https://www.facebook.com/share/p/FUj6ygLReGRsZQBD/?mibextid=qi2Omg

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

31 Aug 2024 Leave a comment

in applied welfare economics, Austrian economics, comparative institutional analysis, constitutional political economy, development economics, economic growth, economic history, entrepreneurship, growth miracles, history of economic thought, human capital, income redistribution, industrial organisation, labour economics, labour supply, law and economics, liberalism, macroeconomics, Marxist economics, politics - New Zealand, poverty and inequality, property rights, Public Choice, rentseeking, technological progress Tags: child poverty, family poverty, The Great Enrichment

27 Aug 2024 Leave a comment

in budget deficits, business cycles, econometerics, economic growth, economic history, financial economics, fiscal policy, history of economic thought, inflation targeting, macroeconomics, monetary economics, politics - New Zealand Tags: monetary policy

Over the last few years, The Treasury seems to have been toying with bidding for a more significant role for fiscal policy as a countercyclical stabilisation tool It seemed to start when Covid hubris still held sway – didn’t we do well? – and the first we saw of it in public was at a […]

Fiscal and monetary policy

20 Aug 2024 Leave a comment

in economic growth, economic history, gender, history of economic thought, industrial organisation, labour economics, labour supply, macroeconomics, market efficiency, occupational choice, survivor principle, unemployment Tags: creative destruction

My tradition on this blog is to take a break (mostly!) from current events in the later part of August. Instead, I pre-schedule daily posts based on things I read during the previous year about three of my preoccupations: economics, editing/writing, and academia. With the posts pre-scheduled, I can then relax more deeply when floating…

Telephone Operators: The Elimination of a Job

19 Aug 2024 Leave a comment

in economic history, industrial organisation, macroeconomics, monetary economics, politics - USA Tags: 2024 presidential election, inflation, monetary policy

Who is advising this woman? In what universe do they think she can say this and at the same time fool enough voters that she hasn’t been part of the Biden Administration that has had these price hikes happen on their watch, on her watch. Did they not think that Trump’s campaign would run with […]

