The present rate of technology adoption is nearly a vertical line —@blackrock https://t.co/3oS3YAI4ld—

Vala Afshar (@ValaAfshar) January 22, 2016

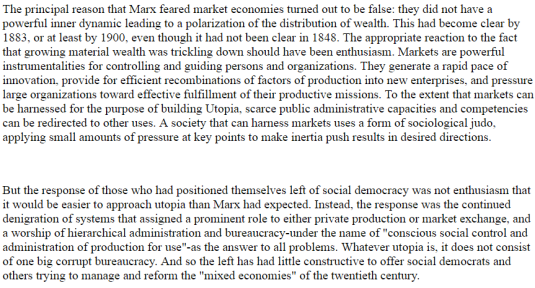

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

04 Aug 2016 Leave a comment

in economic history, labour economics, politics - USA, poverty and inequality Tags: child poverty, family poverty, technology diffusion, The Great Enrichment

The present rate of technology adoption is nearly a vertical line —@blackrock https://t.co/3oS3YAI4ld—

Vala Afshar (@ValaAfshar) January 22, 2016

30 Jul 2016 Leave a comment

in applied welfare economics, constitutional political economy, development economics, economic history, poverty and inequality

Source: Brad de Long, The Fall of the Soviet Union

19 Jul 2016 Leave a comment

in economic history, human capital, industrial organisation, labour economics, occupational choice, politics - Australia, poverty and inequality Tags: Australia, CEO pay, superstar wages, superstars, top 1%, top incomes

Australia has had a working rich for a long time now. Australian top income earners are top wage earners. They are athletes, celebrities, business executives and in the professions.

Source: The World Wealth and Income Database.

18 Jul 2016 Leave a comment

in applied welfare economics, economic history, human capital, industrial organisation, labour economics, occupational choice, politics - USA, poverty and inequality, survivor principle Tags: CEO pay, entrepreneurial alertness, superstar wages, superstars, top 1%, top incomes

The rich in the USA long ago became a working rich; most top incomes are from wages and salaries.

Source: The World Wealth and Income Database.

17 Jul 2016 Leave a comment

in economic history, human capital, labour economics, occupational choice, politics - New Zealand, poverty and inequality Tags: Leftover Left, pessimism bias, top 1%, top incomes, Twitter left

Max Rashbrooke was good enough to remind us that the 2013 update of New Zealand top income shares came online a few days ago.

As is well known to everyone except those obsessed with top income shares, New Zealand top income shares have not changed much since the late 1980s. They are now no higher than in the good old days when New Zealand was an egalitarian paradise in their eyes.

Source: The World Wealth and Income Database.

10 Jul 2016 Leave a comment

in applied welfare economics, economic history, economics, politics - New Zealand, poverty and inequality Tags: The Great Enrichment, The Great Escape

06 Jul 2016 Leave a comment

in economics of love and marriage, labour economics, labour supply, poverty and inequality, welfare reform Tags: child poverty, family poverty, single mothers, single parents

Looks like the greed of the top 1% was targeted exclusively as single parents since the 1980s. Child poverty in two-parent families has not risen much at all. These households often have jobs and will presumably be under the jackboot of neoliberalism stripping away their bargaining power through the decimation of unions and the introduction of the Employment Contracts Act. Despite these horrors, family poverty did not increase much if there are two parents in the house.

Source: Bryan Perry, Household Incomes in New Zealand: trends in indicators of inequality and hardship 1982 to 2014 – Ministry of Social Development, Wellington (August 2015), Table H.4.

Bryan Caplan argues that there is an undeserving poor if they fail to follow the following reasonable steps to avoid poverty and hardship:

05 Jul 2016 Leave a comment

in human capital, labour economics, labour supply, occupational choice, poverty and inequality Tags: creative destruction, entrepreneurial alertness, top 1%

The average top income in New Zealand is that of a professional, executive or entrepreneur.

Source: The World Wealth and Income Database.

