Is there a Natural Resource Curse?

24 Mar 2018 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, constitutional political economy, development economics, economic history, growth disasters, growth miracles, international economics, Public Choice, public economics, rentseeking, resource economics Tags: resource curse

Why libertarianism is a marginal idea and not a universal value | Steven Pinker

10 Mar 2018 Leave a comment

in applied price theory, development economics, economic history, fiscal policy, growth disasters, growth miracles, income redistribution, Public Choice, public economics Tags: Director's Law, growth of government, Steven Pinker, Wagner's Law

The new corporate tax landscape

19 Dec 2017 Leave a comment

in fiscal policy, politics - New Zealand, politics - USA, public economics Tags: company tax

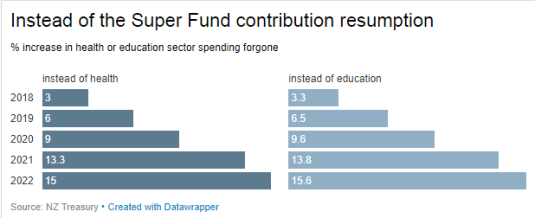

Instead of what? @NZSuperfund contribution resumption @taxpayersunion

14 Dec 2017 Leave a comment

in politics - New Zealand, public economics

Would it have been cheaper just to raise the eligibility age to 67 for New Zealand superannuation? By 2022, either health or education spending could have been 15% higher.

.@SenSanders opposed the reforms that caused this

14 Dec 2017 Leave a comment

in economic history, politics - USA, public economics Tags: top 1%

Reaganonomics to blame again

10 Dec 2017 Leave a comment

in economic history, politics - USA, public economics

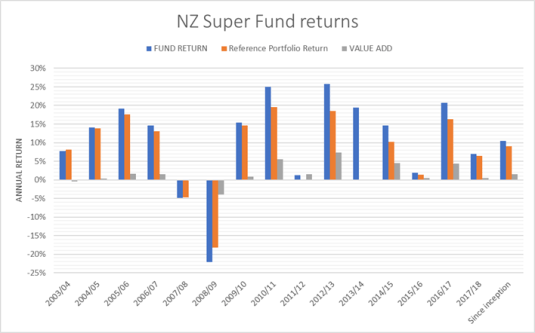

.@NZSuperFund still struggles to beat reference portfolio @TaxpayersUnion; 1.45% p.a. since inception

26 Nov 2017 Leave a comment

from https://www.nzsuperfund.co.nz/performance-investment/monthly-returns

Little wonder that no hedge fund headhunts from the New Zealand superannuation fund. Their staff turnover ratios are below 10% and often 5% and the CEO is paid a pittance by hedge fund standards.

Page 32 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/12SEI9p http://t.co/HYm0II2UNI—

Catherine Mulbrandon (@VisualEcon) May 08, 2013

Page 33 of "An Illustrated Guide to Income" more economic #dataviz at: bit.ly/10M7lqR http://t.co/FcmaqZWB32—

Catherine Mulbrandon (@VisualEcon) May 09, 2013

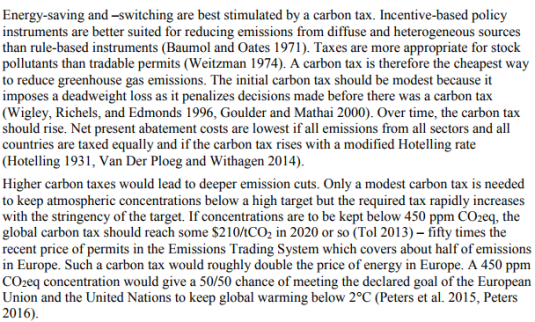

All you need to know about carbon tax pricing from @RichardTol

21 Nov 2017 Leave a comment

in applied price theory, energy economics, environmental economics, environmentalism, global warming, public economics

Source: Tol, Richard S J (2017) The structure of the climate debate. Energy Policy, 104. pp. 431-438.

Who pays taxes in the USA?

