Thomas Sargent on the conquest of American inflation

03 Oct 2019 Leave a comment

in budget deficits, business cycles, economic growth, economic history, fiscal policy, history of economic thought, inflation targeting, macroeconomics, monetary economics, politics - USA, Public Choice, unemployment Tags: real business cycles, unemployment and inflation

Money For Nothing: Inside the Federal Reserve – Trailer

21 Oct 2018 Leave a comment

in business cycles, economic growth, economics of bureaucracy, global financial crisis (GFC), great recession, inflation targeting, macroeconomics, monetary economics, politics - USA, Public Choice Tags: economics of central banking

Thomas Humphrey on the cost push theory of inflation fallacy that will not die

15 May 2018 Leave a comment

in inflation targeting, macroeconomics, monetary economics Tags: cost-push inflation

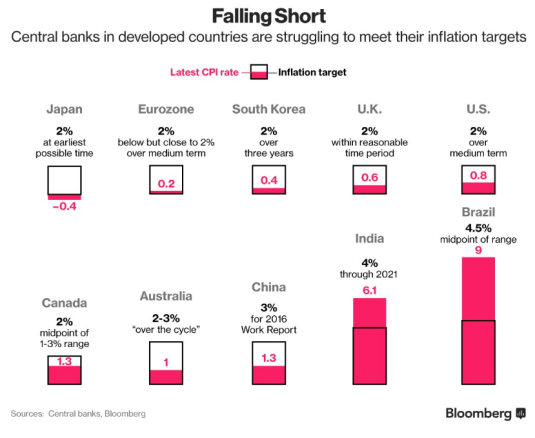

Monetary Policy: The Best Case Scenario

11 Aug 2017 Leave a comment

in business cycles, economics, inflation targeting, macroeconomics, monetarism, monetary economics Tags: monetary policy

NZ inflation rate since 1991 with 1% CPI bias adjustment

13 Sep 2016 Leave a comment

in economic history, inflation targeting, macroeconomics, monetary economics, politics - New Zealand Tags: CPI bias, inflation rate

The inflation rate is overstated by about 1% each year because of difficulties in measuring new goods entering the consumer price index and improvements in the quality of existing goods in the consumer price index. With that adjustment of 1% in the chart below, a common measure of that bias, New Zealand has had zero to negative inflation for four years

Source: Reserve Bank of New Zealand Key Statistics.

One of the reasons for an inflation target band of 1 to 3% is an inflation rate of 1% is actually an inflation rate of 0%.

% industrialised countries at zero or near zero central bank interest rates

04 Feb 2016 Leave a comment

in business cycles, currency unions, Euro crisis, global financial crisis (GFC), great recession, inflation targeting, macroeconomics, monetarism, monetary economics Tags: central banks, liquidity trap, monetary policy

Greg Mankiw on the zero influence of modern macroeconomics on monetary policy making

17 Sep 2015 1 Comment

in business cycles, history of economic thought, inflation targeting, macroeconomics, managerial economics, monetarism, monetary economics, organisational economics Tags: Alan Blinder, Alan Greenspan, credible commitments, Greg Mankiw, modern macroeconomics, monetary policy, neo-Keynesian macroeconomics, new classical macroeconomics, The Fed, timing inconsistency

Two of my brothers studied economics in the early 1970s and then went on to different paths in law and computing respectively. If Greg Mankiw is right, my two older brothers could happily conduct a conversation with a modern central banker. Their 1970s macroeconomics, albeit batting for memory, would be enough for them to hold their own.

Source: AEAweb: JEP (20,4) p. 29 – The Macroeconomist as Scientist and Engineer – Greg Mankiw (2006).

I would spend my time arguing with a central banker that Milton Friedman may be right and central banks should be replaced with a computer. The success of inflation targeting is forcing me to think more deeply about that position. In particular the rise of pension fund socialism means that most voters are very adverse to inflation because of their retirement savings and that is before you consider housing costs are much largest proportions of household budgets these days.

Much higher house prices and the political sustainability of a return of inflation

13 Sep 2015 1 Comment

in business cycles, economic history, global financial crisis (GFC), inflation targeting, macroeconomics, monetary economics, politics - New Zealand, urban economics Tags: expressive voting, housing affordability, inflation rates, median voter theorem, mortgage belt, mortgage rates, rational ignorance, rational rationality

Mortgage interest rates were last in the double digits in the late 1980s and early 1990s. Since then, housing prices have exploded in New Zealand and barely paused for the recession in the wake of the Global Financial Crisis.