Election Rule #1: Don’t Support Your Opponent

16 Aug 2024 Leave a comment

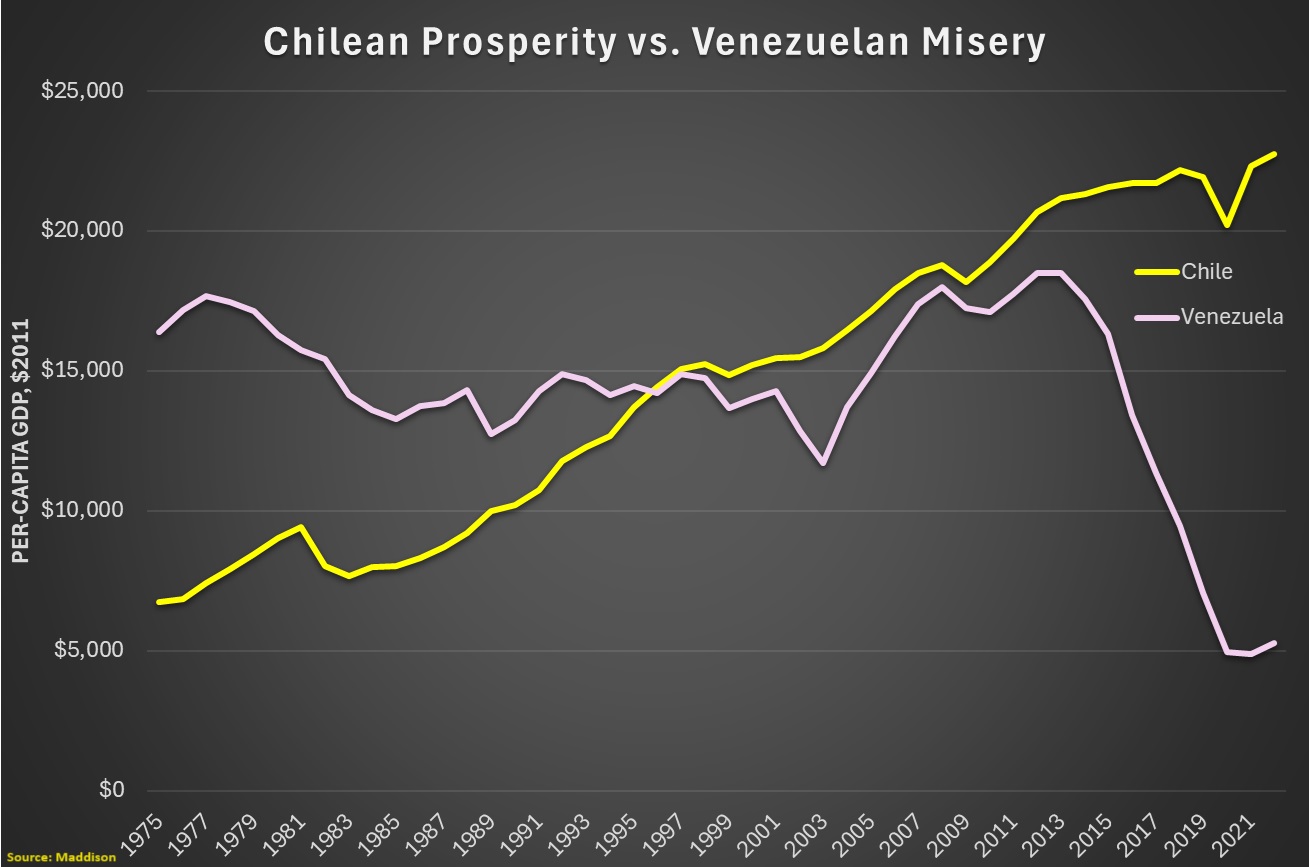

in development economics, economic growth, economic history, economics of regulation, entrepreneurship, growth disasters, growth miracles, history of economic thought, income redistribution, labour economics, law and economics, liberalism, macroeconomics, Marxist economics, Milton Friedman, politics - USA, poverty and inequality, property rights, Public Choice, public economics, rentseeking Tags: Chile, free speech, political correctness, regressive left, The Great Enrichment, Venezuela

I’ve repeatedly praised Chile’s pro-market reforms (see here, here, and here) and I’ve repeatedly condemned Venezuela’s shift to socialism (see here, here, and here). But if you don’t have time to read all those columns, this chart from the Maddison database tells you everything you need to know. Simply stated, Chile’s reforms have delivered huge […]

Friedman vs Stiglitz, Chile vs Venezuela

14 Aug 2024 Leave a comment

in budget deficits, business cycles, econometerics, economic history, financial economics, history of economic thought, inflation targeting, macroeconomics, monetary economics, politics - USA Tags: exchange rates, monetary policy

Exchange-rate models fit very well for the U.S. dollar in the 21st century. A “standard” model that includes real interest rates and a measure of expected inflation for the U.S. and the foreign country, the U.S. comprehensive trade balance, and measures of global risk and liquidity demand is well-supported in the data for the U.S. […]

Finally, exchange rate models seem to work pretty well

13 Aug 2024 Leave a comment

in applied price theory, comparative institutional analysis, constitutional political economy, development economics, economic growth, economic history, economics of bureaucracy, growth disasters, growth miracles, income redistribution, law and economics, macroeconomics, property rights, Public Choice, rentseeking Tags: The Great Enrichment