10 Nov 2017 Leave a comment

in politics - USA, public economics Tags: top 1%

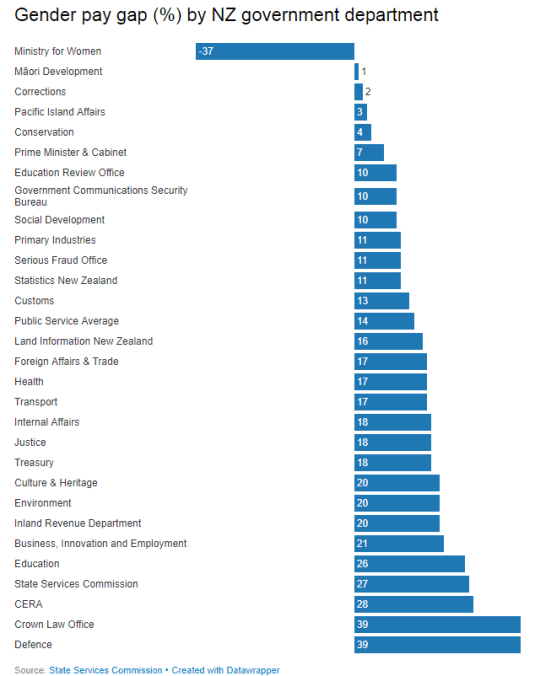

Why no pay equity at the Ministry of Women? @women_nz

05 Nov 2017 Leave a comment

in discrimination, gender, labour economics, labour supply, occupational choice, politics - New Zealand, public economics

Please no excuses like the recruitment pool is made up of too much of one gender and not enough of the other. The occupational choices and labour supply decisions of workers is never accepted as an excuse at the other end of this chart as valid reasons for departmental gender pay gaps.

Brexit will lower company tax rates everywhere

17 Oct 2017 1 Comment

in fiscal policy, politics - New Zealand, public economics

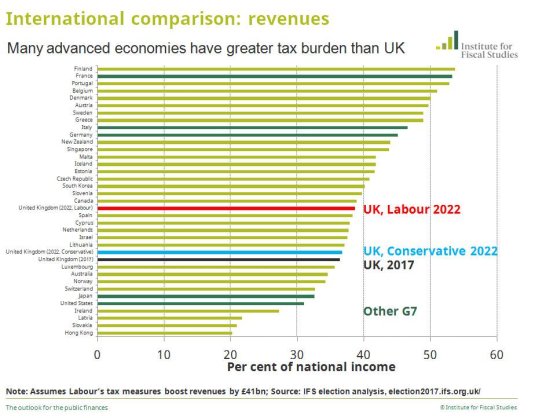

Brexit will turn the British Isles into one great big offshore tax haven. The post-referendum plans for a 15% company tax rate (and the Australian plans for a 25% company tax rate) will put pressure on New Zealand to follow suit.

A common argument against a much lower company tax in New Zealand is the clipping of the ticket argument. A lower company tax rate in New Zealand is said to mean no more than the higher after-tax dividends are taxed at a higher tax rate in the home country of the foreign investor. Less company tax is paid in New Zealand but more tax is paid back home for no net gain to the investor.

The 12 ½% Irish company tax rate attracted investment

The strongest evidence against this is the Irish were relentlessly bullied by the rest of the European Union over its 12 ½% company tax. The other EU finance ministers rightly feared a loss of investment to Ireland. This 12.5% rate applied initially to exports, then manufacturing and then trading profits. The fiscal bounty of the Celtic Tiger years allowed the Irish to finesse these complaints based on EU laws about fiscal discrimination by phasing their 32% general company tax rate down to 12 ½ %.

Our Minister of Finance certainly would not welcome the plans (Senate permitting) for a 25% company tax rate in Australia by 2026. Rather than rubbing his hands in anticipation of more tax revenues on dividends repatriated from New Zealand subsidiaries in Australia, Mr. English will worry about loss of domestic and offshore investment to a more competitive neighbouring tax jurisdiction.

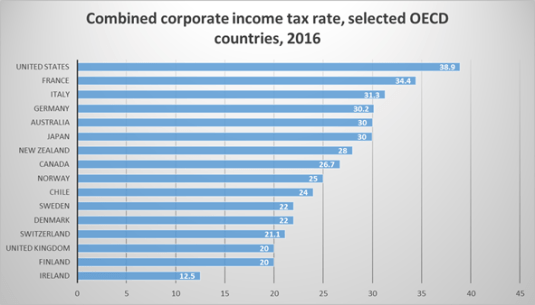

Source: OECD Stat.

The first big country low company tax rate

The British already have the lowest company tax of any major economy with the 20% company tax rate that started on 1 April 2016 (see graphic). This rate will fall to 19% on 1 April 2017, and 17% on 1 April 2020. Brexit will take that rate down to 15% at a date to be determined.

No Minister of Finance welcomes the prospect of a leading world economy and Europe’s key financial centre having by far the 2nd lowest company tax rate of any developed economy by 2020. They will worry about lost investment rather than expect a higher local tax take.

