Source: IZA World of Labor – Do minimum wages stimulate productivity and growth?

Do minimum wages stimulate productivity? @BernieSanders @livingwageNZ

06 Apr 2016 Leave a comment

in econometerics, labour economics, labour supply, minimum wage, politics - New Zealand, politics - USA, poverty and inequality Tags: living wage, The fatal conceit, The pretence the knowledge

The brutal utilitarian calculus of @NoahSmith @livingwageNZ @berniesanders

29 Mar 2016 Leave a comment

in applied price theory, applied welfare economics, labour economics, minimum wage Tags: living wage

The bleeding heart concerns of the Left for job losses from economic policy changes such as from trade liberalisation disappears as soon as they discuss the losers from a living wage increase.

Instead of may the heavens may fall but a manufacturing job must not be lost from trade liberalisation, a brutal utilitarian calculus overtakes Noah Smith and the living wage movement about the small number of job losses that result from modest increases in the minimum wage.

Most are those who support the minimum wage shift gears their applied welfare economics in all other social context to emphasise how the losers should be given priority and greater weight when adding up the social gains and social losses of economic change.

The social cost of the minimum wage is not discussed in this way: how many jobs are lost and that these job losses are much more important than any gains to society.

All that is done is the number of jobs lost is compared with some other social metrics such as how much the wages go up for those that still have a job and that is enough to conclude that there is a socially beneficial change from a minimum wage increase.

Any low paid workers affected by the minimum wage increase are just reduced to numbers and added and subtracted with great ease and few moral compunctions about interpersonal comparisons of utility.

A minimum wage increase is not free if one worker loses their job. The Paretian Criterion states that welfare is said to increase or decrease if at least one person is made better off or worse off with no change in the positions of others.

As Rawls pointed out, a general problem that throws utilitarianism into question is some people’s interests, or even lives, can be sacrificed if doing so will maximize total satisfaction. As Rawls says:

[ utilitarianism] adopt[s] for society as a whole the principle of choice for one man… there is a sense in which classical utilitarianism fails to take seriously the distinction between persons.

Minimum wage advocates fail to take seriously that low paid workers who lose their jobs because of minimum wage increases are real living people who suffer when their interests are traded off for the greater good of their fellow low paid workers, some of whom come from much wealthier households.

It's pretty simple: Minimum Wage = Compulsory Unemployment http://t.co/6xiX6YCp9Z—

Mark J. Perry (@Mark_J_Perry) July 25, 2015

As Rawls pointed out, a general problem that throws utilitarianism into question is some people’s interests, or even lives, can be sacrificed if doing so will maximize total satisfaction. As Rawls says:

[ utilitarianism] adopt[s] for society as a whole the principle of choice for one man… there is a sense in which classical utilitarianism fails to take seriously the distinction between persons.

Minimum wage advocates fail to take seriously that low paid workers who lose their jobs because of minimum wage increases are real living people who suffer when their interests are traded off for the greater good of their fellow low paid workers, some of whom come from much wealthier households. Obviously the teenagers and adults thrown onto the scrapheap of society by an increased minimum wage don’t count in the brutal utilitarian calculus Noah Smith and the living wage movement employs.

@TBillTheProf unintentionally destroys the case for a #livingwage @Mark_J_Perry @arindube

13 Mar 2016 Leave a comment

in applied price theory, labour economics, managerial economics, minimum wage, organisational economics, personnel economics, politics - New Zealand, politics - USA Tags: living wage, rational irrationality, The fatal conceit, The pretense to knowledge

Living wage advocate William Lester published a briefing for the Washington Centre for Equitable Growth that destroys the case for a living wage. He did not intend this but he documented in detail the exclusion of inexperienced workers from the restaurant industry in San Francisco after a living wage was imposed. He compared San Francisco’s minimum wage of $12 per hour with North Carolina which only pays the federal minimum of $7.25 per hour.

