TweetGMU Econ alum Holly Jean Soto busts the myth of “greedflation.” Scott Lincicome identifies an interesting contrast between the facts and opinion about China. George Will decries the spinelessness of the modern U.S. Congress. A slice: The incoming president will be able, on a whim, to unilaterally discombobulate international commerce — and the domestic economy…

Some Links

Some Links

12 Jan 2025 Leave a comment

in applied price theory, budget deficits, development economics, economic growth, economic history, economics of regulation, entrepreneurship, fiscal policy, global financial crisis (GFC), great recession, growth disasters, growth miracles, human capital, income redistribution, industrial organisation, international economics, job search and matching, labour economics, labour supply, macroeconomics, monetary economics, poverty and inequality, Public Choice, rentseeking, survivor principle, unemployment

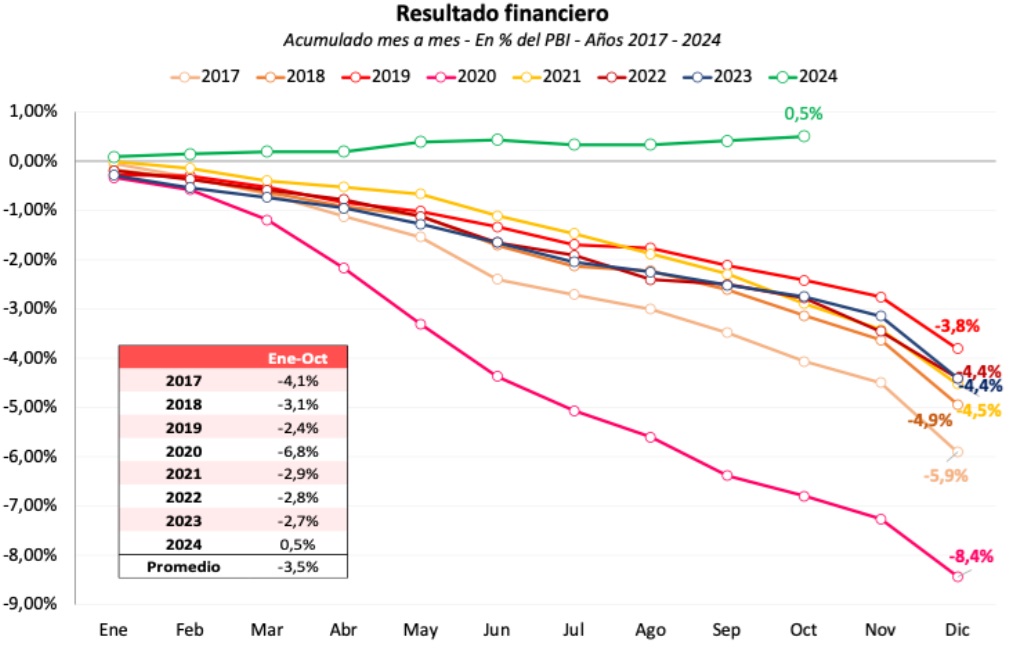

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

10 Jan 2025 Leave a comment

in applied price theory, Austrian economics, budget deficits, business cycles, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of regulation, financial economics, fiscal policy, growth disasters, growth miracles, history of economic thought, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetarism, monetary economics, political change, politics - USA, property rights, Public Choice, public economics, rentseeking, unemployment Tags: Argentina

It’s easy to mock economists. Consider the supposedly prestigious left-leaning academics who asserted in 2021 that Biden’s agenda was not inflationary. At the risk of understatement, they wound up with egg on their faces.* Today, we’re going to look at another example of leftist economists making fools of themselves. It involves Argentina, where President Javier […]

Left-Wing Economists Were Wildly Wrong about Javier Milei and his Libertarian Agenda for Argentina

Argentina facts of the day

29 Dec 2024 Leave a comment

in budget deficits, comparative institutional analysis, development economics, economic growth, economics of bureaucracy, economics of regulation, F.A. Hayek, financial economics, fiscal policy, growth disasters, income redistribution, international economics, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Milton Friedman, monetarism, monetary economics, property rights, Public Choice, rentseeking, unemployment Tags: Argentina

Argentina’s bonds have already rallied dramatically. One gauge of the nation’s hard-currency debt, the ICE BofA US Dollar Argentina Sovereign Index, has generated a total return of about 90% this year. Meanwhile, the S&P Merval Index has risen more than 160% this year through Monday, far outpacing stock benchmarks in developed, emerging and frontier markets […]

Argentina facts of the day

The Secretary to the Treasury defending govt fiscal policy

27 Dec 2024 Leave a comment

in budget deficits, economics of bureaucracy, fiscal policy, inflation targeting, macroeconomics, politics - New Zealand, Public Choice

I wasn’t envisaging writing anything more for a while, but….Welllington’s weather certainly isn’t conducive to either the beach or the garden, and the Herald managed to get an interview with Iain Rennie, the new Secretary to the Treasury (not usually the sort of stuff for 27 December either). I’ve always been rather uneasy about heads […]

