The Miami Herald reports: A stunning 10% of Cuba’s population — more than a million people — left the island between 2022 and 2023, the head of the country’s national statistics office said during a National Assembly session Friday, the largest migration wave in Cuban history. Isn’t it such a weird coincidence that the queue […]

Communism still doing well in Cuba

Communism still doing well in Cuba

05 Aug 2024 Leave a comment

in comparative institutional analysis, constitutional political economy, development economics, economic history, economics of bureaucracy, economics of crime, growth disasters, income redistribution, labour economics, labour supply, law and economics, Marxist economics, property rights, Public Choice, public economics Tags: Cuba

Talking BBB with Veronique de Rugy

03 Aug 2024 Leave a comment

in applied price theory, comparative institutional analysis, economic history, economics of bureaucracy, economics of regulation, income redistribution, law and economics, politics - USA, property rights, Public Choice, public economics, rentseeking, urban economics Tags: housing affordability, land supply

Here’s a lively AIER podcast on Build, Baby, Build with the one and only Veronique de Rugy. Best French libertarian since Bastiat? Décider vous-même!P.S. Capla-Con 2024 starts two weeks from tomorrow in Fairfax, Virginia. You’re all invited! Feel free to coordinate ride-sharing in the comments.

Talking BBB with Veronique de Rugy

Which are the most effective subsidies for green energy?

26 Jul 2024 Leave a comment

in applied price theory, applied welfare economics, economics of regulation, energy economics, environmental economics, global warming, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: cap and trade, carbon tax, climate alarmism

That is the topic of my latest Bloomberg column, here is one excerpt: A recent study finds that, of all domestic subsidies, the most effective involve replacing the dirty production of electricity with the cleaner production of electricity. In practice, that means subsidies or tax credits for solar and wind power. Those are more than twice as effective as […]

Which are the most effective subsidies for green energy?

Current state of knowledge on the Trump tax cuts

25 Jul 2024 Leave a comment

in applied price theory, econometerics, economic history, fiscal policy, macroeconomics, politics - USA, public economics Tags: taxation and entrepreneurship, taxation and investment

That is the topic of my latest Bloomberg column. Here is one summary excerpt: One result: Total tangible corporate investment went up by about 11%. That has been a welcome shot in the arm for an economy that was by some measures suffering from an investment drought. The strong state of the Biden economy may, in…

Current state of knowledge on the Trump tax cuts

Treasury wanting to use fiscal policy more

23 Jul 2024 Leave a comment

in fiscal policy, macroeconomics, monetary economics, politics - New Zealand, public economics Tags: monetary policy

Government departments are now all required by law to write and publish a Long-term Insights Briefing at least every three years. and they have to consult the public on both choice of topic and the draft report The Public Service Commission gives its take on these provisions here Count me more than a little sceptical. […]

Treasury wanting to use fiscal policy more

Will France Opt for Bernie Sanders-Style Taxation?

23 Jul 2024 Leave a comment

in applied price theory, entrepreneurship, income redistribution, Public Choice, public economics Tags: France, regressive left, taxation and entrepreneurship, taxation and investment

Some folks on the left have a deep-seated resentment of successful investors, entrepreneurs, business owners, and other high-income people. They want to hit them with confiscatory tax rates, even if the tax is so punitive that the government doesn’t wind up with more revenue. Heck, some of them are so consumed by hate and envy […]

Will France Opt for Bernie Sanders-Style Taxation?

Hayley Hooper: Historical Origins of the ‘Principle of Legality’ in British Public Law

30 Jun 2024 Leave a comment

in economic history, economics of bureaucracy, law and economics, Public Choice, public economics Tags: British constitutional law

In 2021 the then Lord Chancellor Robert Buckland QC MP cited the principle of legality as an example of an aspect of public law that might ‘take on a life of [its] own, and lead to the courts overreaching.’ In the simplest terms, the principle of legality is a common law rule of statutory interpretation […]

Hayley Hooper: Historical Origins of the ‘Principle of Legality’ in British Public Law

Murphy’s Law of Economic Policy

21 Jun 2024 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, economics of bureaucracy, economics of regulation, history of economic thought, Public Choice, public economics

Economists have the least influence on policy where they know the most and are most agreed; they have the most influence on policy where they know the least and disagree most vehemently.” I’d never heard of it before and it’s quoted in this review of a book called “Free Lunch Thinking – How Economics Ruins […]

Murphy’s Law of Economic Policy

JORDAN WILLIAMS: We can’t afford cancer drugs, but can afford this?

20 Jun 2024 Leave a comment

in health economics, politics - New Zealand, public economics

While cancer patients wait for the Government to “find the money” to fund desperately needed modern drugs, the very money meant for health research and saving lives is being flushed down the toilet. At our weekly staff meeting this morning, the research team took me through the latest batch of grant funding decisions by the…

JORDAN WILLIAMS: We can’t afford cancer drugs, but can afford this?