High company tax rates lower wages

Too many people mistakenly believe that company taxes are paid by shareholders through lower dividends. With capital highly mobile across borders, countries with high company tax rates attract less investment because of the lower after-tax returns relative to competing destinations.

This capital flight means lower wages in high company tax jurisdictions because their workers have less capital to work with. A lower company tax means higher wages because of more investment.

Even the USA is under pressure

The US got away with a very much above average company tax rate (38%) because its economy is so large relative to the rest of the world but it too is under pressure from footloose capital and corporate inversions. The US company tax system is so full of holes that if all tax loopholes were closed, its federal company tax rate could be cut from 35% to 9% with no net loss of revenue.

Leading US tax economist Laurence Kotlikoff estimated that this tax reform would increase wages by 8%, output by 6%, and the amount of capital invested by 17%. Australian Treasury modelling found that a 10-percentage point cut in their company tax rate would increase wages by 1.4% to 3%.

The race is on

The British company tax rate is now well below anywhere else bar one. That will force other countries, other big economies, to reconsider their position. New Zealand should not be left behind in harvesting the large wage increases that flow from a much lower company tax rate.

Room for honest disagreement on tax policy?

16 Oct 2017 6 Comments

in applied price theory, Public Choice, public economics

Too much of tax policy is debated with pistols drawn at ten paces. Each side accusing the other of ignorance or being steeped in moral turpitude, and preferably often both.

Far too much time is spent feuding over the incentive effects of taxes. If you inspect closely the history of the warring sides, they all agree that incentives matter. If you tax something, you see less of it; if you cut taxes, you will see more of it. The difficulty is the advocates for various causes are disappointingly selective about when they admit this is so.

Incentives do matter

Thomas Piketty could not be more honest about the impact of a higher top tax rate. Piketty welcomes the strong incentive effects of high marginal tax rates!

Why? Piketty wants to use high taxes to put an end to top incomes. He wants few to earn a large income and if they do, they should face ruinously high 70-80% marginal tax rates.

This honesty of Piketty is the basis of a ceasefire. Let us all admit that taxes have incentive effects and argue whether that is good or bad or that other considerations are more important than efficiency. Too often in debates over income tax cuts, the opponents will not give an inch on the labour supply and investment effects of lower taxes.

Incentives count, especially when they bolster your case

But when the same groups argue about poverty traps when welfare benefits are wound back or when tax rates and Working for Families abatement rates interact, they admit that work must pay. Ordinary families will work less and second earners may stop working.

Those deeply troubled about poverty traps from high effective marginal tax rates deny point blank that putting the top tax rate back up to 39% or more will harm labour supply, investment, entrepreneurship and the incentive to go on to higher education.

On taxes on sugar and tobacco, consumers are said to be fairly responsive to higher taxes. Unkind words are said about the motives of those that disagree with these taxes.

The opposition is about how taxes on sugary drinks is a waste of time unless they are prohibitively high because there is plenty of substitute sources of sugar and fattening foods.

A higher tobacco tax is much more likely to cut smoking because there is no reasonable substitute. If the Government really wanted people to quit smoking, rather than raise more revenue, they would legalise the sale of the safer alternative — e-cigarettes containing nicotine.

Opponents of company tax cuts are unwilling to admit that in highly integrated global capital markets that a lower company tax wins more investment. They say that more tax is paid in the home country of the foreign investor if we cut our company tax.

In the next breath, they will rage against Facebook and Google for avoiding New Zealand company taxes. This is despite their previous argument implying this tax avoidance must be futile because Facebook and Google will pay more taxes off-shore if they pay less company tax in New Zealand.

European Union politicians will say in domestic elections that company taxes do not deter investment but still relentlessly bully the Irish for its 12.5% company tax rate because it was winning more investment at their expense. What is the point of the EU and G20 push for tax harmonisation unless it is to stop competition for investment through lower company taxes?

Clashing value judgements

It is perfectly reasonable to agree on the effect of a particular tax policy but have an honest disagreement about its desirability. A higher top tax rate will not raise as much revenue as some hope but that may not matter if you want less income inequality. Sugar taxes may not reduce obesity by much, but it could be a useful first signal about healthy eating.

Others disagree because sugar taxes are ineffective and because people should be able to live their lives for better or for worse by their own lights as long as they do not harm others. People meddling in the lives of others because they know better has always ended in tears.

At least we should keep the conversation civil. Incentives matter. Taxes bite. The disagreement is over who you want the taxes to bite. By how much usually depends on by how you value the competing goals of efficiency, equality and liberty.

Recent Comments