The Secretary to the Treasury defending govt fiscal policy

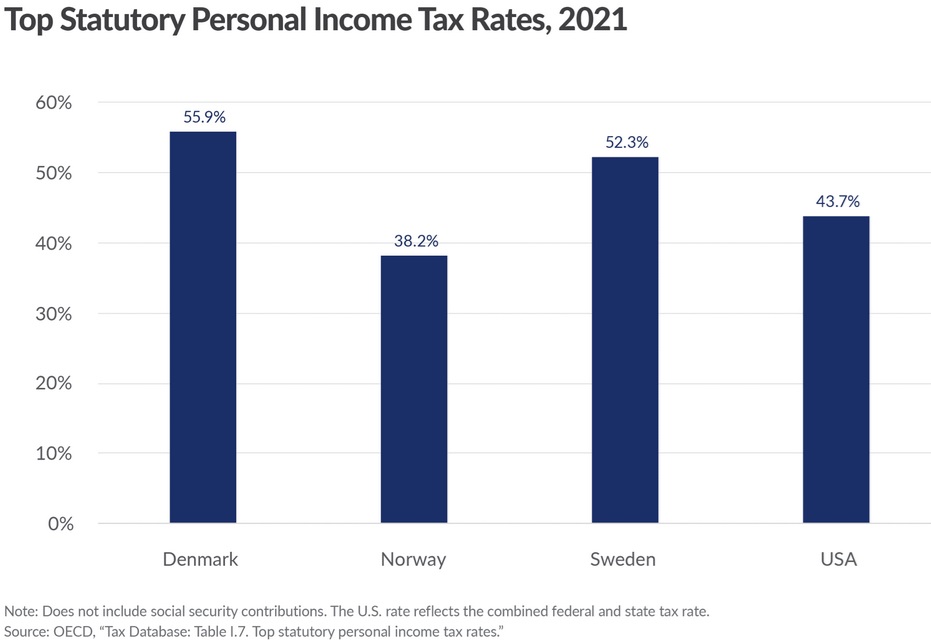

Bye and Bye: Washington State Moves To Toward a “Wealth Tax” As the Wealthy Move to Leave the State

26 Dec 2024 Leave a comment

in applied price theory, entrepreneurship, financial economics, fiscal policy, income redistribution, macroeconomics, Marxist economics, politics - USA, Public Choice, public economics Tags: regressive left, taxation and entrepreneurship, taxation and investment, taxation and savings, wealth tax

Washington State’s unofficial state motto has long been “Al-ki” which means either “bye and bye” or “by and by” in Chinook. The former meaning now seems official as Gov. Jay Inslee pushed for a “wealth tax.” Wealthy citizens are already saying bye to the state in anticipation of what one Democratic billionaire recently called a […]

Bye and Bye: Washington State Moves To Toward a “Wealth Tax” As the Wealthy Move to Leave the State

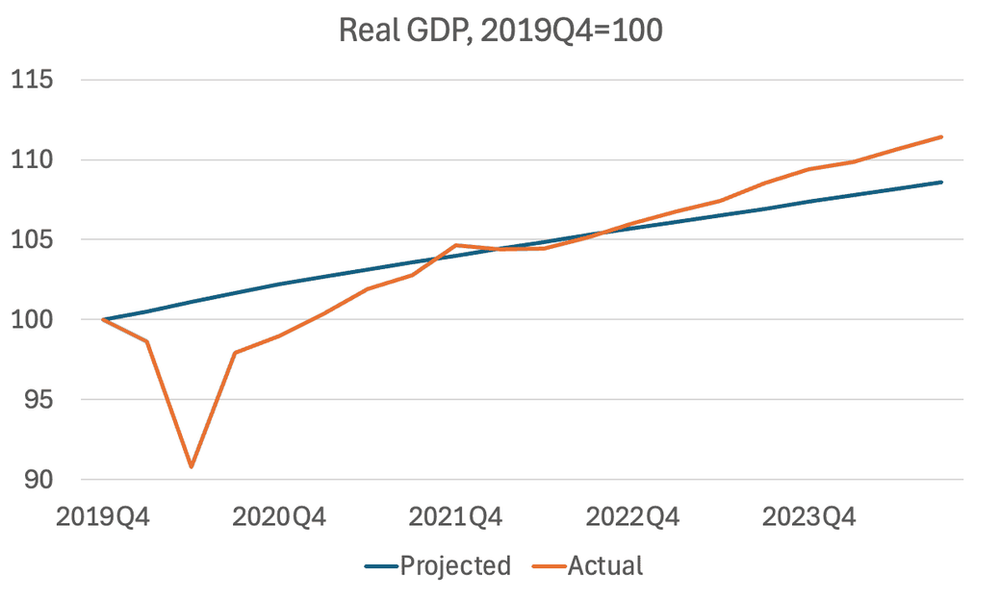

Nobel Laureate Paul Krugman’s GDP Graph Confirms the Bottom has Fallen Out of the New Zealand Economy

18 Dec 2024 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, macroeconomics, monetary economics, politics - New Zealand

High profile US Economist Paul Krugman has written a New York Times article in which he shows in one graph the incredible resilience and performance of the American Economy. The dark blue line below tracks the pre-pandemic long-run trend in Real GDP. Meanwhile the orange line is actual real GDP. Krugman remarks that now, in…