What Lester found was a systematic increase in hiring standards. The living wage in San Francisco of $12 all but ended the hiring of inexperienced workers as shown in the chart below. This is exactly what basic price theory predicts. I put the two pie charts in his paper into a single bar chart so this powerful effect of the living wage on hiring standards is not lost.

Source: The consequences of higher labor standards in full service restaurants – Equitable Growth.

The most fundamental criticism of living wage and minimum wage increases is they exclude workers who do not meet the new labour productivity level required to make it profitable for employers to hire them. UK research found the same thing – an increase in hiring standards and tougher shortlisting. Lester welcomes this transition of the restaurant industry in San Francisco into a career for professionals. As he says in his briefing paper:

Concurrent with this wage compression was a rise in professional standards as employers sought to hire and keep already well-trained workers at higher wages and with expanded benefits. Both developments reduced turnover and attracted more professional employees who maintain a high level of customer service.

As with all minimum wage and living wage advocates, he is incurious as to what happens to those low skilled, inexperienced workers and new workforce entrants who no longer meet the hiring standards of San Francisco restaurants because of the large minimum wage increase.

Best 2 Minimum Wage Cartoons Ever, from Henry Payne, Updated for Seattle's $15 "Economic Death Wish" @HenryEPayne http://t.co/vatUzkHMss—

Mark J. Perry (@Mark_J_Perry) August 18, 2015

As Lester concedes in his conclusions about what will happen if the San Francisco minimum wage of $12 an hour, the highest in the country, is extended to other cities and states:

Higher professional standards may limit entry-level opportunities within the industry, while lower standards may result in more employer-provided training for new workers.

Employer funded on-the-job training is often a major part of a job package. It is well-known in the labour economics literature since the time of Adam Smith that any job is a package of wages and other attributes including learning opportunities.

Workers sell their services and buy learning opportunities; firms buy labour services and sell jobs with varying learning possibilities (Rosen 1972, 1975, 1976). The rational allocation of time results in most careers starting with large investments in full-time schooling and then mostly investments in on-the-job training (Becker 1975; Ben-Porath 1967, 1970; Weiss 1987).

As the training provided by restaurant employers is useful to other employers, the trainee must fund it through trading off wages for this training. Once trained, the employee can command a higher pay because other employers are willing to pay them more now that they are trained. Again, this is a standard result in the human capital literature.

Where the human capital is more specialised to one firm or job, the employer and the trainee share the cost. A classic example of this is an apprenticeship.

Source: IZA World of Labor – Do firms benefit from apprenticeship investments?

In San Francisco, employers expect recruits to be fully trained and experienced. They provide little in the way of on-the-job training. Their recruits must have been able to afford to fund this in their previous jobs by trading off wages for training as Lester notes in his working paper:

…San Francisco employers were less likely to report lengthy formal training periods for either front-of-house or back-of-house workers. Instead, there is an overall higher level of skill expectation and—as is the case for many professions—workers are expected to acquire and exhibit industry specific knowledge on their own.

In North Carolina, as Lester notes, the restaurant industry hires younger workers with less formal education and offers them intensive on-the-job training:

The restaurant industry in the Research Triangle region tends to hire younger workers with a lower level of formal education. Specifically, 49.5 percent of workers in there are under age 24 or have less than a high school education, compared to 38.9 percent in San Francisco. Conversely, 40.6 percent of workers in San Francisco have some college or a bachelor’s degree or higher, compared to 29.7 percent in the Research Triangle Region.

North Carolina restaurants sought to hire unskilled workers who were friendly and reliable as Lester notes:

One manager of a neighbourhood bistro in Raleigh explained what he looks for in a new front-of-house worker: “Basically, we require [that a server] can work a four-shift minimum per week and go an entire shift, an entire eight-hour shift without smoking a cigarette and [without] any facial piercings or anything. Beyond that, just come in with a smile on your face.”

The restaurant industry in North Carolina is willing to give people low skilled, poorly educated and inexperienced a chance to work if they are willing to work. Lester reports this when quoting an upscale bar-and-grill manager on his hiring standards:

We look for at least one year’s experience, but the biggest thing we look for is we look for the person. We don’t look for the skill. I could teach anybody how [to] wait tables [and] pour drinks. I can teach anybody how to cook steaks. What I can’t teach is how to be a good person.

