No income tax to cut anymore until household incomes in the six figures!

31 Mar 2017 Leave a comment

The wage bump from 1% Oz company tax cut @TheAusInstitute @GrattanInst @JordNZ

31 Mar 2017 Leave a comment

in economic growth, fiscal policy, politics - Australia, politics - New Zealand, public economics Tags: company tax incidence, endogenous growth theory, optimal tax theory

How wasteful is the Oz company tax? @TheAusInstitute @GrattanInst

30 Mar 2017 Leave a comment

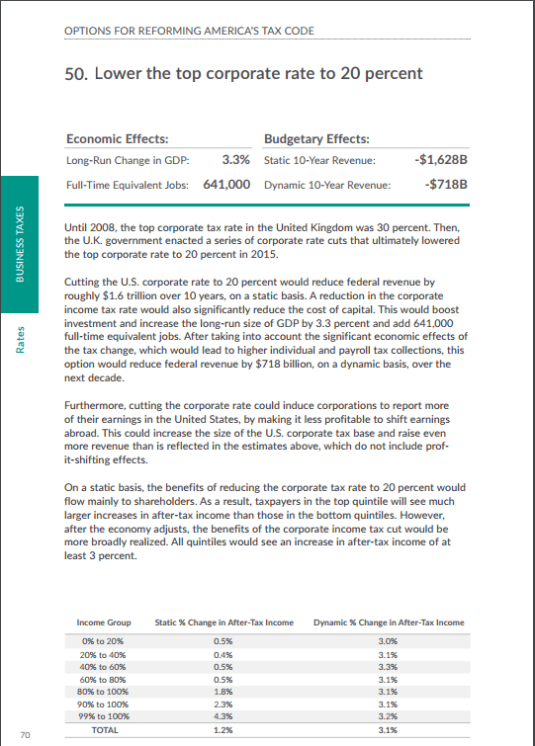

Source: The incidence of company tax in Australia, Xavier Rimmer, Jazmine Smith and Sebastian Wende, Australian Treasury working paper.

Morgan’s capital tax forgot 30% retirees move every 5 years @TaxpayersUnion

30 Mar 2017 Leave a comment

in politics - New Zealand, population economics, public economics Tags: 2017 New Zealand election, capital taxation, inheritance taxes, Opportunities Party, optimal tax theory

With 30% of retirees changing address every 5 years, they will have to downsize into hovels because they have to pay IRD the great big new tax on their capital championed by Morgan and his Opportunities Party well before they die.

Morgan’s 1.8% tax on equity capital is not an inheritance tax for the majority of retirees. It is a nest egg tax as they downsize after the kids fly the nest, grandchildren appear or they move to a more convenient place as they become frail.

Because they will have to pay back taxes of tens of thousands of dollars to IRD every time they sell their house, retirees either will not be able to move closer to family because of grand-children or health issues or they will have difficulty moving into a retirement home of their choice.

This is the first in a series of blogs showing how the Opportunities Party is too clever by half in its manifesto development. By insisting on having different policies to everybody else by a good country mile, it ends up having to take up the policies others rejected because they do not work.

In the case at hand, they put an inheritance tax on ordinary New Zealanders at the same rate as the rich including the founder of the Opportunities Party. This tax will be the only capital tax anywhere that is not progressive.

Over 70% of the retired own their own house mortgage free. The majority of that equity will now go to IRD plus interest by the time both members of the couple die given the average capital tax will be about $10,000 per year in Wellington and twice that in Auckland. They face up to 20 to 25 years of deferred capital taxation that will take half the value of their house easily. It will be hardest if they must cash-out their house to go into retirement home.

The purpose of buying a house is to have a nest egg for retirement. You may draw down that capital because of health issues or pass it on to children if you are luckier than that.

Morgan wants to radically change the way in which retirees go into the evening of their days. People who just managed to save for a house will have nothing to pass on to their children. No more bank of mum and dad either.

Sharp ratios of @NZSuperFund since inception @TaxpayerUnion

28 Mar 2017 Leave a comment

in financial economics, fiscal policy, politics - New Zealand, public economics Tags: sharp ratios, sovereign wealth funds

The Sharp ratio describes how much excess return you are receiving for the extra volatility that you endure for holding a riskier asset. If manager A generates a return of 15% while manager B generates a return of 12%, it would appear that manager A is a better performer. But if manager A took much larger risks than manager B, manager B may be a better risk-adjusted return.

