New technologies unfold daily, and consumer tastes change with rising incomes and the arrival of new products. Jobs will open in the expanding industries and disappear in the shrinking sectors.

A quarter or more of unemployment rate fluctuations over the business cycle could be due to variations in the rate that labour demand shifts across sectors. These sectoral reallocations in labour demand do not arise from mismatches between entrepreneurial forecasts and actual consumer demand.

The higher unemployment rate is not due to a bunching of technological upgrades in a recession. The above average number of sectoral shifts in labour demand is an independent cause of a temporarily higher natural rate of unemployment.

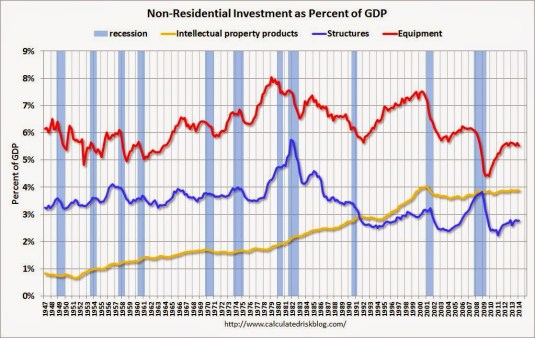

Lilien (1982) suggested that the amount of labour reallocation can change over time. Some periods may be marked by relatively homogeneous growth in labour demand across sectors, whereas others may be characterized by shifts in the composition of labour demand.

Lilien (1982) provided empirical estimates of the variation in the equilibrium unemployment rate from sectoral reallocation. He concluded that the wide unemployment fluctuations in the 1970s were largely induced by unusual structural shifts in the U.S. economy, which caused the equilibrium unemployment rate to fluctuate by about 3 percentage points over the decade!

An important factor behind business fluctuations arises not from the balance between aggregate output and aggregate consumption, but from the accuracy of entrepreneurial matching of the individual patterns of output with the pattern of actual consumer demand in individual sectors (Black 1987, 1995).

Fluctuations in the match between resource deployment to different sectors and product demand across sectors can create major fluctuations in output and employment because moving resources from one sector into another is costly and time consuming.

To a significant extent, observed fluctuations in the unemployment rate can be fluctuations in the natural rate of unemployment rather than deviations from that natural rate due, for example, to aggregate demand shocks. There will always be some unemployment. There will be new labour force entrants looking for jobs and workers who are between jobs.

The natural rate of unemployment is a long-run level of unemployment that cannot be altered by monetary policy. The natural rate of unemployment depends on the flexibility of wage contracts and labour market institutions, variations in labour demand and supply in individual markets, demographic change, the mobility of workers, unemployment benefits, the cost of gathering information about vacancies and available labour, labour market regulation and random variations in the rate of reallocation of jobs across industries and regions as technology advances and consumer tastes change.

Sectoral shifts in labour demand has a randomness about them because the size, pace and diffusion of technological advances across firms and industries is uneven (Andolfatto and MacDonald 1998, 2004).

The implications of technological progress for jobs has a further randomness because new technologies can displace existing jobs and create new jobs or renovate and update current equipment and employee skills (Mortensen and Pissarides 1998).

As a new technology diffuses, productivity will grow faster in the sectors that are adopting the new technology. During this implementation phase, which is slow, costly and may require considerable learning, there will be reorganisations to capitalise on the impending productivity gains. New technologies differ in the size of the improvement over existing methods and designs and in the difficulty of adopting the new methods. There will be lower growth in years where new technologies offer comparatively minor or less broadly applicable improvements on existing methods. Learning consumes resources, and attempts to learn a new technology through innovation or imitation diverts the resources of firms and workers away from production (Andolfatto and MacDonald 1998, 2004).

This unevenness in the pace and sectoral diffusion of technological progress will introduce unevenness in the rate of labour reallocation across sectors.

With both growing and shrinking sectors, employment may stagnate or fall for a time because the unemployed are searching for new jobs in different industries and perhaps in new occupations or are retraining.

A revival in growth in output and productivity in conjunction with initially poor employment growth is possible and has the attributes of a delayed recovery in employment (Andolfatto and MacDonald 2004).

Cross-sector job searches and the redirection of careers is a longer process than job search in the same industries and occupations. Job migration is more time consuming than the more traditional process of layoffs and rehiring by the same employer or in the same industry and occupation.

During periods of more intensive or above-average sectoral reallocation of labour demand, a mismatch can arise between the skills and experience of the workers who have exited the shrinking sectors and the immediate requirements of the expanding sectors. More workers than average can be moving into new sectors. Some of these job seekers may not be immediately viable candidates for the available jobs and may exert little downward pressure on wages.

There can be mismatch unemployment because the skills and locations of job seekers can be poorly matched with the locations of vacancies. Some local labour markets will have more workers than jobs. Others will have shortages. Job finding can depend on the rate at which the unemployed can retrain or move to locations with unfilled jobs, the rate at which jobs open in different locations and the rate at which workers vacate jobs in places with ready replacements (Shimer 2007).

Cyclical unemployment is a reversible response to lulls in aggregate demand. At the start of a recession, there is a general decline in demand, with few industries creating jobs to replace those that are lost.

As a recession ends, the unemployed are recalled by old employers or find new jobs in those industries as demand renews. Monetary and fiscal policy can aim to smooth these temporary job losses.

Job losses from structural changes in employment and technology are permanent. The sectoral location of jobs has changed. Workers must switch to new industries, sectors and locations or learn new skills.

A role for public policy is to facilitate this process of reallocation to new jobs and retraining.

Critics of the sectoral shifts approach point to the inherent difficulties of distinguishing between sectoral and cyclical movements in unemployment, due to cross-industry differences in sensitivity to aggregate fluctuations.

Recent Comments