Lester then discusses with some degree of approval the hiring standards in the San Francisco where restaurants are professional careers:

Rather than viewing servers as essentially interchangeable labourers who can be trained quickly and easily if they possess a modicum of personal hygiene and a friendly personality, employers in San Francisco exhibited a clear description of what a “professional server” was.

One mid-scale restaurant employer said of her front-of-house staff: “We have a lot of people who have made it a career and they’re investing in the knowledge of the product and learning their trade or already know their trade because they’ve done it for years.”

Much to the surprise of believers in the inherent inequality of bargaining power between employers and workers, employers invest heavily in low-skilled employees despite the fact this makes them employable elsewhere. Lester again:

“Training is a huge investment for us and it is constant,” [a manager] said. “Training days depend on the position. Bartending training is ten days and servers require eight days. In the kitchen it’s probably about ten days. Every day they write note cards on all their recipes. But they’ll take a final. When they take their final, their test in the kitchen, they have to know every ingredient, every ounce, and every item, for the entire station. That’s why we require them to write note cards.

Even at higher-end restaurants, employers in the region have built a human resource system that accepts a high rate of turnover. “We try to stay ahead of the game so that we’re always hiring, we’re always interviewing, but hopefully it’s not desperation hires,” says another manager. “And we try to have a mix of needs like people who need fulltime, who can work lunches and brunches and all of that, to servers who really want very part time so that you can kind of over staff on busy shifts and then there’s always someone that wants to go home. There’s always a student that would like a Saturday night off.”

Lester paints a picture of a San Francisco restaurant industry that expects workers to fund their own industry specific human capital. In North Carolina, employers provide those training opportunities to minimum wage workers despite this making these up-skilled employees an attractive proposition for rivals to poach. By depriving low skilled workers of this opportunity of both wages and employer-funded training, a living wage would make them worse off.

I am at a loss here. How can the progressive left regard the exclusion of low paid, low skilled workers as a good thing? How do they put food on the table in San Francisco other than through a welfare check? How do they get their first job?

It's pretty simple: Minimum Wage = Compulsory Unemployment http://t.co/6xiX6YCp9Z—

Mark J. Perry (@Mark_J_Perry) July 25, 2015

Big bills left on the #livingwage sidewalk?

10 Mar 2016 Leave a comment

in applied price theory, entrepreneurship, managerial economics, minimum wage, personnel economics, politics - New Zealand

Living wage activists believe that businesses can profitably pay their low-paid workers a lot more. The living wage pay increase will not jeopardise the survival of the business or jobs because their workers will be more productive because of the living wage increase. Morale will be higher and job turnover will be lower. Both of these will increase productivity perhaps enough to offset the increase in labour costs.

In a nutshell, living wage activists have discovered a hitherto untapped entrepreneurial opportunity for profit. These living wage activists are happy to disclose this secret to lower costs to the world at no fee.

What they are arguing is businesses do not notice a profit opportunity that these political activists have noticed and are now publicising widely. Entrepreneurs are leaving money on the table that could easily be snapped up simply by paying their low-paid employers higher wages.

Source: Mancur Olson (1996) “Distinguished Lecture on Economics in Government: Big Bills Left on the Sidewalk: Why Some Nations Are Rich, and Others Poor.” Journal of Economic Perspectives 3-24.

This money on the table metaphor is similar to the big bills left on the sidewalk metaphor. There is easy money to be had from paying low-paid workers more because these workers will quickly become more productive because of the higher wages.

Living wage activists do not address why entrepreneurs had not discovered this insight into cost saving themselves. After all, every entrepreneur, every employer knows that if they pay more, they will get a better class of job applicant.

Of course, if this insight by the living wage activists is true, all workers should be given a similar increase in their pay because their productivity will go through the roof as well.

Entrepreneurs profit directly from spotting every new opportunity for profit. They have no reason to turn money down particularly when it is obvious and straight under their nose.