03 Jul 2016 Leave a comment

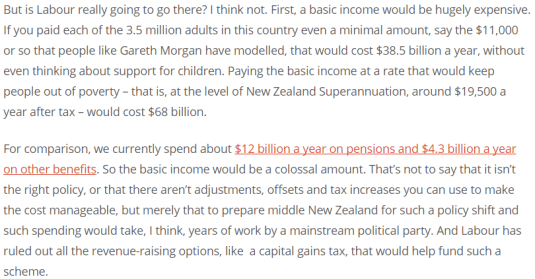

in applied welfare economics, politics - New Zealand, poverty and inequality, Public Choice, public economics

Rashbrooke in the snap-shot quote describes the massive new taxes to fund a universal basic income as a policy shift for which middle New Zealand must be prepared properly over many years. But the purpose of these great big new taxes is to ensure that those with whom the modern welfare state was designed to protect our left no worse off, not better off, just as good as they were under the previous regime of social insurance. Why take that journey when you can target their poverty directly to the current welfare state?

Source: Is Labour really going to deliver a UBI? – Inequality: A New Zealand Conversation.

29 Jun 2016 Leave a comment

in economics of education, economics of love and marriage, human capital, labour economics, occupational choice, poverty and inequality Tags: power couples, student loans

Those of European ethnicity had a median net worth of $114,000, compared with $23,000 for Māori , $12,000 for Pasifika and $33,000 for Asians according to the latest Statistics New Zealand data just released.

The Tertiary Education Union made great play about how much of the low net worth of young people and others is due to student loans

Young people (aged 15–24) had the lowest individual median net worth of any age group – just $1,000. The most common debt for young people is education loans.

The union then goes on to say that

Median education loan liabilities are only one-tenth of Pākehā people’s median assets, but they are a quarter of Māori people’s assets and over a third of Pacific people’s assets (table 7.01).

The data shows that the households with the smallest median net worth have the largest median education loans (table 2.02). These loans make up nearly a quarter of their total debt (table 2.03).

Over a third of households within the poorest quintile of net worth have education loans, whereas less than a tenth of households in the wealthiest quintile have education debt (table 2.04).

In a nutshell, not enough people are going to university because of the prospect of repaying student loans and more would go if it were cheaper and that would reducing inequality. The explosion in tertiary educational attendance over the last generation, an increase of about 150% for the adult population aged 25 to 64 was not good enough to reduce inequality.

Free tuition at University is a hand-out to those already had a good start in life. It will be paid for by those who will never go because they do not have an above average IQ.

How much more will you earn by going to university? It depends hugely on which country you're from http://t.co/7RMnUTM8nj—

paulkirby (@paul1kirby) September 11, 2015

Low-cost student loans were supposed to be away to reduce inequality. Instead, they give a flying start to those of already above-average talents. If social justice is to mean anything, it does not involve giving freebies to those who already have a head start in life.

The average student loan debt is about $14,000 while the lifetime earnings premium from university education is about $1/2 million in New Zealand.

Source: Statistics New Zealand, Household net worth statistics: Year ended 30 June 2015.

Lowering university tuition fees and easing the terms of student loans simply means that those who do well at university will not have to pay back as much to the government. People who succeed at university already have above average IQs so they already had a good head start in life.

Charles Murray points out that succeeded at college requires an IQ of at least 115 but 84% of the population don’t have this:

Historically, an IQ of 115 or higher was deemed to make someone “prime college material.” That range comprises about 16 per cent of the population. Since 28 per cent of all adults have BAs, the IQ required to get a degree these days is obviously a lot lower than 115.

Cheaper higher education does not help the not so smart secure a qualification they lack the innate talent to earn with decent marks and increases the chance of smart men and women marrying. This increases the inequality between power couples and the rest.

23 Jun 2016 Leave a comment

in discrimination, gender, labour economics, politics - New Zealand, poverty and inequality

Control over the number and spacing of women was central to women’s liberation. Young Labour and the Wild Greens forgot that last night on the BackbencherTV show. Neither could handle the notion that people should wait until they can afford to have children before having them. This is an old working class value with which the Young Labour panel member completely disagreed.

The number of children and the spacing between their births has been a major driver of the gender wage gap for decades. Central to greater female participation in the workforce and society outside the home is smaller families.

Many woman put-off having children to their late 20s and early 30s so they could first consolidate their education and career.

Bryan Caplan argues that there is an undeserving poor if they fail to follow the following reasonable steps to avoid poverty and hardship:

Raising a child takes a lot of effort and a lot of money. One poor person rarely has enough resources to comfortably provide this combination of effort and money.

Young Labour in particular has forgotten the old working class value of being a responsible parent able to afford to raise your children and give them the best things in life.

Being a parent is hard work that requires a bit of discipline if child poverty is to be avoided through ill-considered choices and a lack of family planning.

