LIVE from Parliament: 2025 Jonesie Awards

13 Feb 2025 Leave a comment

in budget deficits, economics of bureaucracy, fiscal policy, macroeconomics, politics - New Zealand, Public Choice, public economics

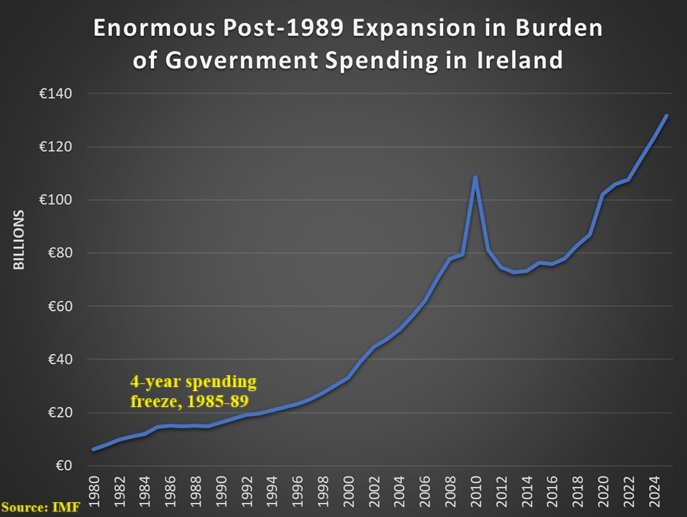

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

11 Feb 2025 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, fiscal policy, global financial crisis (GFC), great recession, labour economics, labour supply, law and economics, macroeconomics, monetary economics, public economics Tags: Ireland, taxation and investment

I’m a big fan of Ireland’s low corporate tax rate for three reasons. First, it shows that good tax policy generates positive economic outcomes as per-capita GDP in Ireland has grown by record amounts. Second, it shows that lower tax rates can in some cases lead to more revenue. Sort of a turbo-charged version of […]

Ireland: Good Corporate Tax Policy vs. Bad Government Spending Policy

Goldilocks and the Laffer Curve

09 Feb 2025 Leave a comment

in applied price theory, budget deficits, economic growth, entrepreneurship, fiscal policy, labour economics, labour supply, macroeconomics, politics - USA, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Other than Art Laffer, I think of myself as the world’s biggest advocate of the Laffer Curve. I’ve literally written hundreds of columns explaining and promoting the concept. My goal is to help people understand that there is not a linear relationship between tax rates and tax revenue. Why is this the case? Because when […]

Goldilocks and the Laffer Curve

By 2025 we were supposed to have closed the gap

05 Feb 2025 Leave a comment

in economic growth, economics of regulation, entrepreneurship, human capital, industrial organisation, labour economics, labour supply, macroeconomics, politics - New Zealand, poverty and inequality

Don Brash and Michael Reddell write – When Don was young and Michael’s parents were young, New Zealand had among the very highest material standards of living in the world. It really was, in the old line, one of the very best places to bring up children. But no longer. For 75 years now, with […]