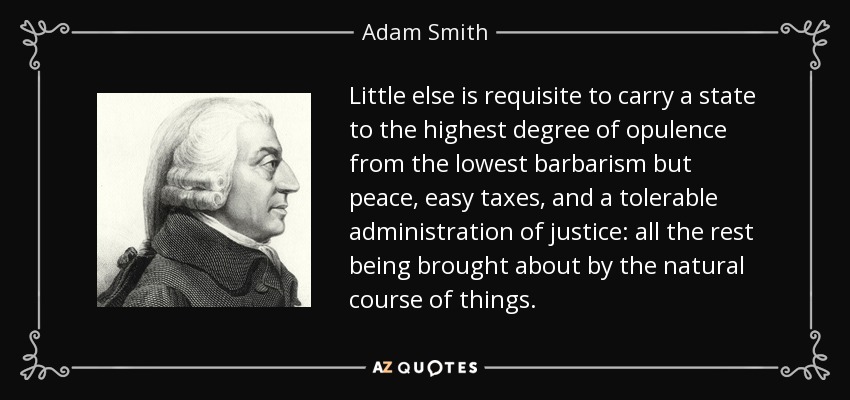

The recipe for economic growth is not complicated. You can put it in very simple terms, as Adam Smith did a few hundred years ago. Or you can develop and utilize data-heavy indexes like the ones published by the Fraser Institute and Heritage Foundation. In either case, the result will be the same. If you […]

The (Non) Mystery of Economic Growth

13 Aug 2024 Leave a comment

in history of economic thought, law and economics, macroeconomics, monetary economics, property rights Tags: bitcoin, Switzerland

Before anti-money laundering laws arrived in Switzerland, anyone could walk into a Swiss bank and open an account without showing any ID. The bank would then issue you something called a bearer savings book, otherwise known as inhabersparheften or livrets d’épargne au porteur. Ownership of the savings book was considered by the bank to be…

Stablecoins – a digital version of Swiss bearer savings books

11 Aug 2024 Leave a comment

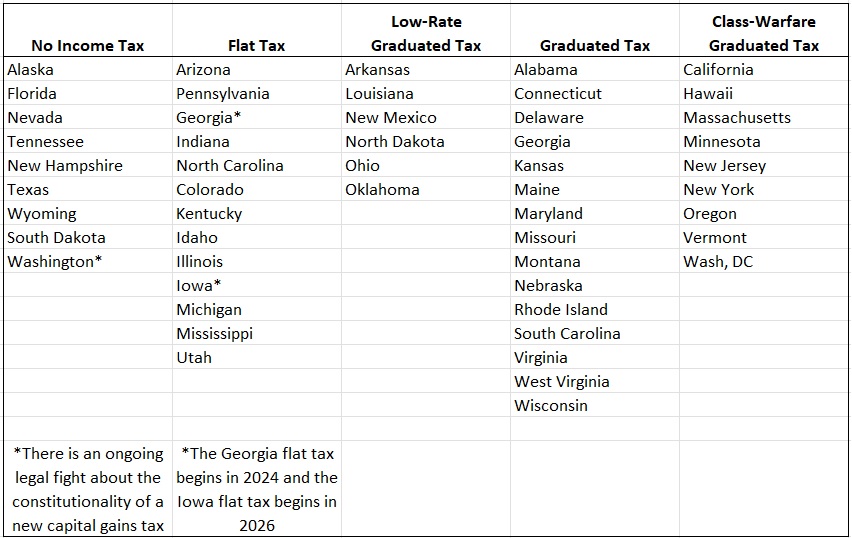

in applied price theory, applied welfare economics, economic growth, fiscal policy, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

Writing about Mitt Romney’s selection of Paul Ryan in 2012, I opined that, “…it probably means nothing. I don’t think there’s been an election in my lifetime that was impacted by the second person on a presidential ticket.” I feel the same way about Tim Walz, who is Kamala Harris’ pick for Vice President. But […]

Minnesota’s Failed Class-Warfare Tax Policy

05 Aug 2024 Leave a comment

in applied price theory, discrimination, economic growth, economics of bureaucracy, economics of crime, economics of regulation, gender, income redistribution, labour economics, law and economics, macroeconomics, Public Choice, public economics, rentseeking, urban economics Tags: British politics

She’s been one of the rising stars of the British Conservative Party for some time now, and I’ve covered stories about her before (Would be nice if a US Democrat said this about Critical Race Theory and A Tory warning for the National Party of 2032), but I’ve finally decided to add Kemi Badenoch as a tag […]