The Sharpe Ratio such as those below of the NZ Superannuation Fund can be used to compare two funds on how much risk a fund had to bear to earn excess return over the risk-free rate.

Source:New Zealand Superannuation Fund response to Official Information Act request.

The Kidney Machine Gambit & @NZSuperFund @VernonSmall @TaxpayersUnion

27 Mar 2017 Leave a comment

in fiscal policy, politics - New Zealand, public economics, television Tags: sovereign wealth funds, Yes Prime Minister

Prime Minister Jim Hacker: “Well, of course we do what we can. There are many calls on the public purse: inner cities, schools, hospitals, kidney machines…”

98% top US economists disagree @NZSuperFund strategy @VernonSmall @JordNZ

24 Mar 2017 Leave a comment

in financial economics, fiscal policy, politics - New Zealand, public economics Tags: active investing, efficient markets hypothesis, passive investing, sovereign wealth funds

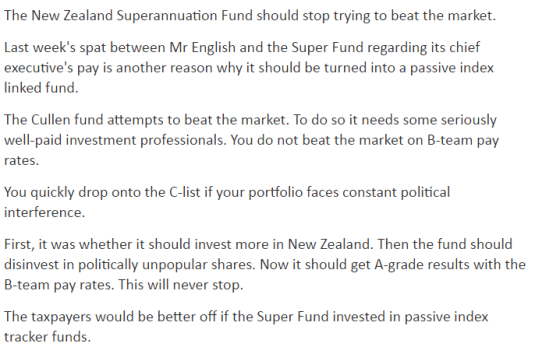

There is always one. Liran Einav had to be the only economist out of 100 or so top American and European economists who disagreed with the proposition that:

In general, absent any inside information, an equity investor can expect to do better by choosing a well-diversified, low-cost index fund than by picking a few stocks.

The New Zealand Superannuation Fund’s policy of active investing has one supporter out of 100 surveyed by the Initiative for Global Markets. I suppose it is better than none.

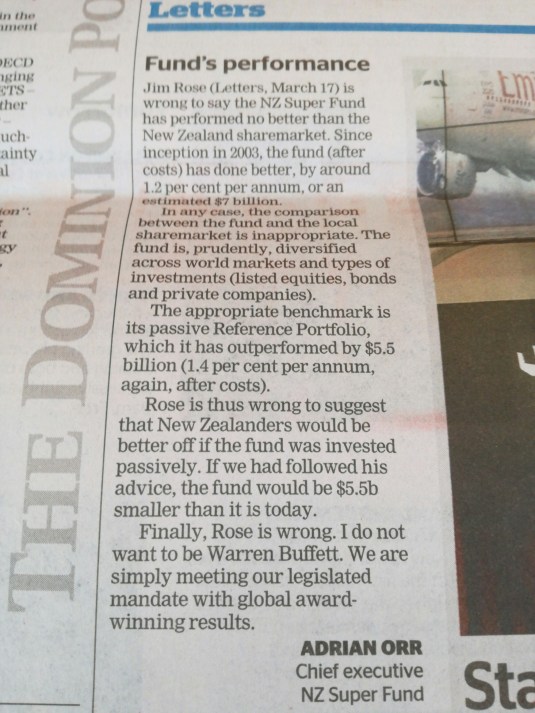

Letter to @DomPost on @NZSuperfund performance @Taxpayersunion utopiayouarestandinginit.com/2017/03/18/let… https://t.co/wxo6F1zZn5—

Jim Rose (@JimRose69872629) March 18, 2017

The chief executive of the fund quibbles by claiming there is a 3rd way between active and passive investing but there is not as William Sharp explained in his timeless 1991 article, The Arithmetic of Active Management:

- A passive investor always holds every security from the market, with each represented in the same manner as in the market. Thus if security X represents 3 per cent of the value of the securities in the market, a passive investor’s portfolio will have 3 per cent of its value invested in X. Equivalently, a passive manager will hold the same percentage of the total outstanding amount of each security in the market2.

- An active investor is one who is not passive. His or her portfolio will differ from that of the passive managers at some or all times. Because active managers usually act on perceptions of mispricing, and because such misperceptions change relatively frequently, such managers tend to trade fairly frequently — hence the term “active.”