By 2025 we were supposed to have closed the gap

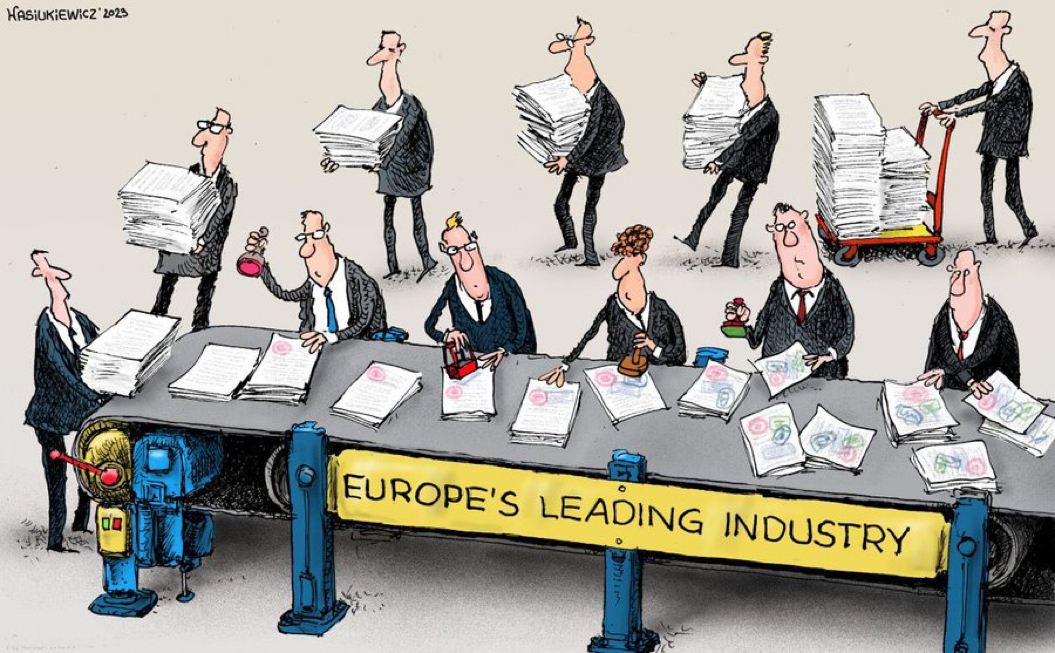

Mocking European Statism

04 Feb 2025 1 Comment

in applied price theory, Austrian economics, comparative institutional analysis, economic growth, economics of bureaucracy, economics of regulation, entrepreneurship, environmental economics, financial economics, industrial organisation, international economics, labour economics, labour supply, law and economics, liberalism, macroeconomics, Marxist economics, property rights, Public Choice, public economics, rentseeking, survivor principle, theory of the firm Tags: employment law, European Union

I have a special page for humor involving Europe, but I have not added to it since sharing some Brexit humor in 2016. Let’s being the process of catching up with some amusing cartoons and memes mocking our government-loving cousins on the other side of the Atlantic Ocean. I’ve made the serious point that bureaucrats […]

Mocking European Statism

Going for growth…..perhaps

04 Feb 2025 Leave a comment

in applied price theory, comparative institutional analysis, economic growth, economic history, economics of regulation, entrepreneurship, macroeconomics, politics - New Zealand

The Prime Minister’s speech 10 days or so ago kicked off a flurry of commentary. No one much anywhere near the mainstream (ie excluding Greens supporters) questioned the rhetoric. New Zealand has done woefully poorly on productivity for a long time and we really need better outcomes, and the sorts of policy frameworks that would […]

Going for growth…..perhaps

Can President Trump break the International Corporate Tax Cartel?

01 Feb 2025 Leave a comment

in entrepreneurship, financial economics, fiscal policy, industrial organisation, International law, macroeconomics, politics - USA, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment

From the Economist: The international tax system has long suffered from two related problems: firms go to great lengths to book profits in low-tax jurisdictions, and governments thus have strong incentives to compete with each other in cutting levies so as to attract investment [only a dirigiste would consider this a problem]. Hoping to forestall…

Can President Trump break the International Corporate Tax Cartel?

Reviewing Covid experiences and policies

01 Feb 2025 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economic growth, economics of bureaucracy, economics of regulation, health economics, macroeconomics, politics - New Zealand, Public Choice Tags: economics of pandemics

Michael Reddell writes – I’ve spent the last week writing a fairly substantial review of a recent book (“Australia’s Pandemic Exceptionalism: How we crushed the curve but lost the race”) by a couple of Australian academic economists on Australia’s pandemic policies and experiences. For all its limitations, there isn’t anything similar in New Zealand. What […]

Reviewing Covid experiences and policies

When did sustained economic growth begin?