Source: International House Price Database – Dallas Fed; Housing prices deflated by personal consumption expenditure deflator.

With house prices and mortgages several times what they used to be, the ability for any household income to absorb the sudden return of high mortgage interest rates because of a return of even moderate CPI inflation and double-digit mortgage rates is well-nigh impossible, politically.

Source: Reserve Bank of New Zealand Mortgage rates and Bryan Perry, Household Incomes in New Zealand: trends in indicators of inequality and hardship 1982 to 2014 – Ministry of Social Development, Wellington (August 2015) Table C.5.

The chart above shows that the number of 25 to 44-year-olds in New Zealand who have more than 30% of their income going to housing expenses has doubled since 1988 to nearly a third of all households. The number of 45 to 64-year-olds who pay more than 30% of their income in housing expenses has quadrupled to 20%. That is a lot of voters who would be offended by mismanagement of monetary policy.

None of these households would have much left over to absorb an increasing mortgage interest rates. That is very different political arithmetic too the last time both mortgage rates and CPI inflation were in double digits, which was more than 20 years ago. Not many New Zealanders under the age of 40 or 45 have an adult memory of high inflation and high mortgage rates.

The exchange rate “needs” to come down?

01 Aug 2015 Leave a comment

in inflation targeting, macroeconomics, monetary economics, politics - New Zealand Tags: central banking, forecasting errors, The fatal conceit, The pretence to knowledge

Anyone who had a good idea about what the the New Zealand dollar should be would be trading on their own account. These super-rich would not be wasting their time giving advice to others. Their time would be too handsomely rewarded for such meagre returns as pontificating to others as to what they should do with their portfolios.

https://twitter.com/JimRose69872629/status/626597273007296514

One of my delights as a bureaucrat was at a meeting between the Reserve Bank of New Zealand and the International Monetary Fund some 15 years or so ago

The Fund asked whether Bank whether it thought the exchange rate was too high, and what their exchange-rate modelling say about this?

- The reply of the Deputy Governor of the Reserve Bank of New Zealand was we don’t have exchange rate model because we don’t think there are any good. Gone are those days.

- The International Monetary Fund team was quite flabbergasted by this response.

At one stage the Fund team tried to draw me into the conversation about the level of New Zealand dollar because I was there representing the New Zealand Treasury. I was only attended as an observer, so naturally my response to their questions was to waffle incoherently. I could have been blunter and simply said the Reserve Bank of New Zealand spoke for New Zealand in this matter, but that would have been impolite.

I’ve been continuing to reflect on Graeme Wheeler’s repeated observation that New Zealand’s exchange rate “needs” to come down. I’m still not entirely sure what he means. The exchange rate is an asset price and presumably should reflect all expected future relevant information, not just spot information about current dairy prices. And the market has no particular reason to focus on stabilising the net international investment position at around current levels. Indeed, although it is a convenient reference point, neither does the Reserve Bank.

“Need” or not, I’d have thought it was likely that the exchange rate would fall further.

The ANZ Commodity Price Index, which lags behind (for example) falling GDT and futures dairy prices, has already had one of the larger falls in the history of the series.

Meanwhile, the fall in the exchange rate, while material, remains pretty small by the standards of past New Zealand adjustments…

View original post 165 more words

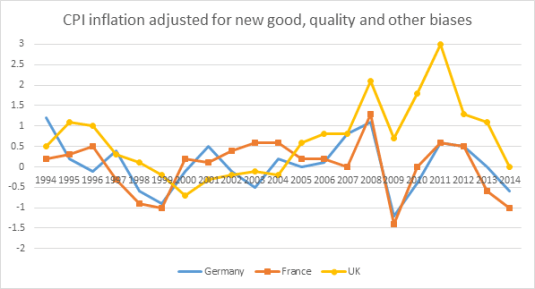

British, German and French inflation rates adjusted for 1.5% new goods and quality bias, 1994-2014

24 Apr 2015 Leave a comment

in economic history, inflation targeting, macroeconomics, monetary economics

There has been close to zero inflation in France and Germany for almost 20 years now. The UK had mild deflation between 1998 and 2005, followed by a spike in inflation.

Source: OECD StatExtract.

Note that the 1.5% bias adjustment includes other known biases in the CPI in addition to new goods and quality variation.

Recent Comments