The modern theories of the firm focus, in part or in full on reducing opportunistic behaviour, cheating and fraud in employment relationships. The cost of discovering prices and making and enforcing contracts and getting what you pay for are central to Coase’s theory of the firm put forward in 1937.

The profits of entrepreneurs for running a firm is directly linked from their successful policing of the efforts of employees and sub-contractors to ensure the team and each member perform as promised and individual rewards matched individual contributions (Alchian and Demsetz 1972; Barzel 1987). Alchian and Demsetz’s (1972) theory of the firm focused on moral hazard in team production. As they explain:

Two key demands are placed on an economic organization-metering input productivity and metering rewards.

The main rationale in personnel economics from everything ranging from employer funding of retirement pensions to the structure of promotions and executive pay including stock options is around better rewarding self-motivating employees who strive harder and reducing the costs of monitoring employee effort.

Does a higher minimum wage really reduce employment? econ.st/1gp4Jbs http://t.co/WGMZGLKHmI—

The Economist (@EconBizFin) July 30, 2015

At bottom, the efficiency wage hypothesis is entrepreneurs are unaware of the higher quality and greater self-motivation of better paid recruits for vacancies but wise bureaucrats and farsighted politicians notice these gaps in the market. Bureaucrats and politicians notice these gaps in the market before those who gain from superior entrepreneur alertness to hitherto untapped opportunities for profit do so and instead leave that money on the table.

@BernieSanders no living wage for interns @HillaryClinton hires interns illegally

28 Feb 2016 Leave a comment

in minimum wage, politics - USA Tags: 2016 presidential election, interns, left-wing democracy, living wage

Bernie Sanders pays well below the $15 living wage he expects all other employers to be by law required to pay out of their equally limited budgets. His revolution will be built on near starvation wages for the work of the worker bees.

The good old days are now

20 Feb 2016 Leave a comment

in economic history, labour economics, minimum wage, technological progress Tags: good old days, living wage, The Great Enrichment

@EconomicPolicy’s strangest yet case for the #livingwage @Mark_J_Perry

17 Feb 2016 Leave a comment

in applied price theory, labour economics, minimum wage, politics - USA, public economics

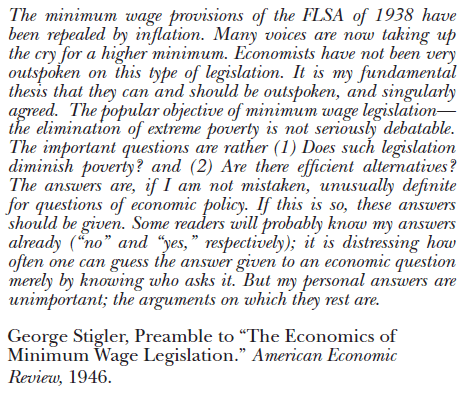

In a bizarre twist, the Economic Policy Institute is spinning one of the strongest arguments against minimum wage increases into an argument for them.

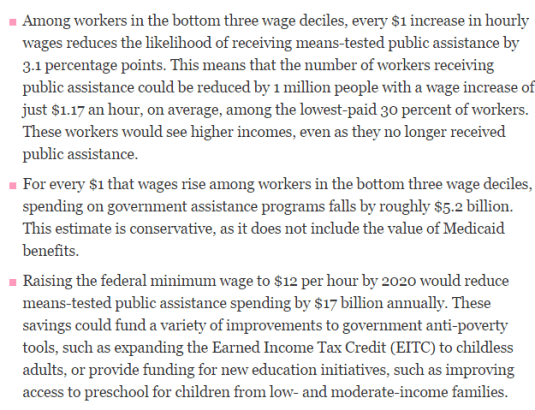

The Economic Policy Institute pointed out this week that raising the minimum wage saves billions because public assistance to low-paid workers is wound back as their wages rise.

A bog standard argument against minimum wage rises is the take-home pay of low paid workers will rise by much less than the rise in labour costs to their employers.

