As everybody who is not blind and deaf is aware, there is a huge political preoccupation with climate change at the moment, a widespread (though by no means unanimous) belief that global temperatures are rising mainly as a result of the greenhouse gases created by humankind, and a strong view that all countries have a…

DON BRASH: BANKS AND CLIMATE CHANGE: THE LAW IS AN ASS

DON BRASH: BANKS AND CLIMATE CHANGE: THE LAW IS AN ASS

30 Mar 2024 Leave a comment

in energy economics, entrepreneurship, environmental economics, financial economics, global warming Tags: climate alarmism, efficient markets hypothesis

How credible is the Milei plan?

24 Mar 2024 Leave a comment

in applied price theory, budget deficits, business cycles, development economics, economic growth, financial economics, fiscal policy, growth disasters, income redistribution, international economics, macroeconomics, monetary economics, Public Choice, public economics Tags: Argentina

Here is a good Substack essay by Nicolas Cachanosky, excerpt: Inflation expectations depend on what is expected to happen to the budget in the months to come. It is natural, then, to ask whether the observed surpluses are sustainable in the months ahead. Answering this question requires looking at two things. First, how was the fiscal […]

How credible is the Milei plan?

Aussie Renewable Investment Slumped 80% in 2023

20 Mar 2024 Leave a comment

in energy economics, entrepreneurship, environmental economics, financial economics, global warming, politics - Australia Tags: wind power

Rooftop solar / battery installations were the exception. Perhaps Aussie households are preparing for the coming grid failure?

Aussie Renewable Investment Slumped 80% in 2023

One Year Since the Meltdown at Silicon Valley Bank: Commercial Real Estate and Ongoing Threats

13 Mar 2024 Leave a comment

in applied price theory, economics of information, economics of regulation, financial economics, macroeconomics, monetary economics, politics - USA Tags: banking panics

One year ago in March 2023, Silicon Valley Bank melted down, quickly followed by similar meltdowns at Signature Bank and First Republic Bank. Measured by the nominal size of bank assets, these were three of the biggest four US bank failures in history. (The failure of Washington Mutual Bank in 2008 remains the largest.) Was…

One Year Since the Meltdown at Silicon Valley Bank: Commercial Real Estate and Ongoing Threats

The Black-Scholes-Merton Options Pricing Equation

07 Mar 2024 Leave a comment

in applied price theory, entrepreneurship, financial economics Tags: active investing

A superb video on the history and mathematics of options pricing from Veritasium.

The Black-Scholes-Merton Options Pricing Equation

PETER WILLIAMS: RIP Newshub

03 Mar 2024 Leave a comment

in economics of information, economics of media and culture, entrepreneurship, financial economics, industrial organisation, politics - New Zealand, survivor principle Tags: media bias

Could anything have saved it? The real surprise is not that Newshub is going under but that it’s lasted this long. TV 3 started broadcasting in November 1989, almost 35 years ago. It was a different era. There was no Sky, no digital platforms and the new kid on the block was going head to head…

PETER WILLIAMS: RIP Newshub

Is ESG investing illegal?

28 Feb 2024 Leave a comment

in energy economics, entrepreneurship, environmental economics, financial economics, global warming Tags: active investing

For fund managers, it may violate their fiduciary responsibility (to maximize returns) to their shareholders. Apparently, the legal risk is too big for JP Morgan, State Street, and BlackRock: Asset managers have been walking a fine legal line. GOP Attorneys General in 2022 warned that they might be violating their fiduciary obligations and antitrust laws.…

Is ESG investing illegal?

“Nothing Succeeds Like Excess”: New York’s Perverse Incentive in Pricing Trump Out of an Appeal

25 Feb 2024 Leave a comment

in economics of crime, financial economics, law and economics, politics - USA, property rights Tags: 2024 presidential election, regressive left

Below is my column in the New York Post on the confiscatory fines imposed on former president Donald Trump and his family and corporation. Democrats are thrilled by the over the $450 million bill facing Trump and the possibility that he could be forced to sell off property just to seek an appeal. On ABC, […]

“Nothing Succeeds Like Excess”: New York’s Perverse Incentive in Pricing Trump Out of an Appeal

Orsted’s Financial Collapse Spells Armageddon For US Offshore Wind Industry

17 Feb 2024 Leave a comment

in energy economics, entrepreneurship, environmental economics, financial economics, global warming, politics - USA Tags: celebrity technologies, wind power

When the most heavily subsidised industry on earth can’t make it pay, you know the economics must really stink. Denmark’s Ørsted share price plummeted 25% late last year, and after slashing dividends to shareholders was forced to write $billions off the projected value of its US offshore projects, and its share price is still heading south. Exhibiting […]

Orsted’s Financial Collapse Spells Armageddon For US Offshore Wind Industry

Creative destruction

13 Feb 2024 Leave a comment

in economic history, entrepreneurship, financial economics, industrial organisation, survivor principle Tags: creative destruction