How Politicians Should Debate: Kemi Badenoch

01 Aug 2024 Leave a comment

in comparative institutional analysis, constitutional political economy, development economics, economic growth, economic history, history of economic thought, macroeconomics

See Socialists, Knowledge of History and Agency. These are letters to the editor of The WSJ in response to an article about socialism by Joseph Epstein. The one below reminded me of a 1992 article by Robert Samuelson in Newsweek. “Joseph Epstein’s “Socialists Don’t Know History” (op-ed, May 30, 2019) on the abysmal historical knowledge…

Joseph Schumpeter, Capitalism and Intellectuals

30 Jul 2024 Leave a comment

in applied price theory, budget deficits, business cycles, economic growth, economic history, history of economic thought, labour economics, macroeconomics, monetarism, monetary economics, unemployment Tags: monetary policy

The Fiscal Theory of the Price Level has been percolating among monetary theorists for over three decades: Eric Leeper being the first to offer a formalization of the idea, with Chris Sims and Michael Woodford soon contributed to its further development. But the underlying idea that the taxation power of the state is essential for […]

Thought and Details on the Fiscal Theory of the Price Level

28 Jul 2024 Leave a comment

in budget deficits, business cycles, economic growth, fiscal policy, inflation targeting, labour economics, macroeconomics, monetary economics, politics - New Zealand, unemployment Tags: monetary policy

I picked up The Post this morning to find the lead story headlined “Recession hits homes harder than businesses”, reporting a speech given earlier this week by Treasury’s deputy secretary and chief economic adviser Dominick Stephens. There was an account of the same speech, but with some different material, on BusinessDesk a couple of days […]

Treasury says one thing in a speech but quite another in the BEFU

27 Jul 2024 Leave a comment

in applied price theory, comparative institutional analysis, financial economics, law and economics, macroeconomics, monetary economics, politics - New Zealand, property rights Tags: digital currency

The Reserve Bank’s latest round of consultation on a possible central bank digital currency (CBDC) closes today. The thick and probably expensive (at least one of the documents was produced jointly with the consultancy firm Accenture) set of consultation documents came up a few months ago. I thought I had run out of time to […]

Not a good case for a CBDC

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Scholarly commentary on law, economics, and more

Beatrice Cherrier's blog

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Why Evolution is True is a blog written by Jerry Coyne, centered on evolution and biology but also dealing with diverse topics like politics, culture, and cats.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

A rural perspective with a blue tint by Ele Ludemann

DPF's Kiwiblog - Fomenting Happy Mischief since 2003

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

The world's most viewed site on global warming and climate change

Tim Harding's writings on rationality, informal logic and skepticism

A window into Doc Freiberger's library

Let's examine hard decisions!

Commentary on monetary policy in the spirit of R. G. Hawtrey

Thoughts on public policy and the media

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Politics and the economy

A blog (primarily) on Canadian and Commonwealth political history and institutions

Reading between the lines, and underneath the hype.

Economics, and such stuff as dreams are made on

"The British constitution has always been puzzling, and always will be." --Queen Elizabeth II

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

WORLD WAR II, MUSIC, HISTORY, HOLOCAUST

Undisciplined scholar, recovering academic

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Res ipsa loquitur - The thing itself speaks

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Researching the House of Commons, 1832-1868

Articles and research from the History of Parliament Trust

Reflections on books and art

Posts on the History of Law, Crime, and Justice

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Exploring the Monarchs of Europe

Cutting edge science you can dice with

Small Steps Toward A Much Better World

“We do not believe any group of men adequate enough or wise enough to operate without scrutiny or without criticism. We know that the only way to avoid error is to detect it, that the only way to detect it is to be free to inquire. We know that in secrecy error undetected will flourish and subvert”. - J Robert Oppenheimer.

The truth about the great wind power fraud - we're not here to debate the wind industry, we're here to destroy it.

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Economics, public policy, monetary policy, financial regulation, with a New Zealand perspective

Celebrating humanity's flourishing through the spread of capitalism and the rule of law

Restraining Government in America and Around the World

Recent Comments