Nobel Laureate Paul Krugman’s GDP Graph Confirms the Bottom has Fallen Out of the New Zealand Economy

o1 explains why you should not dismiss Fischer Black on money and prices

08 Dec 2024 Leave a comment

in applied price theory, business cycles, economic growth, financial economics, fiscal policy, history of economic thought, macroeconomics, monetarism, monetary economics Tags: monetary policy

The prediction of inflation dynamics—how prices change over time—has increasingly confounded modern macroeconomists. Throughout much of the twentieth century, there seemed to be clear relationships linking the money supply, economic slack, and price levels. Monetarism, the school of thought that posits a stable connection between the growth rate of a money aggregate and the subsequent […]

o1 explains why you should not dismiss Fischer Black on money and prices

How is the Russian war economy doing?

08 Dec 2024 1 Comment

in applied price theory, defence economics, development economics, economic growth, economics of regulation, entrepreneurship, fiscal policy, growth disasters, income redistribution, industrial organisation, international economics, law and economics, macroeconomics, monetary economics, property rights, Public Choice, war and peace Tags: Russia, Ukraine

Here is a gloomy account from Vladimir Mirov: Ruble depreciation will contribute to inflation even further, as Russia is continued to be heavily reliant on imports – this is a kind of self-sustaining spiral. I also strongly disagree with those who say that cheaper ruble is “good” for exporters and the budget. Exporters have yet […]

How is the Russian war economy doing?

The no-confidence vote in France

04 Dec 2024 Leave a comment

in comparative institutional analysis, constitutional political economy, fiscal policy, law and economics, macroeconomics Tags: France

The French National Assembly is scheduled to vote tomorrow (4 Dec.) on a vote of no confidence against the government of Premier Michel Barnier. The premier has been in office only three months, having been appointed following (with some lag) the snap election President Emmanuel Macron had called in July, and which–predictably, given the timing–did […]

The no-confidence vote in France

The Consequences of Limiting the Tax Deductibility of R&D

03 Dec 2024 Leave a comment

in applied price theory, econometerics, entrepreneurship, fiscal policy, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment

We study the tax payment and innovation consequences of limiting the tax deductibility of research and development (“R&D”) expenditures. Beginning in 2022, U.S. companies are required to capitalize and amortize R&D rather than immediately deduct these expenditures. We utilize variation in U.S. firms’ fiscal year ends to test the effects of the R&D tax change […]

The Consequences of Limiting the Tax Deductibility of R&D

Usual suspects want more debt

30 Nov 2024 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, fiscal policy, labour economics, liberalism, macroeconomics, Marxist economics, monetary economics, politics - New Zealand, Public Choice, public economics, unemployment Tags: monetary policy

A group of economists have written to Nicola Willis complaining about the modest fiscal restraint imposed on the public sector. Grant Robertson grew government expenditure by $76 billion/year or a massive 7.6% of GDP, leaving NZ with a structural deficit. Many were champions of his policies or worked for him, and now they complain his […]

Usual suspects want more debt

Milei and populism

23 Nov 2024 1 Comment

in applied price theory, budget deficits, comparative institutional analysis, constitutional political economy, development economics, economic growth, economics of bureaucracy, economics of regulation, fiscal policy, growth disasters, income redistribution, macroeconomics, monetarism, monetary economics, Public Choice, rentseeking, unemployment Tags: Argentina

Bryan Caplan and Daniel Klein both opine on Milei and populism, Dan being very enthusiastic, while Bryan praising Milei but more reserved in his praise of populism. I too am a big fan of Milei, and I think he is still on a good track. If his reforms do not succeed, likely it will not […]

Milei and populism

Popuphobia’s Javier Milei Problem

22 Nov 2024 1 Comment

in development economics, economic growth, economics of bureaucracy, economics of regulation, fiscal policy, growth disasters, income redistribution, labour economics, law and economics, liberalism, libertarianism, macroeconomics, Marxist economics, monetary economics, property rights, Public Choice, public economics, rentseeking, unemployment Tags: Argentina

My dear friend and colleague Dan Klein wrote this. He loves feedback, so please share your thoughts in the comments. And he’d especially appreciate reactions from friends Shikha Dalmia and Nils Karlson, which I’d definitely be glad to run.P.S. Dan asked me to link to the latest Milei news.I define popuphobe as someone who propagates…

Popuphobia’s Javier Milei Problem

Trump’s victory: Golden age or fiscal reckoning?

14 Nov 2024 Leave a comment

in business cycles, economic growth, fiscal policy, industrial organisation, international economics, labour economics, law and economics, macroeconomics, monetary economics, politics - USA, property rights, public economics Tags: 2024 presidential election

Oliver Hartwich writes – In his victory speech, Donald Trump promised Americans a new “golden age”. While he had the numbers to win the election, the economic realities he faces will make delivering on his promise challenging. Trump’s victory reflects many Americans’ frustrations with living standards and inflation during the Biden-Harris administration. Vice President Kamala […]

Trump’s victory: Golden age or fiscal reckoning?

Recent Comments