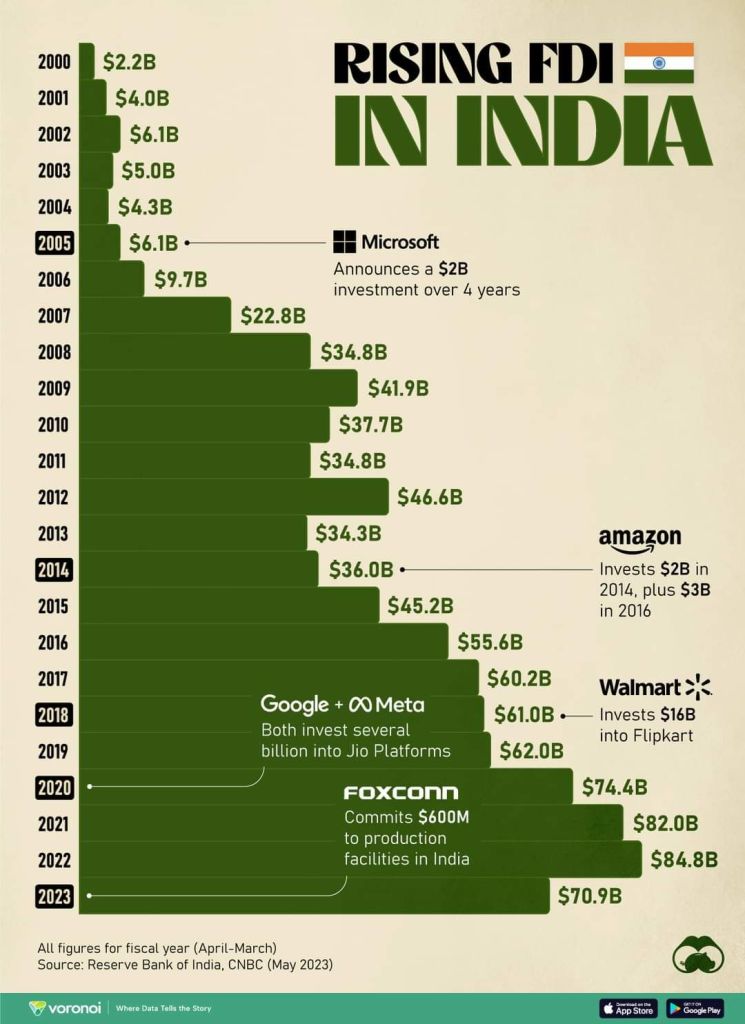

A boom

22 Jan 2024 Leave a comment

in development economics, economic history, entrepreneurship, financial economics, growth disasters, growth miracles Tags: India

📸 Look at this post on Facebook

https://www.facebook.com/share/utqMWmwSv6CsNYNR/?mibextid=RXn8sy

Investors Are Turning on A Key Pillar of Biden’s Climate Agenda

27 Dec 2023 Leave a comment

in energy economics, environmental economics, financial economics, global warming

“I think the investor class has grown weary of the industry’s lack of profitability,” Blink Charging’s CEO Brendan Jones told the WSJ. EV charging companies once received lofty valuations from investors, Jones told the WSJ. The post Investors Are Turning on A Key Pillar of Biden’s Climate Agenda first appeared on Watts Up With That?.

Investors Are Turning on A Key Pillar of Biden’s Climate Agenda

Central Banking and the Real-Bills Doctrine

21 Dec 2023 Leave a comment

in economic history, financial economics, great depression, history of economic thought, macroeconomics, monetary economics Tags: monetary policy

Robert Hetzel, a distinguished historian of monetary theory and of monetary institutions, deployed his expertise in both fields in his recent The Federal Reserve: A New History. Hetzel’s theoretical point departure is that the creation of the Federal Reserve System in 1913 effectively replaced the pre-World War I gold standard, in which the value […]

Central Banking and the Real-Bills Doctrine

The Piketty-Saez-Zucman response to Auten and Splinter

17 Dec 2023 Leave a comment

in applied price theory, econometerics, economic history, entrepreneurship, financial economics, income redistribution, labour economics, politics - USA, poverty and inequality, Public Choice, public economics Tags: top 1%

A number of you have asked me what I think of their response. The first thing I noticed is that Auten and Splinter make several major criticisms of PSZ, and yet PSZ respond to only one of them. On the others they are mysteriously silent. The second thing I noticed is that PSZ have been […]

The Piketty-Saez-Zucman response to Auten and Splinter

Hetzel Withholds Credit from Hawtrey for his Monetary Explanation of the Great Depression

14 Dec 2023 Leave a comment

in business cycles, economic growth, economic history, financial economics, great depression, history of economic thought, labour economics, macroeconomics, Milton Friedman, monetarism, monetary economics, unemployment Tags: monetary policy

In my previous post, I explained how the real-bills doctrine originally espoused by Adam Smith was later misunderstood and misapplied as a policy guide for central banking, not, as Smith understood it, as a guide for individual fractional-reserve banks. In his recent book on the history of the Federal Reserve, Robert Hetzel recounts how the […]

Hetzel Withholds Credit from Hawtrey for his Monetary Explanation of the Great Depression

Recent Comments