The reason for that discrepancy between before and after-tax pay is cash and non-cash assistance from government reduces as their wages rise with the minimum wage increase.

It is pretty standard for effective marginal tax rates and low-paid workers to be high because of the many forms of assistance in cash and in-kind which they receive winds back as their wages rise.

Working Class American Families Face Marginal #Tax Rates up to 43.7% bit.ly/1IGqQqE @ScottElliotG https://t.co/zJwIfrp2pT—

Tax Foundation (@taxfoundation) January 04, 2016

There is a large literature on the labour supply effects of this winding back of family tax credits and other assistance to low-paid as their earnings increase.

The poverty trap facing welfare beneficiaries and the low-paid because of this winding back of family tax credits and other social assistance is so widely accepted that is the only time that the Left believes in supply-side economics. It is one of the reasons for their enthusiasm for a universal basic income.

Because of the interaction between wage rises and social assistance, the practical upshot is the job of the low-paid worker is put at risk by the minimum wage increase and yet their take-home pay increases by much less. Some will lose their jobs. Others will not be hired in the first place.

Jens Rushing's perfect response to #RaiseTheWage critics went viral this summer. Read it: attn.com/stories/2619/e… https://t.co/KBIM5XLKmz—

The Fairness Project (@ProjectFairness) November 06, 2015

Almost 20 years ago, Paul Krugman pondered on why supporters of the minimum wage was so adamant that their before-tax wage must increase rather than their incomes be supplemented by family tax credits and other social assistance. He asked:

…why take this route? Why increase the cost of labour to employers so sharply, which–Card/Krueger notwithstanding–must pose a significant risk of pricing some workers out of the market, in order to give those workers so little extra income? Why not give them the money directly, say, via an increase in the tax credit?

In his book review, Krugman nailed it when he concluded that the demands for a higher minimum wages about morality:

…I suspect there is another, deeper issue here-namely, that even without political constraints, advocates of a living wage would not be satisfied with any plan that relies on after-market redistribution. They don’t want people to “have” a decent income, they want them to “earn” it, not be dependent on demeaning handouts…

In short, what the living wage is really about is not living standards, or even economics, but morality. Its advocates are basically opposed to the idea that wages are a market price–determined by supply and demand, the same as the price of apples or coal.

And it is for that reason, rather than the practical details, that the broader political movement of which the demand for a living wage is the leading edge is ultimately doomed to failure: For the amorality of the market economy is part of its essence, and cannot be legislated away.

The advocates of the living wages simply offended by the notion of people earning so little. I am less kind than Krugman to this moralising.

These do-gooders are perfectly willing to put the jobs of the low-paid at risk so that they are not offended by how little they have paid.

In the finest traditions of rational irrationality and expressive voting, they simply deny they are putting jobs at risk and going into terribly convoluted arguments about how the employment effects of be small and everyone are we better off and more productive. Arguments that Paul Krugman laughed at back in 1998.

Living wage advocates are not using the low-paid for policy experiments, which would be pretty bad, they use them to make themselves feel better about the inequalities of the world. They just want to drive the sinners out of the temple come what may.

@LivingWageUK documents the Achilles heel of the #livingwage

09 Feb 2016 1 Comment

in applied price theory, economics of bureaucracy, economics of regulation, entrepreneurship, managerial economics, minimum wage, organisational economics, personnel economics, politics - New Zealand, Ronald Coase, theory of the firm

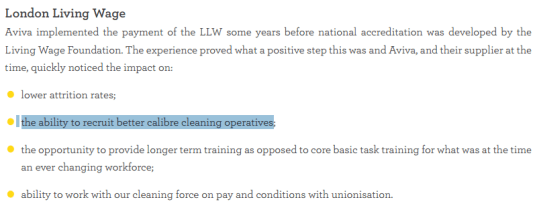

Research publicised by a Living Wage UK highlighted the Achilles heel of any living wage proposal. This Achilles heel applies to the voluntary adoption of the living wage and a living wage mandated through minimum wage laws.