Young Labour has forgotten the policy of the Labour Party on family planning

Labour believes that all individuals should have control over their own sexual and reproductive lives. An individual’s choice to determine the number and timing of one’s children cannot be compromised.

To ensure that all people can make free and informed choices about their future, Labour supports safe, affordable and universal access to contraception, sexual and reproductive services and information. Labour recognises all women have the right to make their own choices about their own bodies, and should have access to abortion services

New Zealand has a high rate of unplanned pregnancies, estimated at between 40% and 60% of all pregnancies. Labour’s health spokesperson, Annette King agrees that it is a problem and for too long people have avoided dealing with it.

22 Jun 2016 Leave a comment

in applied welfare economics, politics - New Zealand, poverty and inequality, public economics

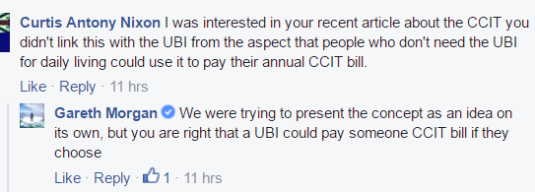

Before my two comments disappeared from Gareth Morgan’s Facebook page, I pointed out that his universal basic income of $11,000 per adult is as of last night at least triple pledged.

According to Gareth Morgan’s latest remark in the screenshot, people can use their universal basic income of $11,000 to pay their comprehensive capital tax bill. This new tax is proposed to fill the at least $10 billion gap in the funding of his universal basic income.

This is not possible because his universal basic income is already pledged to at least two other purposes that may use up a good part of the universal basic income of $11,000 per adult that he is proposing.

The first of these pledges is a by-product of adults under the age of 50 not being grandfathered in to the current level of generosity of New Zealand Superannuation – New Zealand’s universal old age pension.

Adults under the age of 50 under the Morgan Foundation’s universal basic income are expected to save part of their universal basic income. This saving is to make up for the $50 per week cut in New Zealand Superannuation when it is replaced by a universal basic income of $11,000 per adult. Gareth Morgan explains

Only people who are today under the age of 50 could be expected to retire under the UBI policy, the policy would not apply to existing superannuitants.

The key question is whether someone aged, say 40 today, would be better or worse off in retirement under the policy. And the answer is if they earn the average wage now, have an average house, they will tend to be neither better nor worse off.

For the 25 years prior to retirement they will receive the UBI on top of their wages. If they save a good portion of it they will have nest egg at retirement which they can use in retirement to supplement the UBI (which is more modest than today’s NZ Super).

In addition to this, the universal basic income makes those on a single parents benefit $150 a week worse off on the basic benefit that is not including lost accommodation supplements and additional child payments. The Morgan Foundation solution is to take part of the universal basic income of the other parent and give it to their children. Gareth Morgan explains again

It is totally feasible that the UBI of both parents could be required to be directed to support the children in the event of separation.

So in addition to the poor and ordinary families saving their universal basic income for as little as 15 years to making up for the $50 per week cut in support for old age pensioners, and the $150 plus cut in income support to single parents on a welfare benefit, the universal basic income also will be used to pay the comprehensive capital tax on the family home.

Somewhere buried in the universal basic income is it is the idea that it replaces existing welfare benefits. However, as most of the universal basic income has been pledged to other purposes such as saving for retirement, supporting children and paying the great big new tax in the family home, it will be very unwise to actually become unemployed, get sick, become a single parent or being invalid on the already meagre universal basic income as Geoff Simmons explains

With an unconditional basic income, most beneficiaries would be no better off than they are now (in fact sole parents would almost certainly receive a lower benefit).

There is a high risk that nothing will be left over from the Morgan foundation’s universal basic income to help you out when you fall in bad times because that universal basic income is already spoken for by your children, your retirement, and a capital tax bill.

Helping people out in times of misfortunes is the purpose of social insurance. The Morgan Foundation’s universal basic income fails this basic test set by Gareth Morgan

…let’s agree on what is a minimum income every adult should have in order to live a dignified life and then see what flows from that. We begin by specifying the income level below which we are not prepared to see anyone having to live.

At very best, and only very best, the Morgan Foundation’s universal basic income leaves some of those for whom social insurance was designed perhaps no worse. There are plenty of commonplace scenarios where individuals and families down on their luck are made much worse by a universal basic income replacing existing welfare benefits and plunged far deeper in poverty and hardship.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments