London is (very) different – Europe edition. Chart from today's UK productivity plan. #summerbudget http://t.co/PbZqAdVvFe—

RBS Economics (@RBS_Economics) July 10, 2015

London is different

11 Jul 2015 Leave a comment

in urban economics Tags: agglomeration, British economy, London

It usually begins with the RMA – fewer warm, dry homes as an unintended consequence of regulatory restrictions on land supply

10 Jul 2015 1 Comment

in applied welfare economics, economics of regulation, industrial organisation, labour economics, law and economics, politics - New Zealand, poverty and inequality, property rights, survivor principle, urban economics Tags: consumer products standards, do gooders, economics of regulation, nanny state, offsetting behaviour, rent control, The fatal conceit, The pretence to knowledge, urban economics

The Government admits that its proposed insulation and smoke alarm standards for rental properties could push up rents by more than $3 a week. Under legislation to be introduced in October, social housing would have to be retrofitted with ceiling and underfloor insulation by next July, and all other rental homes by July 2019.

An important driver of lower quality housing in New Zealand is the restrictions on land supply. The costs of those restrictions, land makes up 60% of the cost of new houses rather than 40%. Land prices have doubled and tripled in a number of cities. As the Ministry of Business, Innovation and Employment has said:

The median price of sections has increased from $94,000 in 2003 to over $190,000 today (compared with $NZ 100,000 per section in the US), ranging from Southland ($82,000) to Auckland ($308,000)…

Section costs in Auckland account for around 60% of the cost of a new dwelling, compared with 40% in the rest of New Zealand.

The RMA is the Resource Management Act and was passed just before New Zealand housing prices started to rise rapidly.

Source: Dallas Fed; Housing prices deflated by personal consumption expenditure (PCE) deflator.

Higher land prices for new houses spill into the prices of existing houses, which are now much more expensive than they need to be but for the RMA inspired land supply restrictions in Auckland and elsewhere in New Zealand.

One way in which homeowners and landlords can keep costs down when buying a house either for their own use or as an investment property is not to invest in insulation and smoke alarms. Deposits are less, mortgages are less and rents are less. It all adds up.

$3 is not much for some but it is enough that some parents cannot find $3 or so per week to feed their children breakfast. Joe Trinder, the Mana News editor blogged about the great expense of feeding the kids for ordinary families.

Put simply, you cannot argue that a few dollars is a lot of money to people on low incomes but ignore the consequences for their welfare of a $3 per week increase in their rents.

If tenants were willing to pay for insulation, landlords would provide well-insulated rental properties to service that demand. Walter Block wrote an excellent defence of slumlords in his 1971 book Defending the Undefendable:

The owner of ghetto housing differs little from any other purveyor of low-cost merchandise. In fact, he is no different from any purveyor of any kind of merchandise. They all charge as much as they can.

First consider the purveyors of cheap, inferior, and second-hand merchandise as a class. One thing above all else stands out about merchandise they buy and sell: it is cheaply built, inferior in quality, or second-hand.

A rational person would not expect high quality, exquisite workmanship, or superior new merchandise at bargain rate prices; he would not feel outraged and cheated if bargain rate merchandise proved to have only bargain rate qualities.

Our expectations from margarine are not those of butter. We are satisfied with lesser qualities from a used car than from a new car.

However, when it comes to housing, especially in the urban setting, people expect, even insist upon, quality housing at bargain prices.

Richard Posner discussed housing habitability laws in his Economic Analysis of the Law. The subsection was titled wealth distribution through liability rules. Posner concluded that habitability laws will lead to abandonment of rental property by landlords and increased rents for poor tenants.

https://twitter.com/childpovertynz/status/618985237628858368

What do-gooder would want to know that a warranty of habitability for rental housing will lead to scarcer, more expensive housing for the poor! Surprisingly few interventions in the housing market work to the advantage of the poor.

Certainly, there will be less rental housing of a habitability standard below that demanded by do-gooders in the new New Zealand legislation. In the Encyclopaedia of Law and Economics entry on renting, Werner Hirsch said:

It would be a mistake, however, to look upon a decline in substandard rental housing as an unmitigated gain.

In fact, in the absence of substandard housing, options for indigent tenants are reduced. Some tenants are likely to end up in over-crowded standard units, or even homeless.

The straightforward way to increase the quality of housing in New Zealand without increasing poverty is to increase the supply of land.

As land prices fall, both homebuyers and tenants will be able to pay for better quality fixtures and fittings because less of their limited income is paying for buying or renting the land.

Anthony Downs on the unsustainability of buses and trains as compared to cars

30 Jun 2015 Leave a comment

in politics - New Zealand, transport economics, urban economics Tags: Anthony Downs, antimarket bias, expressive voting, Leftover Left, makework bias, meddlesome preferences, nanny state, rational ignorance, rational irrationality

Creative destruction in house sizes

28 Jun 2015 Leave a comment

in economic history, politics - USA, urban economics Tags: creative destruction, the good old days, The Grade Enrichment

CHART: Today’s new homes are 1,000 square feet larger than in 1973, and average living space per person has doubled http://t.co/vdBTwWsygG—

Mark J. Perry (@Mark_J_Perry) June 27, 2015

Auckland housing is more expensive than many big US cities

22 Jun 2015 Leave a comment

in economics of regulation, politics - New Zealand, politics - USA, urban economics Tags: Auckland, land supply, land use planning, RMA, zoning

Rising mortgage rates to test U.S. housing market rebound on.wsj.com/1IsKVde http://t.co/vHDJAdM292—

Pedro da Costa (@pdacosta) June 22, 2015

The decline of home ownership in the USA

16 Jun 2015 1 Comment

in economics of regulation, politics - USA, urban economics Tags: home ownership, housing affordability, lamb supply, land use planning, zoning

Home ownership rate, down to level of 20 yrs-ago, is headed even lower, says @NickTimiraos on.wsj.com/1IvwgDA http://t.co/2GeP3VIZzE—

Greg Ip (@greg_ip) June 08, 2015

What will Labour do about the supply of land in Auckland?

12 Jun 2015 Leave a comment

in politics - New Zealand, urban economics Tags: Auckland, housing affordability, land supply, RMA, zoning

New QV figures show Auckland house prices are up a massive 16.1% on last year, now estimated to reach $1m by Aug '16. http://t.co/DwAU79ozCy—

New Zealand Labour (@nzlabour) June 09, 2015

If the world’s population had to live in one city

06 Jun 2015 Leave a comment

in population economics, urban economics Tags: economic geography, maps, population bomb

The world's population, concentrated http://t.co/Eq5jq1xn3x—

Amazing Maps (@Amazing_Maps) April 06, 2015

This Eco-Friendly Capsule Home Would Let You Live Off The Grid Anywhere In The World?

03 Jun 2015 Leave a comment

in economics of regulation, urban economics Tags: land use planning, NIMBYs, RMA, zoning

I doubt that it would get planning permission in either Auckland and Christchurch?

It is hard to get local government land use permission to build new granny flats and other small and temporary accommodation units in Auckland and Christchurch.

Auckland has rapidly increasing housing prices. Christchurch is still rebuilding after an earthquake so both housing prices and rents in particular are skyrocketing. The local councils in both cities are strict regulations restricting or prohibiting high-density housing.

via This Eco-Friendly Capsule Home Would Let You Live Off The Grid Anywhere In The World | IFLScience.

Civil War-era Washington DC

30 May 2015 Leave a comment

in economic history, politics - USA, urban economics Tags: American Civil War, DC, Washington

Civil War-era Washington DC—Smithsonian Institution and US Capitol: #SI http://t.co/bKKnfYM7WF—

Michael Beschloss (@BeschlossDC) April 20, 2015

Rent controls never work – they force up rents and destroy investment in housing

24 May 2015 Leave a comment

in economics of regulation, politics - Australia, politics - New Zealand, politics - USA, urban economics Tags: British general election, expressive voting, offsetting behaviour, rational irrationality, rent controls, The fatal conceit, UK politics, unintended consequences

The robots are coming, the robots are coming to property values

16 May 2015 Leave a comment

in applied price theory, economics of media and culture, entrepreneurship, industrial organisation, survivor principle, technological progress, transport economics, urban economics Tags: agglomeration, compensating differentials, creative destruction, driverless cars, drones, entrepreneurial alertness, land prices, land supply

A few years ago, Casey Mulligan wrote a fascinating little op-ed about the impact of drones on land prices and urban living.