The critique to follow accepts pretty much everything claimed by the living wage movement about the benefits of the living wage but simply traces out the consequence of this one promised benefit.

Source: New evidence of business case for adopting Living Wage Living Wage Foundation.

The living wage is substantially above the minimum wage. Offering the living wage will change the composition of the recruitment pool of low-wage employers. This is the Achilles heel of the living wage which Living Wage UK documents in its study it tweeted about and from which I have taken the above snapshot.

Jobseekers would not have considered vacancies by these employers will now apply because of the living wage increase. These better calibre applicants will win those jobs ahead of the jobseekers whose current productivity levels are less than that to justify the cost of the living wage.

Central to the living wage rhetoric is that somehow employees will be more productive because of the adoption of the living wage.

The simplest way of doing that for an employer is to hire more qualified, more productive employers are no longer a hire the type of people you currently hire. They will be unemployed or pushed into the non-living wage sector of the low-wage market.

Best 2 Minimum Wage Cartoons Ever, from Henry Payne, Updated for Seattle's $15 "Economic Death Wish" @HenryEPayne http://t.co/vatUzkHMss—

Mark J. Perry (@Mark_J_Perry) August 18, 2015

A living wage is an exclusionary policy where ordinary workers, often with families who are not productive enough to produce $19.25 per hour living wage plus overheads will never be interviewed.

The workers with the type of skills that currently win those jobs covered by a living wage increase will not be shortlisted because the quality of the recruitment pool will increase because of the living wage.

There will be an influx of more skilled workers attracted by the higher wages for living wage jobs. They will go to the head of the queue and displaced workers who currently apply for and win these jobs before the adoption of the living wage.

Any extra labour productivity from paying a living wage increase is in doubt because low skilled service sectors are notorious for their low potential for productivity gains. They are the bread-and-butter of Baumol’s disease.

The modern theories of the firm focus, in part or in full on reducing opportunistic behaviour, cheating and fraud in employment relationships. The cost of discovering prices and making and enforcing contracts and getting what you pay for are central to Coase’s theory of the firm put forward in 1937.

The profits of entrepreneurs for running a firm is directly linked from their successful policing of the efforts of employees and sub-contractors to ensure the team and each member perform as promised and individual rewards matched individual contributions (Alchian and Demsetz 1972; Barzel 1987). Alchian and Demsetz’s (1972) theory of the firm focused on moral hazard in team production. As they explain:

Two key demands are placed on an economic organization-metering input productivity and metering rewards.

The main rationale in personnel economics from everything ranging from employer funding of retirement pensions to the structure of promotions and executive pay including stock options is around better rewarding self-motivating employees who strive harder and reducing the costs of monitoring employee effort.

At bottom, the efficiency wage hypothesis is entrepreneurs are unaware of the higher quality and greater self-motivation of better paid recruits for vacancies but wise bureaucrats and farsighted politicians notice these gaps in the market. Bureaucrats and politicians notice these gaps in the market before those who gain from superior entrepreneur alertness to hitherto untapped opportunities for profit do so and instead leave that money on the table.

It’s kicking the living wage movement when it is down to mention that low paid workers with families will lose a considerable part of the living wage increase because of reductions in family tax credits and in-kind assistance from the government that are linked to their pay.

Their jobs are put at risk because of a large increase in the cost of employing them to their employers. Their take-home pay after taxes, family tax credits and other government assistance increases by much less. This is a pointless gamble with job security because of the much small increase in the take-home pay of many breadwinners on the living wage.

Happy birthday – you’re fired! #livingwage and youth job losses

04 Feb 2016 Leave a comment

in labour economics, labour supply, minimum wage, unemployment Tags: living wage, rational irrationality, teenage unemployment, The fatal conceit

The Dutch minimum wage increases with every birthday until the age of 23. Not surprisingly, there is a surge in job losses and a recession in hiring around birthdays. What is even worse is employment opportunities are redistributed from a group with a high rate of unemployment, teenagers and young people, towards prime age adults who have a much lower rate of unemployment.

Recent Comments