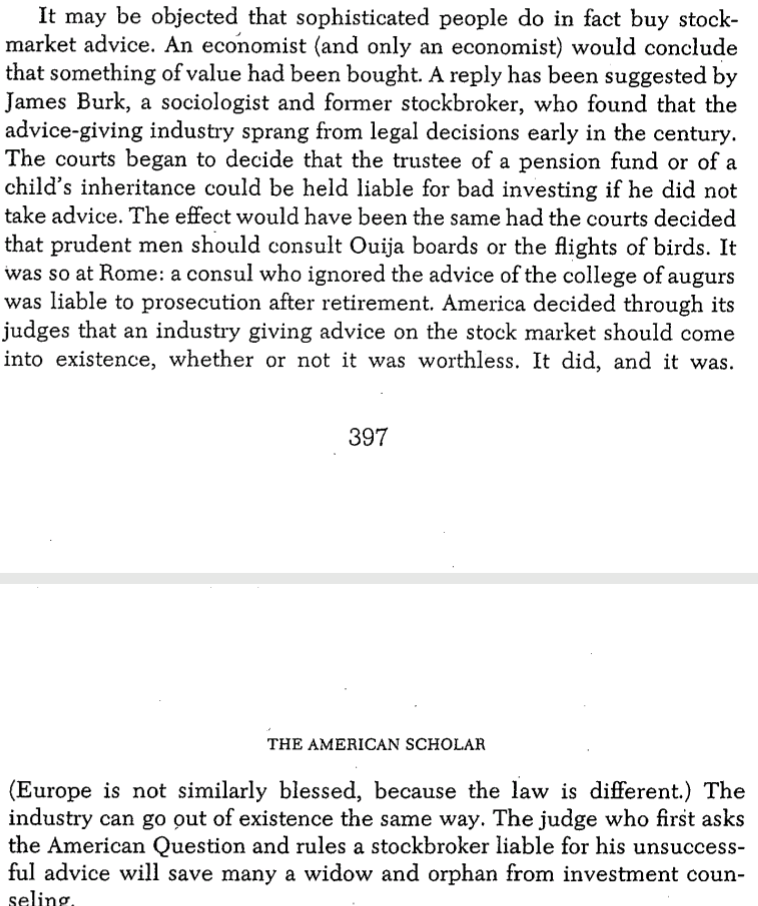

Deirdre McCloskey explains the origin of consultants

11 Oct 2018 Leave a comment

in applied price theory, economic history, financial economics, law and economics Tags: Deirdre McCloskey

Jonn Cochrane Says Allowing European Defaults `Best’ for Euro

04 Oct 2018 Leave a comment

in budget deficits, business cycles, currency unions, Euro crisis, financial economics, law and economics, macroeconomics, monetary economics, property rights Tags: sovereign defaults

How Did Paul Krugman Get It So Wrong? John Cochrane

02 Oct 2018 Leave a comment

in budget deficits, business cycles, entrepreneurship, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), great depression, great recession, macroeconomics, monetary economics Tags: Paul Krugman

Recent Comments