An active fund is a fund that is not a passive fund. If you do not own a balanced portfolio of every security in the market, you are an active investor.

The majority of the New Zealand Superannuation fund is passively invested but some of it is not. It is invested in dogs like KiwiBank, in Z service stations and even in some bad Portuguese loans.

It’s "threadbare" to question @NZSuperFund’s investment strategy @TaxpayersUnion

23 Mar 2017 Leave a comment

There really is an issue on which economists are unanimous, a big issue to boot.

Source: Diversified Investing | IGM Forum.

Actively-managed mutual funds cannot earn excess returns over index funds because in aggregate they earn the same as index funds, less the difference in cost. This was proposed by Sharpe in his timeless 1991 article, The Arithmetic of Active Management.

Of course, certain definitions of the key terms are necessary. First a market must be selected — the stocks in the S&P 500, for example, or a set of “small” stocks. Then each investor who holds securities from the market must be classified as either active or passive.

- A passive investor always holds every security from the market, with each represented in the same manner as in the market. Thus if security X represents 3 per cent of the value of the securities in the market, a passive investor’s portfolio will have 3 per cent of its value invested in X. Equivalently, a passive manager will hold the same percentage of the total outstanding amount of each security in the market2.

- An active investor is one who is not passive. His or her portfolio will differ from that of the passive managers at some or all times. Because active managers usually act on perceptions of mispricing, and because such misperceptions change relatively frequently, such managers tend to trade fairly frequently — hence the term “active.”

… Properly measured, the average actively-managed dollar must underperform the average passively-managed dollar, net of costs. Empirical analyses that appear to refute this principle are guilty of improper measurement.

In 2008, Warren Buffett made a bet of $1 million with Protégé Partners LLC that, including fees, costs and expenses, an S&P 500 index fund would outperform a hand-picked portfolio of hedge funds over the 10 years ending December 31, 2017.

How much is Working for Families per year?

20 Mar 2017 Leave a comment

in fiscal policy, politics - New Zealand, public economics Tags: family tax credits

The last Labour Government so hated tax cuts that it would not call its family tax credit a family tax credit. For those on the minimum wage, it could increase your income by 1/3rd. Oddly enough, because of abatement rates of 22.5% after $36,000, two minimum wage earners do not get much at all.

Shouldn’t @NZSuperfund be funded by earmarked taxes? @TaxpayersUnion

19 Mar 2017 Leave a comment

in fiscal policy, macroeconomics, politics - New Zealand, public economics Tags: intergenerational equity, intergenerational justice, old age pensions, sovereign wealth funds

Pre-funding of New Zealand’s old age pension obligations requires contributions to the New Zealand Superannuation Fund now, higher taxes now in return for lower taxes later through the joys of compounding of the returns on the investments. If that is so, when the contributions are not made, the $3 billion in annual taxes should not be collected.

Source: Andrew Coleman, PAYGO vs SAYGO: Prefunding Government-provided Pensions, Motu Economics and Public Policy 26 Oct 2010.

There should be a separate New Zealand superannuation fund contribution levy that should lapse when contributions are suspended, as they were from 2009, and the pay-outs start after 2036? Otherwise, taxpayers will never see the promised lower taxes in the future. Never?

Source: Andrew Coleman Mandatory retirement income schemes, saving incentives, and KiwiSaver at http://www.treasury.govt.nz/publications/reviews-consultation/savingsworkinggroup/pdfs/swg-b-m-mris-24dec10.pdf

Constitutional political economy matters despite the reluctance of most who specialise in Social Security reform to think about that backend public choice risk. Unless there is iron-clad guarantee of lower taxes in the future, the whole deal about pre-funding superannuation pay-outs is a con.

That politicians can pass a law in 2003 to pre-fund old-age pensions 40 years hence and expect the politicians of 2036 and onwards to honour the deal with tax cuts is politically naive.

Efficient taxes lead to higher taxes

19 Mar 2017 1 Comment

in economic growth, fiscal policy, macroeconomics, public economics Tags: growth of government, size of government

My op-ed on the NZ super fund in the New Zealand Herald

18 Mar 2017 Leave a comment

The remainder of the op-ed can be found at http://www.nzherald.co.nz/opinion/news/article.cfm?c_id=466&objectid=11808972

Recent Comments