31 Jan 2025 Leave a comment

in applied price theory, econometerics, economic growth, economic history, history of economic thought, labour economics, labour supply, macroeconomics, poverty and inequality Tags: The Great Enrichment

The subtitle is New Estimates of Productivity Growth in England from 1250 to 1870, and the authors are Paul Bouscasse, Emi Nakamura, and Jón Steinsson. Abstract: We estimate productivity growth in England from 1250 to 1870. Real wages over this period were heavily influenced by plague-induced swings in the population. Our estimates account for these […]

When did sustained economic growth begin?

Reviewing Covid experiences and policies

30 Jan 2025 Leave a comment

in applied price theory, applied welfare economics, economic history, economics of bureaucracy, economics of regulation, fiscal policy, health and safety, health economics, labour economics, labour supply, law and economics, macroeconomics, politics - Australia, politics - New Zealand, property rights, Public Choice Tags: economics of pandemics

I’ve spent the last week writing a fairly substantial review of a recent book (“Australia’s Pandemic Exceptionalism: How we crushed the curve but lost the race”) by a couple of Australian academic economists on Australia’s pandemic policies and experiences. For all its limitations, there isn’t anything similar in New Zealand. What we do have is […]

Reviewing Covid experiences and policies

Daron Acemoglu expects only a tiny macroeconomic impact of AI

26 Jan 2025 Leave a comment

in applied price theory, economic growth, entrepreneurship, industrial organisation, labour economics, labour supply, macroeconomics, unemployment

It would be fair to say that 2024 Nobel Prize winner Daron Acemoglu has been a bit of a sceptic about the impacts of generative AI (for example, see here). This scepticism is exemplified in a new paper forthcoming in the journal Economic Policy (ungated earlier version here). Acemoglu first notes that:Some experts believe that truly…

Daron Acemoglu expects only a tiny macroeconomic impact of AI

A pessimist’s reasons to be optimistic in 2025

22 Jan 2025 Leave a comment

in applied price theory, economics of regulation, entrepreneurship, industrial organisation, labour economics, law and economics, macroeconomics, politics - New Zealand

The year ahead: Oliver Hartwich reflects on nearly five decades of living through technological transformation – and finds a giant wellspring of optimism Oliver Hartwich writes – When Newsroom’s editor Jonathan Milne invited me to write one of two special pieces for the summer break, I faced quite the conundrum. My options were to either […]

A pessimist’s reasons to be optimistic in 2025

Everything is Pretty Damn Awesome

21 Jan 2025 Leave a comment

in economic growth, economic history, liberalism, macroeconomics Tags: The Great Enrichment

At the age of about 60, my wife began having terrible pain in her hip. For about a year, this greatly limited her ability to walk longer distances. One of her great joys, exploring new places on foot, was suddenly impossible to pursue. And then the pain got so bad that she could barely sleep,…

Everything is Pretty Damn Awesome

Good Riddance, Joe Biden

20 Jan 2025 Leave a comment

in applied price theory, budget deficits, economic growth, economic history, economics of regulation, energy economics, environmental economics, fiscal policy, global warming, industrial organisation, labour economics, macroeconomics, monetary economics, politics - USA, Public Choice, rentseeking, survivor principle Tags: 2024 presidential election, regressive left

This is the last full day of Joe Biden’s dismal presidency, so let’s do what we did with Justin Trudeau and reflect on his pathetic legacy. I’ve already provided my own economic assessment of Biden’s record, so now let’s review how he is seen by others. We’ll start with the American people. According to a […]

Good Riddance, Joe Biden

US Federal Reserve withdraws from global regulatory climate change group

19 Jan 2025 Leave a comment

in economics of climate change, economics of regulation, energy economics, environmental economics, environmentalism, global warming, macroeconomics, monetary economics, politics - USA

The Fed, which some claim is an unconstitutional body anyway, has noticed the US is changing its leader, so has performed a political manoeuvre by deciding that from now on ‘greening the financial system’ – whatever that means – is somebody else’s problem, officially at least. The decision follows on from various leading banks leaving […]

US Federal Reserve withdraws from global regulatory climate change group

Recent Comments