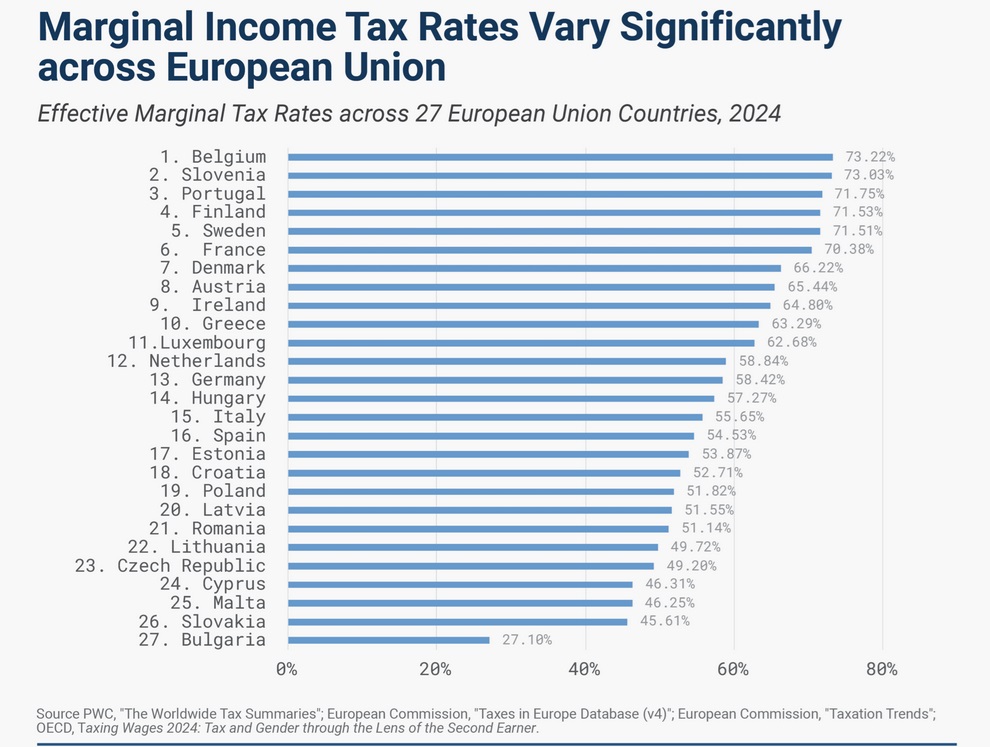

A Primer on Marginal Tax Rates, Part IV: The Combined Burden of Levies on Income, Payroll, and Consumption

02 Jun 2024 Leave a comment

in Public Choice, public economics Tags: taxation and investment, taxation and labour supply

When I think of the world’s most mistreated taxpayers, a few options come to mind. Cam Newton, the quarterback who faced a marginal tax rate of nearly 200 percent on his Super Bowl bonus. The 8,000 French households who had to surrender more than 100 percent of their income in 2012. The unfortunate Spanish laborer […]

A Primer on Marginal Tax Rates, Part IV: The Combined Burden of Levies on Income, Payroll, and Consumption

“Democracy is on the Ballot”: California Democrats Seek to Prevent Voters from Approving New Taxes

01 Jun 2024 Leave a comment

in constitutional political economy, income redistribution, law and economics, Public Choice, public economics Tags: constitutional law

“Democracy is on the ballot.” That mantra of President Joe Biden and other democrats has suggested that “this may be our last election” if the Republicans win in 2024. A few of us have noted that the Democrats seem more keen on claiming the mantle of the defenders of democracy than actually practicing. Democrats have […]

“Democracy is on the Ballot”: California Democrats Seek to Prevent Voters from Approving New Taxes

Karen Chhour Skewers The Maori Party

31 May 2024 Leave a comment

in economic history, economics of crime, economics of education, income redistribution, labour economics, law and economics, liberalism, Marxist economics, politics - New Zealand, poverty and inequality, property rights, Public Choice, public economics Tags: child abuse, child poverty, crime and punishment, family poverty, law and order

Article is by Chris Lynch and I have pinched this one from The BFD Blog. `ĀCT MP Karen Chhour has responded to the Maori Party’s “divisive outbursts.” Co-leader Rawiri Waititi said yesterday, ‘It’s now time for us to step comfortably into our rangatiratanga and to not give too much to this Pakeha Government with their […]

Karen Chhour Skewers The Maori Party

Development Policies with the Best Benefit-Cost Ratios

29 May 2024 Leave a comment

in applied price theory, applied welfare economics, development economics, econometerics, growth disasters, growth miracles, public economics

In a world with lots of problems and even more proposed policies to address each of these problems, it makes sense to study the possibilities–and then to prioritize policies with highest estimated ratio of benefits to costs. The Copenhagen Consensus think tank carried out this exercise and came up with 12 policies. A special issue…

Development Policies with the Best Benefit-Cost Ratios

India, Dependency, and the 17th Theorem of Government

28 May 2024 Leave a comment

in applied price theory, development economics, economic history, financial economics, growth disasters, growth miracles, income redistribution, macroeconomics, Public Choice, public economics, rentseeking Tags: India

I released my First Theorem of Government in 2015 and today I’m going to unveil the 17th iteration in the series. But I’ll confess upfront that I’m doing a bit of recycling. My latest Theorem is very similar to something I shared back in 2014. I decided to upgrade my 2014 column to a Theorem […]

India, Dependency, and the 17th Theorem of Government

Claude 3 on why the US leads China and the EU in economic dynamism

21 May 2024 Leave a comment

in applied price theory, comparative institutional analysis, development economics, economics of regulation, entrepreneurship, growth miracles, industrial organisation, managerial economics, organisational economics, public economics, survivor principle Tags: taxation and entrepreneurship, taxation and investment

QUESTION TO CLAUDE 3: The EU and China lag behind the US in economic dynamism, measured by start-up activity, number of unicorns, age of unicorns (younger indicates more rapid innovation), and in productivity growth. Can you document this and tell me why?ANSWER: Here is the data to document the economic dynamism gap between the US,…

Claude 3 on why the US leads China and the EU in economic dynamism

Recent Comments