As drones and driverless cars make it cheaper to move people around cities, the value of inner-city land will fall simply because their proximity to the action has diminished.

With drones and driverless cars, it will be easier to bring something in on the just-in-time basis rather than have it on hand as inventory or within walking distance because traffic congestion makes it too slow to call it up from the suburbs through the conventional commercial transport.

But we live in a world of trade-offs. More people may want to move into the city because it’s so much easier to move around and call things up by drone, driverless car and the share economy, so this may intensify agglomeration effects and increased land prices. Another big day out for the two handed economist.

The principle of competitive land supply – Anthony Downs

16 May 2015 Leave a comment

in applied price theory, applied welfare economics, economics of regulation, urban economics Tags: Anthony Downs, green rent seeking, housing affordability, land supply, land use regulation, NIMBYs, offsetting behaviour, RMA, unintended consequences

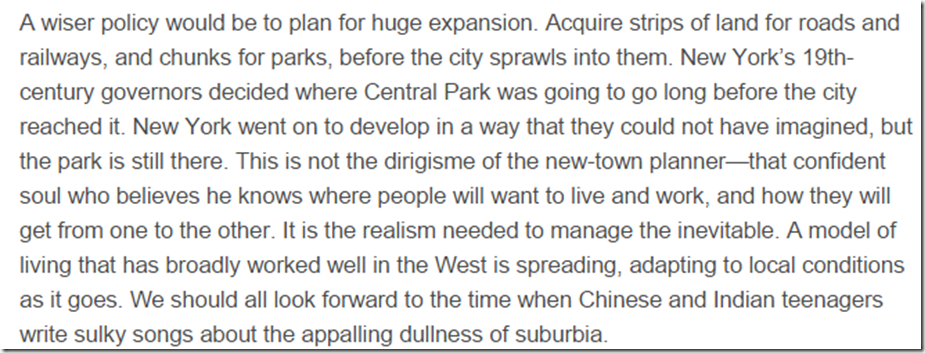

Urban planners are confident souls

15 May 2015 Leave a comment

in development economics, economics of regulation, environmental economics, growth miracles, politics - Australia, politics - New Zealand, politics - USA, urban economics Tags: green rent seeking, housing affordability The fatal conceit, land use regulation, offsetting behaviour, RMA, The pretence to knowledge, unintended consequences, urban planning, zoning

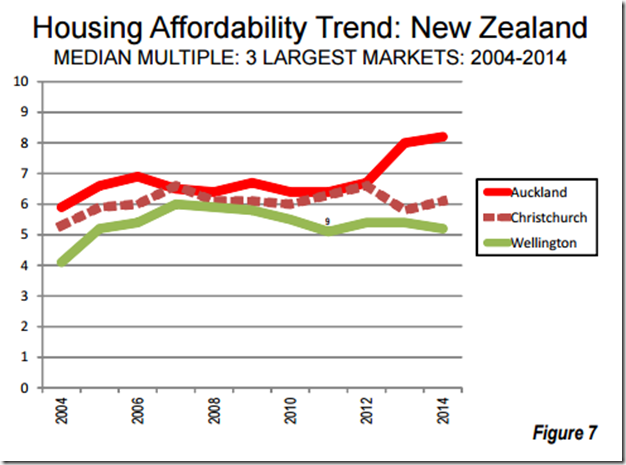

Housing affordability trends in New Zealand and the case for a capital gains tax

14 May 2015 Leave a comment

in applied price theory, economics of regulation, Public Choice, public economics, rentseeking, urban economics Tags: Auckland, capital gains tax, housing affordability, RMA

If the affordability crisis in New Zealand is demand side driven requiring capital gains tax to temper that demand, why is the affordability crisis so marked in one city? Does that make a case for a capital gains tax only on Auckland or suggest the capital gains tax is trying to solve the wrong problem.

via demographia.com

Recent Comments